46

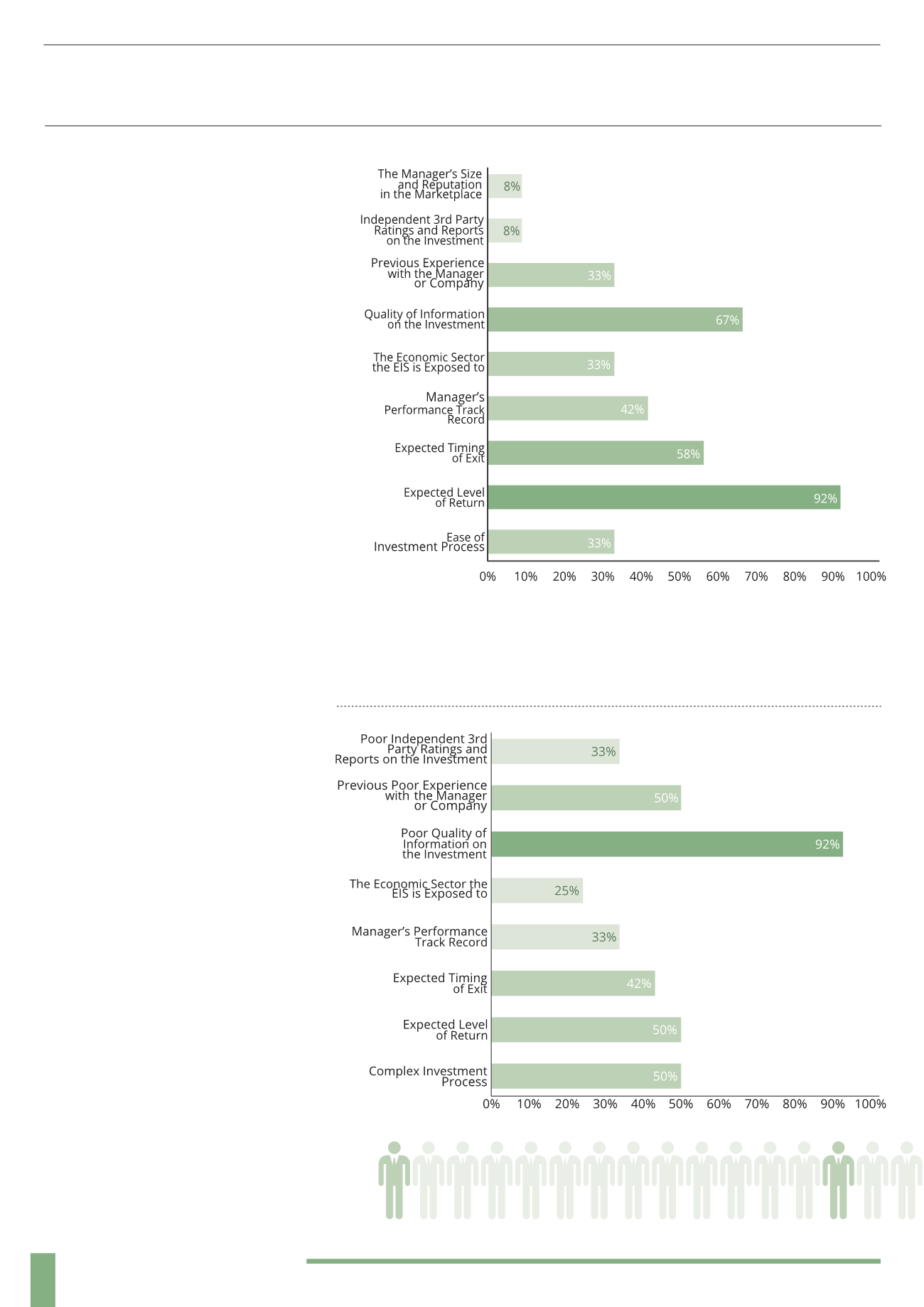

Q. What are your most important criteria

when choosing an EIS investment? (Top 3)

A. Investors were asked to pick their

top three most important criteria when

considering an investment. The vast

majority (92%) cited the expected level

of return, 67% the quality of information

available on the investment and 58% the

expected timing of exit as being within their

top three most important criteria when

considering an investment opportunity.

Returns have stood out throughout this

survey as being extremely important for

investors and as the risks associated to EIS

investments are significantly higher than

traditional investments it is important

for investors to have quality information

on the investment so that they can make

an educated and informed decision.

Criteria picked by only 8% of respondents

included the manager’s size and reputation

in the market place and 3rd party ratings

and reports on the investment – this can

be partly attributed to the large number

of investors that choose single company

EIS investments rather than using the

services of an EIS investment manager.

Identifying the kind of information that

investors value most could help investment

providers tailor their pitch more effectively.

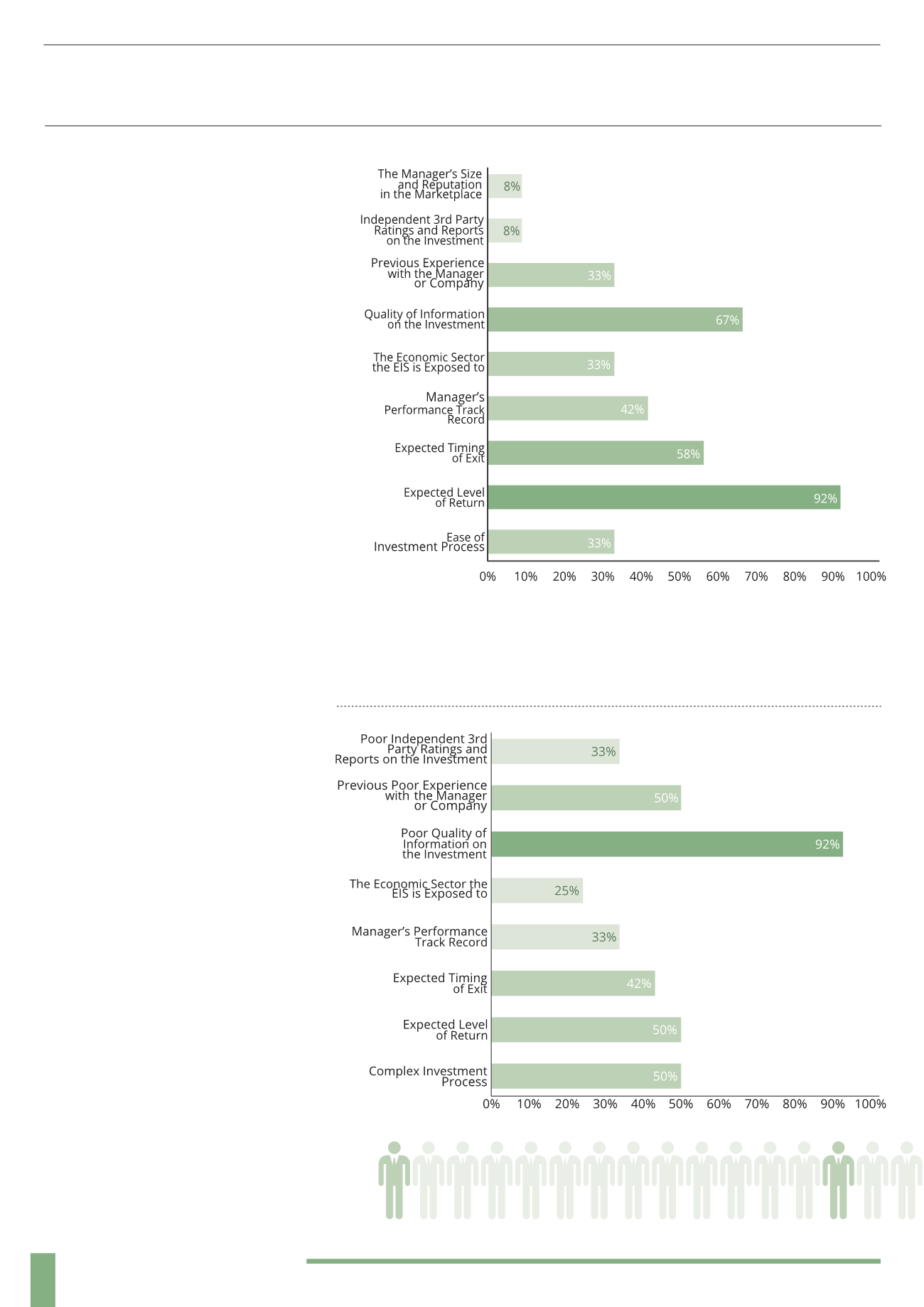

Q. Which factors are most likely

to make you hesitate about

investing in an EIS? (Top 3)

A. Investing into small start-up companies

requires a lot of investment knowledge,

research and due diligence on the

proposition. Once again, the quality of

information is important for investors

with 92% of respondents saying that poor

quality information would cause them to

hesitate making an investment. Investment

providers should again take note of this

as clear, detailed and quality information

on the investment could encourage more

investors to consider EIS. Other factors that

investors are concerned about include the

level of return, having a complex investment

process and previous poor experiences

with the provider or manager (all 50%). The

economic sector the investment is exposed

to was seen as the least likely factor to

make an investor hesitate with only 25% of

respondents selecting this in their top three.

“Increased competition should create a better environment for investors, leading to more

openness and transparency and ultimately better quality investment opportunities”