38

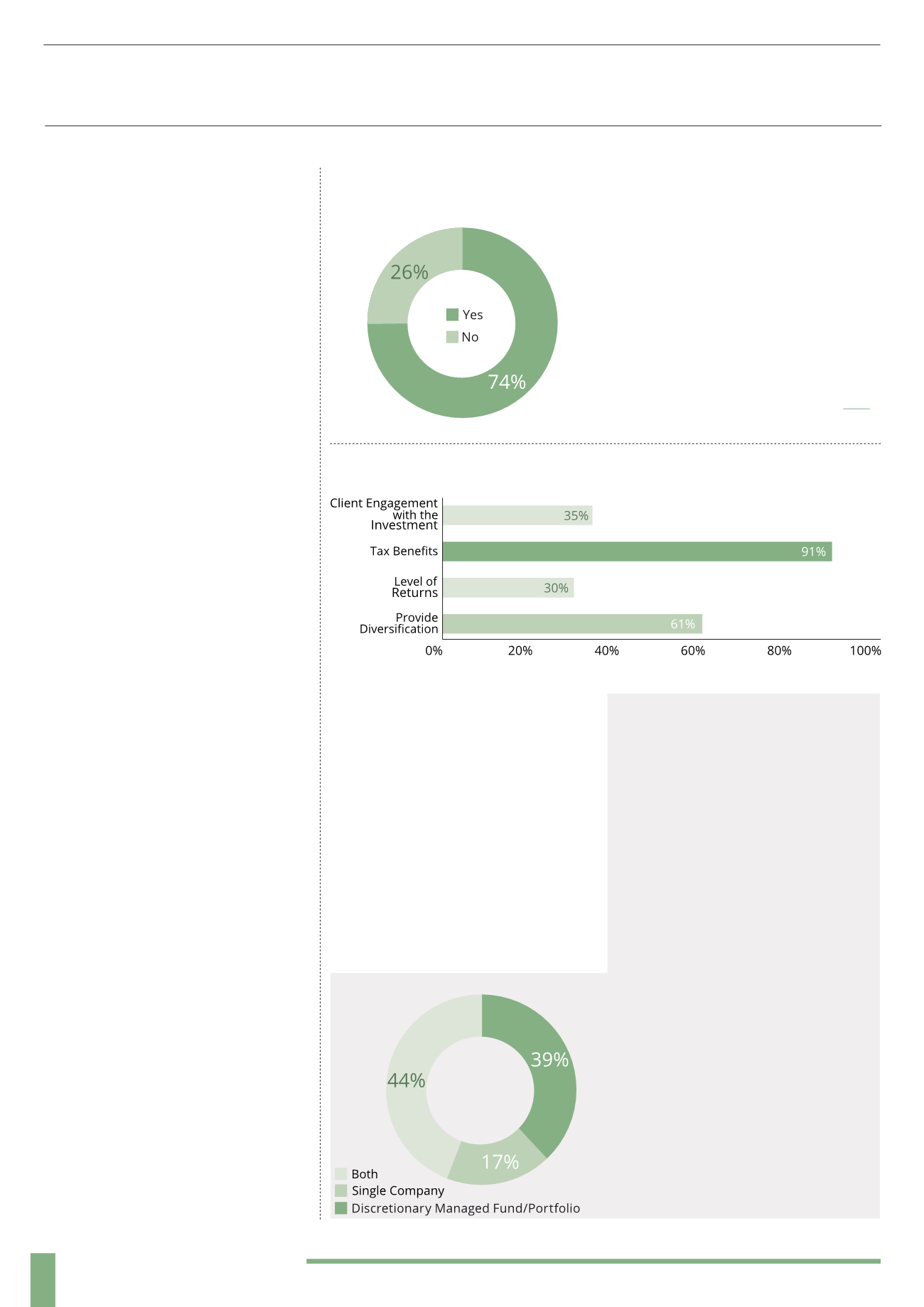

A. Respondents were able to choose more

than one answer to this question. Focusing

only on the 58 respondents that do

recommend EIS investment to their clients

– 91% cited tax benefits as one of the main

reasons to recommend EIS investments

and 61% said that diversification was a

key reason for recommending them. The

level of returns and client engagement

were not seen as particularly important

by respondents with 30% and 35%

respectively. The tax benefits will often

reduce the risk and magnify returns,

but they may only really be beneficial

for higher rate tax payers or investors

looking to offset large capital gains.

ADVISER SURVEY

A. EIS investments are often higher risk as

they focus on small start-up companies, but

in return the investor is given generous tax

benefits and is often rewarded with higher

returns. We wanted to gauge how financial

advisers viewed EIS investments and how

they use them with their clients. Almost

three quarters (74%) of survey respondents

recommend EIS investments to their clients.

The remaining 26% do not recommend EIS and

the reasons for this have been analysed

INTENTION OF THE SURVEY

Our intention was to gain an insight into

how advisers perceive EIS investment

products – how they use them within

client portfolios, what criteria they use

to select EIS investments, and what they

look for and expect from EIS managers.

The survey sample also included advisers

who do not currently use EIS investments.

We wanted to find out what factors make

them hesitant – is it down to the type of

clients they service, their perception of

the risks attached to EIS or the difficulty

in understanding EIS and ensuring they

have whole of market knowledge?

The survey did not ask questions about

specific managers, we wanted to establish

a general view on EIS managers and

investment opportunities. The survey was

conducted as an independent exercise

solely for inclusion in this report.

By participating in the survey, we hope

that the responses and opinions provided

by advisers can help to shape future

EIS offerings. These responses allow us

to draw out trends and developments

within the market, which will ultimately

enable EIS managers to develop their

propositions and deliver products that

best meet the needs of investors.

The survey was sent to a database of

advisers (both independent and restricted),

financial planners, wealth managers and

financial intermediaries. Respondents

were provided with an incentive to

participate in the survey with the chance

to win £250 in shopping vouchers and

receive a free hard copy of this report.

The survey included up to a maximum of

20 questions and was dynamic – questions

changed depending on the answers given

and the route the respondent took. The

most interesting and insightful questions

have been selected as part of this analysis.

We had 78 respondents to the survey,

including a mixture of IFAs, paraplanners,

restricted advisers, wealth managers

and financial intermediaries.

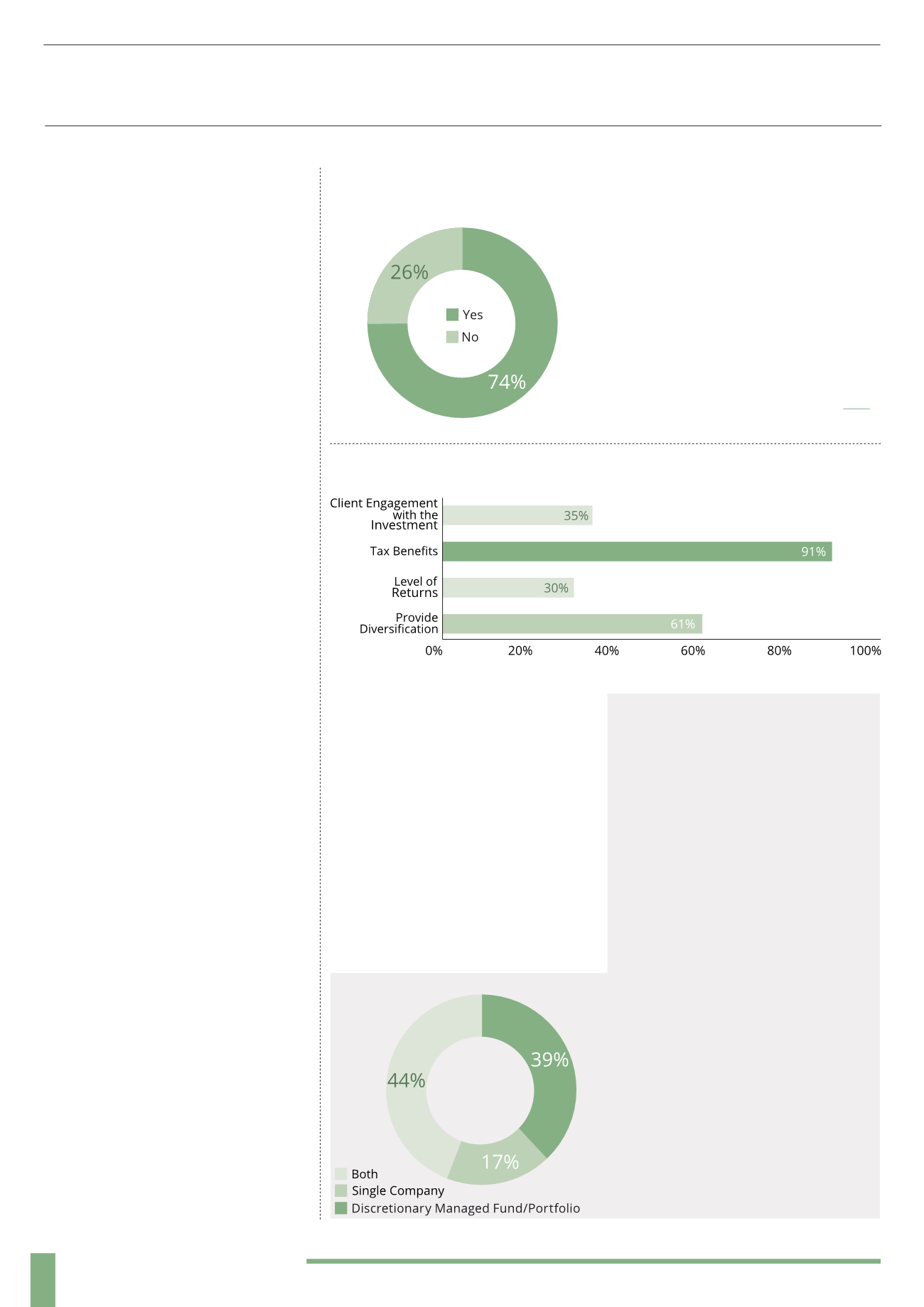

Q. What structure of EIS

investments do you most commonly

recommend to clients?

A. Participants were asked whether they

recommend a discretionary managed fund

(portfolio) of EIS investment companies,

single company EIS investments or both

to their clients. A discretionary managed

fund allows the adviser to benefit from the

expertise of an investment manager, rather

than having to research each underlying

company individually and choose the

company that best suits their client – which

takes time as well as expert knowledge.

Discretionary managed EIS funds also

provide diversification as investor’s money

is spread across a number of underlying

companies. This does mean though that

the adviser is putting their faith in the

knowledge, experience and expertise of

the investment manager and that the client

has to pay an additional layer of charges.

The majority (44%) of respondents

recommend both discretionary managed

funds and single company EIS to their

clients. 39% only use discretionary

managed funds and a small number

(17%) solely recommended single

company investments to their clients.

Q. Do you recommend EIS investments to your clients?

Q. For what reasons do you recommend EIS investments to your clients?