57

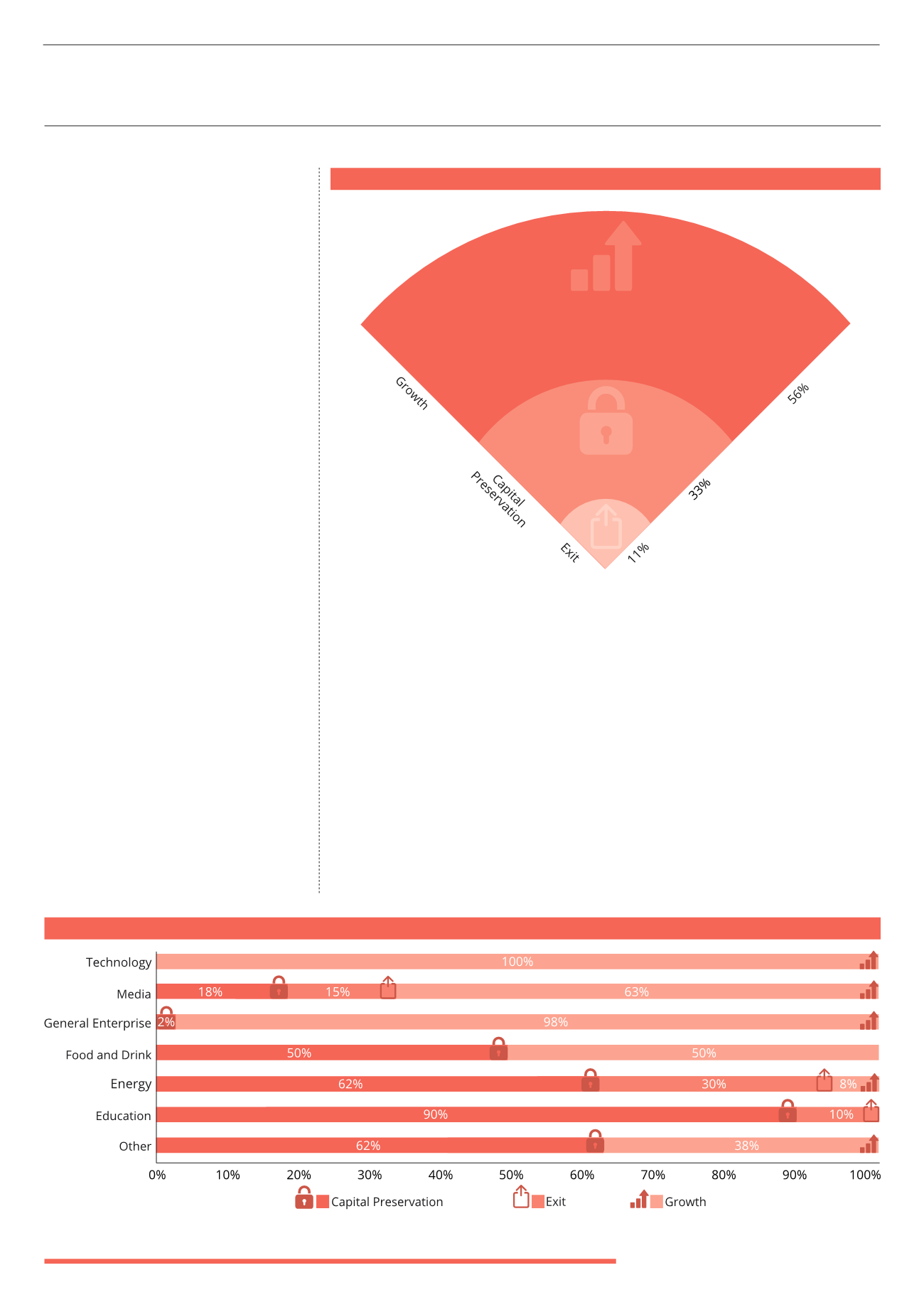

This is also referred to as the investment

focus or investment strategy.

Different providers use different terms

for classifying their investment objective

and risk profile, but for the purposes of

our analysis we have put them all into

one of three broad categories: growth,

capital preservation or exit focused.

Growth is focused on achieving market

beating returns, capital preservation on

achieving inflation level returns and exit

focused on achieving a relatively quick exit

from the investment, within 3-5 years.

The following section analyses the

EIS market by looking at the stated

investment focus of the products.

Looking at the market as a whole just over

half (56%) of investment opportunities

(single company and funds) are growth

focused. This is no real surprise as the

underlying aim of the enterprise investment

scheme is to stimulate investment into small

companies in order to fund their growth.

Capital preservation accounts for 32% of

the market and exit focused investments

just 11%. Capital preservation investments

may be asset backed and are often lower

risk than growth focused opportunities.

Both capital preservation and exit focused

investments have been criticised for not

taking on enough risk, and this has led to

some scrutiny from HMRC, but it should

be noted that there is always going to

be some element of risk surrounding

the exit whatever the stated investment

objective and skill of the manager. Smaller

company investing is a risky activity and

investors have to accept that exits may not

be achieved as intended and their capital

could be tied up for quite some time.

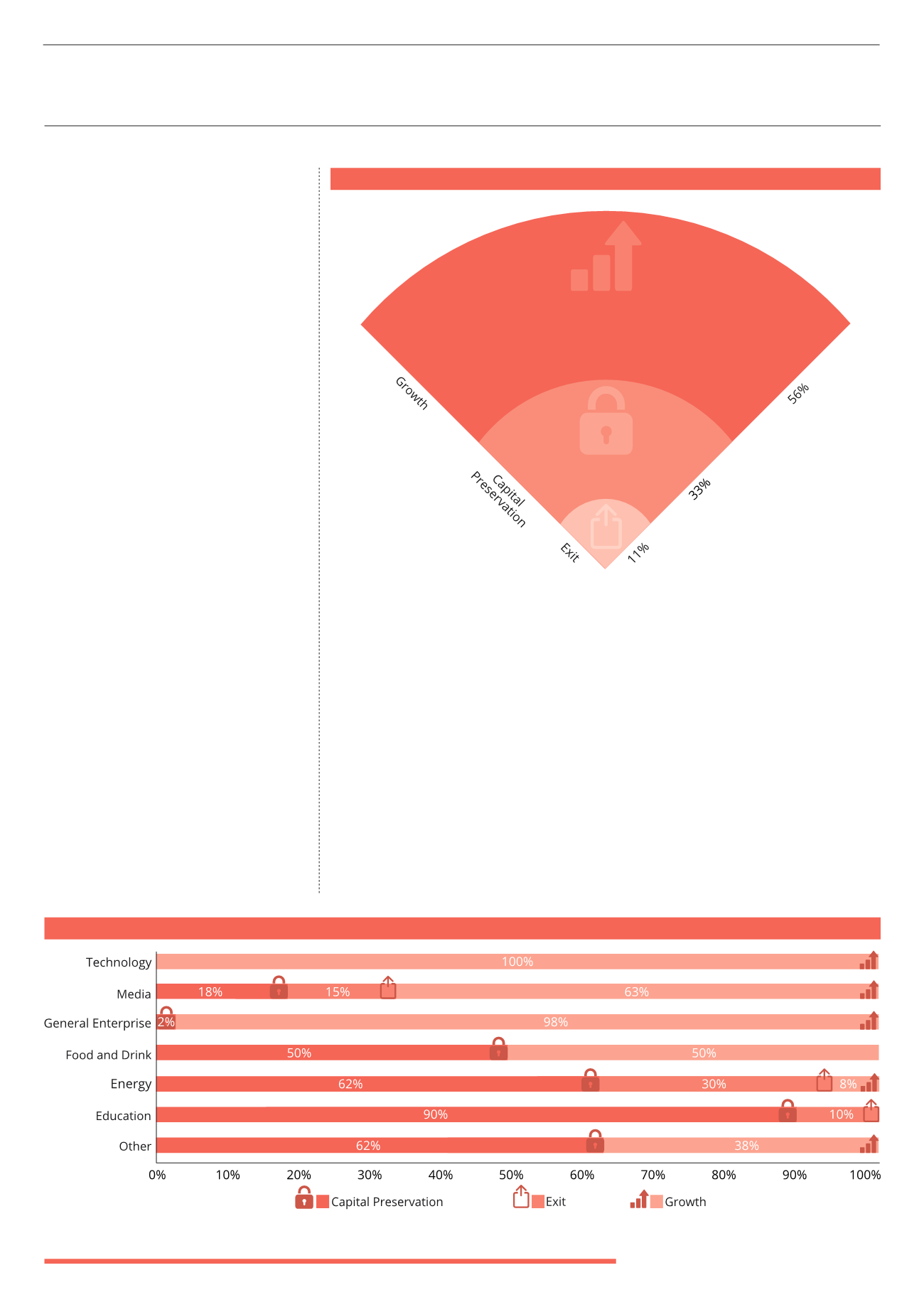

SECTOR SPLIT BY OBJECTIVE

Splitting the market down further we can see the different investment focuses across each

sector. At the extremes, the investments focusing on Transport and Construction are 100%

focused on capital preservation, while investments in the Technology sector are 100%

growth focused.

Again, this is logical: the opportunities available within Other are often asset backed

and therefore provide more protection for investors. In Technology, there are fantastic

opportunities to invest in new start-up companies, with the hits promising stellar returns

and the misses potentially resulting in complete loss of capital (thankfully mitigated by the

EIS tax benefits of course).

Media presents a good mix of opportunities covering all three investment focuses. Energy

is largely weighted towards capital preservation with a number of asset backed investment

opportunities. However, as we should expect, growth is the dominant focus in the majority

of sectors within the EIS market.

ANALYSIS BY OBJECTIVE

OVERALL MARKET SHARE BY INVESTMENT OBJECTIVE

INVESTMENT SECTORS SPLIT BY INVESTMENT OBJECTIVE

(1998-2014)

(1998-2014)