61

that the fees can vary greatly. As with all

debates over fees, it is not necessarily

the case that cheaper is better - it is a

question of value for money - but this

is an area that has not been scrutinised

to date and is sometimes ignored by

advisers.

The initial charges analysed compare

favourably with mainstream investment

fund charges and are lower than their

closest stable mates, EIS products.

This possibly reflects the larger BPR

investment universe and the freedom

from having to source the deal flow (with

all of the associated research and due

diligence) that goes with EIS investing.

The charges for AIM portfolios were in

a slightly tighter range than non-AIM

portfolios, which is logical as the AIM

products are all investing in the same

investment universe, with the same

broad objectives. Initial fees range from

1% to 2.5%, and AMC ranges from 0.75%

to 2.5% with some exceptions – one

provider has a flat initial fee of £250 +

VAT for example.

The majority of investments on the

register have no performance fee.

However the maximum performance

fee was 50% of any increase in the NAV

above 5%. Products with performance

fees had fairly average initial charges

and AMC; however the targeted returns

were in the upper quartile of the overall

market returns. Overall, performance

hurdles range from 3% to 5% of NAV

growth.

AIM focused investments only had one

product with a stated performance fee;

a reflection of the fact that AIM based

products generally don’t target specific

levels of return.

APPLES WITH APPLES?

Comparing the overall cost of

investment between products

(including the initial fee, dealing fee,

AMC, admin fees and performance fees)

can be problematic and a full analysis is

beyond the scope of this report.

As noted above and over the page,

comparing the initial fees and dealing

fees is relatively simple (but still

requires a small amount of leg work),

with most clustered between 2-3% of

the investments NAV.

AMC’s range from zero (the provider

will be charging the investee company)

to 3.5%, but some are applied after

a performance hurdle and some are

not. Some products also charge an

additional administration fee.

Then there are additional performance

fees. Again, these are applied after

a hurdle, and the hurdle is usually

calculated once the other fees have

been accounted for, but this is not

always made clear in the investment

literature. Hurdles range from 3-5%

and performance fees taken above the

hurdle range from 15-50%.

The variety of pricing structures makes

apples with apples comparisons very

challenging and requires access to

detailed charging data that can be

manipulated to compare various

investment scenarios.

Currently MICAP is the only source that

has this data in an easy to compare

format foradvisers to carry out their

own analysis of charges across the

whole-of-market.

OVERALL MARKET

CONCLUSIONS

A

lthough the minimum investment is

high on average, the lowest entry levels

are very affordable, perhaps indicating

that the market is starting to reach out

to a wider group of investors as IHT

becomes a problem for the mass

affluent and not just the high net worth

In theory all of the AIM portfolio

propositions would also be acceptable

within an ISA, providing relief from

income tax as well as IHT, but only 26%

of AIM products market themselves as

ISA’able

The simple, easy and familiar legal

structure of a discretionary managed

fund accounts for 76% of the products

in the market

Although IHT mitigation and capital

preservation are the principal

investment objectives, products that

also target capital growth account for

19% of the market (and the majority of

these are AIM portfolios)

We can speculate that AIM based

BPR products that offer equity levels of

return are more suitable for younger

investors - especially those with large

ISA portfolios

BPR products that focus on unlisted

investments should have lower levels of

volatility and are more likely to quote a

target rate of return

Initial charges are comparable to

other types of tax efficient investments

Charging structures can make

meaningful comparisons difficult.

The variety and complexity of

charging structures can make

comparisons difficult

Dealing fees should be added to

the initial charge to calculate a “cost

of transaction”

Fees to investee companies are

quite opaque, but could impact

investment performance

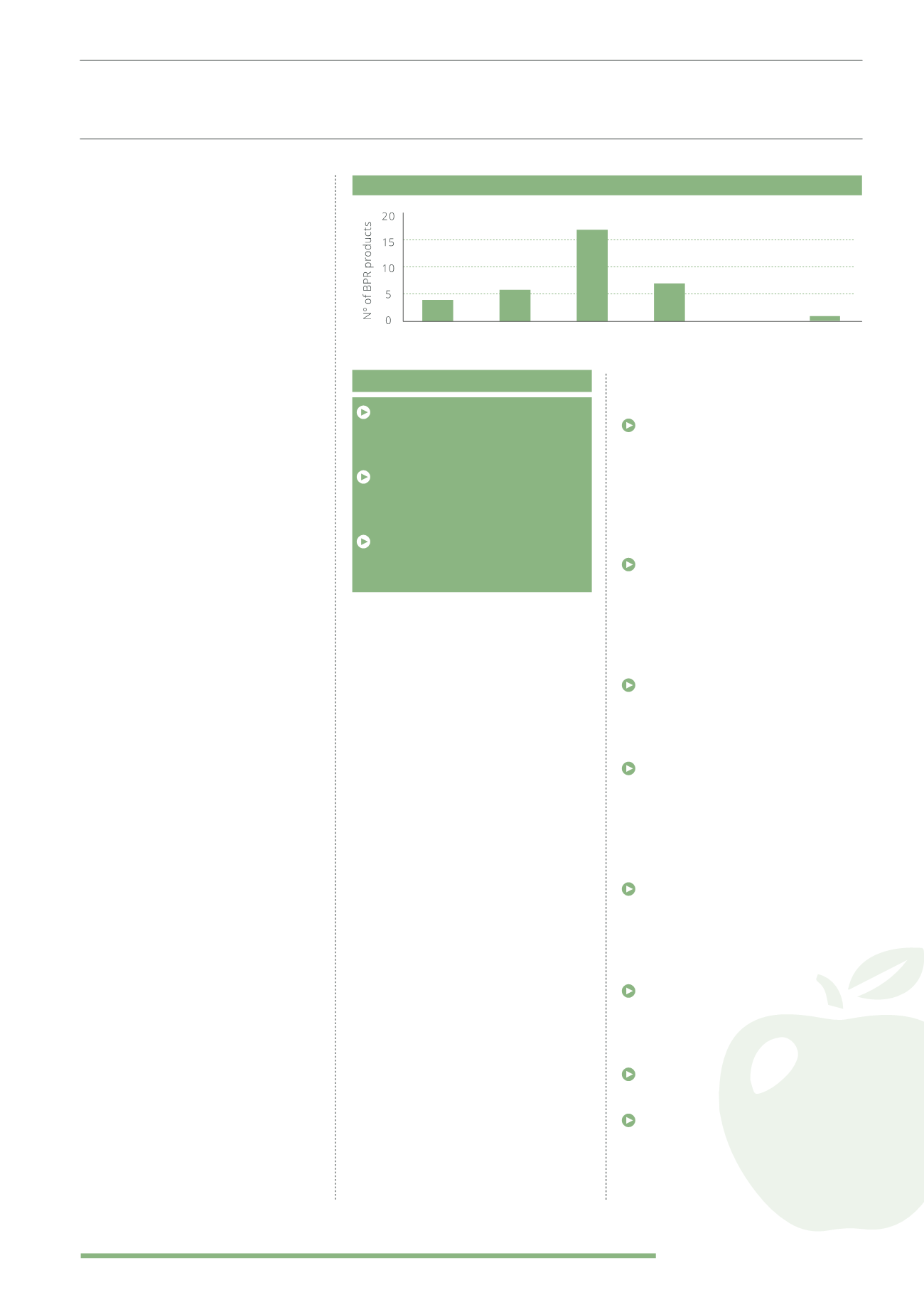

CHARGING RANGES

(INITIAL FEE + DEALING FEE)

0-0.9

%

1-1.9

%

2-2.9

%

3-3.9

%

4-4.9

%

5-5.9

%

“The variety of pricing structures makes apples with apples comparisons very challenging”

KEYPOINTS