64

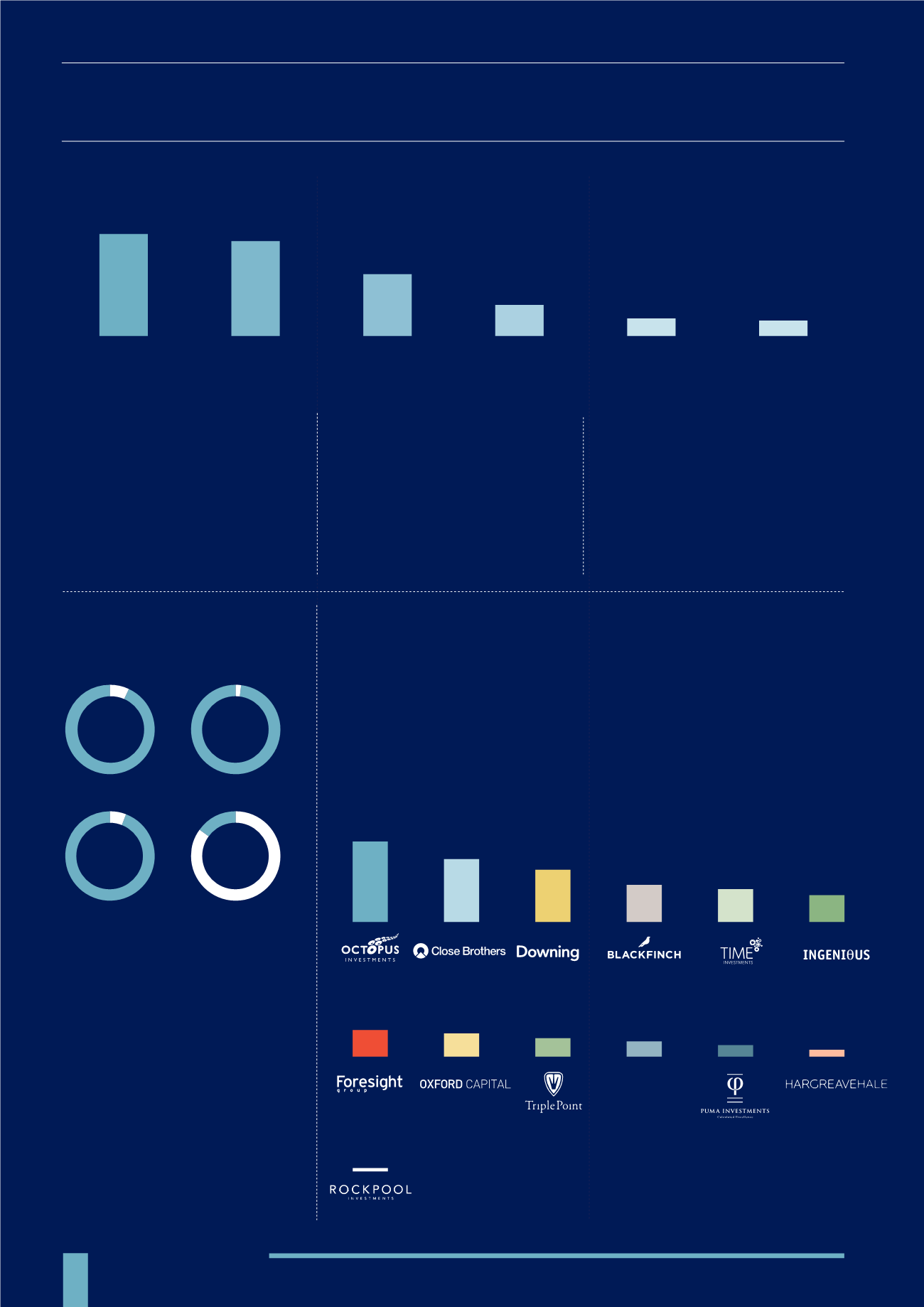

It is interesting to gauge where some of the top product providers stand with the

adviser community. Based on the survey Octopus was by far the most popular with

advisers. Close Brothers, one of the oldest BPR product providers was also popular.

Most providers capture some share of the adviser market, which is a positive

indication of a healthy and competitive marketplace.

Some providers previously established in other tax efficient product types are now

making a move into the BPR market and are seeking to rapidly grow their market share.

Q

.

Which BPR product providers do you typically use?

The most common reason for

recommending a BPR product was the

speed of the IHT mitigation. The simple

legal structure also scored highly and

is perhaps linked to speed of relief -

clients in a hurry to achieve exemption

probably do not want to go through a

complex investment process or medical

underwriting.

Access was the second most common

reason for a recommendation and this

one is perhaps linked to the potential for

future growth, which was the fourth most

common reason. We can speculate that

this is being driven by slightly younger

clients who still want some growth, who

may still require access to those funds

for future spending needs, but who also

want to feel that they have taken some

steps to mitigate IHT. This triumvirate of

needs is perhaps a relatively new financial

planning problem that is unique to the

baby-boomer generation.

100

93

60

30

16

14

Speed of IHT

mitigation compared

to other solutions

Client retains

access to funds

Simple legal structure

compared to other

IHT solutions

Potential for

growth as well

as IHT mitigation

Contributions to

pensions and ISAs are

already maxed out

Corporate clients

require a BPR solution

to pass on the value of

their business

Q

.

What are your

top 3 reasons

for recommending BPR products?

“The most common reason for recommending a BPR product was the speed of the IHT mitigation”

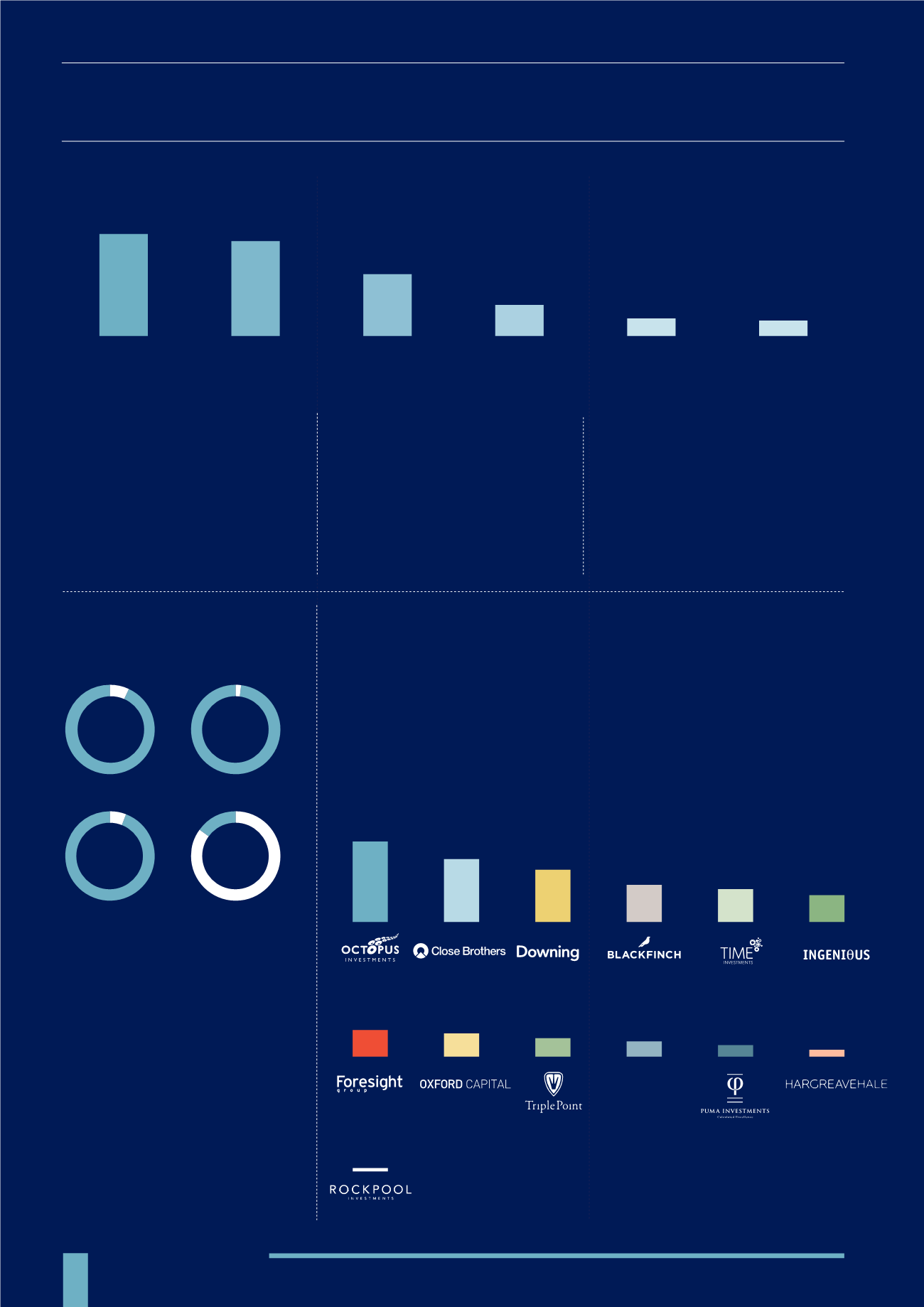

Q

.

Do you consider diversification across

BPR product providers and underlying

assets important?

It seems that advisers diversify across

both providers and underlying assets.

What is not immediately obvious is

whether providers are investing in the

same, or similar, assets and therefore

how much genuine diversification is

achieved. This is a question advisers

have to examine through their own due

diligence and research. The 6% that

believe diversification is unimportant

is interesting - with a BPR product,

the primary objectives are capital

preservation and IHT relief, so perhaps

they feel the products are low in risk

and that diversifying doesn’t need to be

a big concern for them.

Underlying

Assets

Product

Providers

Neither

7

%

2

%

6

%

86

%

Both

83%

28%

11%

40%

1%

39%

32%

56%

68%

36%

5%

17%

21%

Other