39

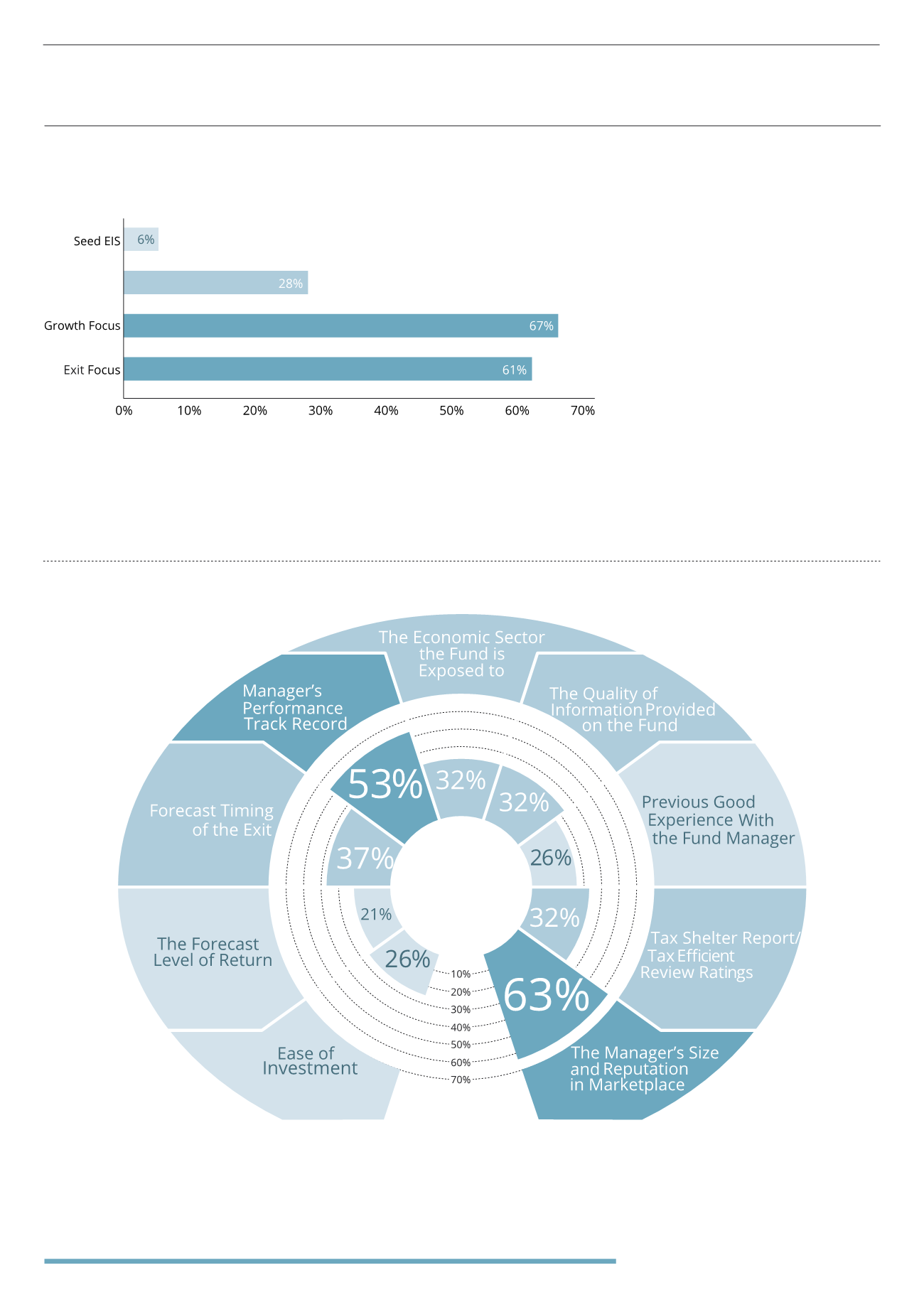

*The following analysis is based on responses from advisers that recommended

discretionary managed funds or both funds and single company investments.

This accounted for 48 respondents in total.

A. Again respondents could choose more

than one answer. This question highlights

the investment strategies that advisers

favour, but of course these are only top

level strategies. Advisers may favour certain

investment managers, sectors or specific

types of opportunities The majority of

respondents choose investment strategies

that have either a growth or exit focus – 67%

of advisers recommend growth focused

and 61% exit focused strategies. These

two options provide for clients looking for

high returns (growth) or tax benefits (exit).

28% of advisers recommend asset backed

investment opportunities which provide

capital preservation and typically include

renewable energy, which can achieve steady

returns over the medium to long-term. Only

6% of respondents recommend Seed EIS

(SEIS) investment strategies which often

focus on very small start-up companies

that can be significantly more risky.

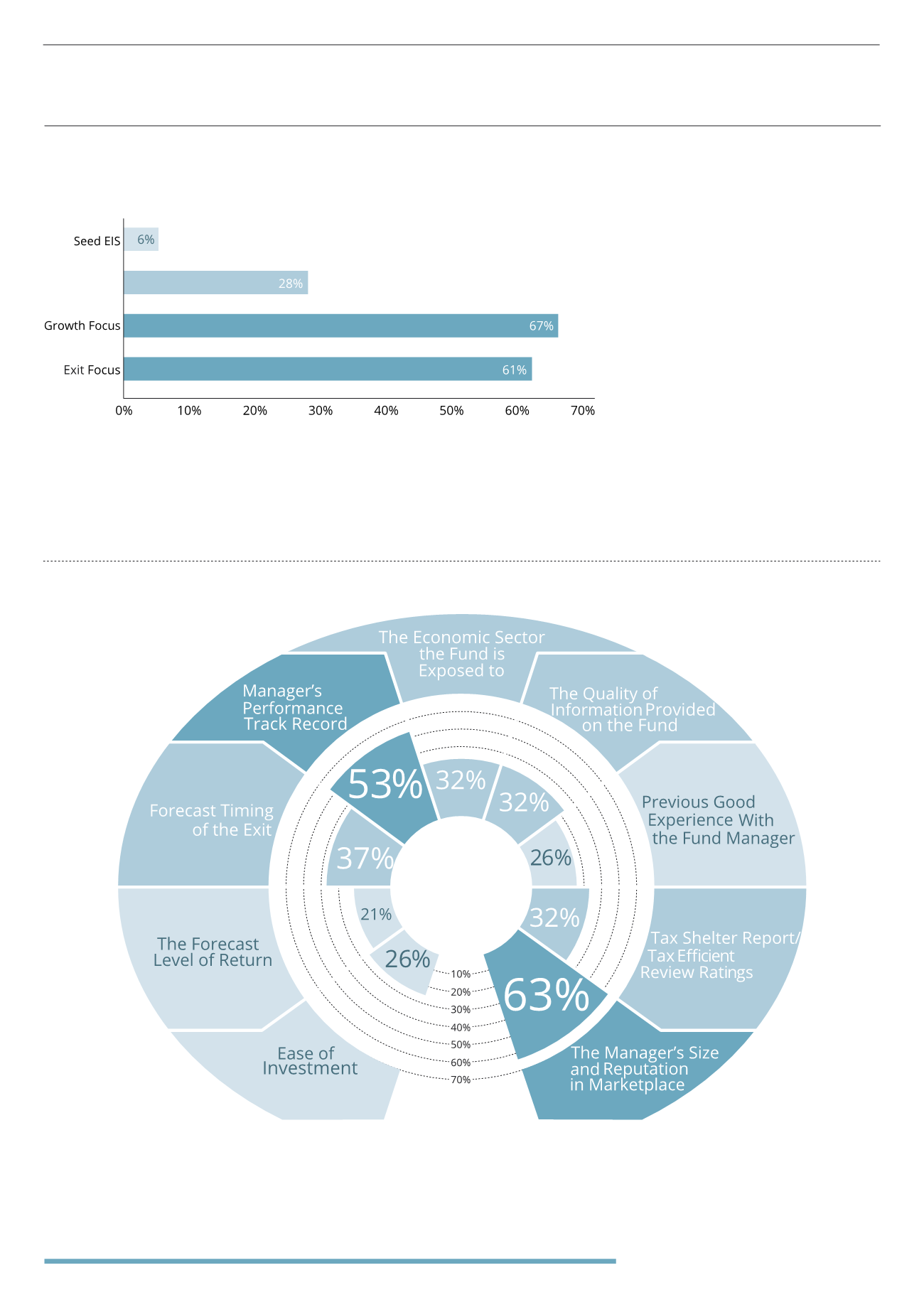

The reputation and size of the manager was cited by 63% of the advisers as the

most important consideration in their selection process.

A. Advisers have a number of considerations when choosing an EIS fund. The reputation and size of the investment manager was cited

by 63% of the advisers as the most important consideration in their selection process. 53% said that the manager’s track record was one

of the most important considerations when choosing an EIS fund. Other criteria such as the forecasting timing of the exit, the economic

sector of the fund and the quality of information provided by the fund manager were also important considerations. Perhaps rather

surprisingly the forecast level of return was seen as the least important consideration, with only 21% of advisers including this.

Q. Which EIS fund strategies do you recommend to your clients?*

Q. What are the most important criteria when choosing an EIS fund?

Asset-backed