64

MANAGEMENT CHARGES

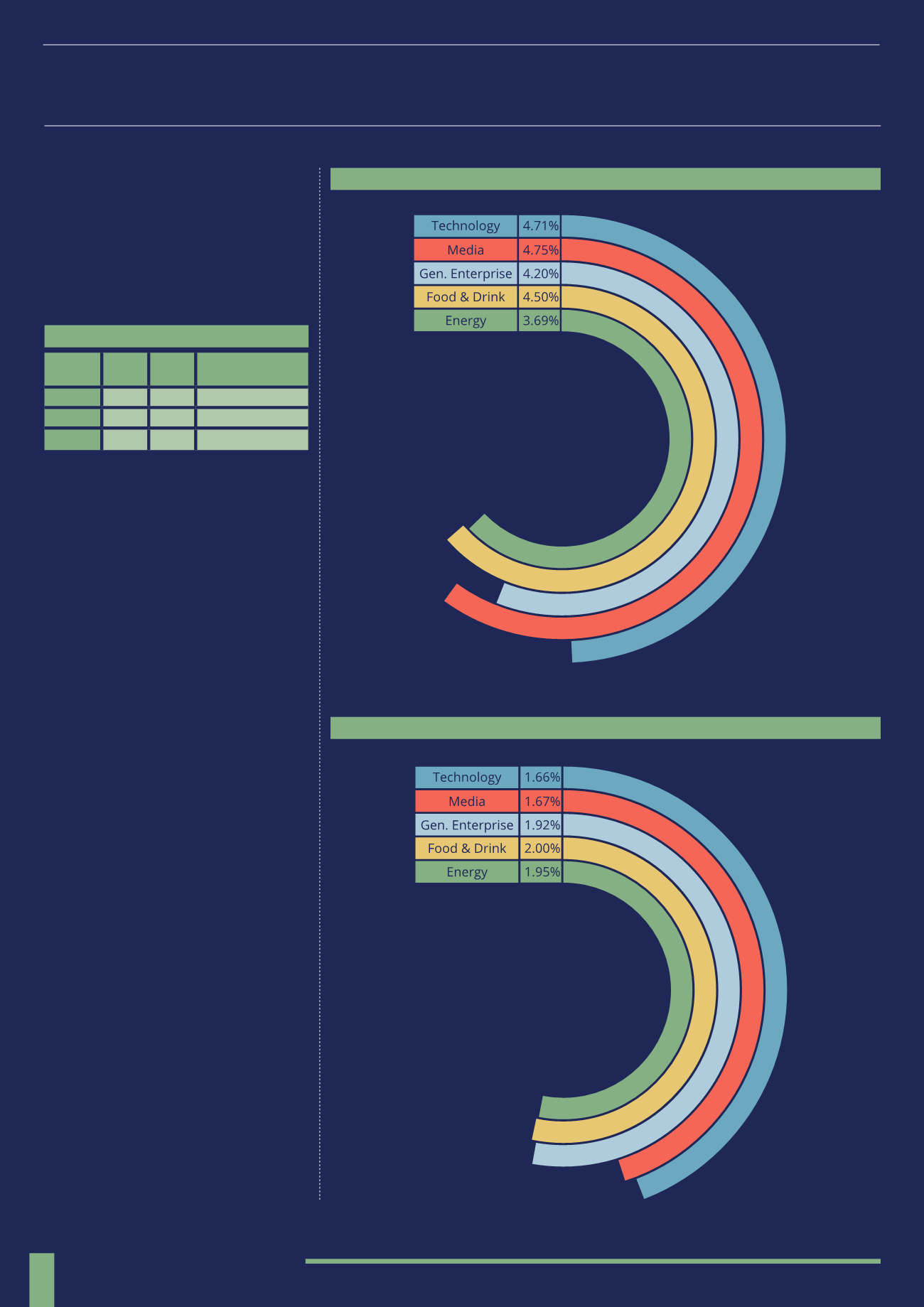

BY INVESTMENT SECTOR

Splitting down the charges by sector, on

average Media has the highest initial fee at

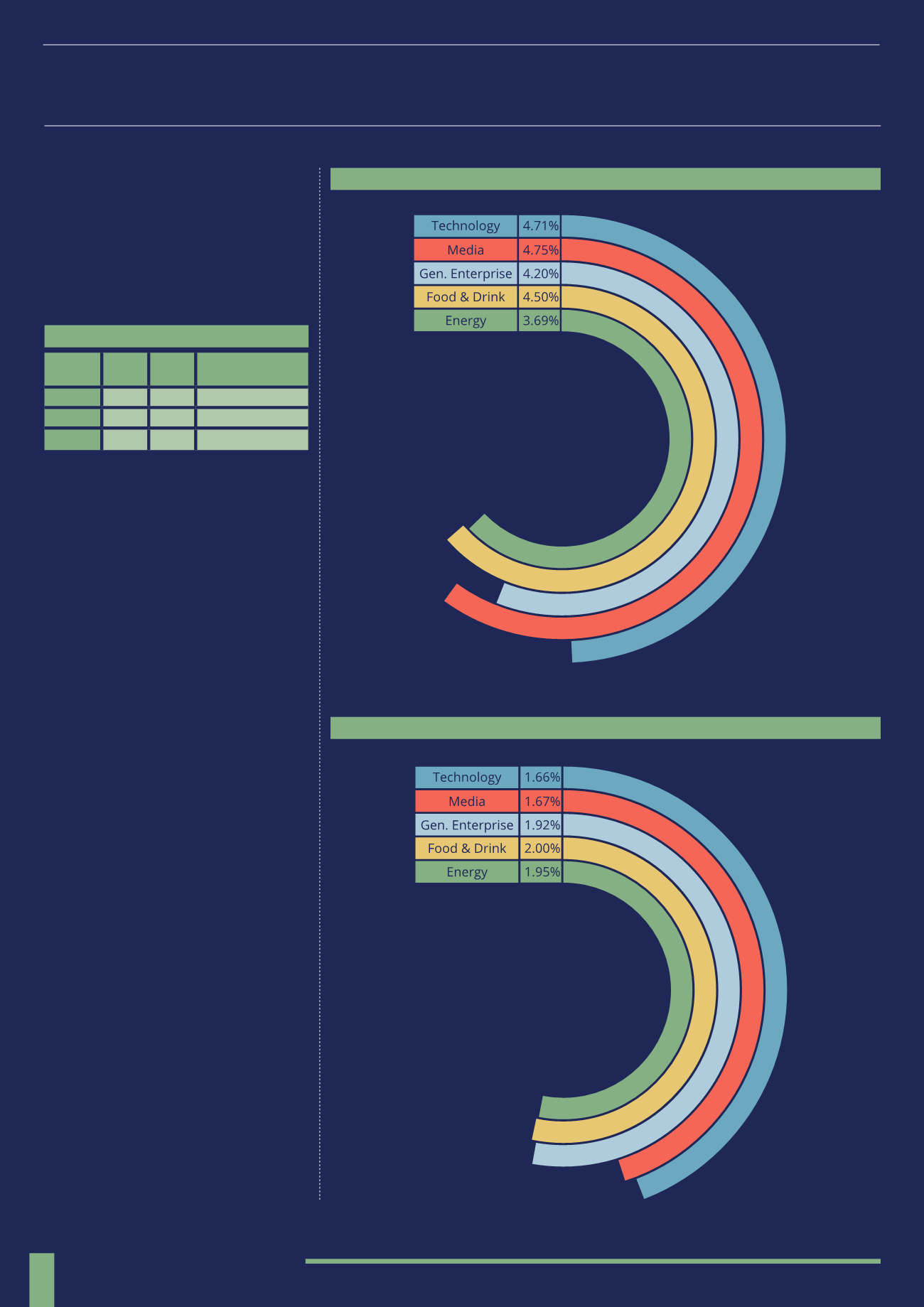

4.75% but one of the lowest AMC’s at 1.67%,

Technology also has a very high initial fee

of 4.71% on average, but the lowest AMC at

1.66%.

The high initial fees for these two sectors

could be due to the large amount of in-

depth research and due diligence that is

required upfront when searching for and

assessing investment opportunities.

On the other hand energy has the lowest

initial fees at 3.69% but one of the highest

AMC’s at 1.95%. Energy projects can

often be income producing and therefore

managers may look to take their fees

through a higher AMC paid for from income

rather than taking a large fee upfront.

Looking at performance fees, the food

and drink sector actually has the highest

average performance fee with 25% taken

from all profits. The lowest average

performance fee is actually seen in the

Technology sector, which is surprising as

this is a high growth focused sector and

therefore it would be envisaged that profits

would be highly rewarded. We don’t have

an explanation for this apparent anomaly!

Across the remaining sectors the

average performance fee is 20-

22.5% of all profits which is relatively

similar to the market average.

MANAGED FUND/PORTFOLIO

INITIAL FEE BY SECTOR

ANNUAL MANAGEMENT CHARGE BY SECTOR (AMC)

Initial

Fee AMC Performance Fee

Low 1.00% 0.50% 10% above 105p

High 6.50% 3.00% 25% of all profits

Average 4.30% 1.82% 20% of all profits

“High charges are one of the main criticisms associated with

EIS investments”

(2002-2014)

(2002-2014)