43

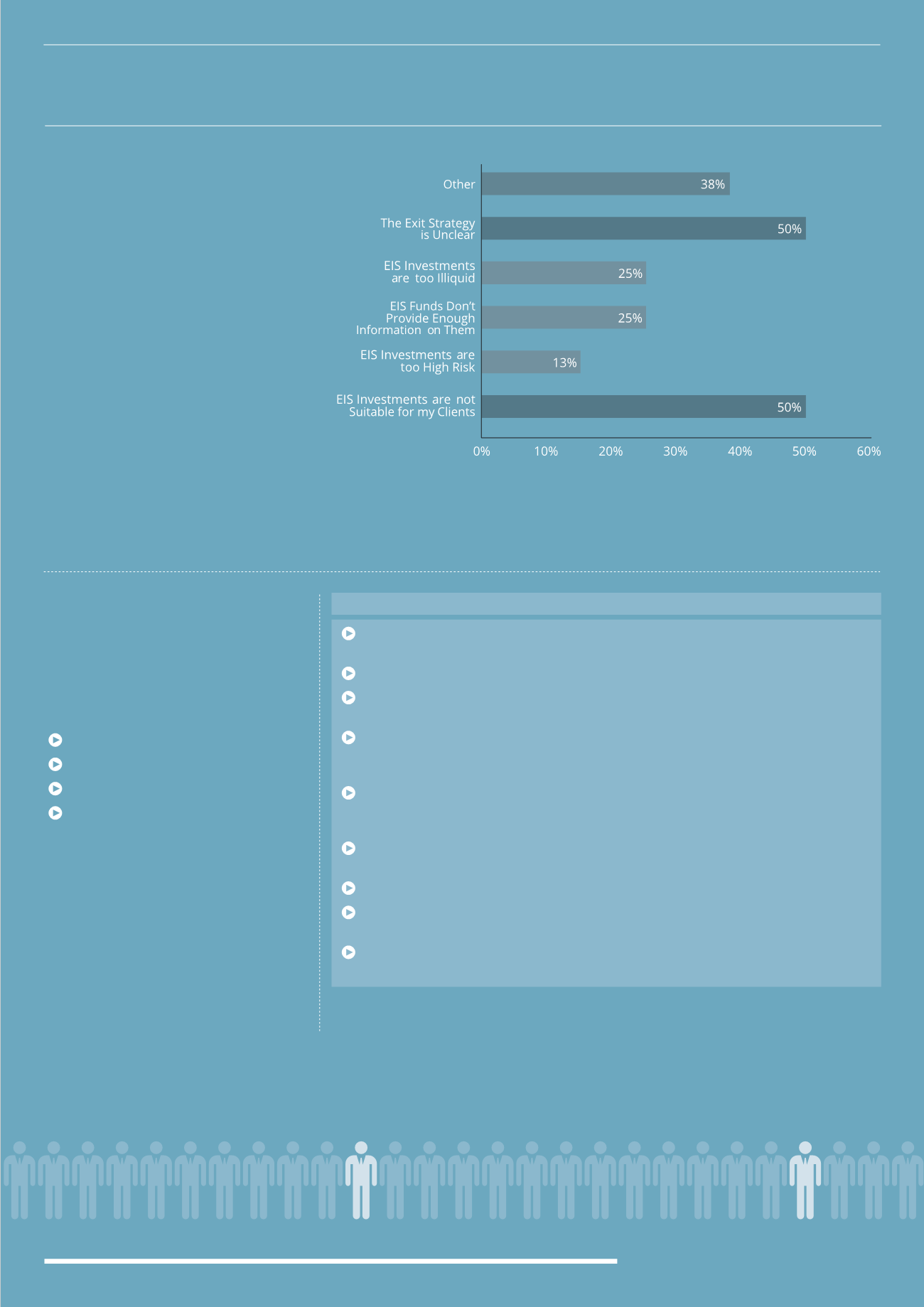

Q. For what reasons do you NOT

recommend EIS investments

to your clients?*

A. The main two reasons cited by 50%

of advisers for not recommending EIS

to their clients are that the investments

are not suitable for their clients and

that the exit strategy is too unclear.

There is a feeling from advisers that

too much control is handed over to

the investment manager and investors

do not have any influence over when

they can exit the investment, even

after the initial holding term.

Other reasons given by advisers are

that EIS investments are too high

risk for their clients and that there

is not enough information available

to fully understand the sector or the

underlying investments themselves.

Growth (67%) and exit (61%) focused strategies were the two most common fund

strategies recommended by advisers

Technology and Renewable energy are the two most popular sectors for advisers

58% of advisers felt that they will increase their use of EIS investments during the next

12 months

Although the majority of respondents advise on EIS, the lack of quality information

available was cited as a major issue by both those that advise on EIS as well as those who

don’t

Advisers felt that HNW investors and those with a larger appetite for risk are more

suited to EIS investments, but benefits such as 100% Inheritance Tax relief could also be

beneficial to ordinary retail investors

63% of advisers cited the fund manager’s reputation as one of the most important

criteria when selecting a fund

26% of advisers who recommend EIS funds stick to only one provider

On average advisers recommend EIS investments from between three and four

different providers

Access to more information and historical performance data was highlighted by a

number of respondents as being essential to help improve the EIS market

*This question was answered by the 20 respondents who do not recommend EIS investments.

Q. What single development

do you believe would most

improve the EIS market?

A. We asked all survey participants what

they believe could be done to improve the

EIS market. The responses were generally

very similar across four key areas:

Availability on traditional platforms

Greater transparency on charges

Historical performance data

More broker support/roadshows

There is clearly a need for advisers to

have more information made available

to them, particularly on historical fund

performance and charges, which will

allow for greater comparisons between

EIS funds and investment managers. The

traditional investment market has a wide

range of tools and resources available,

and many advisers are calling for the same

level of detail making it easier for them to

recommend and facilitate an investment.

KEY FINDINGS FROM SURVEY

“Fifty eight percent of advisers felt that they will increase their use of EIS

investments during the next 12 months

”