56

As noted throughout the preceding

analysis, the EIS market includes a mix

of single company investments and

managed funds/portfolios. The following

section looks at the split of the market

between these two structures and how

they have each developed over time.

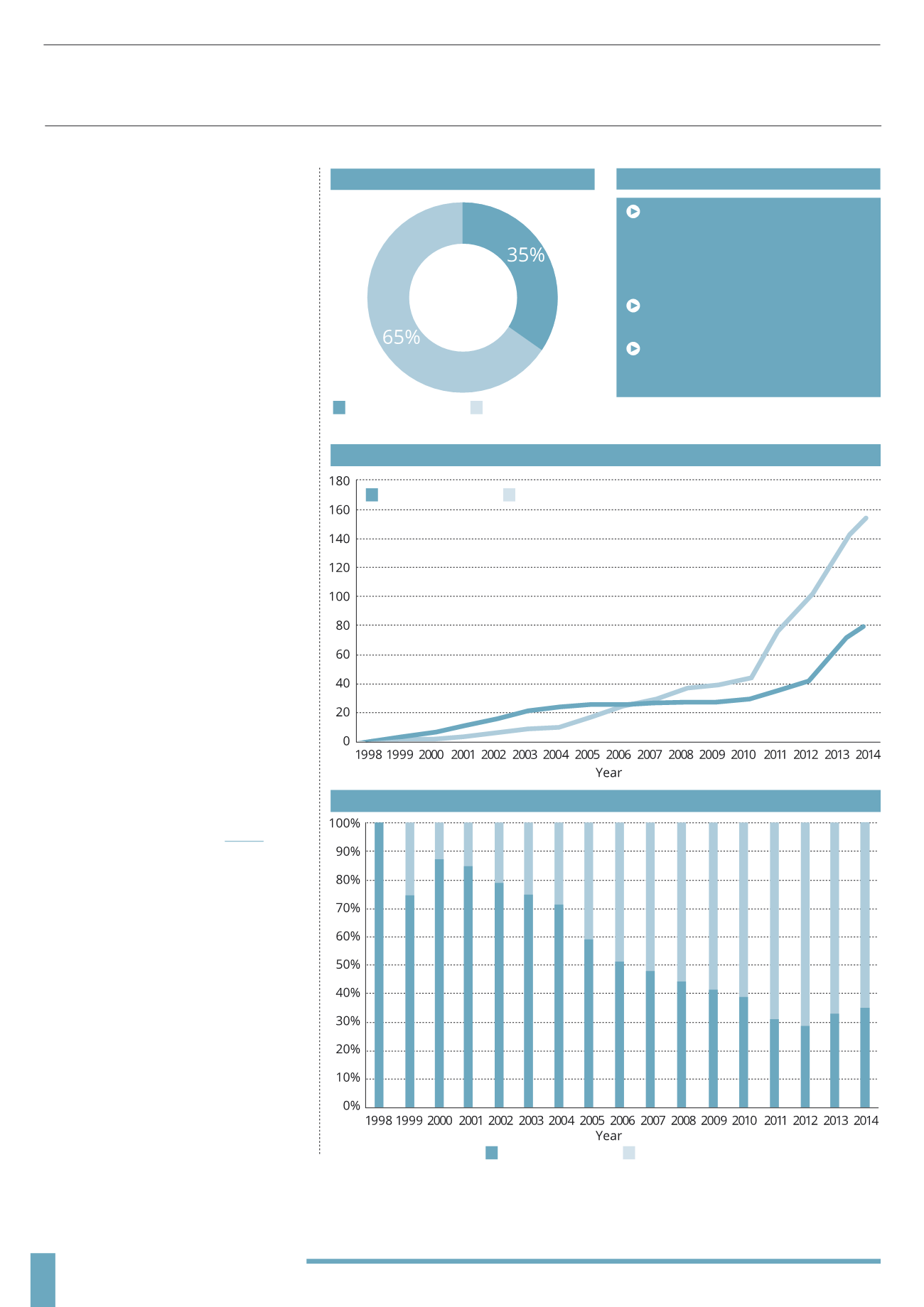

Based on the investments identified, the EIS

market is currently made up of 65% funds

and 35% single company investments. 17%

of EIS funds and 14% of single companies

are currently open for investment.

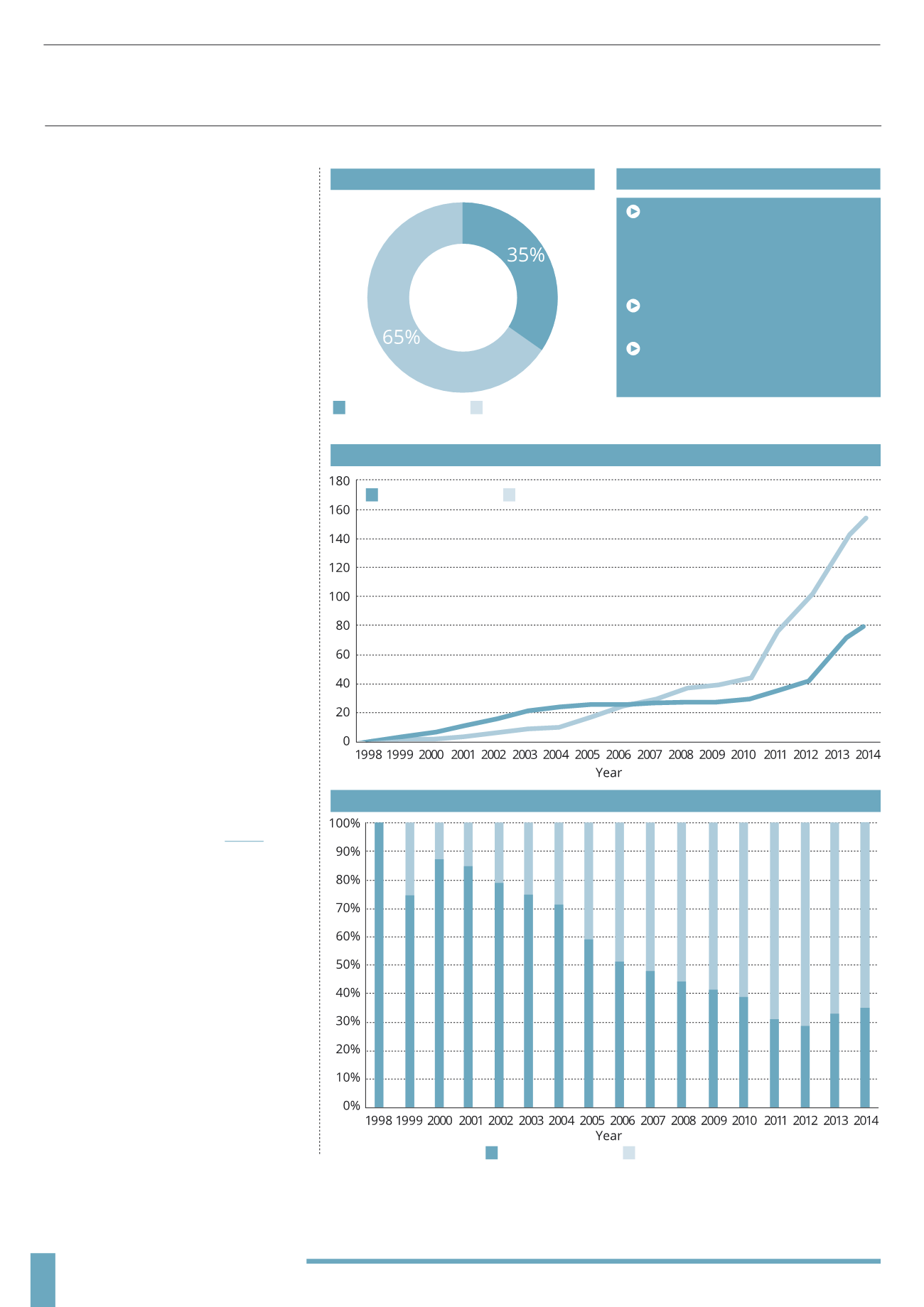

MARKET GROWTH

BY STRUCTURE

Splitting the data between these two

types of investment structure, we can

track the growth in the EIS market and the

changes in the landscape over the period

since 1998. In the initial stages of the EIS

market, single company investments were

the most popular. Funds started from a

very low base and were only available in

very small numbers in the early days of

EIS. However, as the EIS concept became

more widely understood, funds did begin

to enter the market in increasing numbers.

The real catalyst for funds however, was

the rule changes to allow larger companies

to qualify for EIS status. At a stroke the

EIS investment universe was both bigger

and more investable, and fund structures

became more feasible – this is reflected in

the steep up-tick in fund launches in 2010.

Both structures saw their highest number

of product launches in 2013, which can be

attributed to the drivers behind the growth

in the market we’ve discussed

–

lower pension allowances, improved EIS

benefits, an increasing investor appetite for

risk/returns and the need for diversification.

We can also speculate that as fund

managers become more established and

can evidence a track record of success, it

becomes easier to launch new funds – also

contributing to the increasing number of

fund based opportunities in the market.

ANALYSIS BY STRUCTURE

SPLIT BY STRUCTURE

HISTORIC GROWTH BY INVESTMENT STRUCTURE

(1998 - 2014)

HISTORIC MARKET SHARE BY INVESTMENT STRUCTURE

(1998 - 2014)

KEY POINTS

From 1998 to 2005 single company

opportunities dominated the market, but

since 2007 fund/portfolio investments

have grown to account for the largest

share of opportunities

2013 saw the greatest number of

product launches in both structures

As managers establish strong track

records the fund market will continue to

grow

Single Company

Single Company

Fund/Portfolio

Fund/Portfolio

Single Company

Fund/Portfolio

(1998-2014)