42

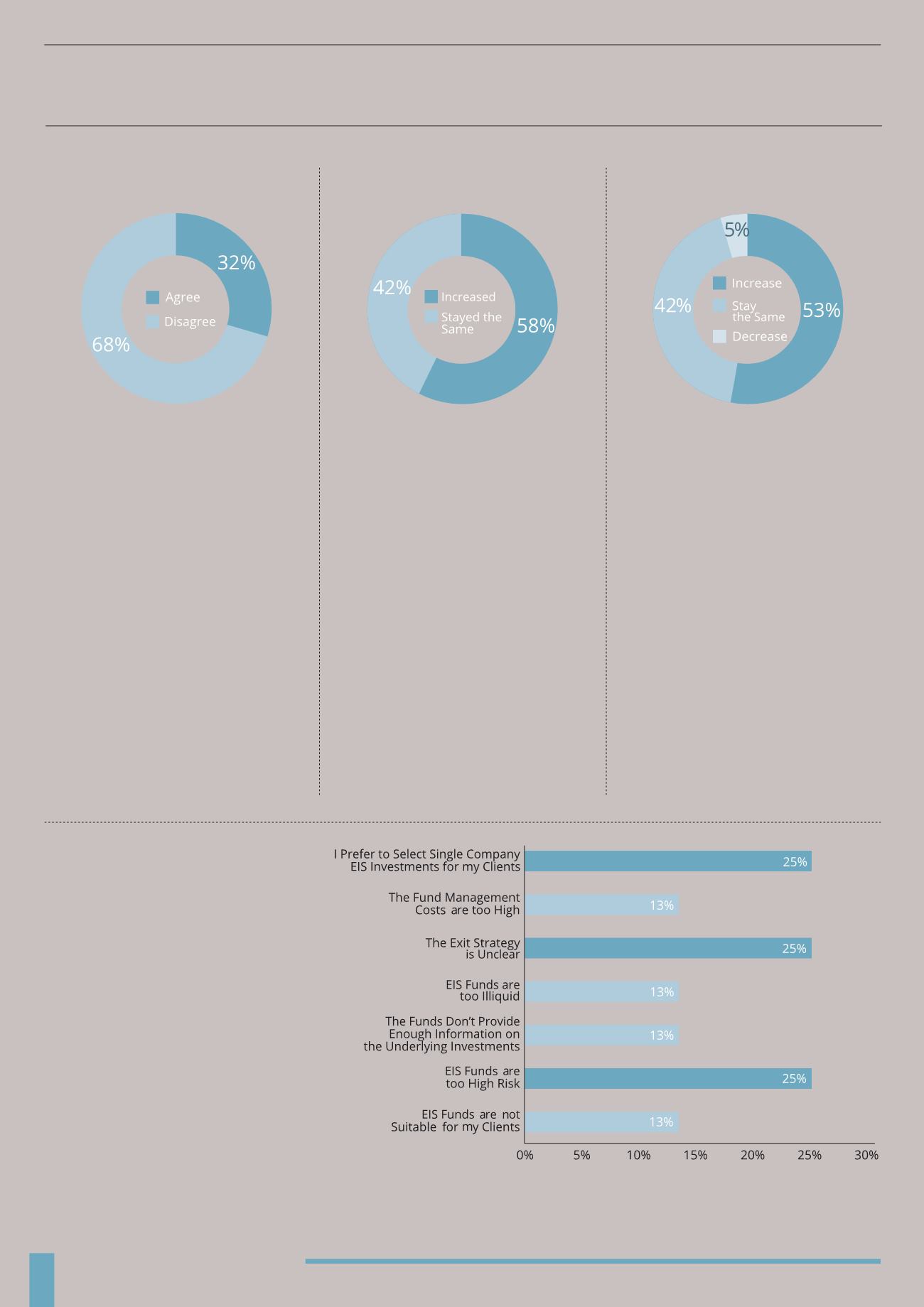

A. Respondents were asked whether they

agree or disagree with this statement.

Only 32% believe that EIS investments

only become appropriate once other

tax efficient saving/investment vehicles

have been used up. The majority believe

that EIS can sit alongside these other

options as they can offer other benefits,

such as interesting investment concepts,

diversification and high returns, which

cannot be found through ISA and

pension held investments. EIS are also

often used to offset capital gains and

for inheritance tax planning, advantages

which don’t come with ISAs or pensions.

A. 58% of the advisers surveyed said they

had increased their use of EIS investment

in client portfolios over the last 12 months.

This could be attributed to a number of

factors including an increase in the size

of companies receiving EIS investments,

an increase in the amount investors

can invest into EIS in a single tax year

and also a reduction in annual pension

contributions and the lifetime allowance.

There may also have been appetite from

investors looking to offset capital gains

achieved elsewhere due to the relatively

strong performance of property and

equities over the last 12 months. Added

to this, there has also been an increase

in promotion and awareness in the

sector and an increase in the number of

opportunities available, which could have

made EIS more attractive to advisers.

A. When asked whether their use of EIS

investments will change over the next 12

months, 53% of advisers believe this will

increase, while 42% feel it will stay the

same. Only 5% see a decrease, although

it is unclear why they think this is likely.

As advisers increase their knowledge and

understanding of the market, develop

long-term relationships with EIS managers

and as managers begin to evidence

strong track records of success it is likely

to lead to more use of EIS investments

by advisers. On the other hand, if the

government cuts support for the sector, or

the UK economy falls back into recession,

this picture could change dramatically.

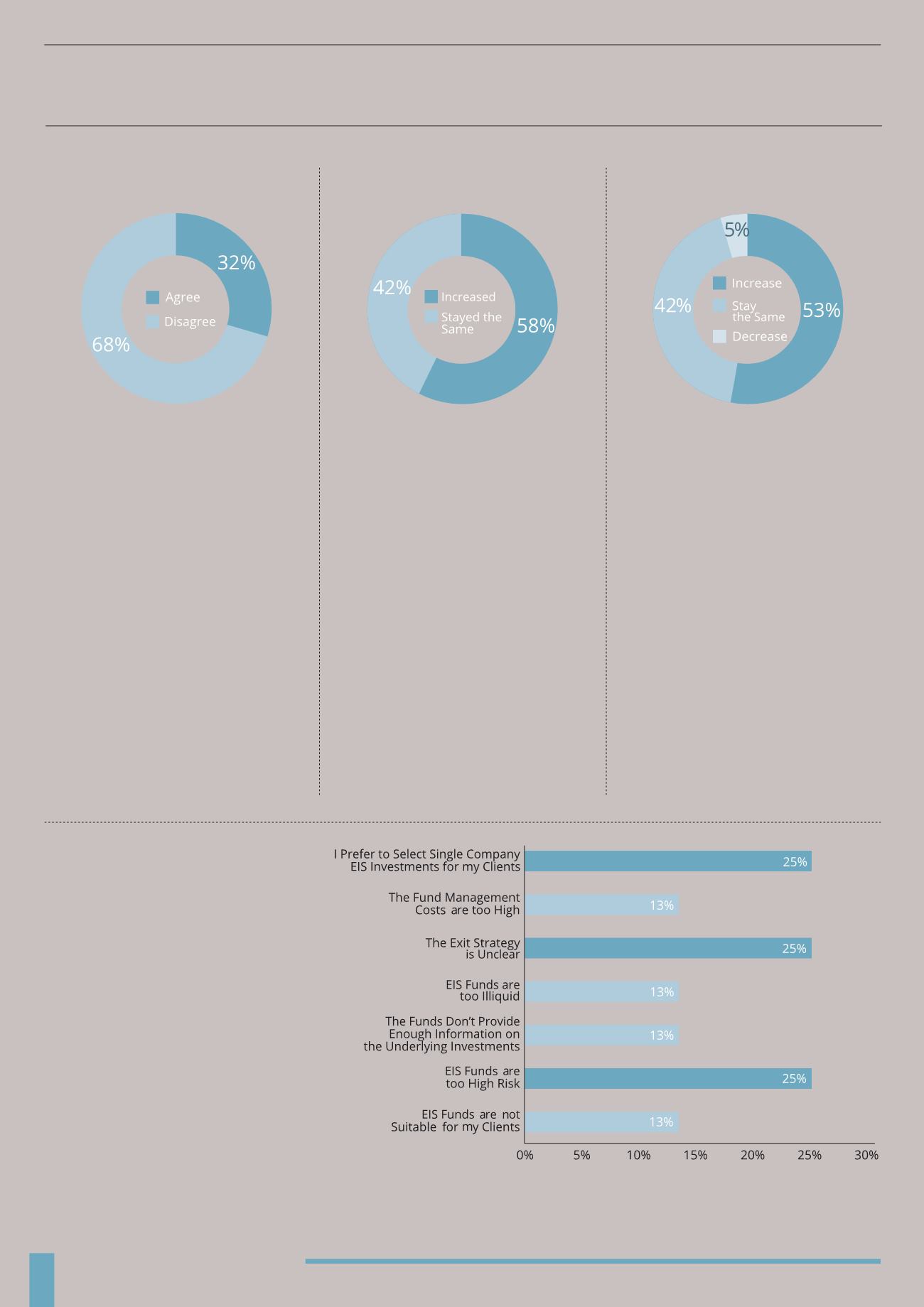

Q. For what reasons do you NOT

recommend EIS funds to your clients?*

A. There wasn’t a particularly high response

rate to this question, but the most

common reasons cited by respondents

for not recommending EIS funds to their

clients include that they are deemed too

high risk or the exit strategy is unclear.

Respondents also prefer the flexibility

and control of picking single company

EIS investments, which could result in

investments that are more suitable to their

clients. As echoed elsewhere, advisers

also feel that fund management costs

are too high and there is not enough

information provided on the underlying

investments. These are two areas which

need to be addressed by EIS managers.

Q. EIS are only appropriate when both

ISA and pension allowances have been

maximised

Q. Did your use of EIS in client portfolios

change over the last 12 months?

Q. Do you see your use of EIS in client

portfolio changing over the next 12

months?

“Increased knowledge of the market, long-term relationships with EIS managers and

a strong track record of success should lead to more use of EIS investments by advisers”

*Answered by the 10 respondents who only recommend single companies. Respondents could tick more than one answer.