71

Estate planning and tax efficiency are

financial planning activities that cut across

a number of professions – reflected in

the wide range of professional advisers

that our panel of tax efficient investors

consulted for help. We also asked what

sources of information they used for their

own research. 38% said they consulted

investment providers’ literature/website,

38% said their IFA’s literature/website, 24%

said their stockbroker’s literature/website

and a small minority said they use sources

such as friends and investment clubs.

“50% of investors feel that tax efficient investments provide a wider social or economic benefit”

Q

.

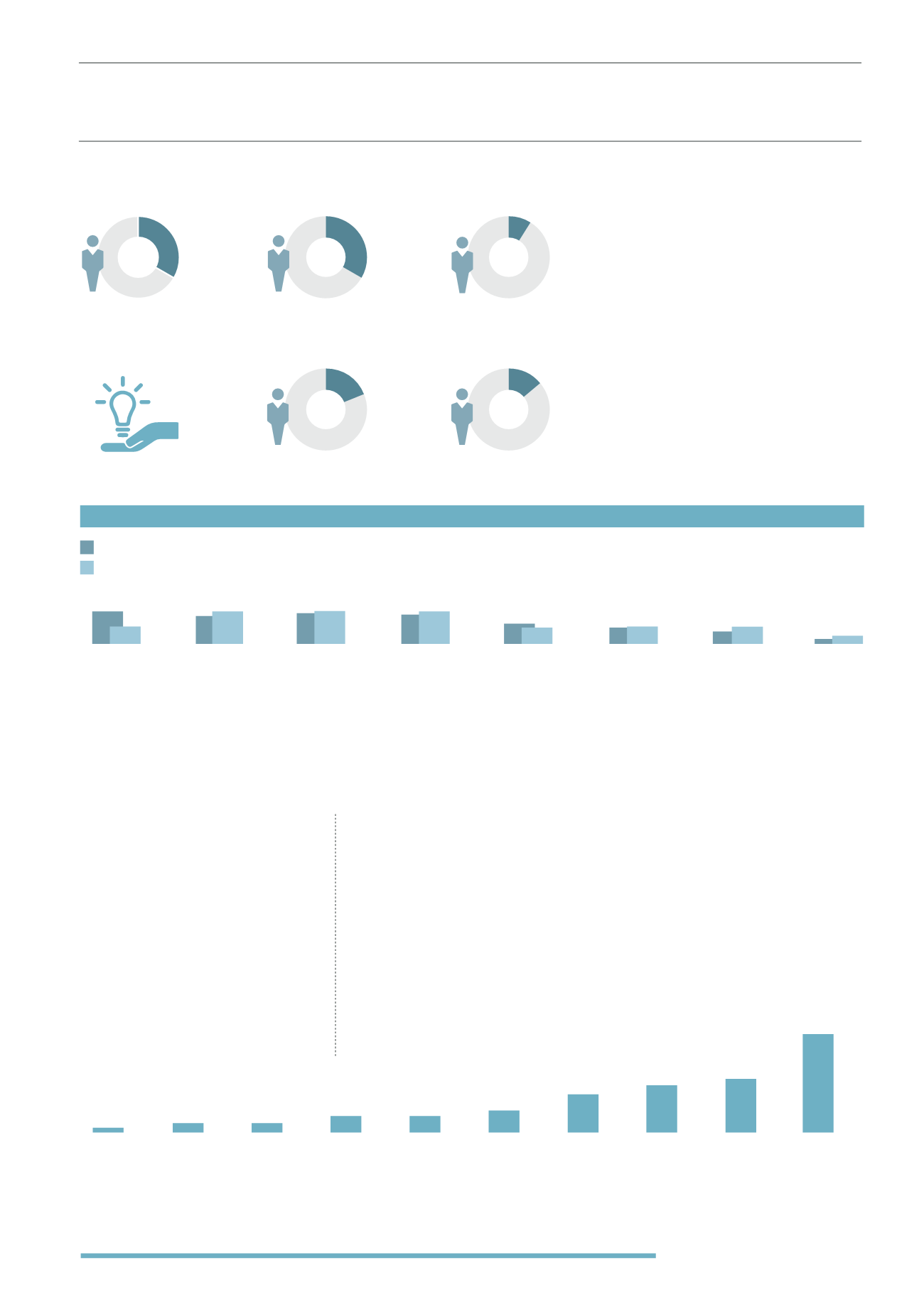

Other Alternatives (% of Panel)

All investors

BPR Investors only

CONCLUSIONS

The majority of our panel DID NOT invest in tax efficient investments,

and even of those that did, very few chose to invest in BPR products -

relief from other taxes seemed to be a bigger consideration.

With all tax efficient investments, the big concerns are around

investment risk, liquidity and being able to do the research and due

diligence needed to acquire a sufficient level of understanding.

However, it does appear that where an investor can build some trust up with

a provider and has faith in both the management team and their investment

philosophy, these become important factors in securing investment.

This was very similar to what we found in the adviser survey too.

Q

.

Reasons NOT to invest

We asked these respondents to rank

their top three reasons for not investing

in tax efficient investments (even

though they were aware of them) and

collated the scores. As with advisers

who were cautious on the sector,

risk and liquidity were big concerns

and research and transparency

seemed to play into that - perhaps

they feel that it is just too difficult to

acquire the knowledge needed to get

comfortable with these investments.

Our panel had made quite a lot of investments into

other alternative asset classes, reflecting their wealth

and experience. It was interesting to the see the

high allocation to alternative finance asset classes

like Peer to Peer Lending and Crowdfunding.

There were no significant differences when we looked

at this picture just focused on BPR investors.

Only one respondent ticked “none of the above”.

Minibonds

6

10

Unquoted

shares

16

19

Property

Schemes

13

10

UCIS

3

5

Social

impact

10

10

Structured

products

16

19

Crowdfunding

16

19

Peer to peer

lending

4

10

19

Q

.

Professional Advic

e

(only BPR investors)

Financial Adviser

34%

Accountant

34%

Tax Adviser

19%

Lawyer

14%

Stockbroker

9%

8

Other

8

Fear of loss of

tax efficient

status

46

Too much

research

required

4

Deal flow will

dry up for the

providers

26

Fear of

investing

in non-

mainstream

assets

20

Fear of

investing in

an esoteric

tax avoidance

scheme

54

Lack of

transparency /

Too hard to

understand / No

past performance

to assess

20

Too

expensive

62

Lack of

liquidity

116

Investment

Risk