69

Q

.

Do you expect to see an increase or

decrease in BPR business in the next five

years?

Although some providers feel that

advisers/investors may be hesitant

about recommending BPR products,

all providers believe they will increase

BPR business over the next five years.

Estimates range from 15% per year to

25% per year, over the next 5 years.

Many believe that the increased

awareness and credibility of the sector

will be a major driver in market growth.

This is different from the advisers, who

felt that the growth in business will be

driven by their ageing client banks.

Q

.

In your opinion, what single

change or innovation would

improve the BPR market?

Most providers felt that a change in the

regulation of BPR would greatly improve

the market. These suggestions ranged

from obtaining published FCA opinion

on these products, to the government

being clearer on their plans for the nil

rate band in the future.

A call for increased knowledge and

education available on the sector was

noted by several providers. This is a

trend in all three surveys - there is a

definite need for more education in

the sector.

CONCLUSIONS

Overall, what the providers think and

what the advisers think is not a million

miles apart. Providers are expecting

to do more business over the next

five years, and would like to see

more certainty around the rules and

regulations governing BPR to allow them

to gear up for more business confident

that it will be time and effort well spent.

It’s clear that advisers think the industry

could be more transparent, and the

providers recognise this, but whether

any of them would take unilateral

steps to improve transparency is

another matter. And in a less than 100%

transparent environment, providers

have underestimated how much value

advisers attach to firms telling the story

of their investment philosophy and

strength of their teams.

INVESTOR SURVEY

The last survey we undertook was

of investors. We surveyed a panel

of 120 HNW investors with assets

over £500,000 and also collected 38

responses from other sources, including

some ordinary retail investors.

Q

.

How would you describe your level of

investment experience?

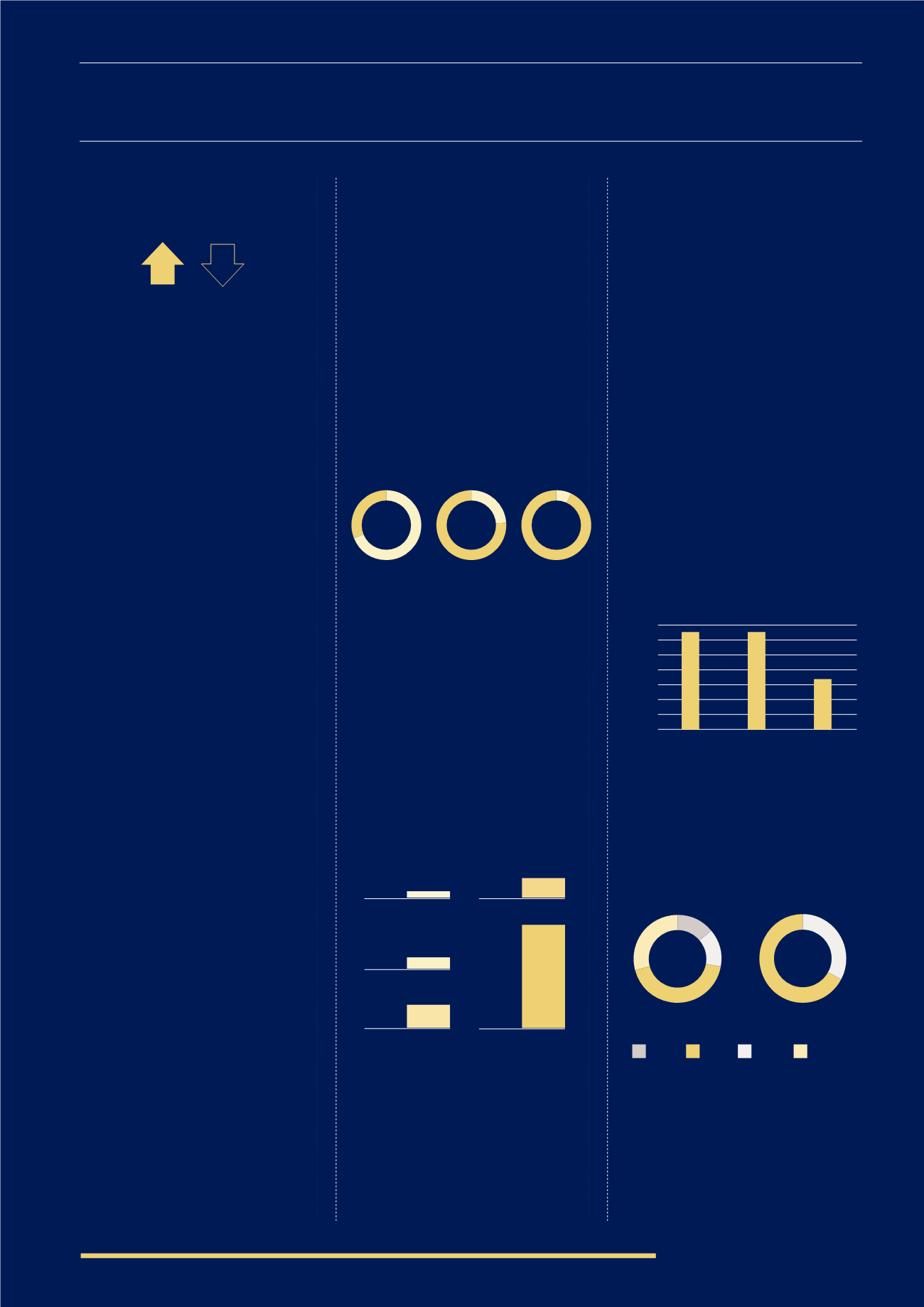

82% of the respondents were male

and 15% were female, 24% described

themselves as sophisticated, 69% as

reasonably sophisticated and 7% as

having little to no investment experience.

Once again, the survey was dynamic and

the questions changed to accommodate

previous responses.

Q.

Use of tax efficient investments?

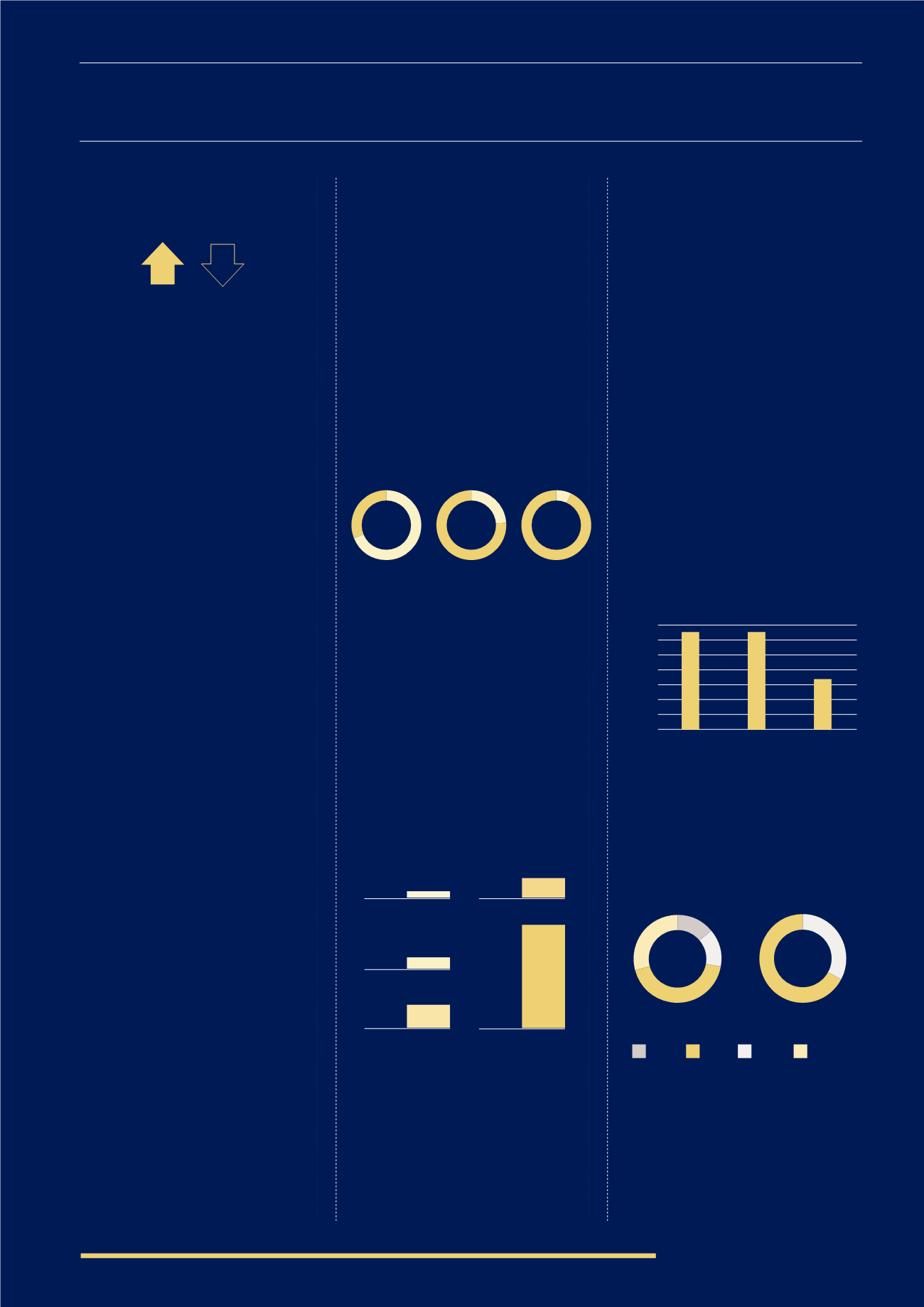

Out of our panel, 63% of them did not

make use of tax efficient investments,

14% had invested in VCT, 12% in EIS, 7%

in BPR and 4% in SEIS. The low numbers

for investment in SEIS are probably

because this is a new scheme investing in

the riskiest end of the market. It makes

sense that more established EIS and

VCT schemes have more investment.

Investment in BPR was low, either

reflecting its very specific investment

objective or a lack of awareness amongst

the panel. More surprising is the high

number of investors who do not utilise

any of these tax efficient investment

products - which can either be viewed

as a disappointment or an opportunity

by the tax efficient investment industry.

The next section focuses on those investors

who do invest in tax efficient investments.

Another surprise was the age range

of BPR investors on our panel. 67%

of them were 40-50 and the 33%

were 60-70. We don’t know if this was

influenced by the online nature of the

panel survey, or if perhaps it reflects

that younger business owners who

are more aware of the reliefs are

more likely to use these products.

All of the BPR investors had made

other tax efficient investments. We can

speculate that some exposure to the

industry’s other products makes the

transition to investing in BPR easier.

In keeping with other alternative

investments, few people would sanction

a portfolio allocation of higher than

10% and certainly no more than

20%. Singling out the BPR investors,

they were a little more aggressive,

again perhaps reflecting a deeper

understanding of the issues.

100

%

0

%

“Providers have underestimated the value advisers put on their investment philosophy”

69

%

24

%

7

%

Sophisticated

Reasonably

sophisticated

Little or no

experience

SEIS

BPR

EIS

VCT

None

4

%

14

%

63

%

7

%

12

%

35%

30%

25%

20%

15%

10%

5%

0%

EIS

VCT

SEIS

Q

.

Use of tax efficient investments

(only BPR investors)

Q

.

Allocation to tax efficient

investments

Only BPR investors

All investors

<5% 5-10 >10% Unsure

%

%

% % %