60

The Tax Efficient Review published some

timely data on EIS funds raised in the

2013/14 tax year (see table opposite). In

the main this is based upon data provided

by the relevant providers. The investment

opportunities have been categorised

using their own unique methodology.

What the data shows us chimes with the

findings from our research. The two biggest

areas of investment are funds or portfolios

with a track a record – supporting our

point that as a track record is established,

launching and raising investment into a

fund becomes easier. The biggest sector

for investment is renewable energy, with

62% of investment during the period. The

second biggest sector contained a mixture

of growth focused funds, which shows that

the tax incentive is working, pushing capital

into smaller, growth focused companies.

This also demonstrates that companies

without a track record can struggle

to establish themselves. Perhaps

surprisingly, there were not many AIM

focused EIS investments, even though

investing in AIM listed companies

provides some additional insight into the

underlying investments that is not always

available with non-listed companies.

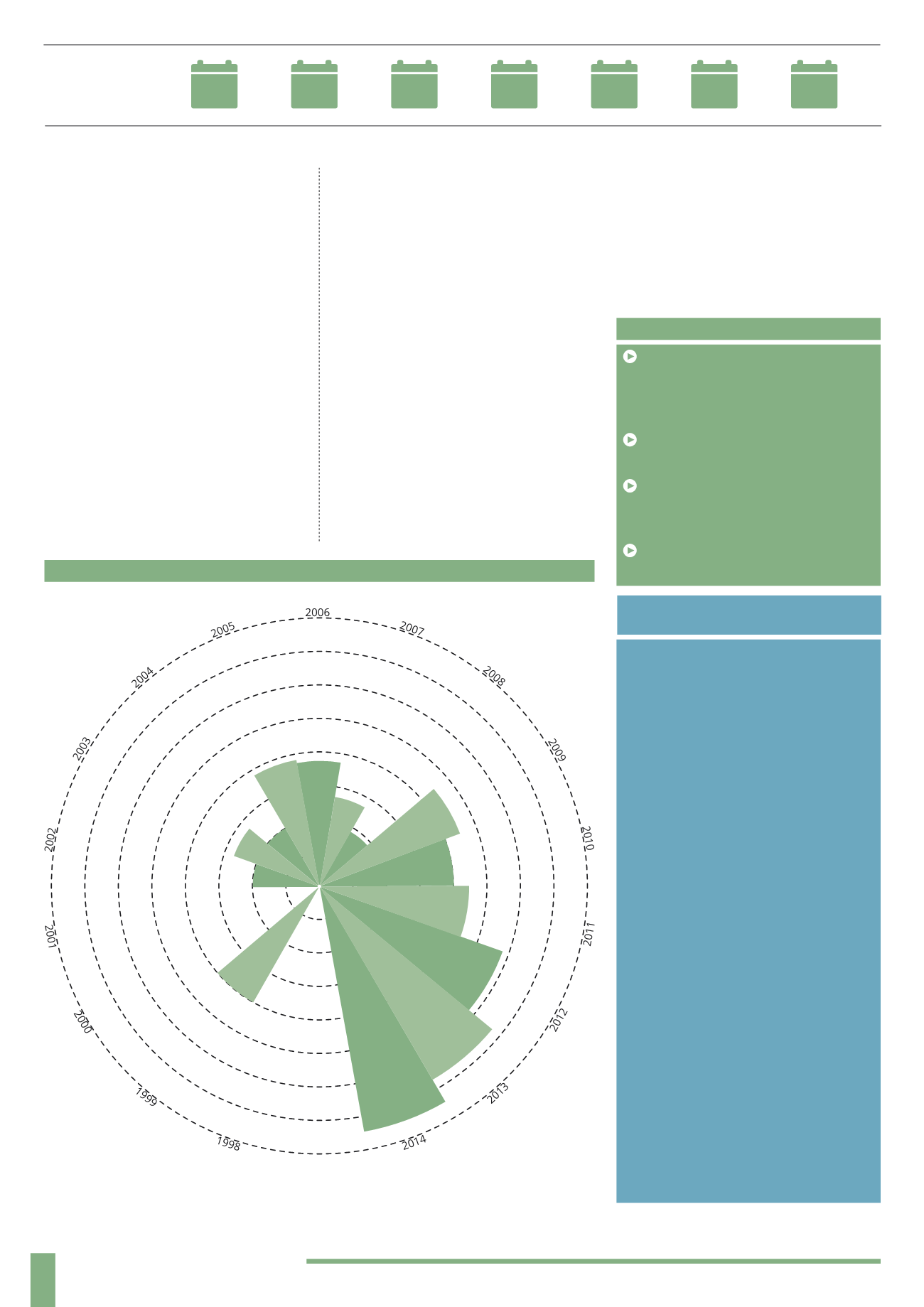

AVERAGE ANNUAL TARGETS PER OPPORTUNITY

(1998 - 2014)

£10m

£6.5m

£6.43m

£11.35m

£11.25m

£9.79m

£16.57m

£14.48m

£5m

£10m

£9.29m

£17.77m

2014

2013

2012

2011

2010

2009

2008

FUNDRAISING

TARGET

GROWTH:

-31%

60%

-11%

14%

28%

14%

7%

AVERAGE ANNUAL

FUNDRAISING TARGETS

It is more meaningful to focus specifically

on fund/portfolio investment opportunities

here as they account for the largest share

of the EIS market and have seen the largest

amount of growth in recent years. The main

aim of looking at the growth in this way is

to see whether, on average, investment

providers have increased their fundraising

each year as investor interest and the

number of available opportunities in the

market has increased. This will also show

whether providers have more confidence

in their ability to raise money and have

increased their targets each year.

Between 1998 and 2005 there was a lot of

variation in the average fundraising target.

There were a number of years when there

weren’t any fund launches recorded or

where there were only a very small number.

There was also a noticeable drop in

fundraising in 2007 and 2008, which is

likely to be down to the performance of

the wider financial markets. However there

was then a jump in the average fundraising

target in 2009, and since then we can

identify a pattern of steady increases in the

average target over the last four years.

It is also interesting to note how the smallest

and largest fundraises have changed over

this period. The lowest fundraising amount

has generally fallen over the last five years,

and at the same time the highest has

increased. This could be down to the wide

range of opportunities now available in the

sector, but perhaps can also be attributed

to there being a number of new entrants

in recent years with smaller funds.

At the other end of the scale, the increase

in the number of large funds could be

down to growing investor confidence in and

awareness of the sector, and also wider

economic confidence stimulating larger

scale investment projects. The growth in

the energy sector generally is also

an important factor here.

KEY POINTS

Single company investments are

smaller scale (raising £3.79m on average)

compared to managed funds/portfolios

(raising £12.84m on average)

Technology based investments have

on average the largest fundraising targets

Exit focused investment strategies

have on average the largest fundraising

targets

39% of investments did not meet their

upper level fundraising target

ANOTHER LOOK AT

FUNDRAISING TARGETS