58

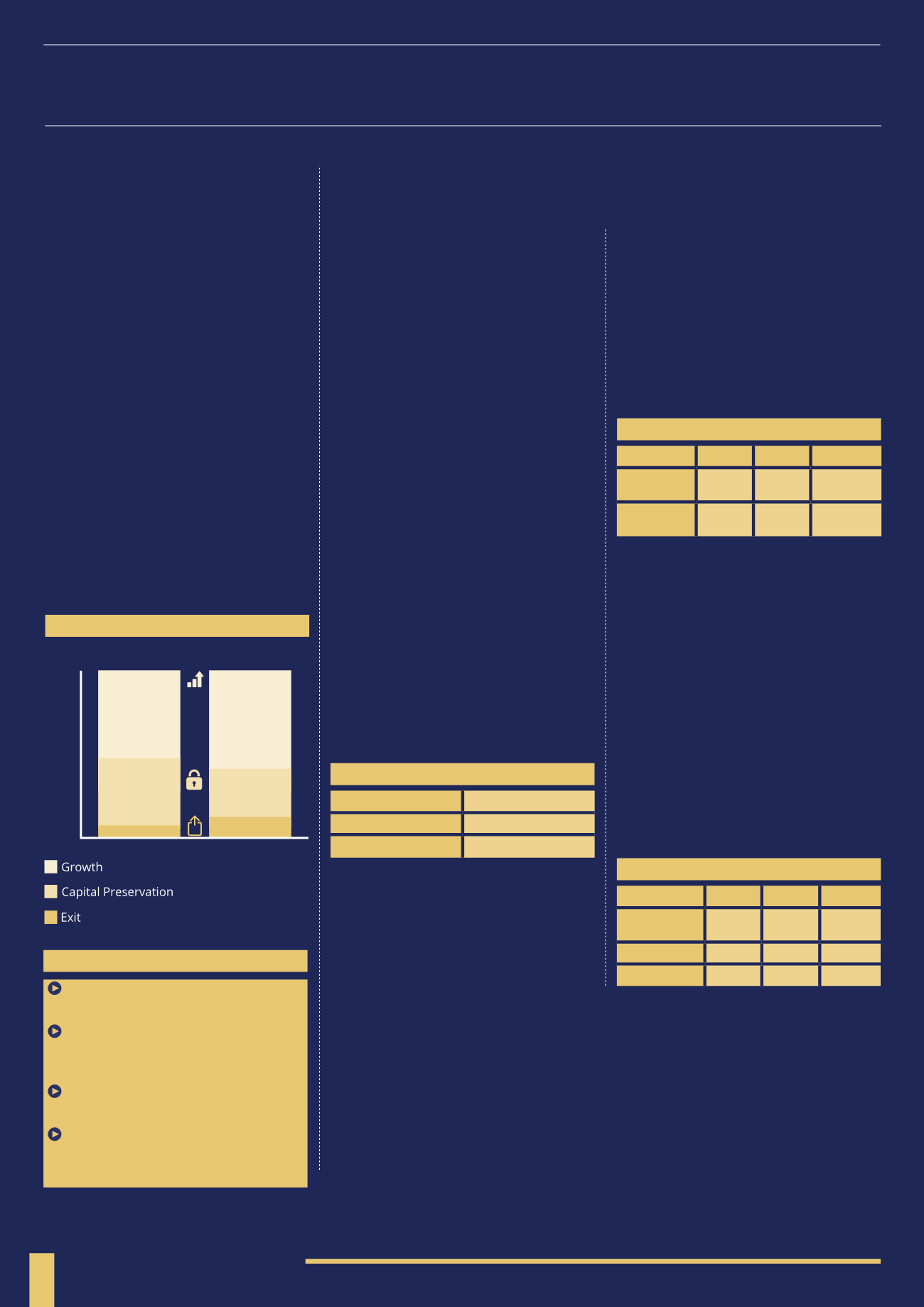

STRUCTURE SPLIT BY FOCUS

Another way to look at the investment

focus is to split it by investment structure.

The following charts look at how single

company investments and funds are

split down by investment focus.

51% of single company investments are

growth focused, 40% capital preservation

and only 9% exit. The higher proportion

of investments focused on capital

preservation could be due to the high

number of investments in the food and

drink sector. These often include take-

overs of established pubs and restaurants

and therefore they are asset backed

opportunities with lower levels of risk.

Funds have a higher focus on growth (59%

of investments) and a lower proportion

of investments focusing on capital

preservation. The higher number of growth

based investments could be attributed to

several funds focused on the Technology

sector, which as noted above tends to

be higher risk/higher return activity.

The fundraising target is the amount of

capital each investment offering (single

EIS company or managed fund/portfolio)

is looking to raise. It should represent

the provider’s confidence that they can

successfully deploy that amount of capital

productively and earn returns. Unfortunately

in the mainstream fund universe it can

also occasionally represent the provider’s

confidence that their marketing machine can

raise large sums of money that they can take

a healthy initial fee and on-going charges

from. This is a malaise that thankfully

does not seem to have spread to the EIS

market to date from what we can tell.

For single company investments, the size of

the fundraise is obviously dictated by the

activities they are undertaking and their

intentions for putting the capital to work. For

funds, the number of opportunities available

that meet their investment criteria is key.

Being under-capitalised is of course a major

problem as firms cannot develop according

to their business plans. However, being over-

capitalised is also an issue as it can make

it hard to generate returns for investors.

The average fundraising target across the EIS

market is just under £9.5m, but this ranges

from as low as £175,000 to as high as £75m.

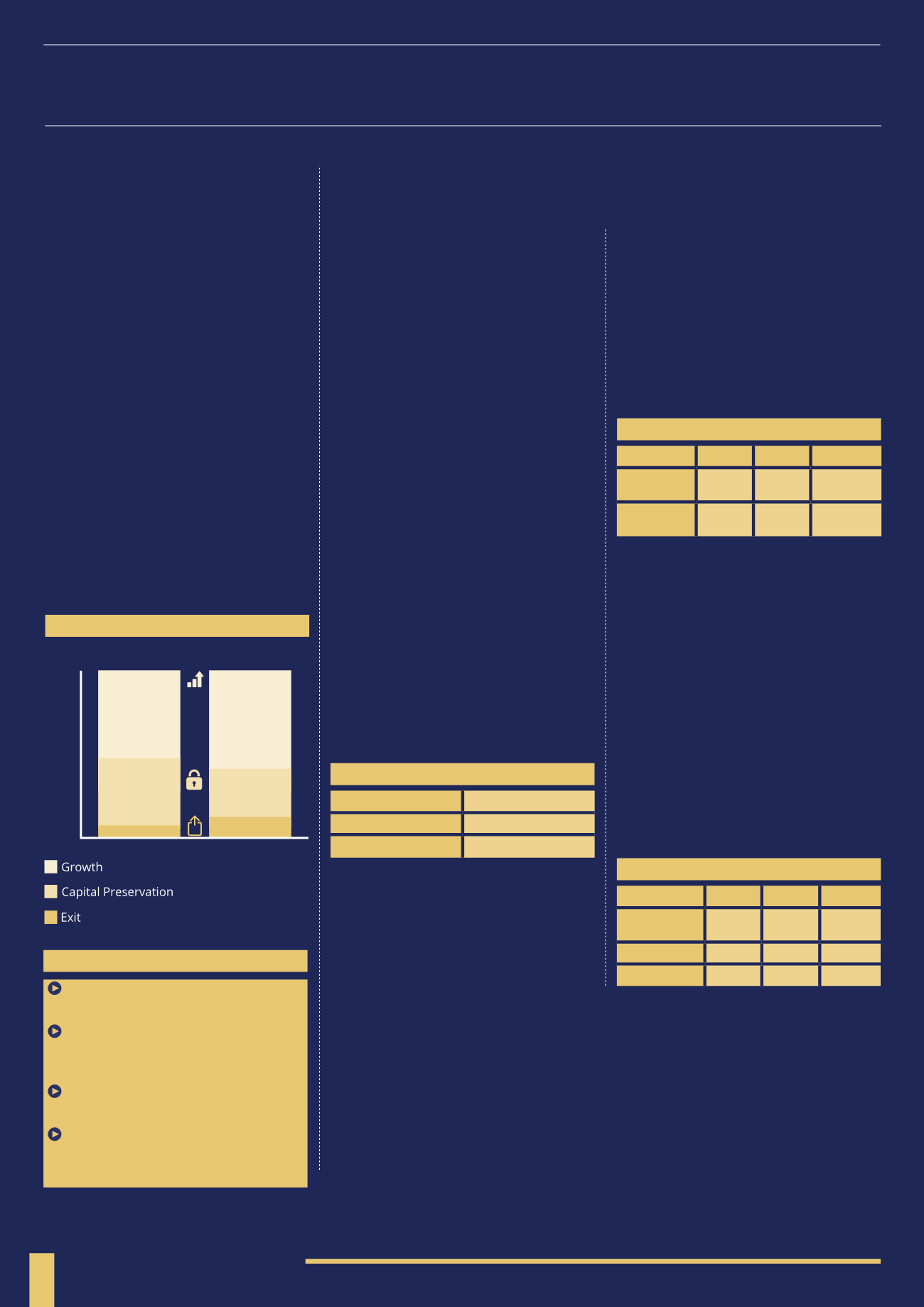

FUNDRAISING TARGET

BY STRUCTURE

As discussed earlier, single company

investments are typically much smaller

fundraises. The average for companies

is £3.79m whilst for funds this is much

higher at £12.84m. Funds generally have

much higher fundraises due to the fact that

they are raising money to invest across

a number of underlying companies.

FUNDRAISING TARGET BY

INVESTMENT FOCUS

Exit focused investments had the highest

average fund size of £16m. We can speculate

that this is down to investor demand, or it

could be due to many of these investments

being either asset-backed, investments

into more established companies or

investments into renewable energy

installations – all of which are expensive.

Growth focused investments had the

lowest average fundraising target of

£7.55m. Growth focused opportunities are

usually investments into smaller start-up

companies that are cheaper to acquire.

KEY POINTS

Growth focused investments account

for 56% of the EIS market

The Technology sector, which favours

small start-up companies, has 100%

growth focused investments

The Media sector is the most balanced

based on investment focus

Fund/portfolio structures have a higher

focus on growth than single company

investments

FUNDRAISING ANALYSIS

SPLIT BY FOCUS

FUNDRAISING TARGETS

Low

£175,000

High

£75,000,000

Average

£9,418,000

TARGET BY STRUCTURE

Low High Average

Single

Companies

£175k £15m £3.79m

EIS Fund/

Portfolio

£1.2m £75m £12.84m

“Funds and portfolios generally have a higher investment focus on growth and a

lower proportion of investments focused on capital preservation”

Low High Average

Capital

Preservation £250k £40m £9.94m

Exit

£250k £75m £16.08m

Growth

£175k £50m £7.55m

TARGET BY FOCUS

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Single Company

Fund/Portfolio

(1998-2014)

51%

59%

40%

29%

9%

12%