62

The following section looks at the returns

available in the EIS market. There is

often a criticism that EIS investments

focus too much on the tax benefits

rather than the actual investment case

for underlying opportunities. This can

often skew the returns and make the

investment manager’s performance

appear disproportionally positive.

This also presents a challenge when

it comes to assessing the market, as

some opportunities are advertised with

targeted returns before tax relief, whilst

others advertise returns after tax relief.

EIS investments must be held for a

minimum of three years in order to qualify

for tax relief. The vast majority of EIS

investments look to pay returns at the end

of the investment term (often variable)

in the form of a capital gain which is tax

free. Any dividends paid are subject to

Income Tax at the investor’s marginal rate.

Investors therefore have to wait a number

of years for returns to be realised. Single

company investments can provide the

investor with more flexibility as they can

sell their shares as and when they wish

(but they must of course find a buyer).

A very small number of investment

opportunities look to pay annual

returns in the form of a dividend or

royalties based on the performance

of the underlying company, but of

course this income is taxable.

OVERALL RETURNS

Every investment in the EIS market

offers variable returns – there are no

products offering a fixed rate of return.

Returns are usually positioned as a

target level of return. It’s worth noting

that it has not been possible to collect

return information on every investment

included in this analysis, with 35% of

opportunities not quoting their targeted

returns in their marketing literature

or providing them to us on enquiry.

Investments only quoting total returns

range from 100% to as high as 500%.

This is often worded in the parlance of

angel investors as ‘5x return of capital’.

These returns can look very attractive,

but they must be looked at based upon

time – a 500% return may not appear as

attractive if it’s going to take 10-20 years

to be realised. As always, the exit is as

important as the level of return achieved.

Whilst overall there is a very wide range of

returns available in the market, it is more

meaningful to look at the products when

split down by structure. Single company

EIS investments have the highest range

of targeted returns and make up both

extremes of the market. A number of

the returns on offer are very aggressive,

and are therefore likely to present some

very high risks to investors. The average

targeted return from single company

EIS investments is 23% per year.

EIS funds/portfolios have more moderate

targeted returns but these still range

from a conservative 6% per year to a

very aggressive 60%. The average for

this structure is lower than the market

average at 18%. There are only a very small

number of EIS funds/portfolios that offer

particularly high returns and these are

all found within the Technology sector.

While there are some extremely high

returns targeted in the market, it is

important to note that returns are often

advertised including tax relief (often for a

higher rate tax payer) and this therefore

skews the actual return achieved by the

manager. Ordinary rate tax payers would

not benefit from the same sort of returns

and investors must be mindful that the

tax reliefs on offer could potentially hide

poor performance from the company and/

or fund manager when the investment is

compared to more mainstream investment

opportunities (although of course, provided

the investor gets the tax reliefs this

is somewhat of a moot point).

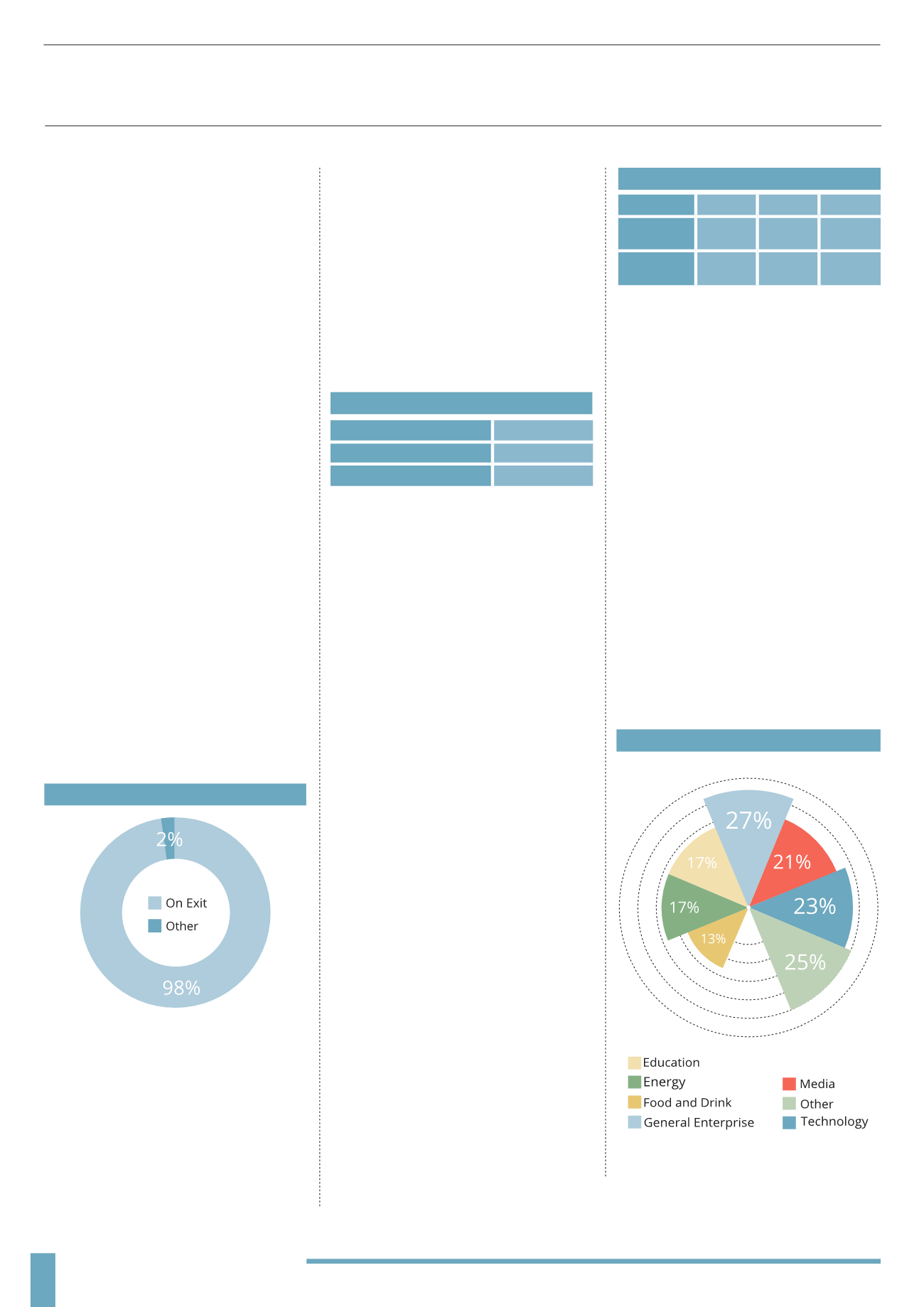

RETURNS BY SECTOR

The highest average forecast return

comes from the General Enterprise

sector at 27%. At the other end of

the scale Education offers the lowest

targeted return at only 13% per year.

Media, Technology and Other all target

average returns of over 20% per year, which

would signal that these sectors present a

number of high risk/reward opportunities.

The Energy sector offers lower returns of

17% on average, which is still very strong

compared to mainstream opportunities.

As many of these investments are lower

risk, asset backed investments that benefit

from long-term revenue streams based on

government subsidies, it is easy to see why

they have been so attractive to investors.

But even within each sector there is a very

wide range of potential returns, offering

a large number of opportunities for

investors targeting varying risk profiles.

ANALYSIS BY RETURNS

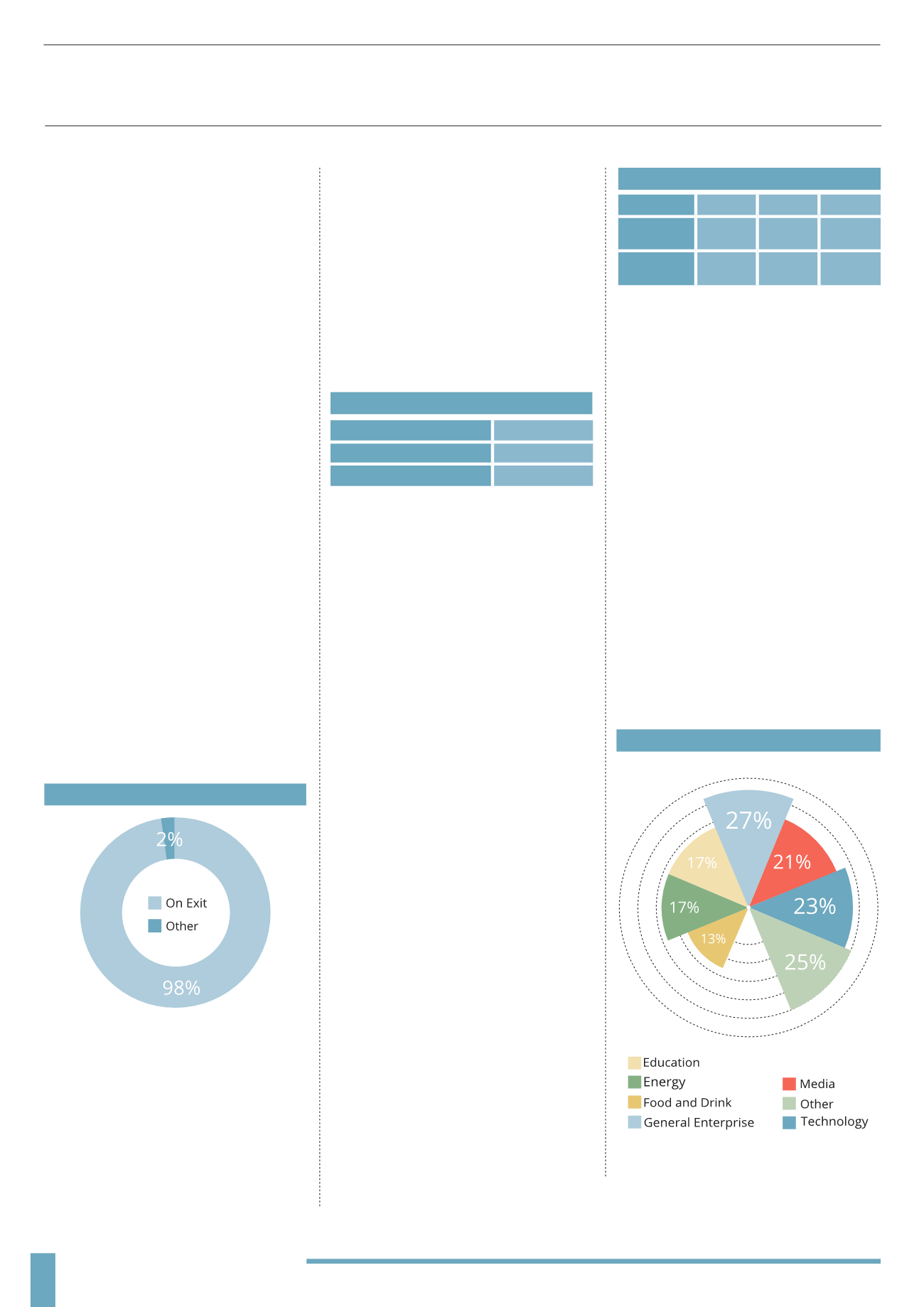

FREQUENCY OF RETURNS**

RETURNS BY SECTOR*

Low

3%

High

84%

Average

20%

Low High Average

Single

Company

3% 84% 23%

EIS Fund/

Portfolio

6% 60% 18%

ANNUAL RETURNS*

RETURNS BY STRUCTURE**

*targeted **1998-2014

(1998-2014)

(1998-2014)