65

MANAGEMENT CHARGES

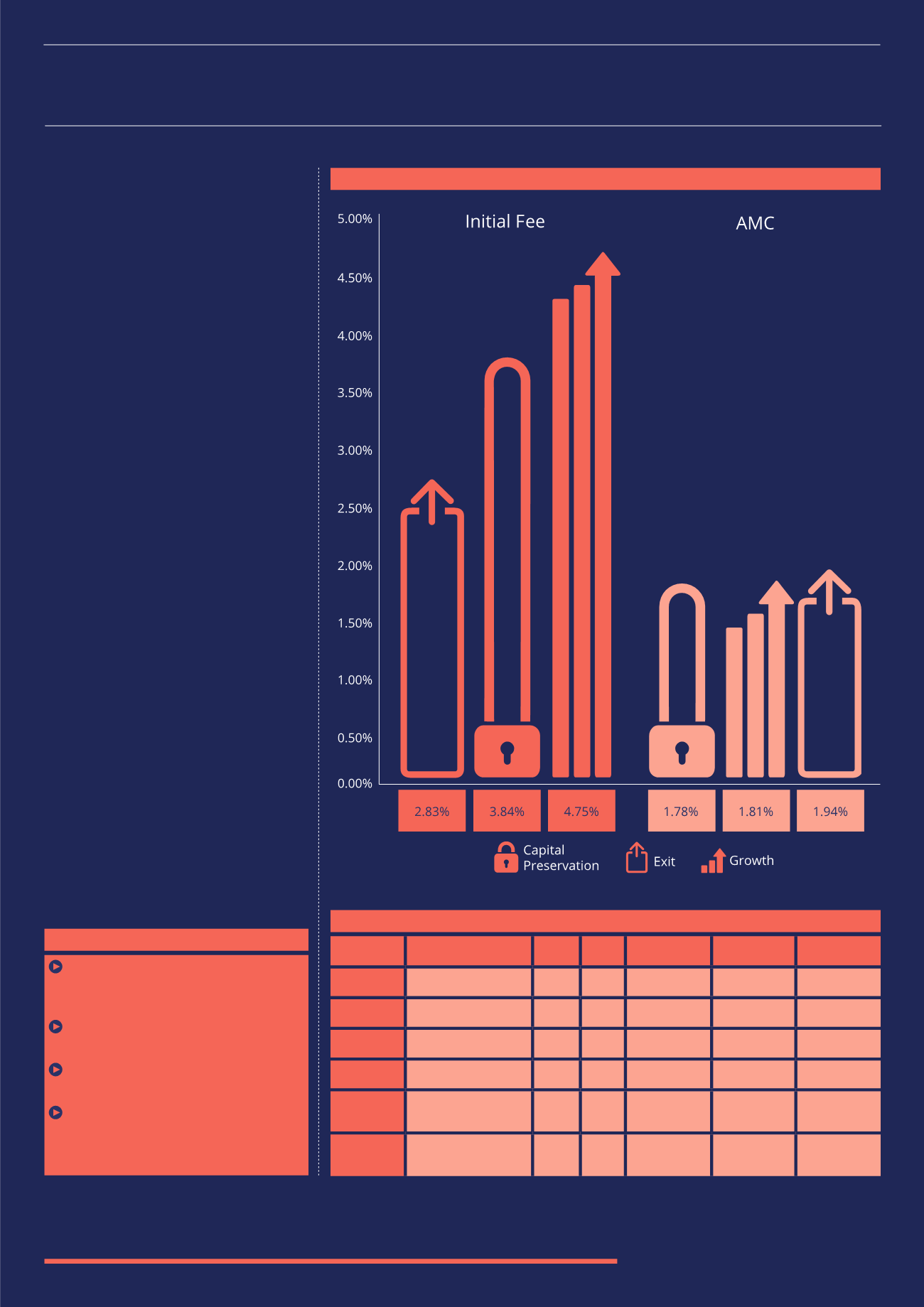

BY INVESTMENT FOCUS

Analysing the charges by the investment

focus could provide some insight into

whether high growth focused opportunities

take higher charges in reward for more

active management and expertise, or

whether capital preservation and exit

focused opportunities take higher charges

in return for looking after investors’ capital

whilst providing a modest, lower-risk return.

The high initial fee for growth focused

investment opportunities is likely to be

down to the large amount of research and

due diligence required to find suitable

high growth investment opportunities.

The majority of investments are likely to

be early stage companies in specialist

sectors, and therefore information

is harder to access and assessment

requires more time and resources.

At the other end of the scale, exit focused

investments may be into slightly more

mature companies which are closer to

becoming profitable. They may have

been established for a longer period

of time and therefore less research

and due diligence is required to find

suitable investment opportunities.

The annual management charges are

much closer across the three sectors,

ranging on average from 1.78% for

capital preservation to 1.94% for exit. The

moderate AMC seen from growth focused

investment opportunities is likely to be

offset by the very high initial fees involved.

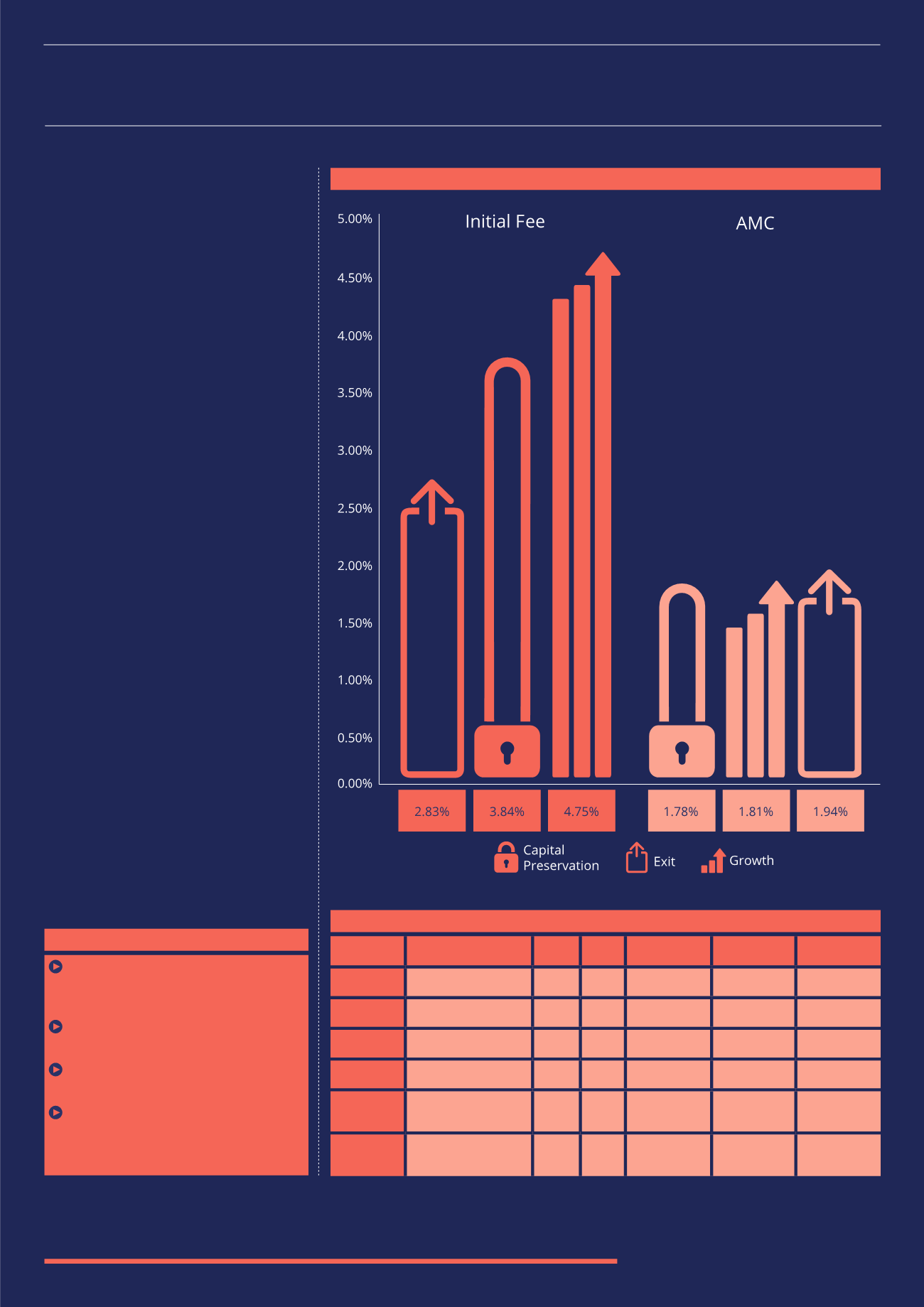

The following table provides a snapshot

of some of the different fees and charges

in the market. This includes examples

of some of the highest and lowest initial

fees, AMCs and performance fees.

KEY POINTS

Initial fees within the EIS market are

very high with an average of 4.3% of the

subscription amount

Initial fees and AMCs are due regardless

of the performance of the fund

20% performance fee on all profits is

the most common charged on EIS funds

Technology and Media have the highest

initial fees, due to the large amount of

research and due diligence required

CHARGES BY FOCUS

EXAMPLES OF HIGH AND LOW CHARGES

Sector

Name

Initial

Fee AMC Performance

Fee

Focus

Category

Technology Anglo Scientific EIS

Fund 2012

1.25% 1.50% Variable

Growth

Low Initial

Fee

Media

Film Fund One

6.50% 2.50% None Stated Growth

High Initial

Fee

Media

Prime Time EIS

Fund

3.50% 0.50% 25% Above

105p

Capital

Preservation

Low AMC

General

Enterprise

Jenson Growth EIS

Fund

5.50% 3.00% 25% of All

Profits

Growth

High AMC

Energy

Elara Renewables

EIS Fund II

6.50% 2.75% 10% Above

105p

Capital

Preservation

Low

Performance

Fee

Energy

Ingenious

Renewable Energy

EIS Fund

6.50% 1.50% 30% Above

105p

Capital

Preservation

High

Performance

Fee

“The high initial fee for growth focused investment opportunities is likely to

be due diligence required”

(2002-2014)