54

THIRD PARTY REVIEWS

Investments often go through a third

party review from either Allenbridge

Tax Shelter Report or Tax Efficient

Review. These companies review both

single companies and funds and aim to

provide impartial opinions on a number

of aspects of the investment such as the

track record of the manager, the focus

and sector of the investment and the key

principles behind the offering. These two

reports are often used in the marketing

of the product as they provide impartial

opinions for investors and advisers to

use as part of their own due diligence and

investment decision making process.

As reviews are only made available to

paying subscribers it is not possible to

accurately ascertain which investment

offers have or haven’t been reviewed: based

on our desk research we estimate that 62%

of investments (across both single company

and funds/portfolios) have been reviewed

by either Allenbridge Tax Shelter Report

or Tax Efficient Review, with 6% reviewed

by both companies. If these estimates are

correct it would suggest the remaining

32% have not been reviewed by either

company. Going through this review process

does not incur a cost for the provider.

The benefits include increased exposure,

marketing and enhanced credibility.

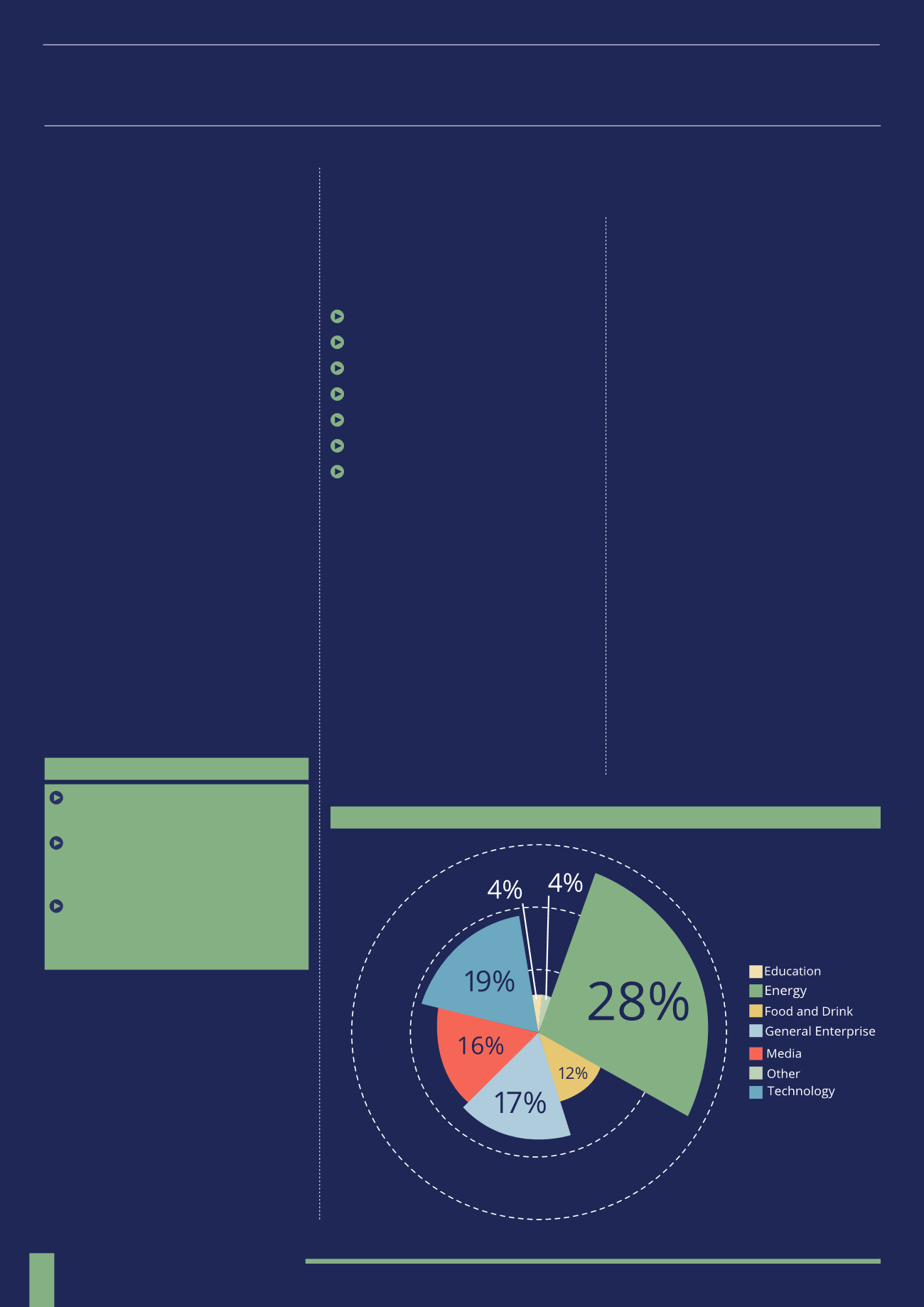

There are seven principal industry sectors

within the EIS market which can be

broken down into a number of specific

sub-sectors. This analysis looks at the

sector level only. The sectors are:

Energy

Technology

General Enterprise

Food and Drink

Media

Education

Other

At present the largest sector is Energy,

which accounts for 28% of the market.

Investments available within the Energy

sector include traditional energy projects,

but the bulk of investments are in

renewable energy projects such as wind

turbines and solar power installations.

These projects have their revenue streams

underpinned by government subsidies

such as Feed-in Tariffs (FiTs) and Renewable

Obligation Certificates (ROCs), which

guarantee a minimum price for the energy

produced over a fixed period of time.

The subsidies remove some of the

uncertainty from the undertaking, and

as the installation, maintenance and

performance of renewable energy kit is

now well understood and very robust,

these investments are very attractive.

The treasury has recognised this and

has gradually been lowering FIT levels

resulting in them now being excluded

from inclusion in EIS (with the exception

of hydro and biomass installations).

Technology is the next largest sector

accounting for 19% of the market, followed

closely by General Enterprise with 17%

and Media with 16%. These sectors are all

relatively well established in the market

and include a mix of single company and

managed funds. General Enterprise is a bit

of a catch-all, but it is no surprise to see

Technology and Media capturing so much

of the EIS investment market, as they are

both sectors that experience a high degree

of change and engender themselves to

adventurous, smaller start-up companies

of the sort that qualify for EIS status.

Smaller niche investment sectors including

Construction, Transport and Sport have

been grouped together under Other due

to the very small number of investments in

this space. Education is another very small

sector, which together with Other accounts

for less than 10% of the overall market.

“EIS funds allow an investor into a deal-flow that is not generally seen by Angel investors”

Alastair Kilgour, Parkwalk Advisors

28%

OPPORTUNITIES BY SECTOR

KEY POINTS

16% of the EIS investments on our

investment register are currently open

EIS providers prefer unapproved funds

to provide more flexibility to managers

and investors

Fund/portfolio investments tend to

have higher minimum investments than

single company investments, averaging

around £16,000

SECTOR ANALYSIS

(1998-2014)

20%

30%