57

The market breakdown of BPR shows

that the majority of investment products

fall under general enterprise (46%). The

majority of these are AIM portfolios,

which tend to be sector agnostic and

look for investee companies that fit their

rigorous investment criteria. Other

products specialise in sectors where the

management team have experience,

contacts and a good track record.

Favoured sectors for specialism are

renewable energy (26%), infrastructure

(19%) and real estate (17%).

Portfolio valuation is a simple

business for AIM portfolios, but for

unlisted assets it can be much harder.

Of course, investors and advisers

need regular valuations for financial

planning purposes and to monitor the

performance of the managers.

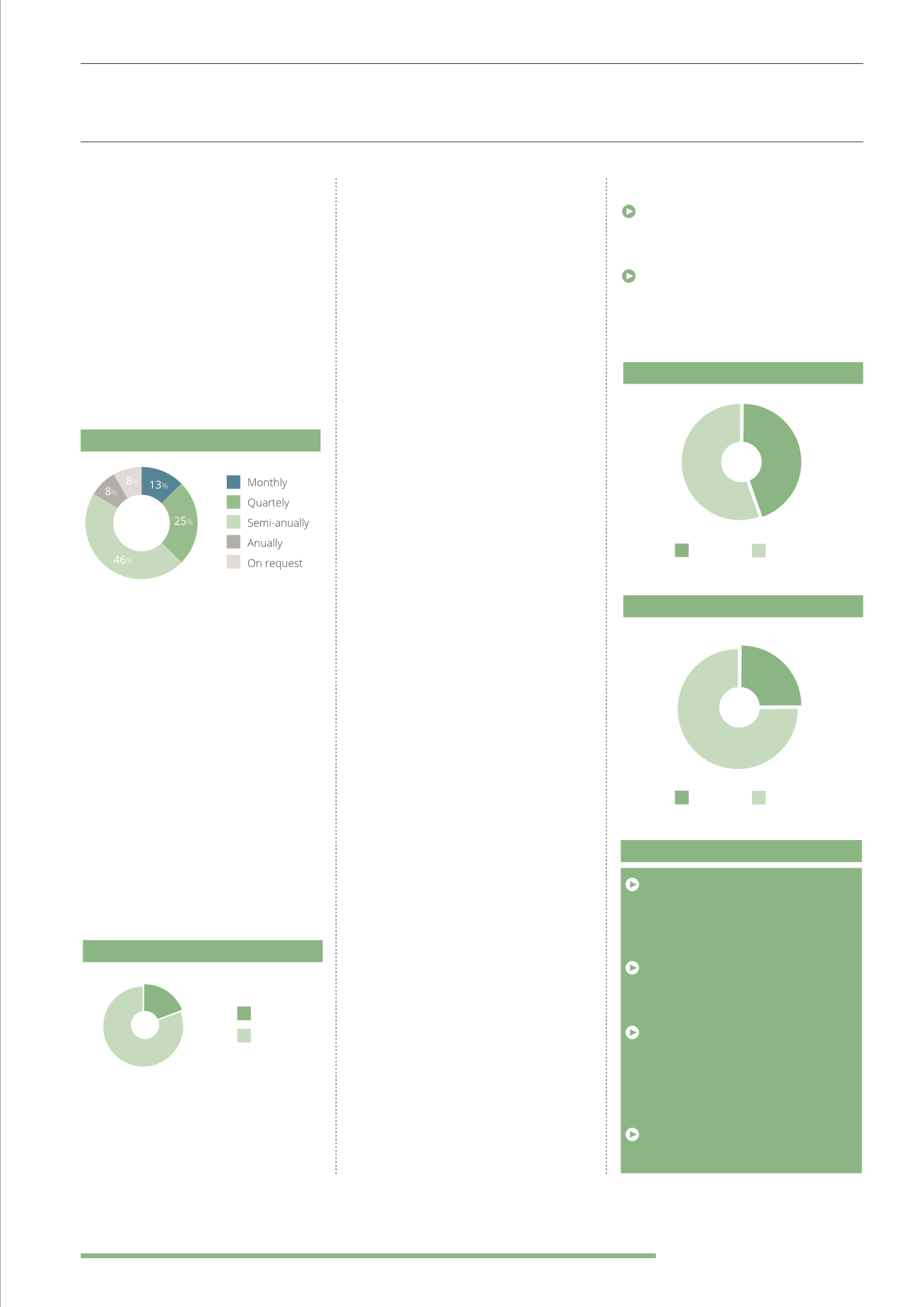

According to our research, the most

common practice was to value the

portfolios semi-annually (46% of

investments). Quarterly was also

common (25%). At the extremes, a

minority were valued monthly (AIM

portfolios), while some were less

frequent ranging from annually to only at

the request of the investor.

Some products offer some form of

insurance - a logical feature bearing in

mind the vital importance of capital

preservation if these products are going

to meet their objectives.

AIM / NON-AIM

BPR products utilise BPR to achieve IHT

relief and since 1996 shares listed on

the AIM and ISDX market have qualified

for this relief. Since then the market has

split into those that focus on AIM and

those that do not.

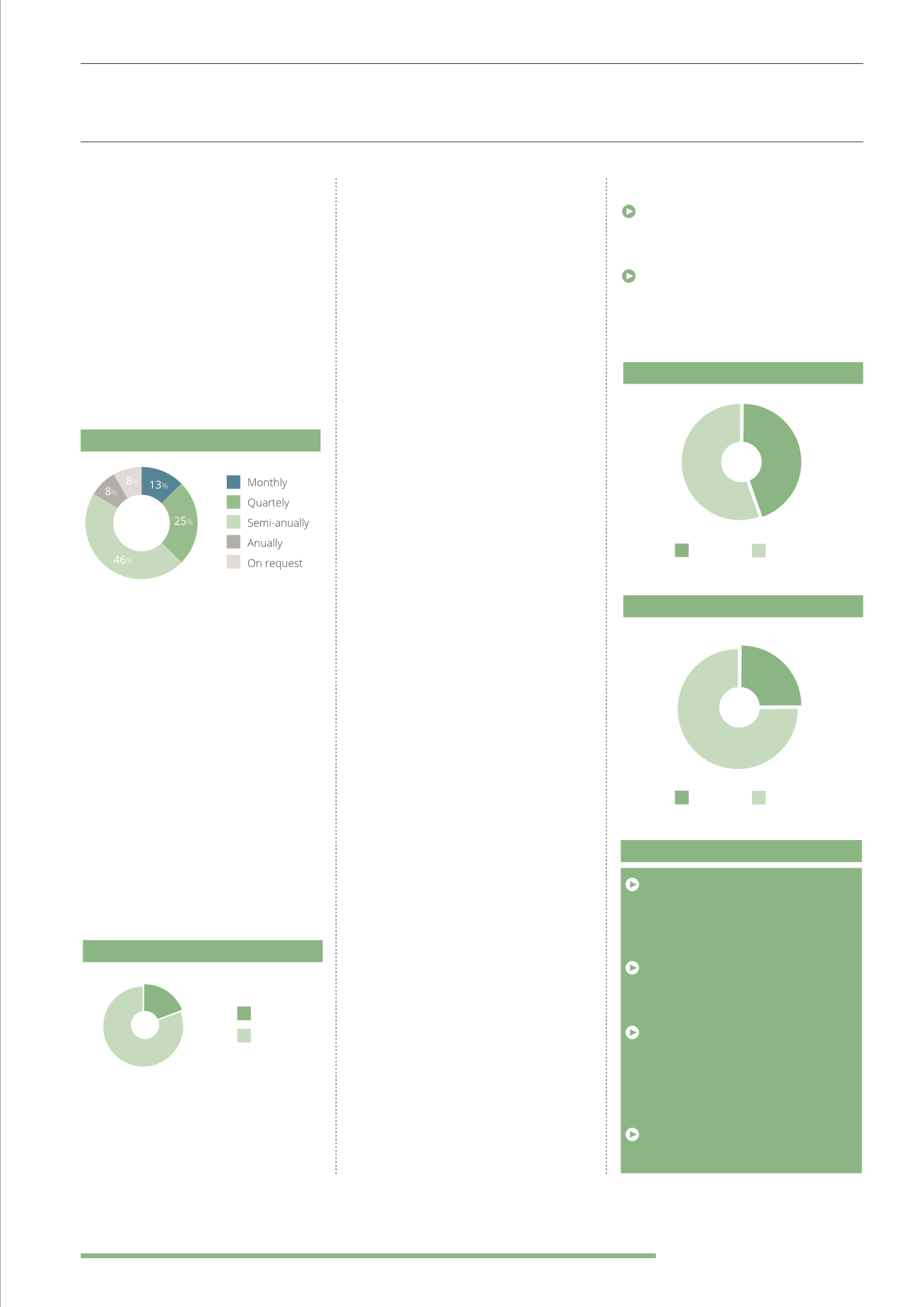

Based on our register, 45% of products

take the form of AIM portfolios to gain

IHT relief. AIM is often viewed as high

risk as the shares can be volatile, there

have been a high number of company

failures and the market as a whole has

underperformed mainstream indices.

However, this overall picture is

misleading. A lot of the volatility,

failures and underperformance of AIM

stocks are driven by the high number

of IPOs, a weighting towards junior

miners and explorers, and various

investment trends that have come

and gone. These are all characteristics

that you would expect from a junior

market, but they mask the fact that

there are a large number of steady and

established companies listed on AIM,

with good earnings per share, stable

or growing dividends and entrenched

market positions: exactly the sorts of

companies that meet the investment

criteria of BPR investment product

managers. These are not start-ups,

speculative ventures, shell companies

or high growth firms with ambitions to

list on the main market.

As noted elsewhere, non-AIM products

tend to be concentrated in a narrower

range of assets that managers have

more control over and valuations are

less volatile.

Since August 2013, AIM shares have

qualified for inclusion within ISAs,

so in theory, an AIM portfolio of BPR

qualifying shares can also enjoy the tax

benefits of an ISA wrapper.

Of the products on the register, 26%

were advertised as being able to be held

within an ISA (52% of the AIM portfolios).

Perhaps some of the managers should

be doing more to highlight this valuable

benefit.

AIM / NON-AIM KEYPOINTS

45% of BPR investment products in

the market utilise AIM shares to achieve

IHT relief

Although AIM shares can be held in

an ISA, only 26% of the investment

products offered or promoted an ISA

option

VALUATION FREQUENCY

“Portfolio valuation is a simple business for AIM portfolios, but for unlisted assets it can be much

harder“

PORTFOLIO INSURANCE

81

%

19

%

Yes

No

AIM/NON AIM BPR PRODUCTS

55

%

45

%

ISA OPTION OFFERED

26

%

74

%

The market has seen a 90% increase

in the number of BPR investment

products in the market over the past

10 years

37 products are currently open to

investment with the majority of these

being evergreen

There is a wide range of products

for investors, with minimum

investment levels ranging from £5,000

to £500,000, but most in the £50,000

to £70,000 range

26% of products are ISAable, adding

another valuable benefit

OVERALL KEY POINTS

AIM

Non AIM

Yes

No