59

FUNDRAISING TARGETS

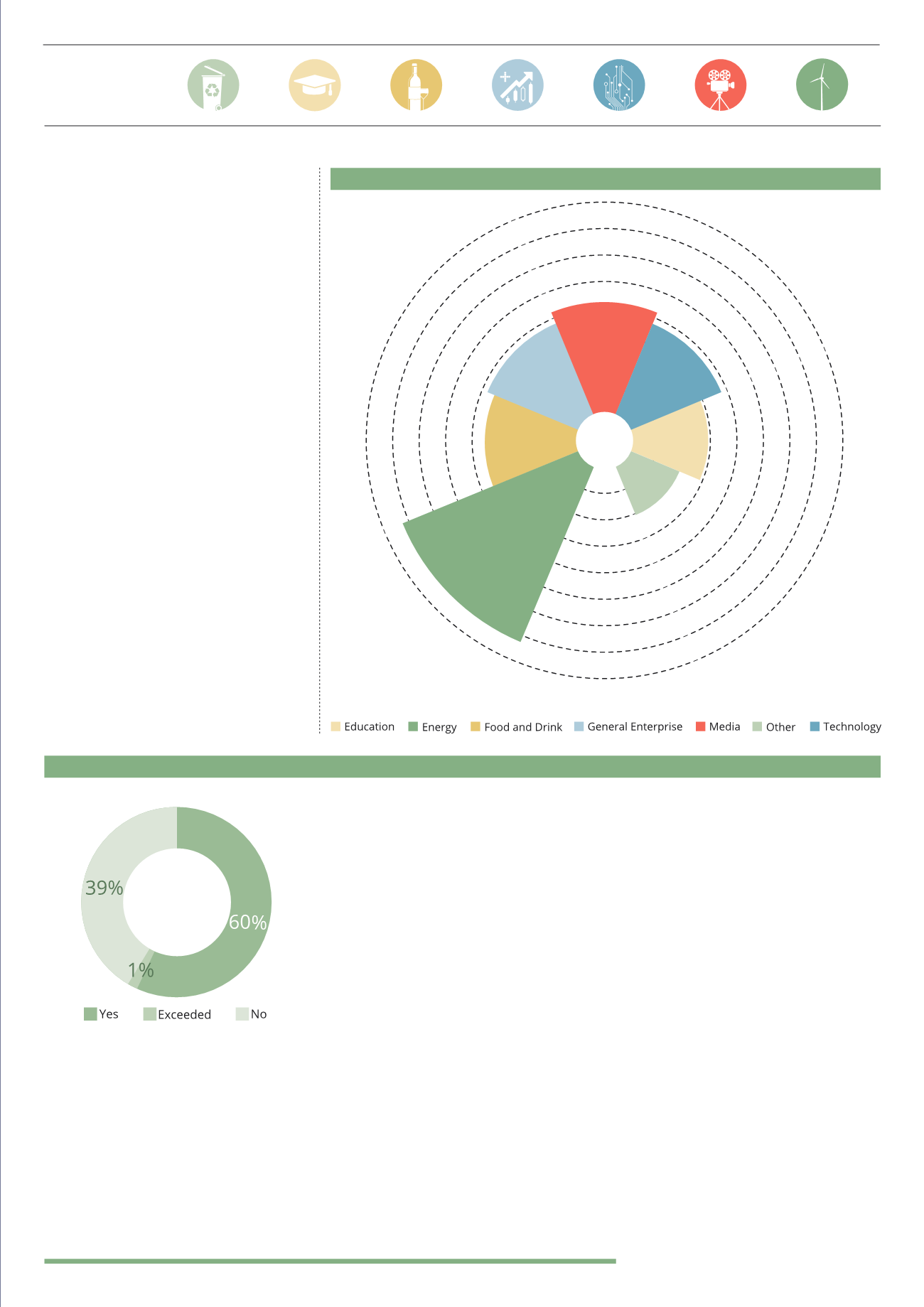

BY SECTOR

By analysing fundraising targets

by industry sector we can pick out

some further interesting trends.

The Energy sector (the largest EIS sector)

presents a very wide range of opportunities,

which look to raise anything between

£250,000 and £75m. This sector has the

highest average across the market of

£14.67m, which is almost £6m higher than

the next highest sector average. This is

not really surprising due to the size of the

energy sector and the large upfront cost

often associated with energy projects.

Media, General Enterprise and Technology

are the next largest sectors when it comes

to fundraising targets. The smallest

fundraises are seen within the Other

category, which includes Construction

and Sport focused investments. They

are relatively specialist sectors which

are dominated by single company

investments – which have lower

fundraising targets as we have noted.

AVERAGE FUNDRAISING TARGET BY INVESTMENT SECTOR

FUNDRAISING

TARGETS BY

SECTOR (£M):

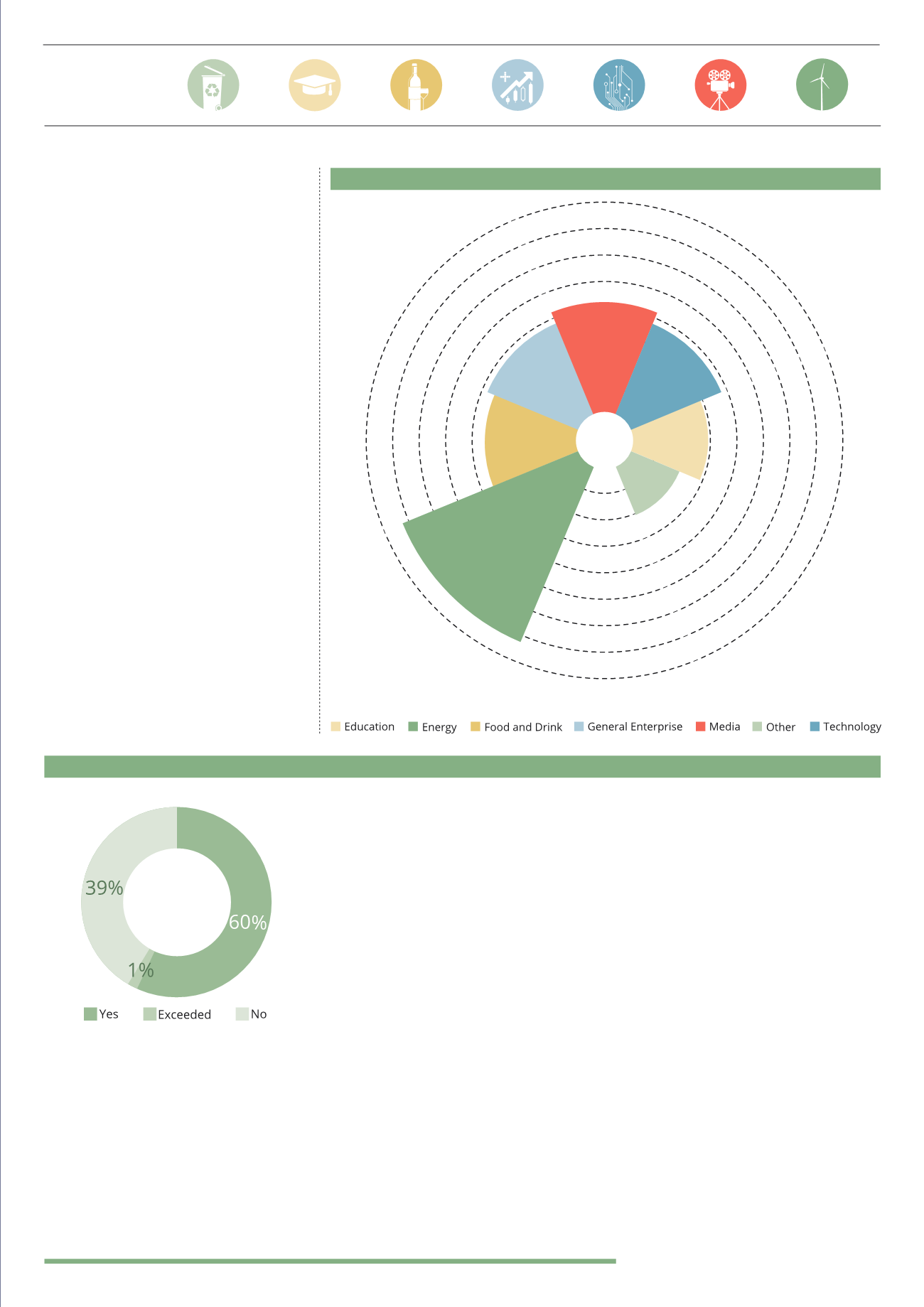

It is important to note how many investments achieve their fundraising targets.

Providers do not always disclose this information and therefore this only

represents a sample of the market. Based on information provided by 70% of the

market, 60% of opportunities achieved their targets, just over 1% exceeded their

fundraising and the remaining 39% were unable to meet their total targets.

Note here that we are looking at the upper cap on total fundraising. Investments will

have a minimum hurdle for their fundraising, but we were not able to obtain statistically

significant data on the success (or otherwise) of firms meeting minimum investment levels.

PROPORTION OF OPPORTUNITIES ACHIEVING FUNDRAISING TARGET

£14.6m

£6.8m

£7.6m

£8.2m

£7.4m

£5.9m

£4.1m

£2m

£4m

£6m

£8m

£10m

£12m

£14m

£16m

(1998-2014)

(1998-2014)

6.8

4.1

8.2

7.6

7.4

14.6

5.9