44

The second survey undertaken as part

of this report focused on investors,

with the aim of identifying their feelings

towards EIS managers and investment

opportunities. These results will also

allow us to see whether advisers’ and

investors’ views support each other

and where their views differ.

The survey was sent out by a third

party

to their

database of 6,000 private investors

which included a mixture of HNW and

sophisticated individuals and ordinary

retail investors. It should be noted

that a large number of those surveyed

are very knowledgeable investors and

are likely to have had some previous

knowledge or experience of this sector.

INTENTION OF THE SURVEY

The intention of this survey was to see

how investors perceive the EIS sector:

do they invest; how do they invest; what

opportunities interest them; the types

of investment structures and strategies

they prefer; the criteria they use when

considering a potential investment;

their investment objectives and how EIS

investments meet these objectives.

As with the adviser survey, this survey did

not focus on specific managers and is not

aimed to feed information back to managers

about their position in the market. The

survey has been undertaken independently

in order to gather detailed information

on the EIS sector to support the adviser

survey and for inclusion in this report.

Our hope is that these responses will

echo the adviser survey and will help

to shape future offerings in the market,

helping EIS managers to develop their

propositions and deliver products

that meet the needs of investors.

The survey included less than 20

questions and was relatively similar

in nature to the adviser survey. The

most relevant questions have been

included in the analysis that follows.

PRIVATE INVESTOR SURVEY

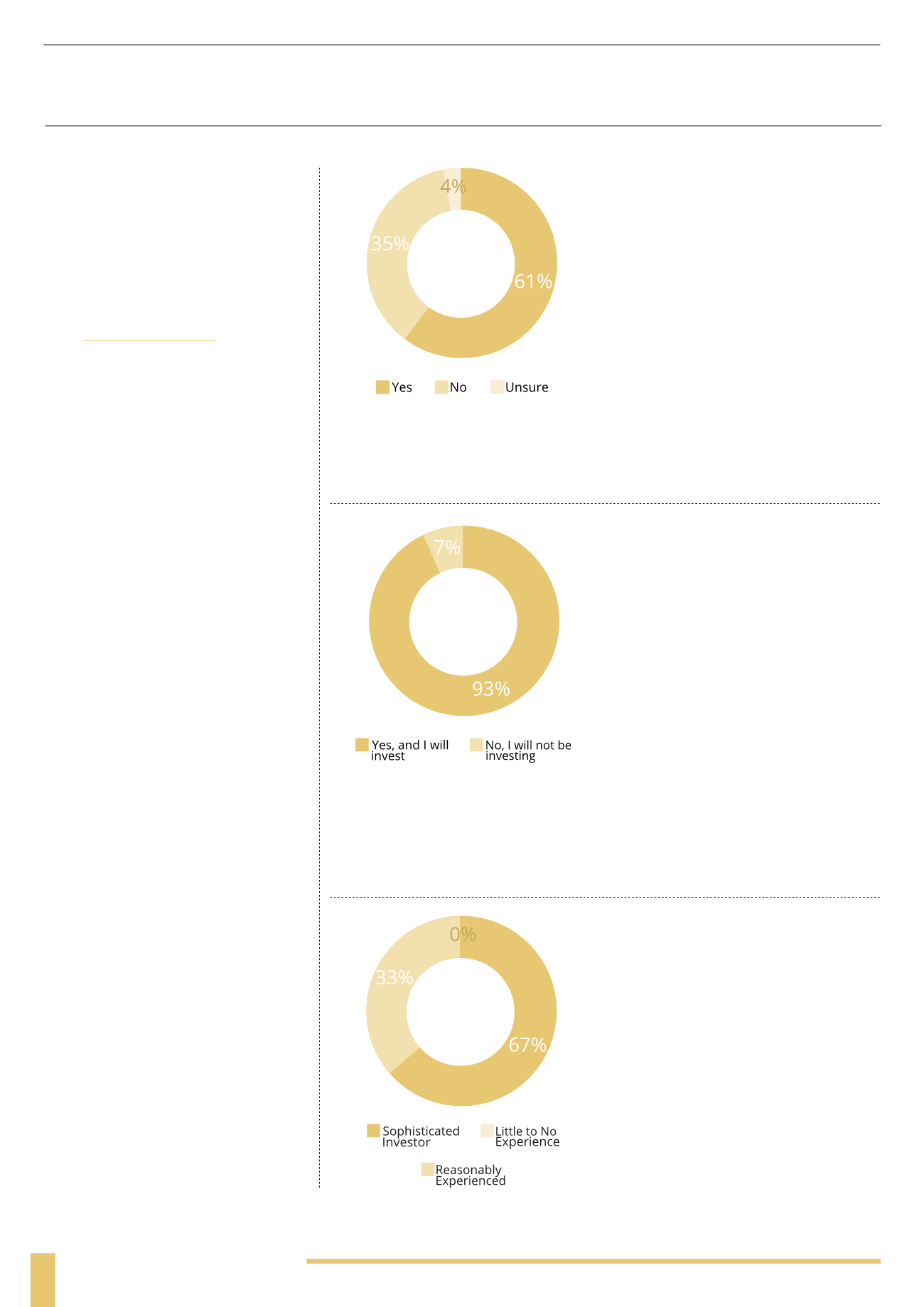

Q. Do you currently hold any Enterprise

Investment Schemes (EIS) Investments?

A. The enterprise investment scheme aims

to help smaller higher risk companies raise

funds from private investors, with investors

receiving tax incentives and the possibility

of strong returns to somewhat offset the

risks involved. We wanted to gauge how

many investors surveyed currently hold an

EIS qualifying investment. 61% of investors

surveyed said that they currently hold an EIS

investment, compared to the 35% that do

not. These results are not representative of

the whole population but they do show that

EIS investments are very popular among

the sophisticated investor community.

Q. Have you ever considered

investing in an EIS?

A. Investors who currently hold an EIS

investment were then asked whether

they would consider investing in an EIS

again in the future. 93% said that they

would consider investing again in the

future and only 7% said they wouldn’t.

We can speculate that this positive

response could stem from previously

good experience with EIS investments,

a good relationship with the investment

manager or from the numerous benefits

that EIS investments can offer such as

portfolio diversification; generous tax

reliefs and the potential for high returns

which can be hard to come by elsewhere.

What it does show is that there is a lot

of mileage for providers in returning to

current investors with new opportunities,

as well as trying to find new investors.

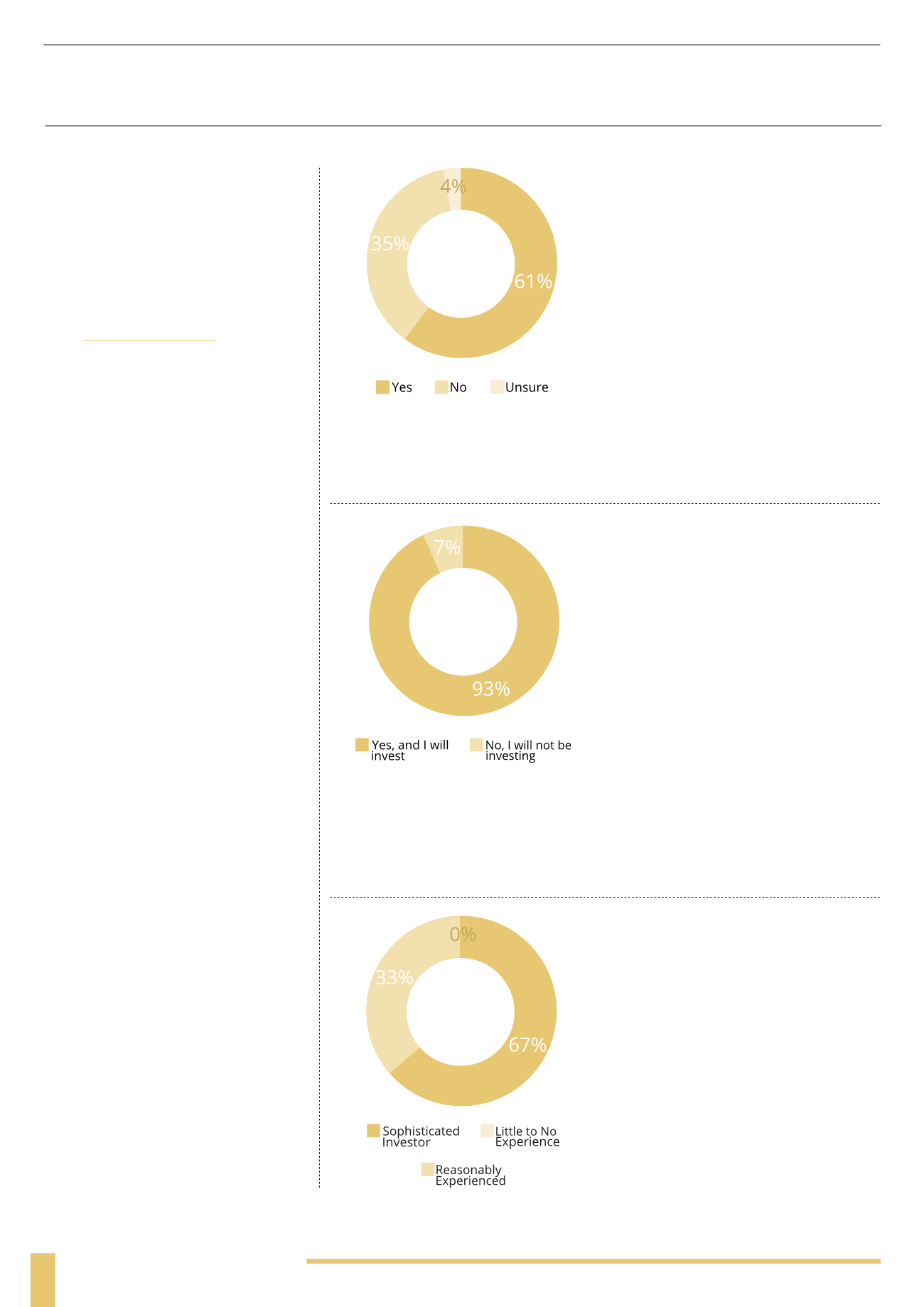

Q. Please state your

investment experience.

A. 67% of respondents to the survey

classed themselves as sophisticated

and the remaining 33% as reasonably

experienced. No one who completed the

survey classed themselves as having little

or no investment experience and therefore

it is likely that every respondent has at

least a good understanding of the market.