41

A. Being an education and content provider

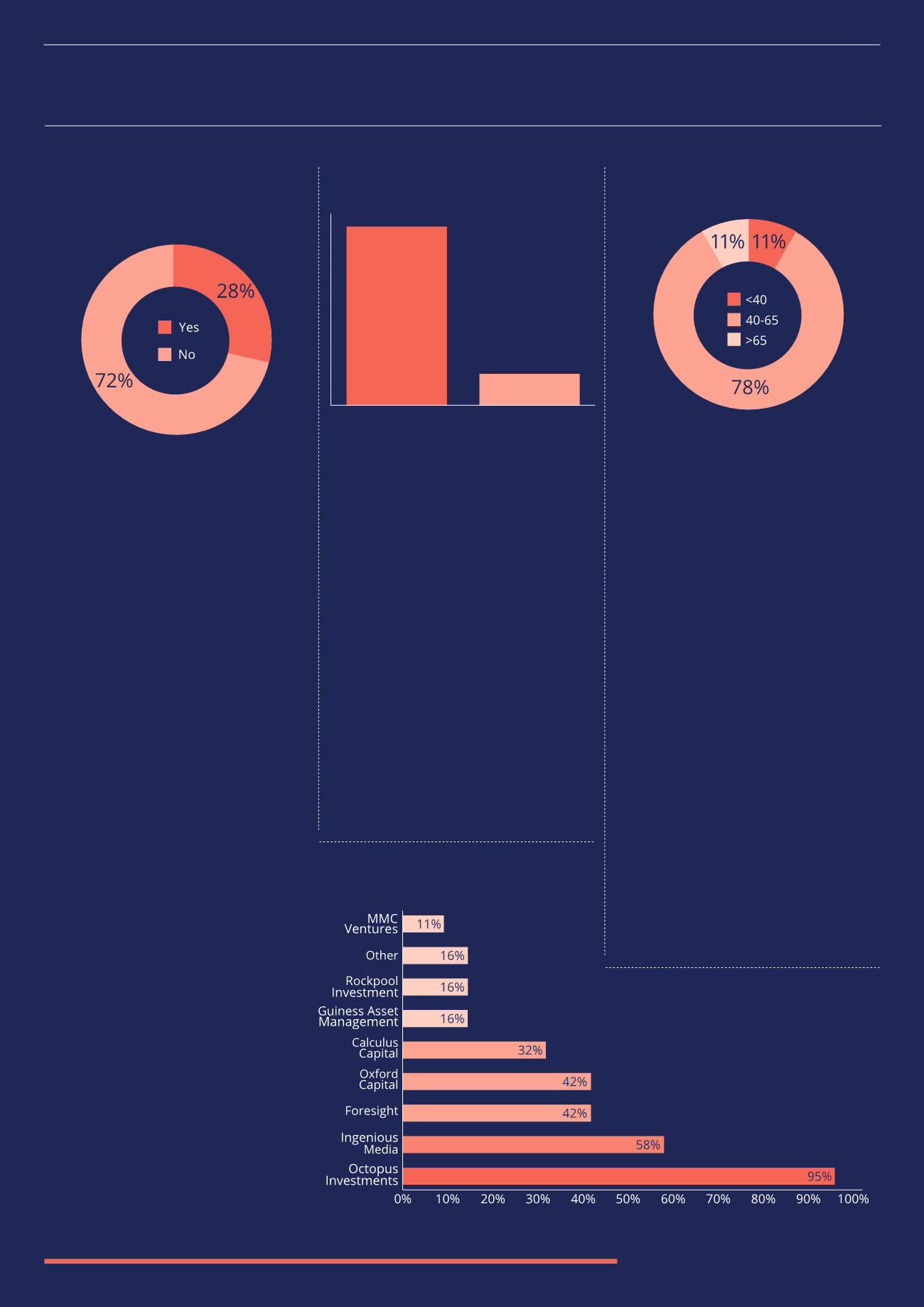

this is a very interesting question for

us. 72% of advisers feel that there are

not enough resources and information

available on the EIS sector. Although the

EIS has been available since 1994 and

there are a number of well-established

managers in the market, advisers feel that

they still do not have enough resources

to gain the whole of market knowledge

they require to fully understand the sector

and recommend these products to their

clients. It seems there is definitely scope

for more education and training in this

space, which should ultimately improve

the market for everyone involved.

A. Advisers were asked whether they

recommend EIS to HNW and sophisticated

investors or ordinary retail investors

(they could also tick both). Unsurprisingly

the vast majority only recommend EIS

to HNW and sophisticated investors,

with only 16% seeing them as suitable

for ordinary retail investors.

EIS investments generally involve a large

amount of risk and capital can be tied

up for a number of years. The tax reliefs

offset some of this risk, but the majority of

ordinary retail investors will not be higher

rate tax payers and therefore will not

receive the maximum benefit from these tax

breaks. Therefore HNW and sophisticated

individuals are usually considered a better

fit for EIS investments as they will take

full advantage of the tax relief available,

have a greater understanding of both

the underlying investment and the risks

involved and also have a greater capacity

for loss should the investment fail.

A. The typical age of an EIS investor is

between 40 and 65 years old. Investors

in this age group will usually be at (or

approaching) the peak of their working

life (and income), may have children

that have recently flown the nest and

will be focused on building a portfolio of

investments to provide for their retirement.

They may also have surplus income

which they can afford to allocate to

riskier investments such as EIS in

the search of higher returns.

Only 11% of advisers recommend EIS

investments to investors below the age of

40 or above the age of 65. Younger investors

may not have the capital to allocate to

these types of investments as they are

likely to be focused on buying a property

and/or starting a family. However, there is

potential for growth from this age group

as they pay more attention to saving for

retirement, and they may also have a

higher capacity for loss, as any losses can

be made up through future earnings.

Investors in the over 65 age group are

likely to be in retirement and therefore

would not take on investments that could

risk their retirement income. They may

though consider EIS for the potential

Inheritance Tax relief available.

“Advisers need good quality information covering the nature of EIS, the practical process of investing

and the many ways of using EIS as part of a broader financial strategy”

Andrew Sherlock, Oxford Capital

Q. Do you feel that there are enough

resources and information available to

enable advisers to achieve whole of the

market knowledge of the EIS sector?

95%

16%

HNW and

Sophisticated

Ordinary Retail

Investors

Q. What category of client do you

recommend invest in EIS funds?

Q. What age is your average EIS investor?

Q. Which EIS investment managers and

platforms have you had dealings with?

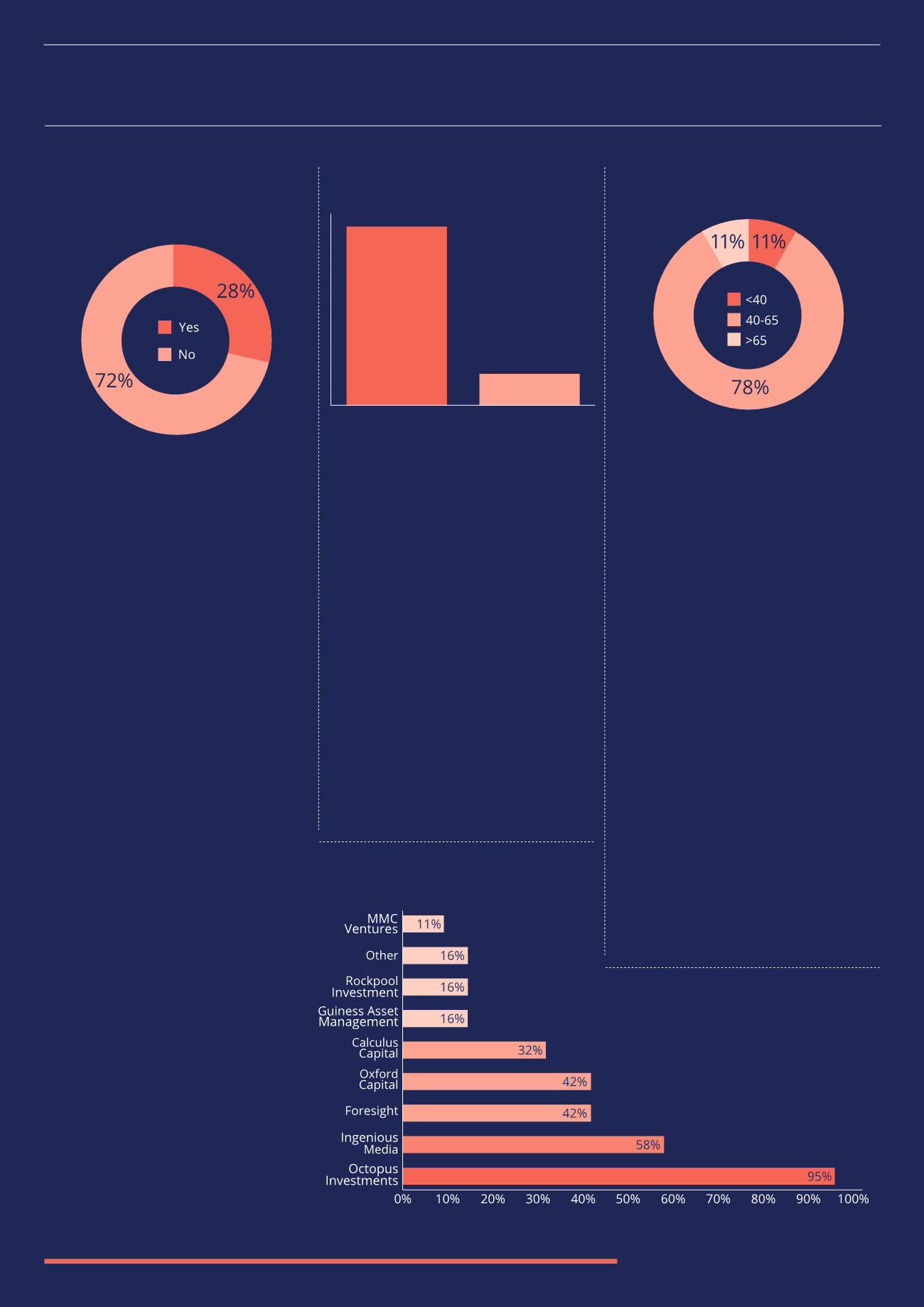

A. Octopus Investments was by far the

most widely known EIS manager with 95%

of advisers having dealings with them.

This is likely due to their track record and

existence in the EIS market for a number of

years. Other well-known managers include

Ingenious Media with 58% and Oxford

Capital and Foresight, both with 42%, and

managers with a smaller presence including

MMC with 11%. It appears advisers stick to

managers that they have had previously

good experiences with, making it hard for

new entrants or competitors to attract

these advisers. Many of the advisers

questioned had not used a manager that

wasn’t listed above. Interestingly just over

a quarter of advisers use only one EIS

manager, but some use as many as nine

and a large number use between five and

seven managers. On average advisers use

between three and four EIS managers.

Other EIS managers and platforms that

advisers use include Kuber Ventures,

RAM Capital, Downing, Motion Picture

Capital, Triple Point and Par Equity.