47

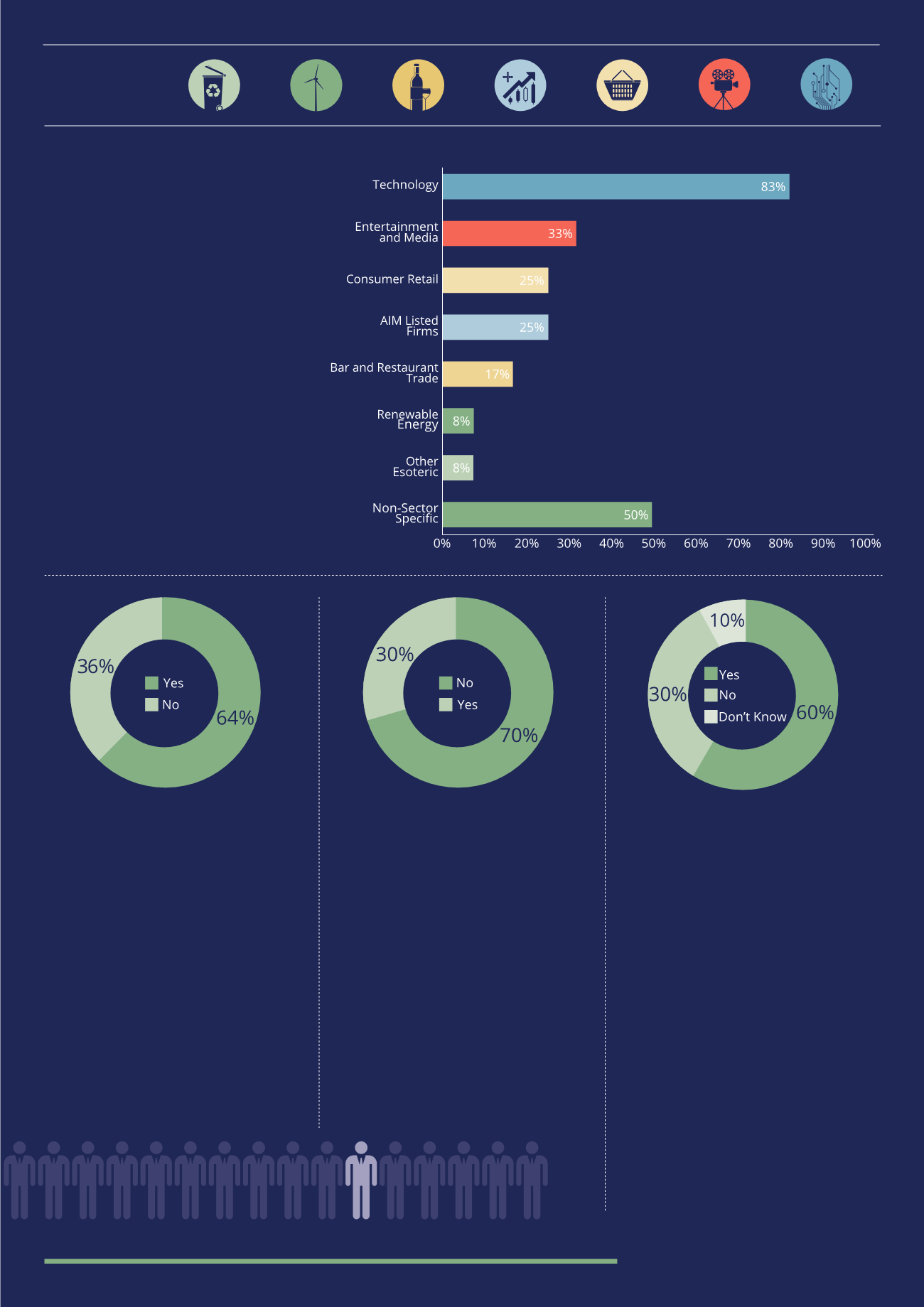

Q. What are your preferred sectors

for EIS investment? (Top 3)

A. 83% of investors surveyed said that

Technology was one of their top three

preferred sectors for EIS investment,

followed by 33% for Entertainment and

Media. Technology is one of the best

established EIS investment sectors with a

huge range of investment opportunities

available which can possibly explain why

so many investors prefer this sector –

and as a sector with many exciting small

start-ups, it also presents the prospect

of excellent returns if somebody can

identify the next Google or Facebook. 50%

of investors said that the sector is not

as important as the specific investment

opportunity. This highlights again how the

quality of information and the potential

returns on offer has a big influence

on the decision making process.

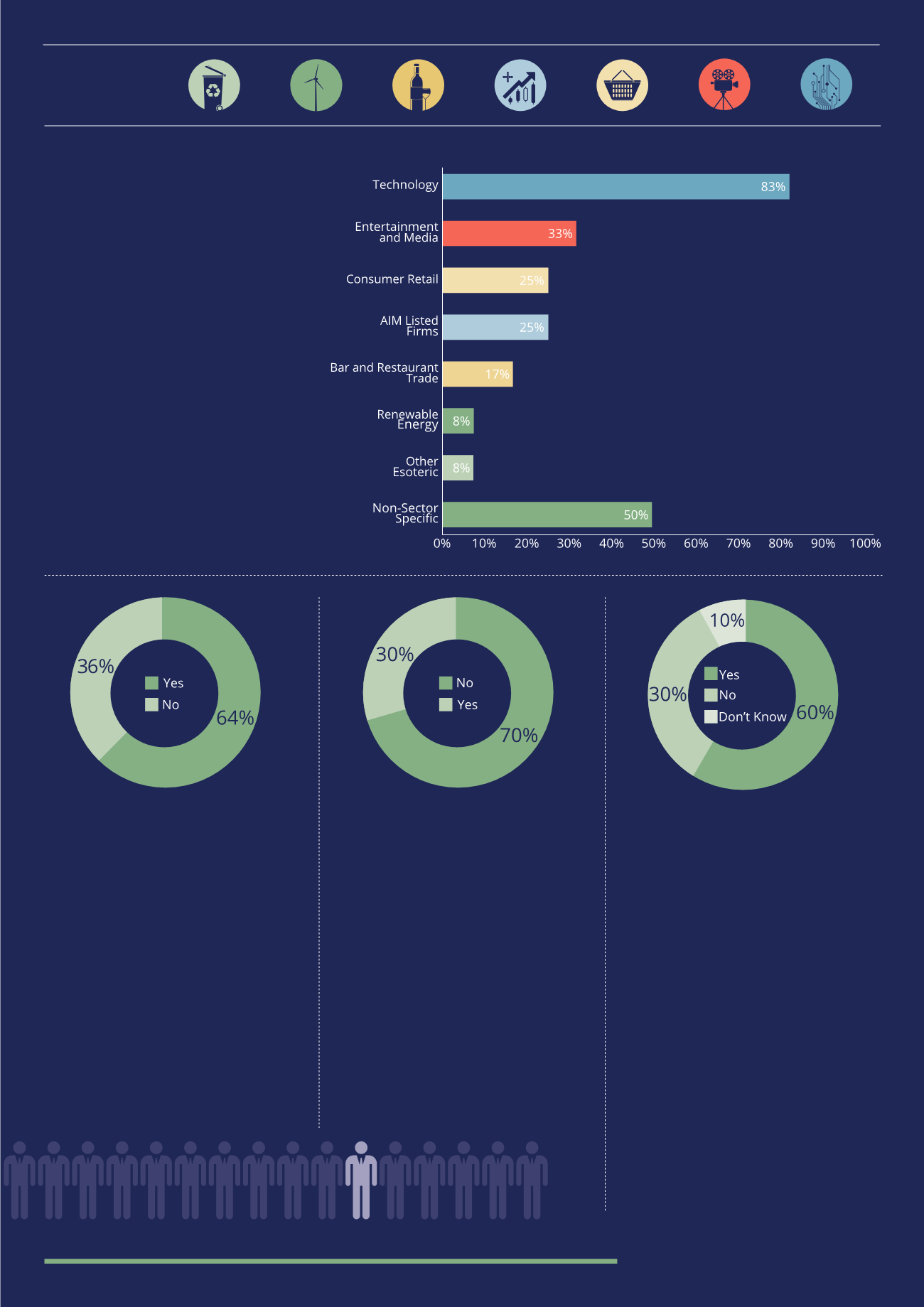

Q. Do you feel there is enough

competition in the EIS market?

A. 64% of investors felt that there is

currently enough competition in the EIS

market, compared to 36% who believe

there is not enough competition. These

results were very close to the responses

advisers gave. Increased competition should

create a better environment for investors,

leading to more openness and transparency

and ultimately better quality investment

opportunities. Respondents feel that there

is too much dominance by the largest three

EIS managers and EIS managers do not

always take on enough risk. There is also

a feeling that single company investments

need more promotion and are often

overshadowed by portfolio offerings.

Q. Do you feel EIS managers provide

enough historical performance data?

A. Despite the substantial size of the EIS

market over two thirds (70%) of investors

feel there is not enough historical

performance data made available from

EIS managers. The quality of available

information has been an important theme

throughout these survey responses.

The lack of coverage in the EIS market

is felt by many investors and there is

some way to go to create a more open

and transparent marketplace. This

may explain this groups’ preference

for single company EIS investments.

Q. Do you feel that there are enough

resources and information available to

enable you to understand the EIS market?

A. Along with the need to have specific

information on each investment

proposition, there is also a need to be

educated on the EIS market as a whole.

Knowledge is required to understand the

tax reliefs available, the risks associated

with investing in unlisted companies and

the often complex investment process.

60% of investors feel that they have access

to enough information to understand

the market, while 30% believe there is

not enough information available and a

further 10% are not sure. There is definitely

scope to further educate investors

on the EIS market, but interestingly

investors felt differently to advisers –

72% of advisers felt that there was NOT

enough information available, perhaps

reflecting their need for more information

in order to comply with regulations.

SECTOR

PREFERENCE

(INVESTOR):

25%

8%

17%

25%

33%

83%

8%