52

BROKEN PROMISES

Whatever the parties say about

inheritance tax prior to forming a

Government, it has to be taken with

a pinch of salt as they do not have a

strong track record of keeping their

word. Investors who held back from

making their own estate planning

arrangements while waiting for the

Government to make good on their

promises will have lost valuable time.

SUMMARY

A small increase in the threshold

would not have a large impact on the

need for IHT solutions that utilise

BPR, but a large increase would

dramatically reduce demand as the

number of households caught by the

tax falls.

This could prompt those investors

who have smaller estates just over

the threshold and who have been

using BPR to complete their estate

planning to exit their investments.

It can be argued that this would be

somewhat unnecessary, as if the

product is being well managed and

was appropriate for the investors

as an investment in its own right, it

should remain a sensible investment

for them without the additional tax

saving advantage.

For those with substantial estates,

assuming that the investor has not

let the tax tail wag the investment

dog it may well be that increases in

the nil rate band just serve to make

their IHT planning fit better - in that

the amount invested into BPR will

cover more of their IHT liability.

LABOUR PARTY

Like the Lib Dems, the Labour party

have not made a specific commitment

on IHT, although they have been very

clear that they want to clamp down

on aggressive tax avoidance.

2015 is an election year, and as we

noted earlier, inheritance tax is an

emotive topic that gets the attention

of voters. It’s fair to say that IHT, and

specifically the level of the nil rate

band, is one of those issues that gets

inordinate attention in the run up to an

election because the older generation

are much more likely to vote (75% of

those aged 65+ turned out in 2010

compared to 52% of 18-24 year olds).

At the time of writing, the

Conservatives have promised to

raise the threshold to £500,000 by

introducing a new zero-rate band

of £175,000 on a principal property,

creating an effective £1m threshold

for property owning couples. There

have been no new announcements

by the other main parties.

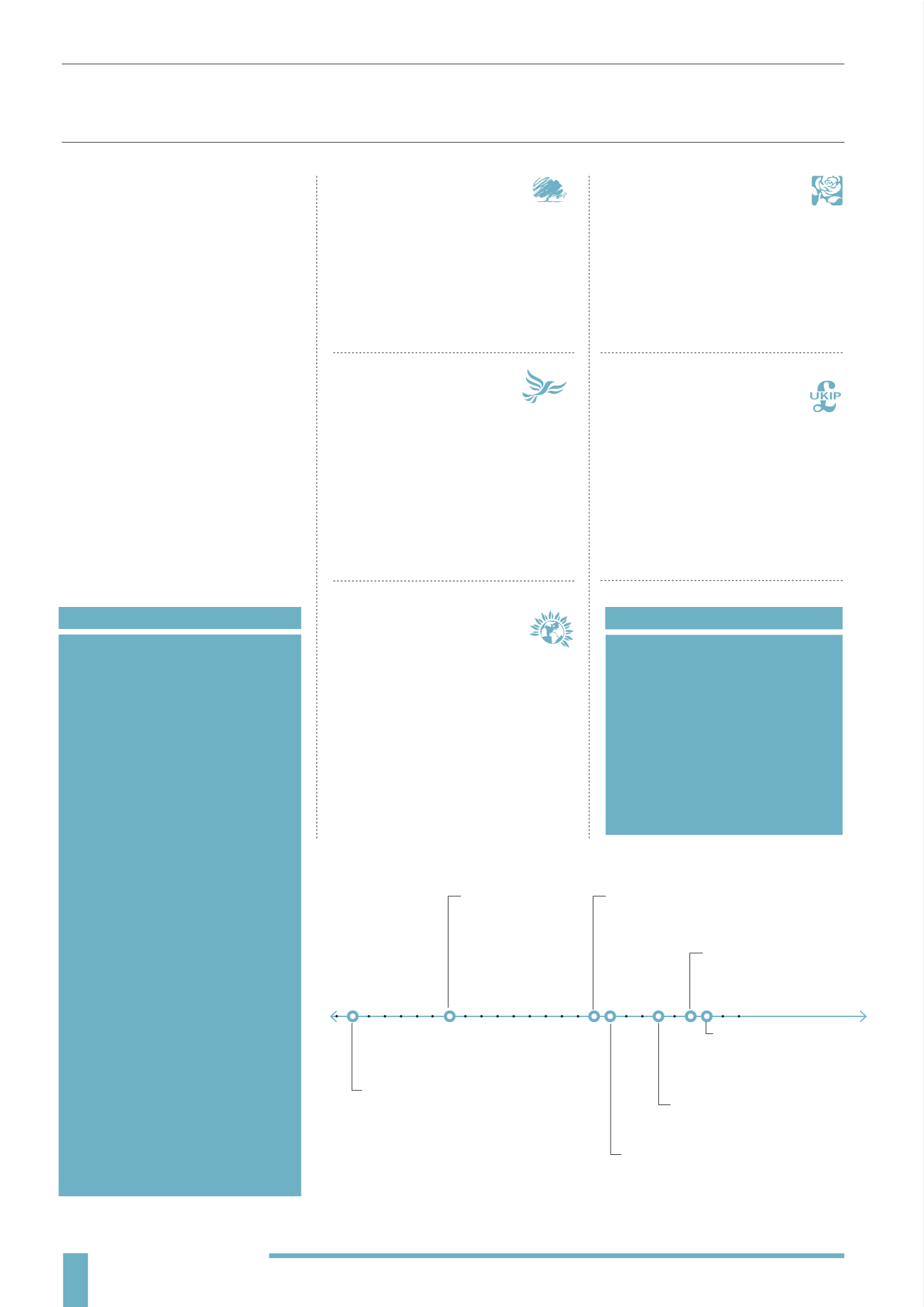

1991

- Prime Minister

John Major proposed

to abolish IHT at a

Conservative Party

Conference

1995

-

John Major

was challenged on his

promise by Tony Blair

but replied “when it

is appropriate and we

can afford to do so”

2006

-

Labour MP Stephen

Byers wrote in the Sunday

Telegraph that IHT should be

abolished

2007

- The Conservative Party

announced their intention to increase

the nil rate band to £1m (from £300,000)

2010

- during the General election the

conservative party retained their £1m

threshold promise

2012

- coalition announce that

the nil rate band will increase

to £329,000 in the Chancellor’s

autumn statement

2013

- the coalition

government announce that the

nil rate band will be frozen at

£325,000 until 2018

LIBERAL DEMOCRATS

The Lib Dems originally blocked the

conservatives from increasing the IHT

threshold in 2010 in order to help pull the

UK out of a recession. To date, they have not

made any announcement on their policy

on IHT. With another coalition government

a realistic prospect, it’s prudent to look at

the views of the minor parties as well.

UK INDEPENDENCE PARTY

UKIP state that they plan to completely

abolish inheritance tax, saying that “The

super-rich avoid it, while modest property

owners get caught by it.” UKIP obviously

feels the wealthy have found ways around

IHT while many others are caught by a

tax that was not intended for them.

THE GREEN PARTY

The Green Party propose to reform

inheritance tax by basing the tax on the

recipient, rather than on the deceased. The

idea is to encourage people planning for

inheritance to distribute their wealth across

a number of recipients. They also propose

a banded tax rate, with those recipients

in the lower income tax band exempt.

THE CONSERVATIVES

In their 2010 manifesto, they planned to

increase the IHT threshold to £1 million, but

the coalition government didn’t implement

this policy. David Cameron has indicated that

he would still like to increase the threshold to

£1 million.

IHT ANDTHE POLITICALOUTLOOK