52

INTRODUCTION

The data we collected on the EIS market

can be broken down and analysed in a

number of different ways, using a number

of different criteria. The following sections

of this report provide an overall analysis of

the EIS market, looking at how it has grown

in recent years, the different economic

sectors where investments can be made

and the different structures available for

investors looking to access the market.

We break the data down by:

Sector

Structure

Focus (investment objective)

Size of fundraise

Forecast returns

Charges

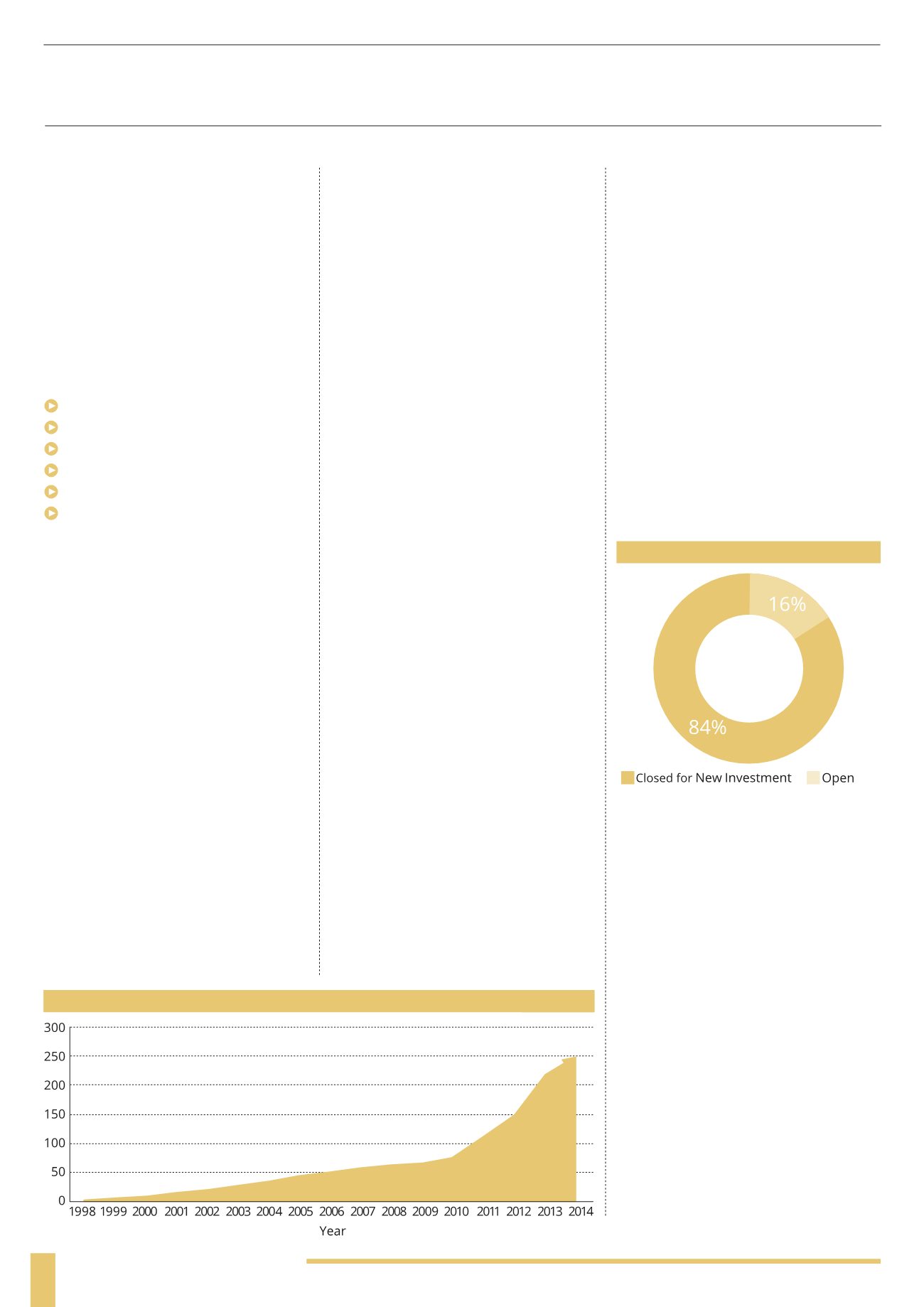

MARKET GROWTH

The first investment included as part of

this analysis was launched in 1998. The

market saw relatively modest and stable

growth between 1998 and 2004 with only

a small number of new product launches

across both single company investments

and managed funds. In 2005 there was

a notable increase in the number of new

product launches, which can probably

be attributed to the total investment

amount qualifying for tax relief increasing

from £150,000 to £200,000. The period

2010 – 2014 has witnessed the most

rapid expansion in the market though:

there has been a 229% increase in the

number of investments in this time.

This recent rapid growth can be

attributed to a number of factors.

Firstly, awareness of the benefits of EIS

has been increasing over time, in part

due to the marketing efforts of some

of the bigger providers and the adviser

education provided by the EISA.

Secondly, after seeing conventional

assets become quite highly correlated

during the 2008 crash and subsequent

recession, there has been a recognition that

conventional portfolios require additional

sources of diversification – something that

EIS products can provide as investments

into parts of the economy that are not

generally covered by mainstream funds.

Third, there has been an appetite for

higher returns. Low interest rates and

low bond yields have depressed the

returns on fixed income investments,

and many commentators are forecasting

that equities will continue to be volatile in

the future, with more 2008-style shocks

in store. At the same time, investors are

realising that they need to save more

for their retirement as life expectancy

increases. These factors have pushed

investors and advisers into searching for

assets with higher than average returns,

and many EIS investments fit the bill.

Fourth, as mentioned in previous sections of

the report, changes in both the annual and

lifetime allowances in pension contributions

and the increased scope of EIS to cover

more, and bigger, companies will also have

played a part in this increase in activity.

Finally, the flip-side of the 2008

narrative is that we are now seeing the

UK economy starting to recover and

improve and many advisers and their

clients feel that investing into smaller

companies is a good way to participate

in and benefit from that recovery.

It is important to note the limitations in

the data collection process as detailed

at the end of this section – there is

an in-built bias towards investments

launched more recently, which makes

the recent growth appear more

dramatic than it has been in reality.

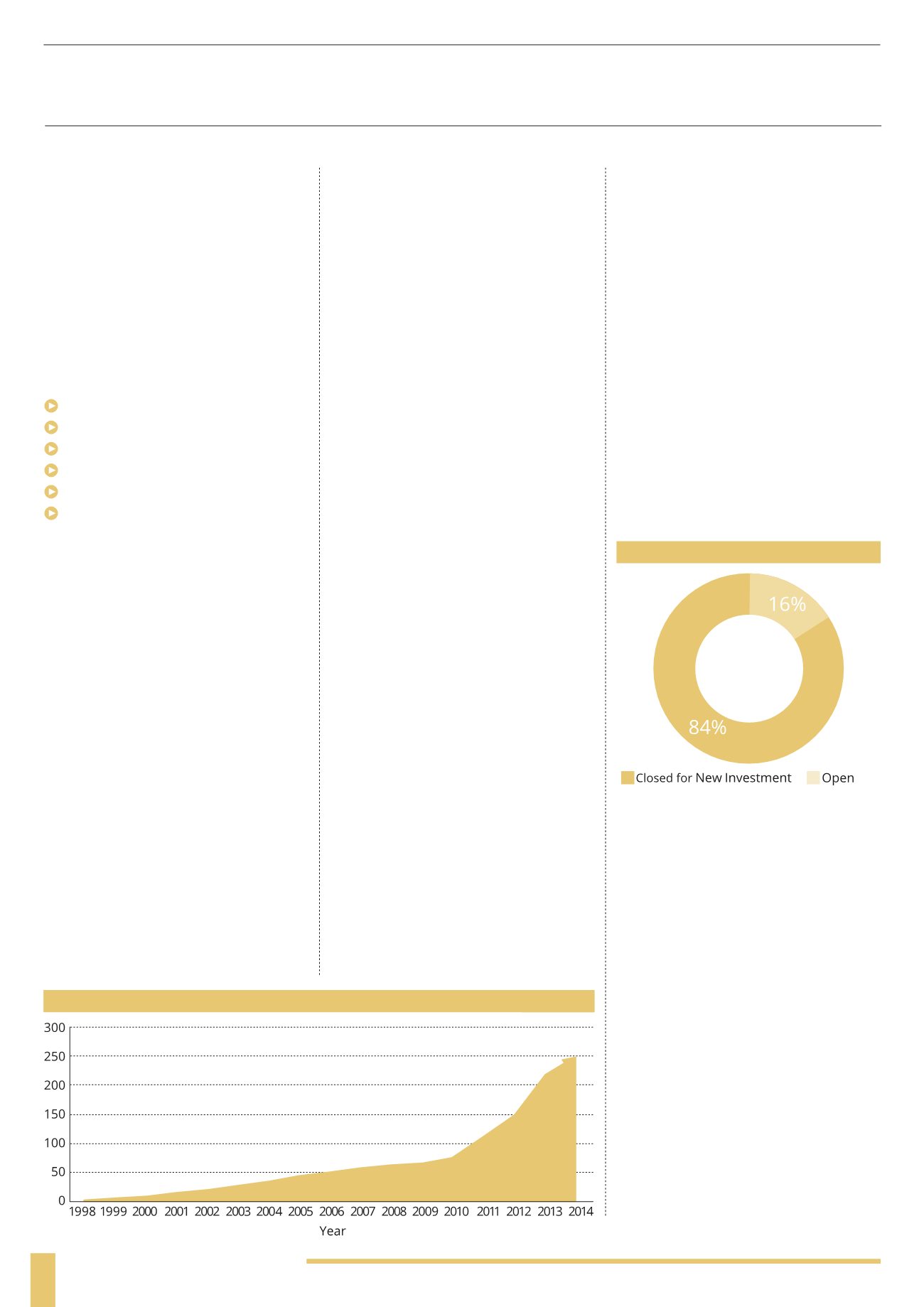

CURRENT OPPORTUNITIES

This analysis covers 244 EIS investment

opportunities across single company

investments and discretionary funds/

portfolios. Of these, 16% of the products

are open to new investment, with 44% of

these being evergreen products (always

open to new investment). It’s worth

noting that a large number of investment

opportunities closed at the end of the

2013/14 tax year at the start of April.

The vast number of opportunities focus

on a single (or sometimes 2) tax year

period, so that investors can claim (and

offset) tax for a specific period. Investment

launches often occur in the final quarter

of the year with a large amount of activity

ramping up towards the end of the tax

year as investors (and their advisers)

look to put their tax affairs in order.

“The enterprise investment

scheme has been a very successful

programme and has no doubt

addressed a significant funding

gap in the UK market”

Bruce Macfarlane, MMC Ventures

OVERALL ANALYSIS

EIS MARKET GROWTH

(1998-2014)

OPEN vs CLOSED

(1998-2014)