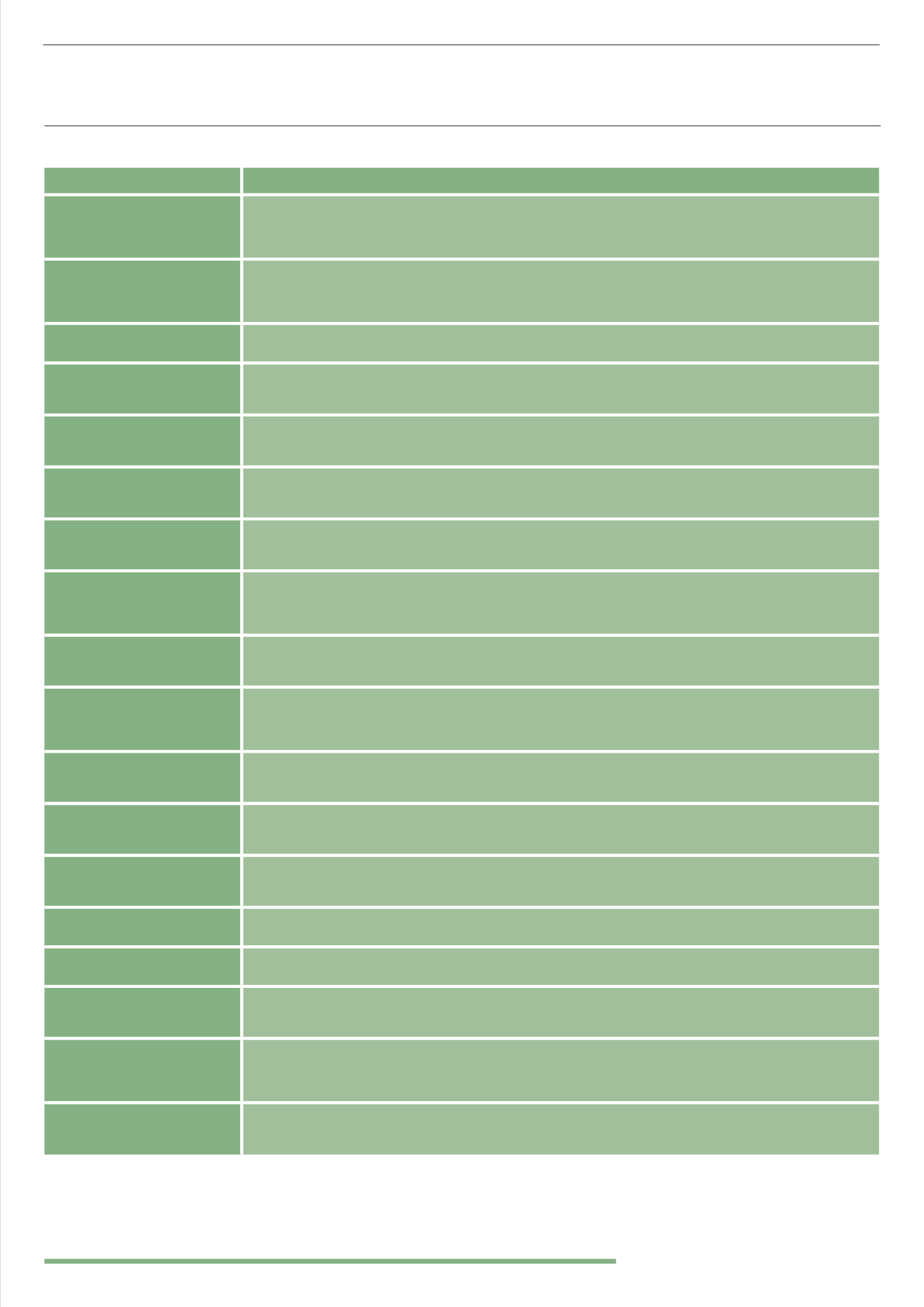

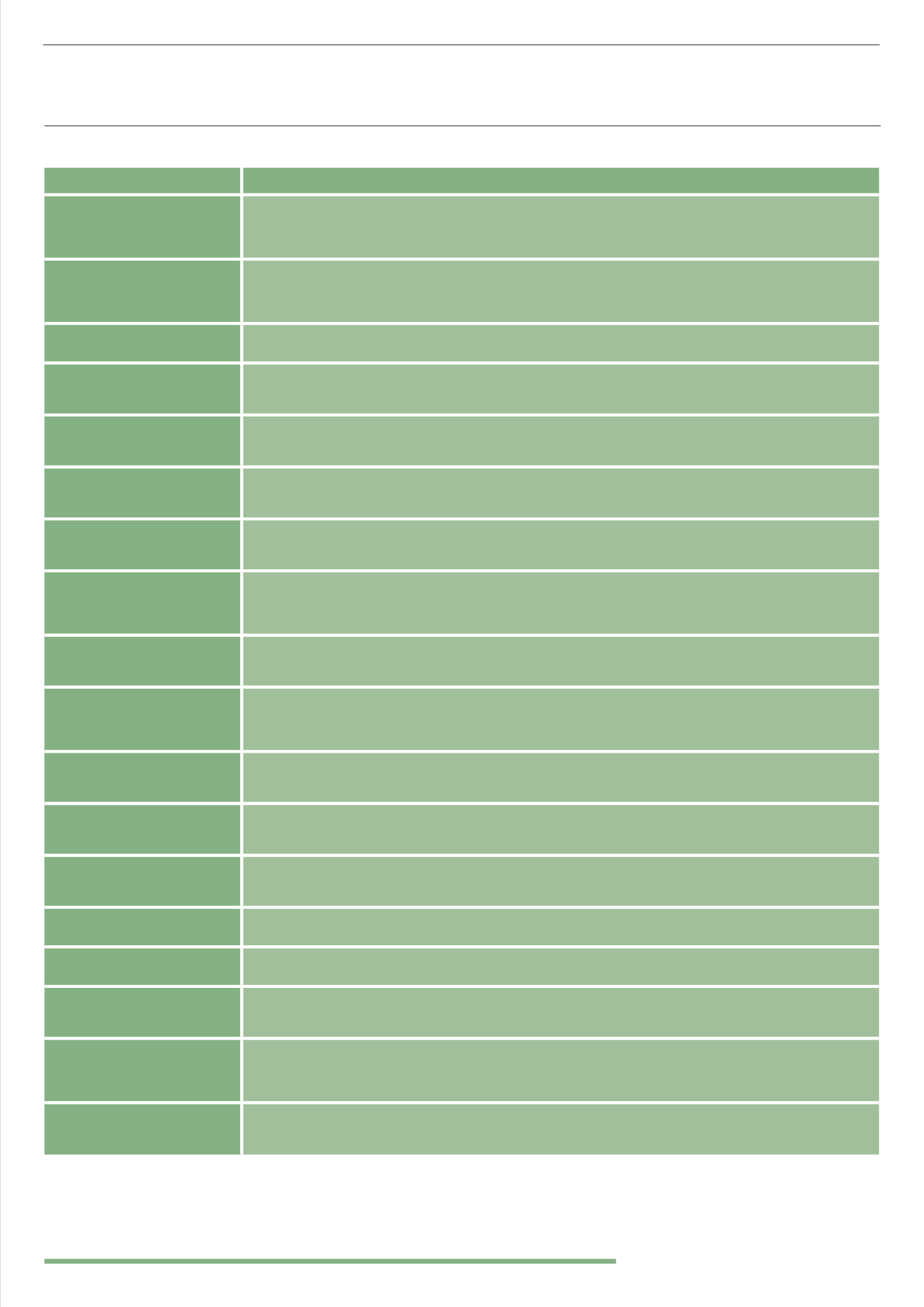

69

Term

Description

AIFMD

Alternative Investment Fund Managers Directive. Published in the Official Journal of the European Union

on 1 July 2011 and was transposed into UK law on 22 July 2013. Covers the management, administration

and marketing of alternative investment funds (AIFs). Its focus is on regulating the Alternative

Investment Fund Manager (AIFM) rather than the AIF.

AIM

The Alternative Investment Market, is a sub-market of the London Stock Exchange (LSE) for smaller

growing companies. It has a more flexible regulatory system than the main listings market to allow

smaller companies to list shares. Businesses include early stage, venture capital backed and more

established companies seeking access to growth capital.

CGT

Capital Gains Tax. This is a tax on the gain or profit made when selling or giving away an asset. It applies

to assets that you own, such as shares or property. The individual CGT allowance for 2014/15 is £11,000.

FCA

Financial Conduct Authority. Replaced the FSA on 1st April 2013 and took over the regulation of the

financial services industry in the UK. Its aim is to protect consumers, promote competition and enforce

standards.

FSA

Financial Services Authority. Up to 31st March 2013 regulated the financial services industry in the

UK, including financial services markets, exchanges and firms. Set and enforced standards for FSA

authorised firms to comply with.

EISA

The EIS Association is an independent, not-for-profit organisation, which exists to assist in the flow

of capital and resource available to British small to medium-sized enterprises through the Enterprise

Investment Scheme.

EIS

Enterprise Investment Scheme. Government supported initiative designed to help smaller higher-risk

trading companies raise finance by offering a range of tax reliefs to investors who purchase new shares

in those companies.

HMRC

HM Revenue and Customs. They are the UK’s tax authority, responsible for making sure that money is

available to fund the UK’s public services and for helping families and individuals with financial support.

Responsible for Income Tax, Corporation Tax, Capital Gains Tax, Inheritance Tax, Stamp, Land and

Petroleum Taxes among others.

IHT

Inheritance Tax. This is a tax due on the value of your estate at death, including any assets held in trust

and gifts made within 7 years of death. The current IHT threshold (2014/15) is £325,000, been frozen

until 2019. Tax is payable at 40% on any amount above this nil rate threshold.

IM

Investment Memorandum, Offering Memorandum (OM) or Private Placement Memorandum (PPM).

A legal document stating the objectives, risks and terms of a private investment. It should provide

buyers with information on the offering and protect sellers from the liability associated with selling

unregistered securities.

NMPI

Non-Mainstream Pooled Investment. Term coined by the FCA in PS13/03 to include UCIS and other forms

of Pooled Investments such as QIS, certain SPVs which have similar attributes and Traded Life Policy

Investments.

PLUS

PLUS Markets Group. London based electronic stock exchange for small companies and a rival to AIM.

Acquired by ICAP in 2012 and re-branded as ICAP Securities and Derivatives Exchange (ISDX). Providing

cash trading, listing, derivatives and technology services.

PS13/03

Restrictions on the retail distribution of unregulated collective investment schemes and close

substitutes: Feedback to CP12/19 including final rules. Policy statement issued by the FCA in June 2013

covering UCIS and close substitutes.

Section 42 of the Finance

(No. 2) Act 1992

Allowed expenditure on the production or acquisition of British films to be matched against income

from the film or written off over three years.

Section 48 of the Finance

(No. 2) Act 1997

Allowed expenditure on low budget British films to be written off immediately.

SEIS

Seed Enterprise Investment Scheme. Aims to help small, early-stage companies raise finance by offering

tax reliefs to individual investors who purchase new shares in those companies. It complements the EIS

and focuses on very early stage companies, offering tax relief at a higher rate than the EIS.

UCIS

Unregulated Collective Investment Scheme. An investment structure which pools investors’ funds

in order to invest directly in underlying companies or assets. The marketing of UCIS is regulated and

subject to complex rules, including restrictions imposed by s. 238 of the Financial Services and Markets

Act 2000 and COBS 4.12.

VCT

Venture Capital Trust. Scheme started on 6 April 1995 and is designed to encourage individuals to invest

indirectly in small higher-risk trading companies whose shares are not listed on a recognised stock

exchange. VCTs are traded on a regulated market and tax reliefs are available to individuals who invest.

GLOSSARY OF TERMS