63

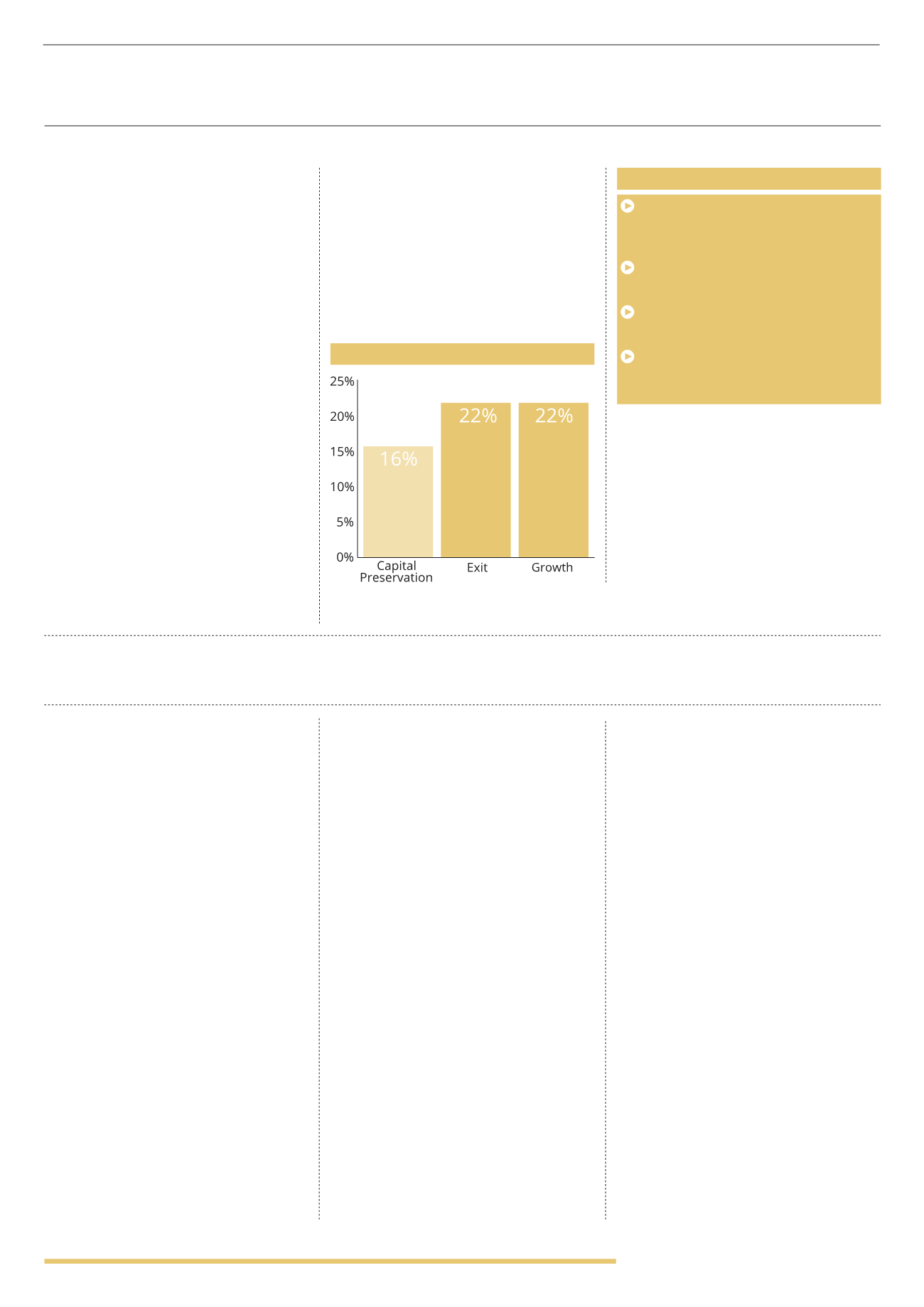

AVERAGE ANNUAL RETURNS

BY INVESTMENT FOCUS

Both growth and exit opportunities

have a targeted average return of 22%

per year, which is surprising as growth

opportunities are likely to take on

inherently more risk and often focus on

earlier stage start-up companies. This is

even more surprising when looking at the

range of targeted returns on offer, with

exit focused investments ranging from

12-84% per year and growth focused

from 6-76% per year. Note though that a

small number of exit focused investments

targeting very high (speculative) returns

has skewed the average to some extent

here. Growth focused investments

range from 6% to 76% per year.

A number of growth focused investments

target an overall total return, rather

than splitting this down into a targeted

average annual return. The average total

return is 271% which is particularly strong,

but of course the attractiveness of this

return will depend upon the timeframe

over which the investment is realised.

The following section looks at the

charges associated with EIS investment

opportunities. The focus here is on

funds and portfolio services which

use the experience and expertise

of a specialist investment manager.

There have only been five sectors

included in this analysis as a number

of sectors did not include a sufficient

number of fund based investments

to undertake meaningful analysis.

High charges are one of the main criticisms

associated with EIS investments. There are

three main charges that are levied on pretty

much every investment in the market: an

initial fee; an annual management charge

(AMC) and a performance fee. The initial

fee is taken upfront when an investor first

invests, and this therefore affects the

amount of capital that actually reaches the

underlying investments. Pre RDR, the initial

fee would also cover IFA commissions.

Looking at the market as a whole,

the initial fee ranges from 1% to as

high as 6.5%. The average is 4.3%.

This is extremely high, particularly when

compared to mainstream fund based

investment opportunities, and could have a

dramatic impact on returns.

Products focused on capital preservation,

which are often asset backed and seen

as lower risk investment opportunities,

still offer strong returns which range from

3-72% per year, with an average of 16%.

Again when considering these

investments the impact that tax

reliefs have when calculating targeted

returns must be taken into account.

However, EIS investments are more

specialised and sourcing deals, research

and due diligence, and ongoing

monitoring (often including taking

an active role on the board) all have

higher costs associated with them.

The annual management charge is

commonly taken as a percentage of the

value of the fund on an annual basis. This

covers the active management involved with

EIS funds and portfolios. Some managers

levy this upfront, usually for the first 3

years, and others will take this fee at the

end of the investment when underlying

investments are sold. Other managers may

keep an allocation of cash un-invested in

order to cover this charge annually – this

again will affect performance as it means

less capital is invested from the outset.

AMC’s range from 0.5% to 3% per year.

0.5% is very competitive and lower than a

number of mainstream investment funds.

The average across the market is 1.82%,

which again is quite low, but investors

must also remember the initial fee and

take into account that there is a limited

amount of active buying and selling

throughout the term of the investment,

as most of the investment decisions

will have been made at the outset.

Both the initial fee and the AMC are due

regardless of the performance of the

underlying investment, with managers being

paid even when investments perform badly.

The performance fee is charged on exit,

as and when underlying companies are

sold and profits are realised. The fee is

usually set based on a hurdle rate, such

as 20% of any profit above 105p for every

100p invested. These fees range widely by

investment manager and include a range

of combinations of different hurdle returns

and different fees. The performance fee

incentivises managers’ to return a profit

as they share in the success, but it could

mean that they take on more risks in

search of this profit or that they are unfairly

rewarded with a high share of profits

when they haven’t truly earned them.

The lowest performance fee across the

market is 10% of profits above 105p, the

highest 25% of all profits and the mean

20% of all profits. These fees appear very

high, although if an investor is receiving

a strong return they may be happy for

t

he manager to take a share of success.

RETURNS BY FOCUS

ANALYSIS BY CHARGES

“Attractiveness of returns will depend upon the timeframe over which the investment is realised”

KEY POINTS

Returns quoted in investment material

often include tax benefits which

dramatically increases predictions

98% of investments pay returns on exit

and 100% are variable

Each sector has a wide range of returns

presenting a number of risk/return options

Exit and growth focus investment

strategies have the highest average

returns of 22%

(1998-2014)