55

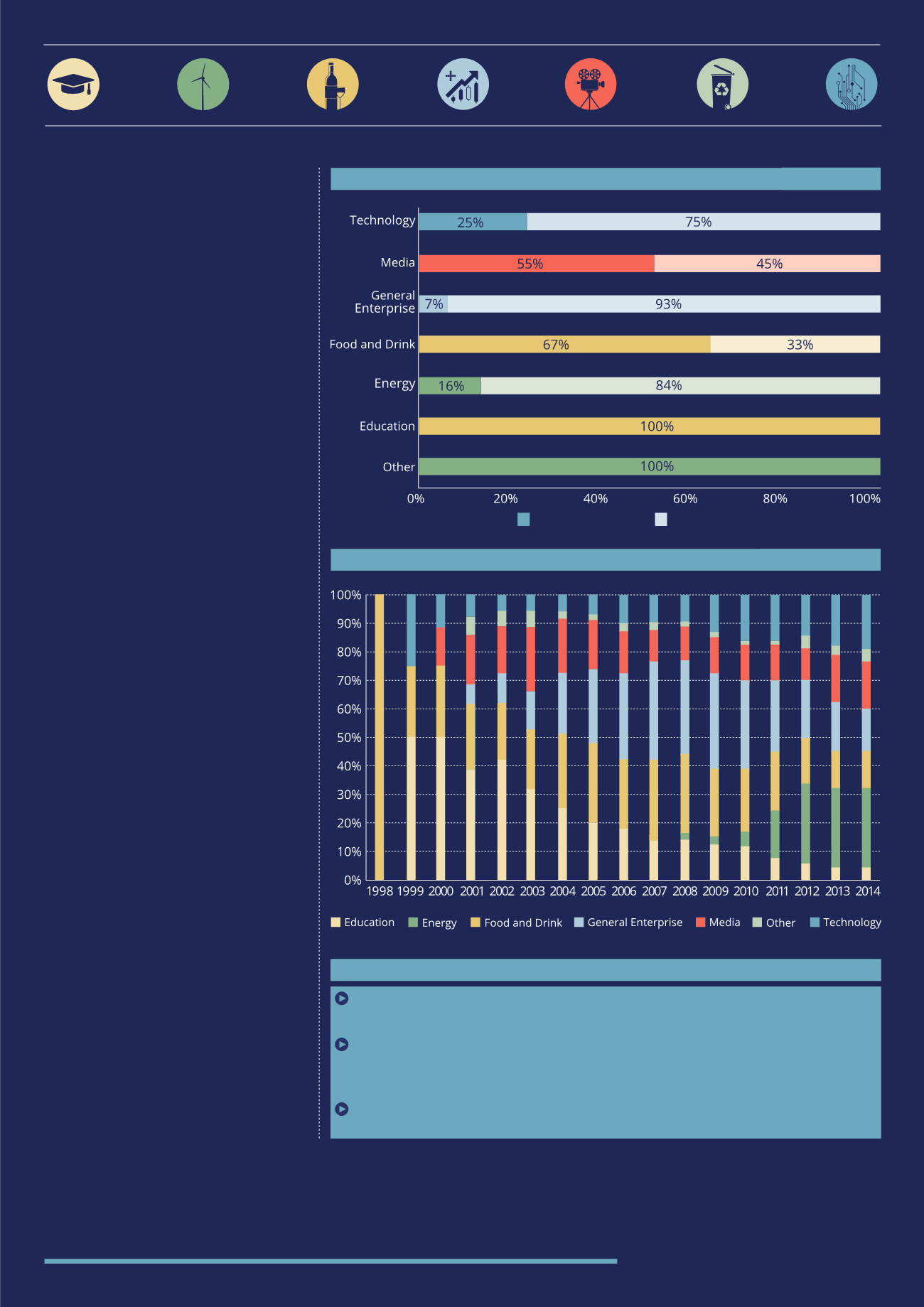

SECTOR SPLIT BY STRUCTURE

The industry sectors can be looked at

in further detail by analysing the split

between single company investments

and managed funds/portfolios.

It is interesting to see that the Other

(including Transport, Sport and

Construction) and Education sectors are all

dominated by single company investments.

It seems that there are no specialist

operators in these sectors as yet, which

suggests that there isn’t the kind of deal

flow required to merit specialist funds.

The larger sectors generally have a good

mix of both single company and fund

based investments. Funds account for

the highest proportion of investments

within General Enterprise accounting for

93% of the sector, followed by Energy with

84% of the sector and Technology with

75%. Media has a relatively even split with

55% single companies and 45% funds/

portfolios. There are a number of well-

established operators in each of these

sectors with many having launched more

than one investment, which suggests

both a healthy amount of deal flow and

investor demand – hopefully an indicator of

successful investments that have benefited

both investors and the companies.

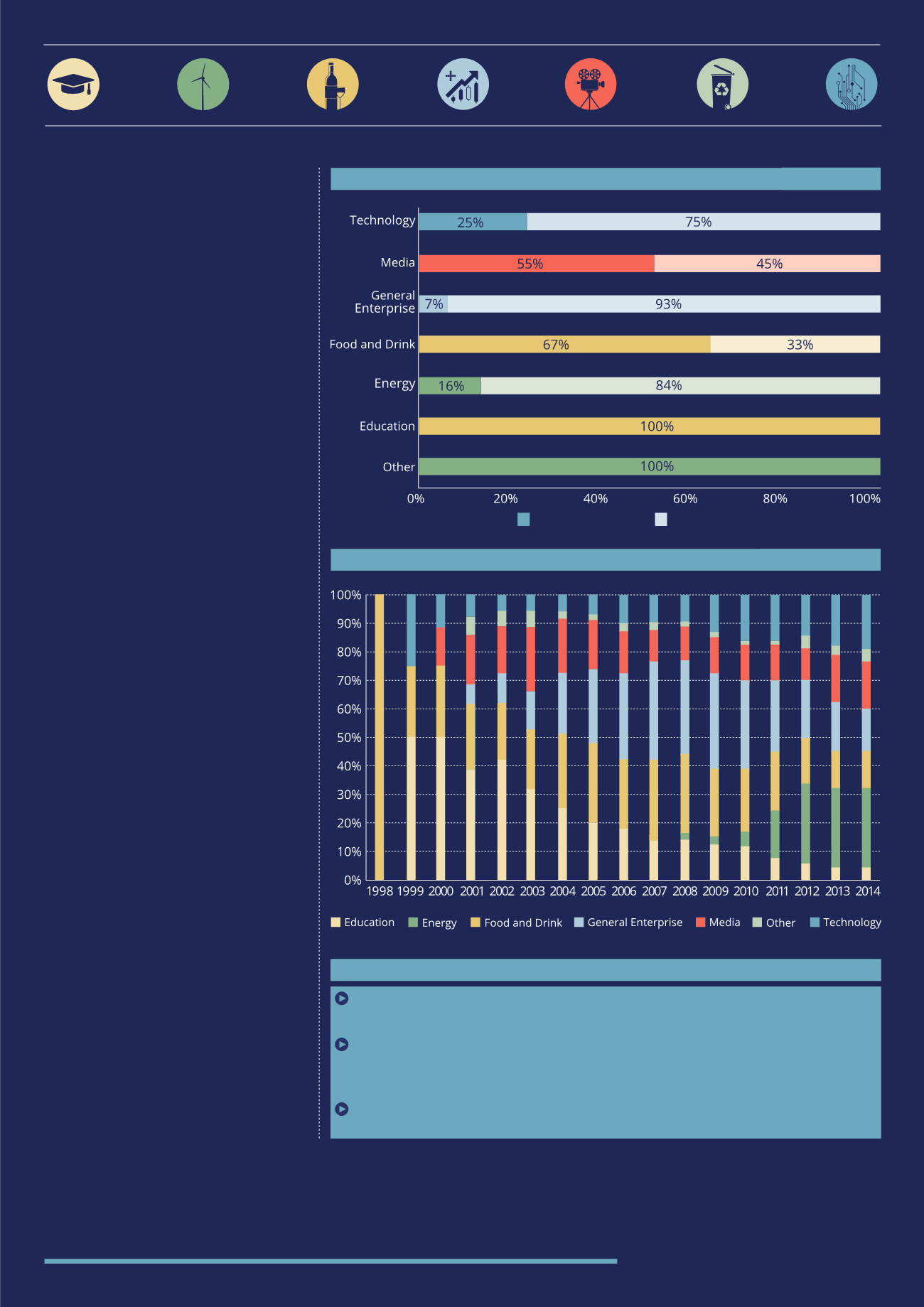

It is also very interesting to see how the

different sectors within the EIS market

have developed over time. The chart on

the right looks at the proportion of the

market each sector accounted for over the

last 16 years. Over time there has been a

reduction in the dominance of sectors such

as Food and Drink and Education, and a

large amount of growth in Energy, which

since 2008 has grown to become the largest

sector. Technology was a dominant sector

in 1999 leading up to the tech bubble, lost

market share between 2002 and 2005

and has since seen strong growth to once

again become one of the largest sectors.

Over the last half dozen years, Food and

Drink and General Enterprise have seen

their market share drop while Technology,

Media and Energy have all risen.

KEY POINTS

There are 7 main sectors in the EIS market with Energy, Technology and General

Enterprise accounting for 64% of the market

The larger, more established sectors tend to be weighted towards fund/portfolio based

opportunities as opposed to the smaller niche sectors which focus on single company

offerings

The EIS market has changed vastly over time with Energy now the largest sector with

28% of the market

67%

33%

SPLIT OF EIS SECTORS BY INVESTMENT STRUCTURE

HISTORIC MARKET SHARE BY SECTOR

(1998 - 2014)

Single Company*

Fund/Portfolio**

(1998 - 2014)

*the darker shade represents single company **the lighter shade represents fund/portfolio