48

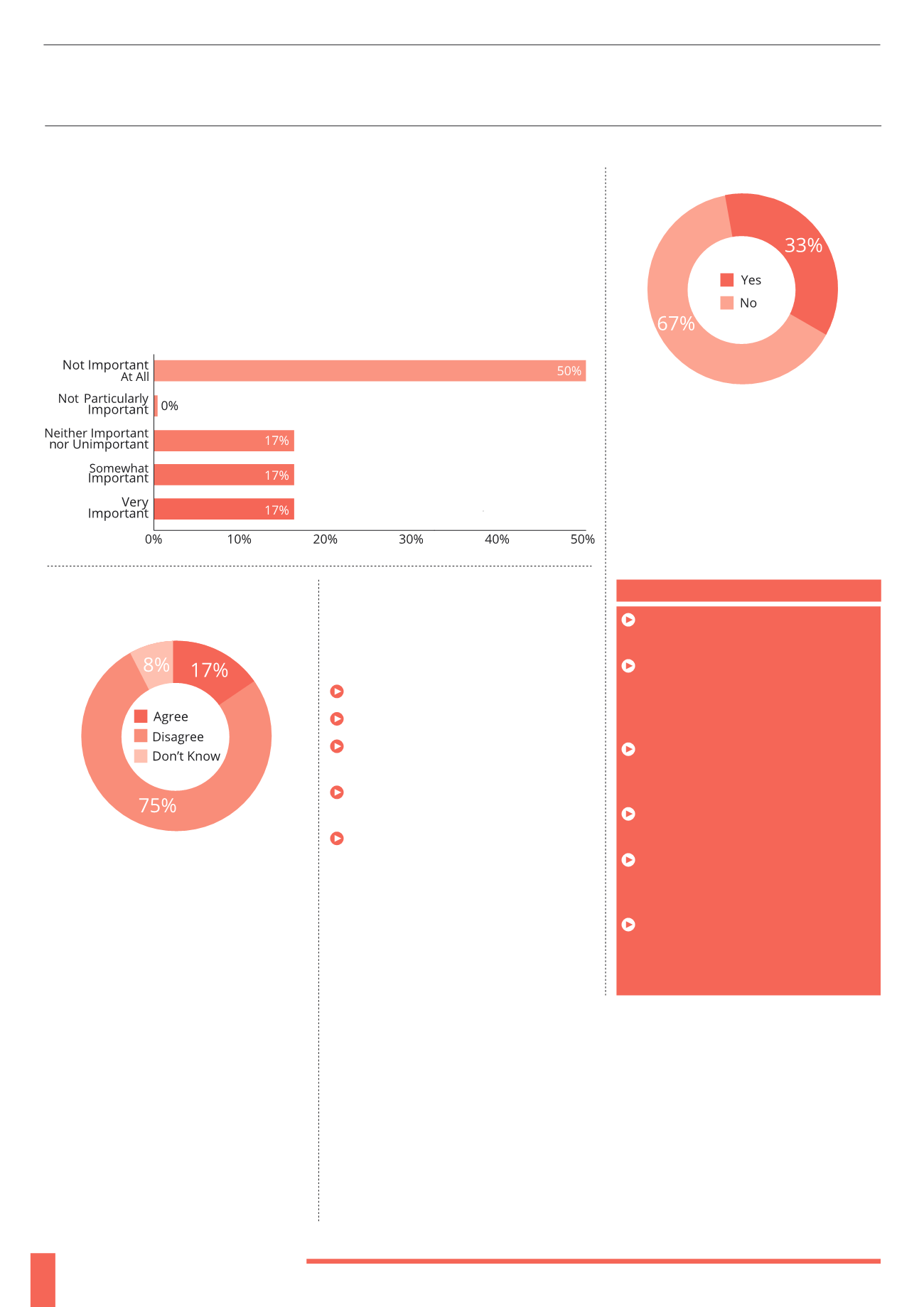

Q. How important is independent financial advice when choosing an EIS investment?

A. The complex investment process often involved with EIS can require time and

knowledge on the part of the investor. Investors were asked whether they felt taking

financial advice was important when considering an EIS investment. 50% feel that it

is not important at all, 17% feel it’s neither important nor unimportant and a further

17% each feel that it’s somewhat important or very important. The requirement to

use an IFA is likely to depend on the knowledge and experience of the investor and

the quality of information available on the investment – the majority of investors

questioned feel they are able to choose an investment without the help of an IFA.

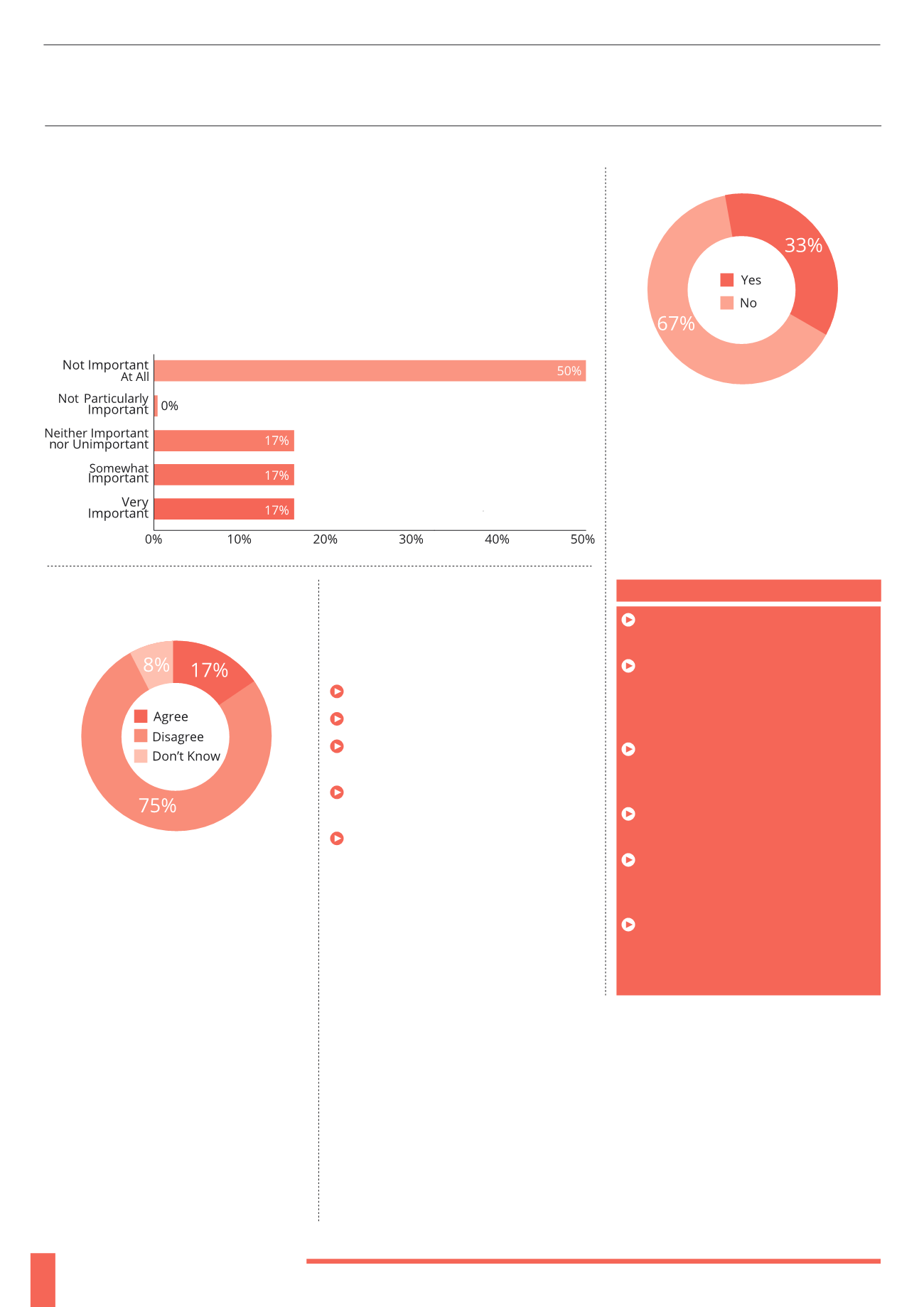

A. Respondents were asked if they agreed

or disagreed that EIS investments should

only be considered once the full ISA and

pension allowances have been used up. The

tax reliefs available from EIS investments

are greater than other tax efficient forms

of saving such as pensions or ISAs. They

also offer further scope for investing across

interesting and exciting sectors as well as

offering the potential for very high returns.

75% of respondents disagreed with this

statement as they feel that EIS should be

considered alongside other tax efficient

saving/investment vehicles. Their suitability

will depend on the investor’s strategy, tax

situation and the level of diversification

they are seeking. EIS investments also offer

opportunities that are not available through

the mainstream investment products

available within pensions and ISAs.

Q. Please state what single

development you would believe would

most improve the EIS market?

A. There were several suggestions here that

cover many different aspects of market:

Better research on the sector

Widely available investment platform

Larger choice when it comes to low risk

funds

Better process for achieving advanced

assurance

More data on performance and track

records

The main development that investors

want to see is an improved process for

submitting paperwork to HMRC for EIS

approved status and advanced assurance

to simplify the process for investors and

speed up the receipt of tax reliefs.

“75% of investors believe EIS should be considered alongside other tax efficient

saving/investment vehicles”

A. Investors with a keen interest in angel

investing, good knowledge of the EIS

market and who are able to obtain quality

information can possibly sidestep the need

to use an IFA to invest in EIS. The remaining

33% do have an IFA who may have expert

knowledge of the market and be able to

assist with in-depth due diligence that the

investor cannot afford to spend time on.

KEY FINDINGS FROM SURVEY

93% of current EIS investors say they

plan on investing in EIS again in the future

The expected level of return was

chosen by 92% of respondents as the most

important criteria when choosing an

investment

92% of investors see poor quality of

information as a reason to hesitate when

considering an EIS investment

67% of respondents selected growth as

their preferred investment strategy

50% of investors feel that it is not

important to seek independent financial

advice when considering an EIS investment

75% of investors believe that EIS

investment should be considered

alongside other tax efficient investing/

savings vehicles

Q. Do you have an IFA?

Q. EIS investments are only appropriate

when both ISA and pension allowances

have been maximised?