45

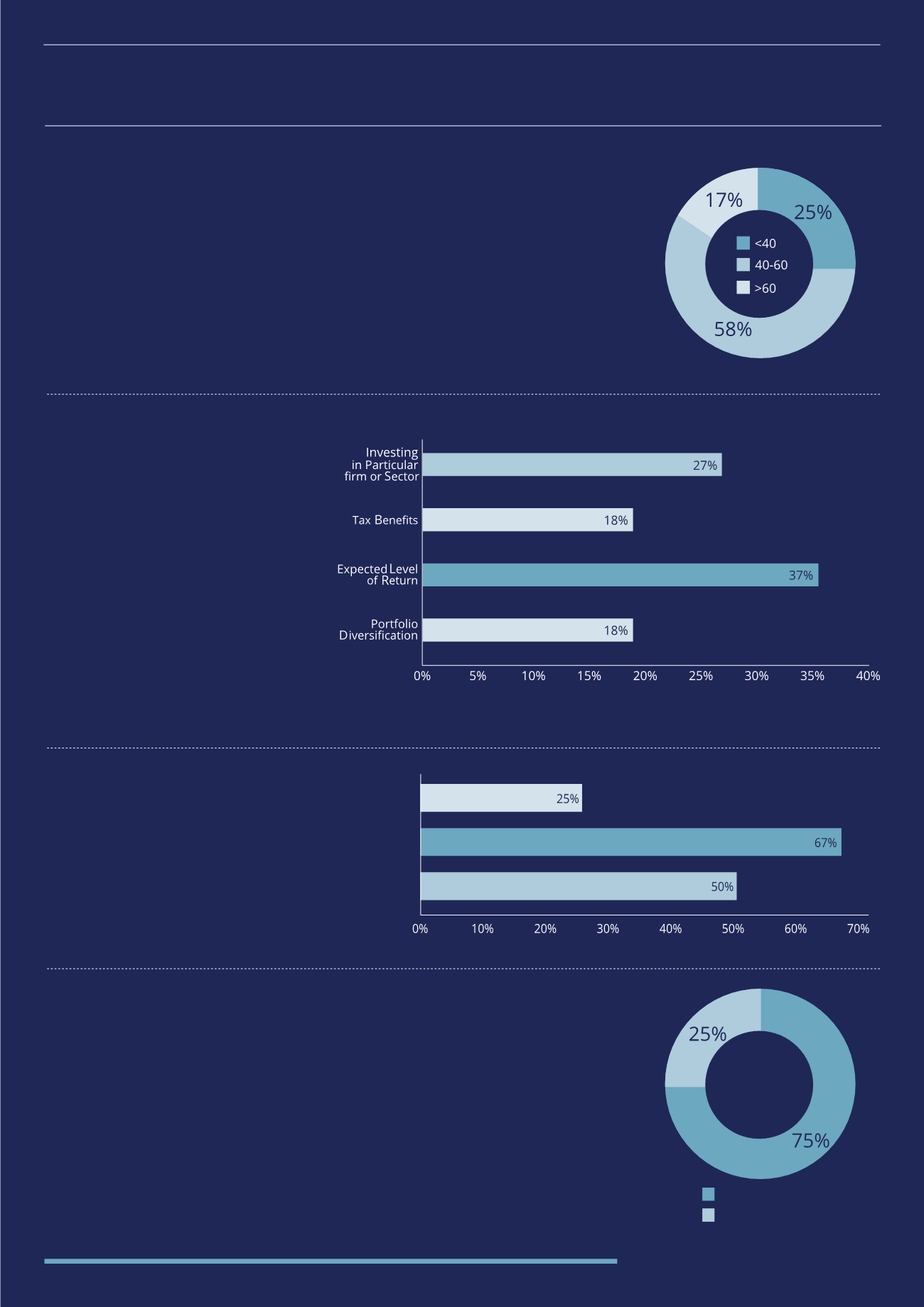

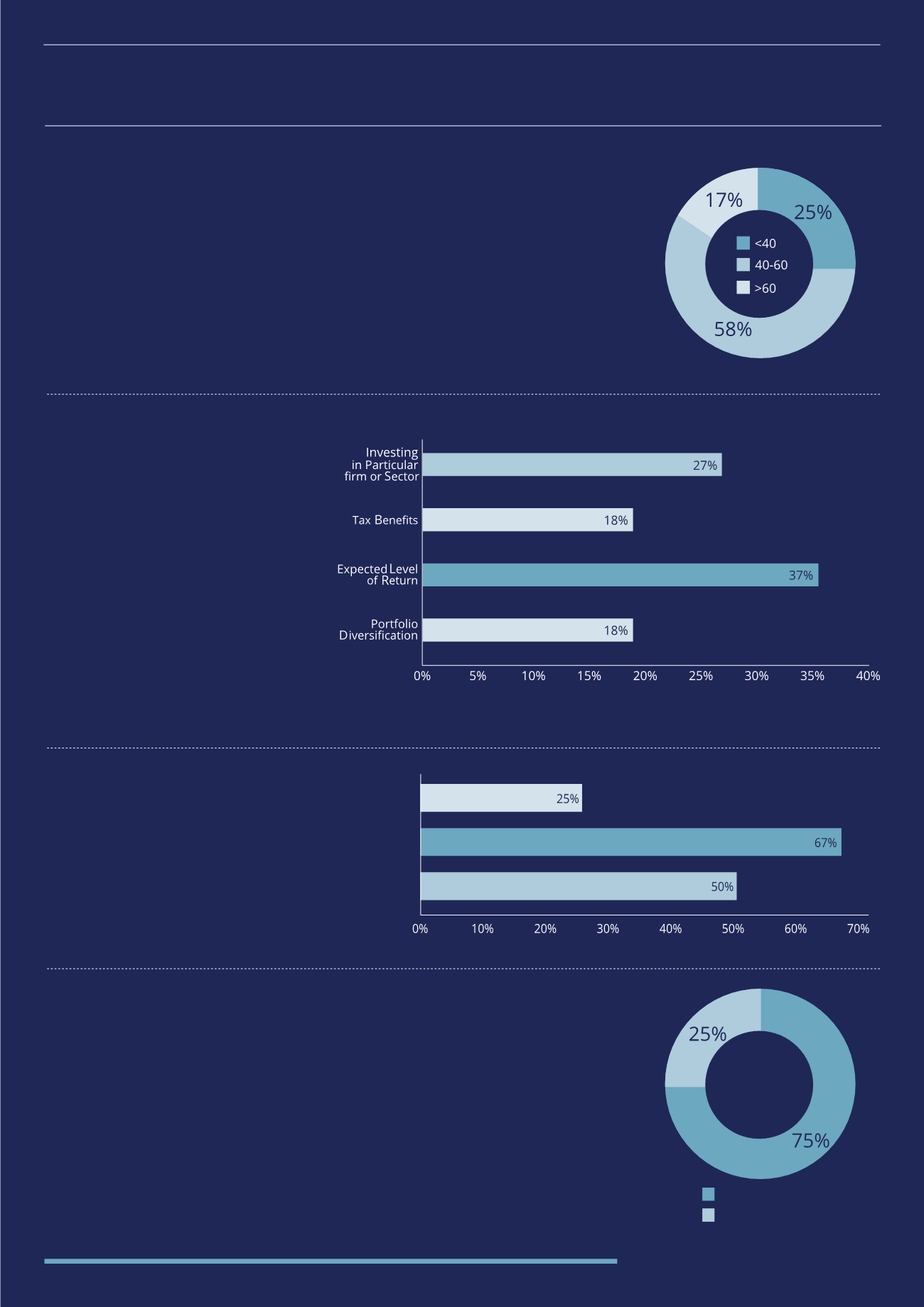

Q. What is your preferred EIS investment structure?

A. Those who have previously invested through the EIS were asked whether they preferred

investing in a discretionary managed fund, a single company EIS investment or both. A

discretionary managed fund will spread risk across several underlying EIS companies

and relies on the knowledge, experience and skill of the investment manager. Single

company investments are likely to require far more research and due diligence on the

part of the investor but will enable the investor to have complete control over which

companies receive their money. 75% of investors prefer single company EIS compared

to only a quarter who choose funds. As evidenced by their main objectives for EIS

investing, many investors value the ability to invest in a specific company or sector

of their choosing. Investing directly also removes an additional layer of charges.

“Private investor respondents view the expected level of return as the primary objective

when investing in EIS, with the tax benefits being much less important”

Q. What is your main objective

when investing, or considering

investing, in an EIS?

A. The expected level of returns was the

most popular choice among investors

and was cited by 37% as being their

main objective when considering an EIS

investment. This is in contrast to the

adviser survey, where tax benefits were

the primary consideration. Investing

into a specific firm or sector from an

angel point of view was chosen by 27% of

respondents as being their main objective

when investing. The EIS can provide a more

direct way for investors to get involved

with certain companies or sectors from a

very early stage. The extra benefits that EIS

investments can offer such as tax relief and

diversification are also seen as important

with 18% of respondents citing these.

Q. Which are your preferred

EIS investment strategies?

Please tick all that apply

A. Investors were asked to choose the

investment strategies that they prefer

and could pick more than one. The two

most popular investment strategies

were growth focused chosen by 67% of

respondents and exit focused chosen by

50%. These results mirrored advisers’

responses to the same question.

Q. Which age bracket do you come under?

A. The typical age of an EIS investor according to this survey is between 40-60 years old

with 58% of respondents falling within this age group. As EIS are generally higher risk

investments they are often not suitable for investors much older than the age of 60 who

are more focused on capital preservation rather than improved returns – although they

may consider EIS for potential Inheritance Tax relief. Younger investors below the age of

40 account for 25% of respondents. They may have more pressing financial goals such

as buying a house or starting a family and not have the capital available to allocate to

riskier EIS investments, although there are likely to be a number of high earners in this

category who can afford to take on the risks as they can supplement any losses with

future earnings. These results reflect the response advisers gave to this question.

Seed EIS

Growth Focus

Exit Focus

Single Company

Fund/Portfolio