40

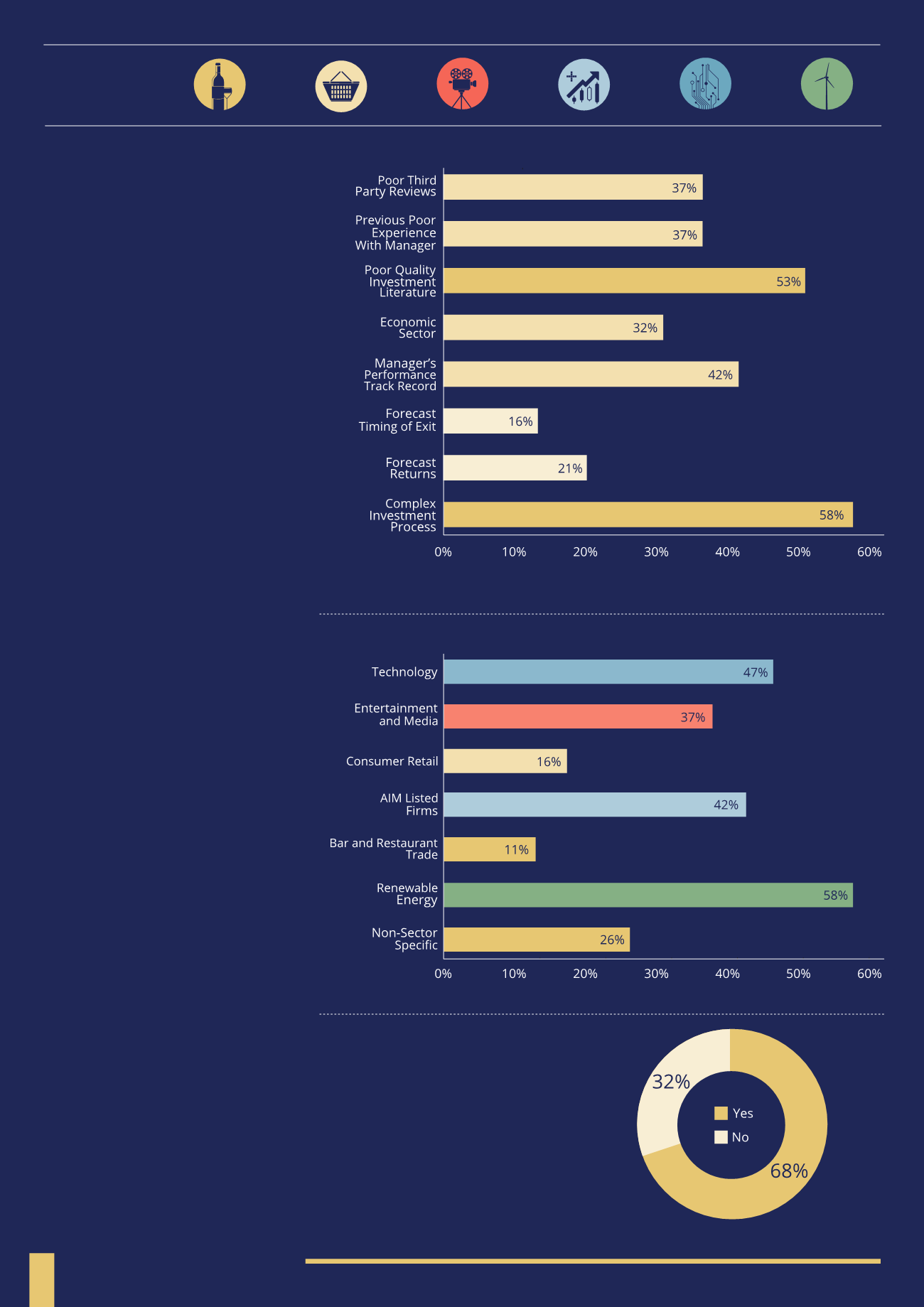

Q. Which factors are most likely

to make you hesitant about

recommending an EIS fund?

A. The most common reasons cited by

advisers as to why they may hesitate before

recommending an EIS fund is due to it

having a complex investment process, with

58% of respondents selecting this response.

Rules and regulations surrounding EIS

investments could be seen as complicated

involving a large amount of paperwork,

which could put advisers off recommending

a certain product. The poor quality of

information provided on the fund was

seen as the second most common reason

to hesitate recommending an investment

with 53% of advisers considering this to be

an issue. Providing regular reporting and

detailed information can really add value

to the manager’s investment proposition.

The knowledge, experience and track record

of the fund manager is seen as another

important consideration for advisers, with

42% citing the manager’s track record

and 37% a previously poor experience

with the fund manager as reasons to

hesitate recommending an EIS fund.

Q. What are your preferred sectors

for EIS fund investments?

A. Renewable Energy was highlighted by

58% of advisers as being their preferred

investment sector. This may be down to the

number of energy opportunities available

in the market place which provides choice

and competition, the government support

behind the sector (through renewable

obligation certificates) or that energy

investments are often asset backed and

offer steady returns over a relatively

long period of time. They can also appeal

to investors as they have a green halo

affect and can support local economies

and the local community. Other popular

investment sectors include Technology

with 47% and AIM listed funds. Niche

sectors such as Consumer Retail (16%)

and Bars and Restaurants (11%) are less

popular, which could be attributed to there

being a smaller number of investments

available, less competition in the market

or a perception that they are higher risk.

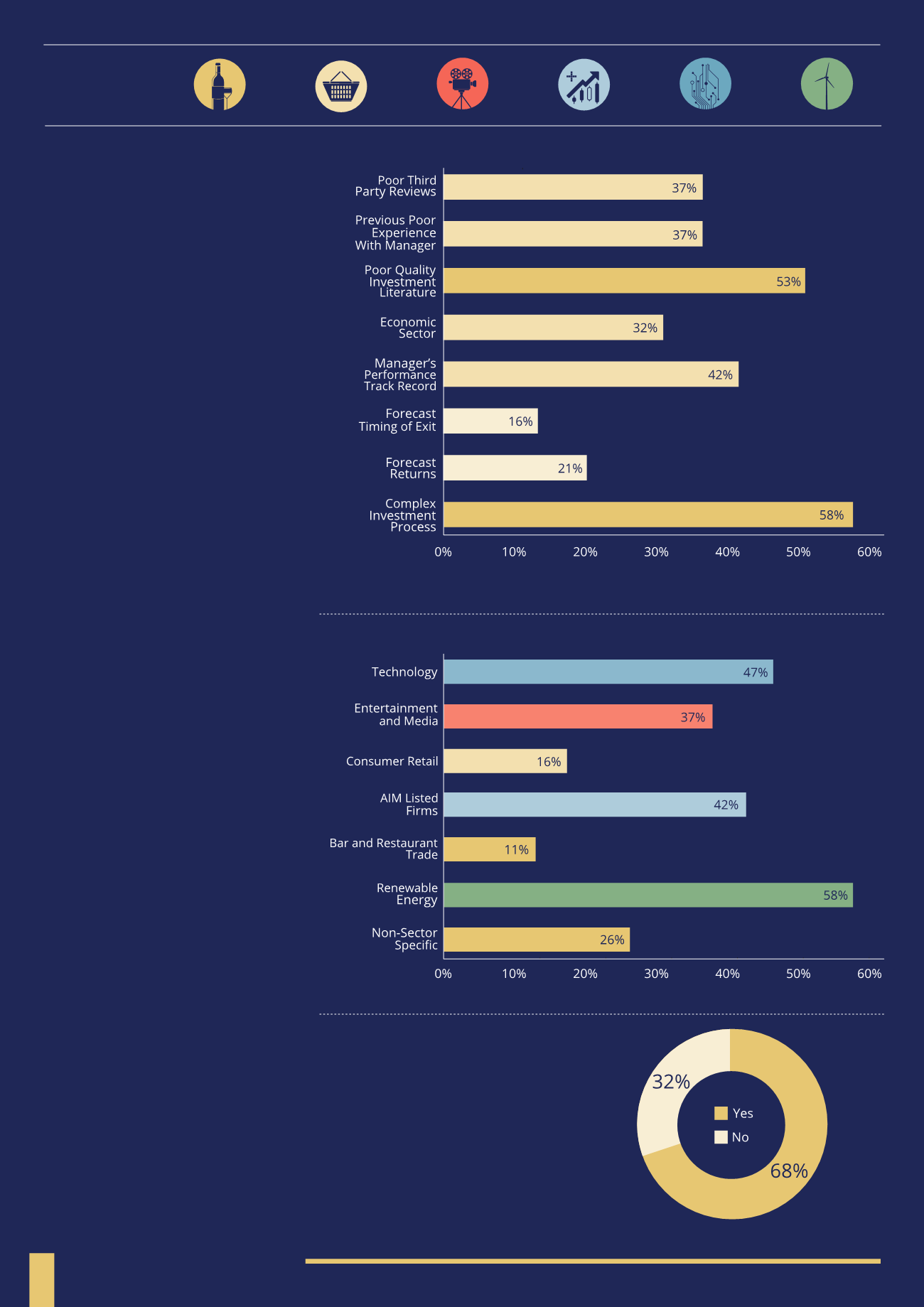

Q. Do you feel

that there is enough competition in the EIS market?

A. It is important to identify whether advisers feel they have enough choice

and whether there is enough competition in the market. Competition is

generally seen as healthy as it lowers costs and improves efficiency.

68% of advisers that recommend EIS funds said they are happy with the amount of

competition in the market. The remaining 32% said that there is not enough competition

in the market which leaves room for new entrants and new investment propositions.

This could also be seen as an opportunity for firms already operating in the

space to improve their investment offerings to attract new business.

SECTOR

PREFERENCE

(ADVISER):

16%

58%

11%

42%

37%

47%