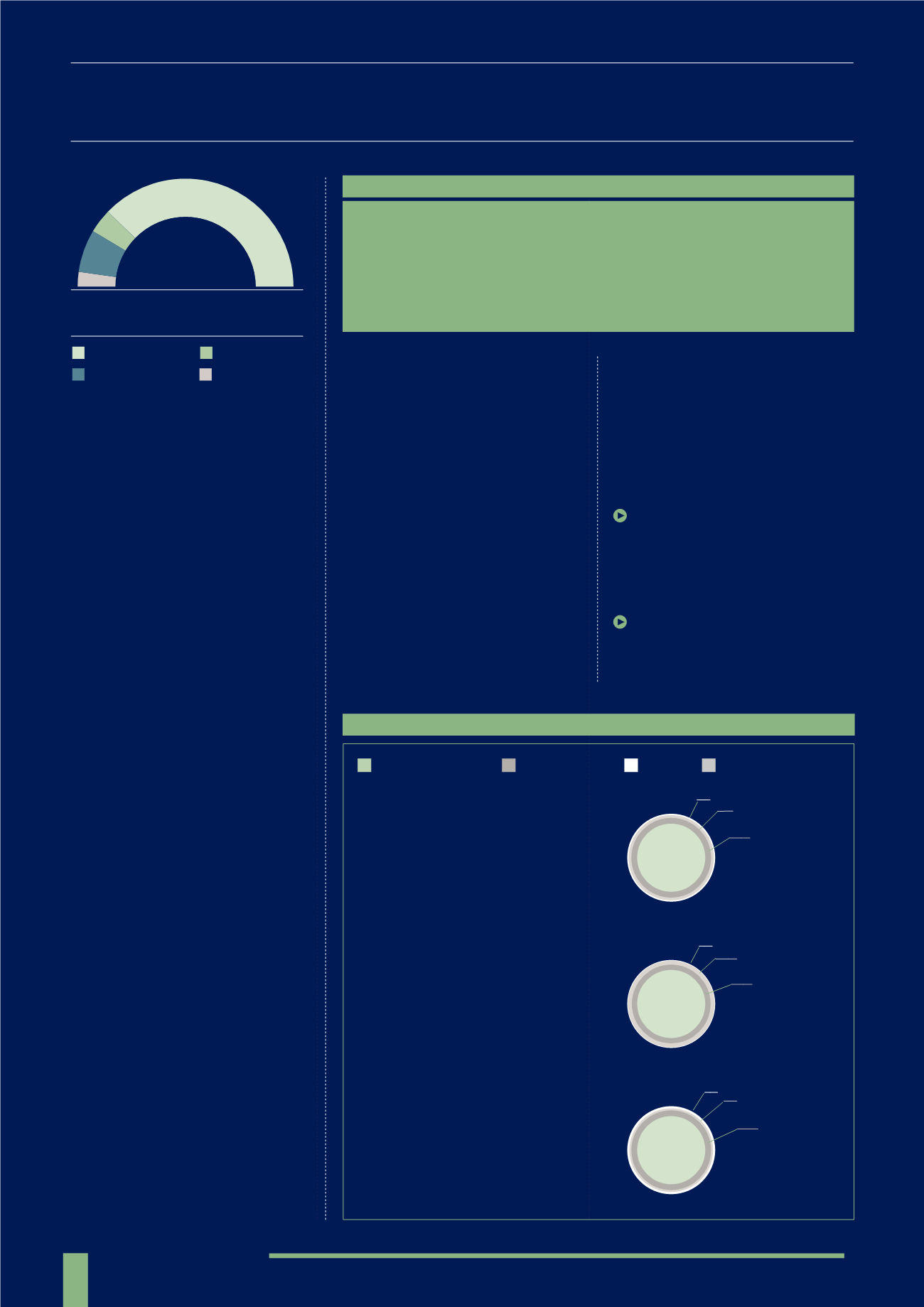

58

LEGAL STRUCTURE

This section looks at the differing

legal structures used to create BPR

investment products. Here they

are broken down into discretionary

portfolios, personal trading companies,

single company investments and

Unregulated Collective Investment

Schemes (UCIS). Each will hold shares

in underlying companies, partnerships,

SPVs or assets that qualify for BPR.

Products can be structured several

different ways in order to access BPR

qualifying investments. The most

common is a discretionary portfolio,

making up three quarters of the market.

Managers invest on a discretionary

basis on behalf of their customers,

with the investors having beneficial

ownership of the underlying assets.

It’s easy to see why discretionary

managed portfolios are so prevalent.

This is a simple legal structure that

is familiar to advisers and investors

and has no restrictions on promotion.

The investment process is quick, with

no legal complications or specialist

structures, which keeps set up costs

down. In fact it would be reasonable

to expect that for any clients with the

levels of wealth that would prompt

them to seek IHT mitigation, this kind

of product will feel exactly the same as

investments they’ve made in the past in

their accumulation phase.

UCIS is the next most common, but the

majority of these products are closed

to new investment. UCIS is a fund

structure, so it lends itself to a fund

raise / fund close operating model.

However, UCIS structures were the

primary target of PS13/03, regulations

which restrict the promotion and

distribution of “non-mainstream pooled

investments” to HNW and sophisticated

investors. This is not a huge problem for

BPR products, but perhaps managers

feel that a discretionary portfolio

arrangement avoids some of the

negative press associated with UCIS.

Single company investments have 7%

of the market. These structures enable

an investor to become a shareholder

in a SPV that will carry out one or more

qualifying activities.

The least common investment structure

is a personal trading company used

to provide a bespoke service. This

structure gives the investor 100%

ownership of their own trading

company that will carry out BPR

qualifying trades and is a more

specialised structure that is more costly

to implement.

INVESTMENT STRUCTURE

ANALYSIS KEY POINTS

There are four main structures in

which BPR investment products are

offered: single company; personal

trading companies; discretionary

portfolios; and UCIS

Discretionary portfolios make up the

majority of the market and tend to hold

shares across a range of 10 to 30 BPR

qualifying companies.

BESPOKE SERVICES

There are several wealth managers that provide IHT planning on a completely

bespoke basis that qualify for BPR. They are very much like discretionary portfolios

but it is very difficult to identify these in the market because they are not widely

marketed and very little public material is available on them. Some bespoke

portfolios were captured in our research but since these products are tailored to

each investor without a consistent investment focus or targeted return, they were

not included here for analysis.

13

%

4

%

7

%

76

%

Personal trading

company

UCIS

Single company

Discretionary portfolio

OVERALL MARKET

PRODUCT STRUCTURE

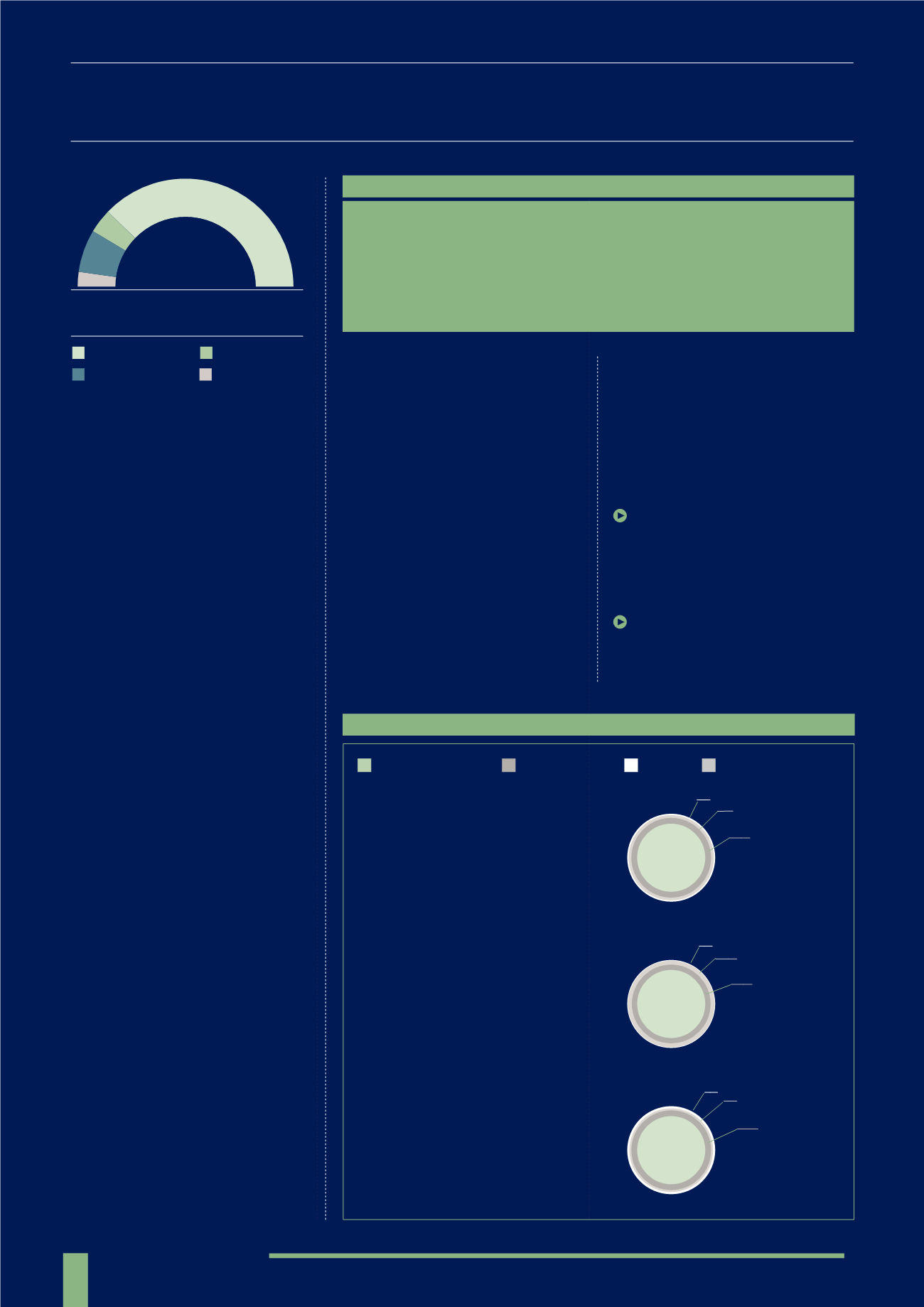

STRUCTURE AND OBJECTIVE

INVESTMENT OBJECTIVE

The investment objective gives an

indication of the overall aim of the

investment and an indication of the

level of risk.

Unsurprisingly the majority of the

market (79%) is solely focused on

capital preservation. However, investors

can also choose growth investment

strategies (7%).

Products that combine both strategies

make up 12% of the market.

A higher percentage of BPR products

that invest in unlisted assets were

focused on capital preservation than

the AIM-based products. We can

speculate that AIM-based products

are more suitable for younger clients

who still need equity levels of return.

Unlisted assets are less volatile and

provide more predictable levels of

return.

Capital preservation

Capital growth

Capital preservation

and growth

Bespoke

ENTIRE

MARKET

2

%

7

%

12

%

79

%

76

%

0

%

12

%

12

%

UNLISTED

PRODUCTS

80

%

4

%

4

%

12

%

AIM

PRODUCTS