59

INVESTMENT OBJECTIVE

ANALYSIS KEY POINTS

Capital Preservation is the stated

investment objective of 79% of the

products in the market

80% BPR products investing in

unlisted assets are solely focused on

capital preservation

24% of AIM based investments focus

on capital growth as well as capital

preservation

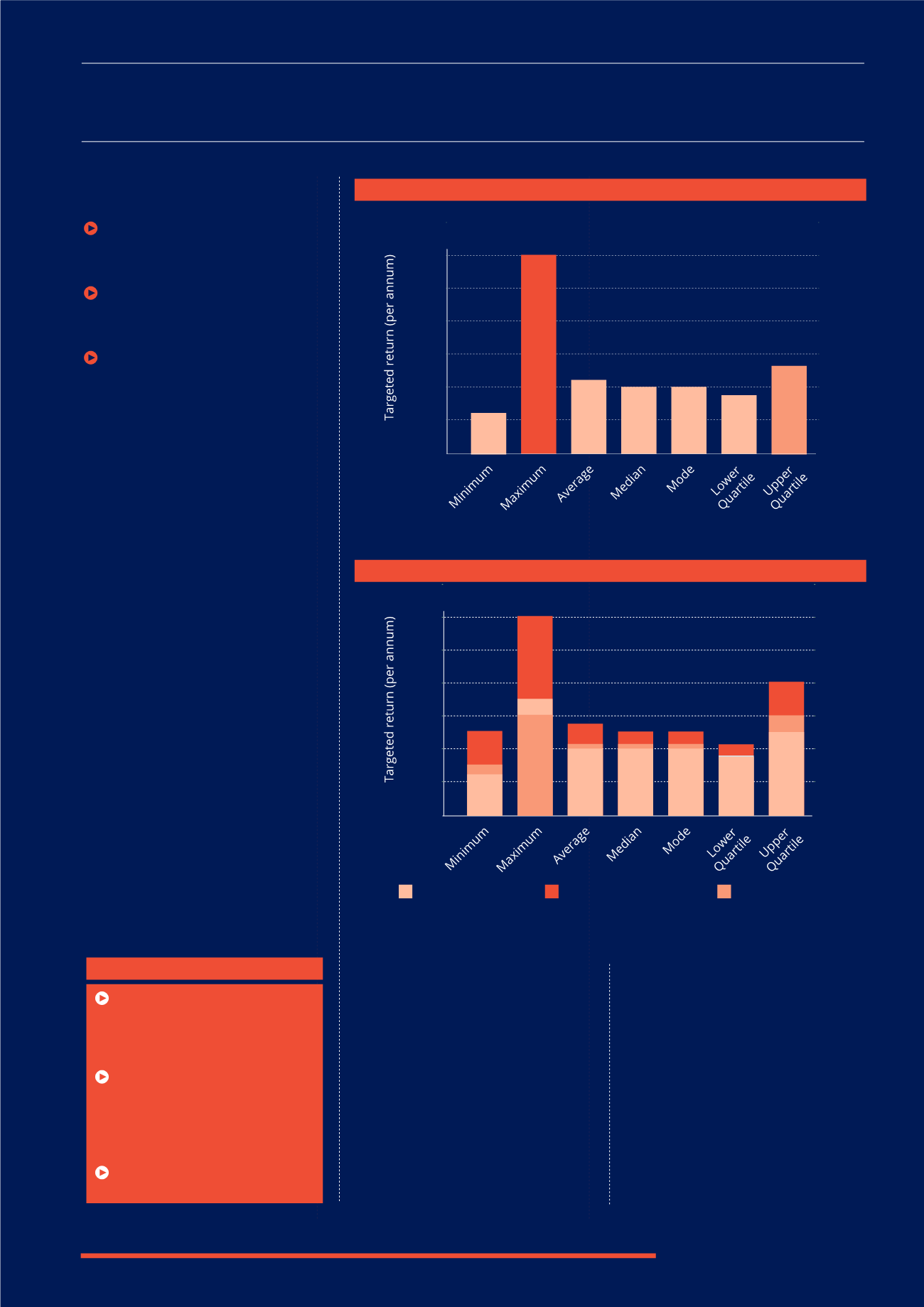

TARGETED RETURNS

This section looks at the range of

targeted returns in the BPR product

market. With most investments focused

on capital preservation, beating

inflation to maintain spending power

is essential. Some investors may still

want to achieve some level of growth

in their portfolio as well. It is important

to note that returns are not guaranteed

or assured by the providers - the returns

are a stated target and the capital is still

at risk.

While many products do not quote a

target return (nearly 60%), those that

do tend to target returns in the low

single digits. Taking the market as a

whole, the lowest targeted return was

2.5% per year, the highest was 12% and

the average 4.5%. The most quoted

targeted return was 4% and returns in

this region make sense - likely to keep

up with any inflation we experience but

not a stretch that requires excessive

levels of risk.

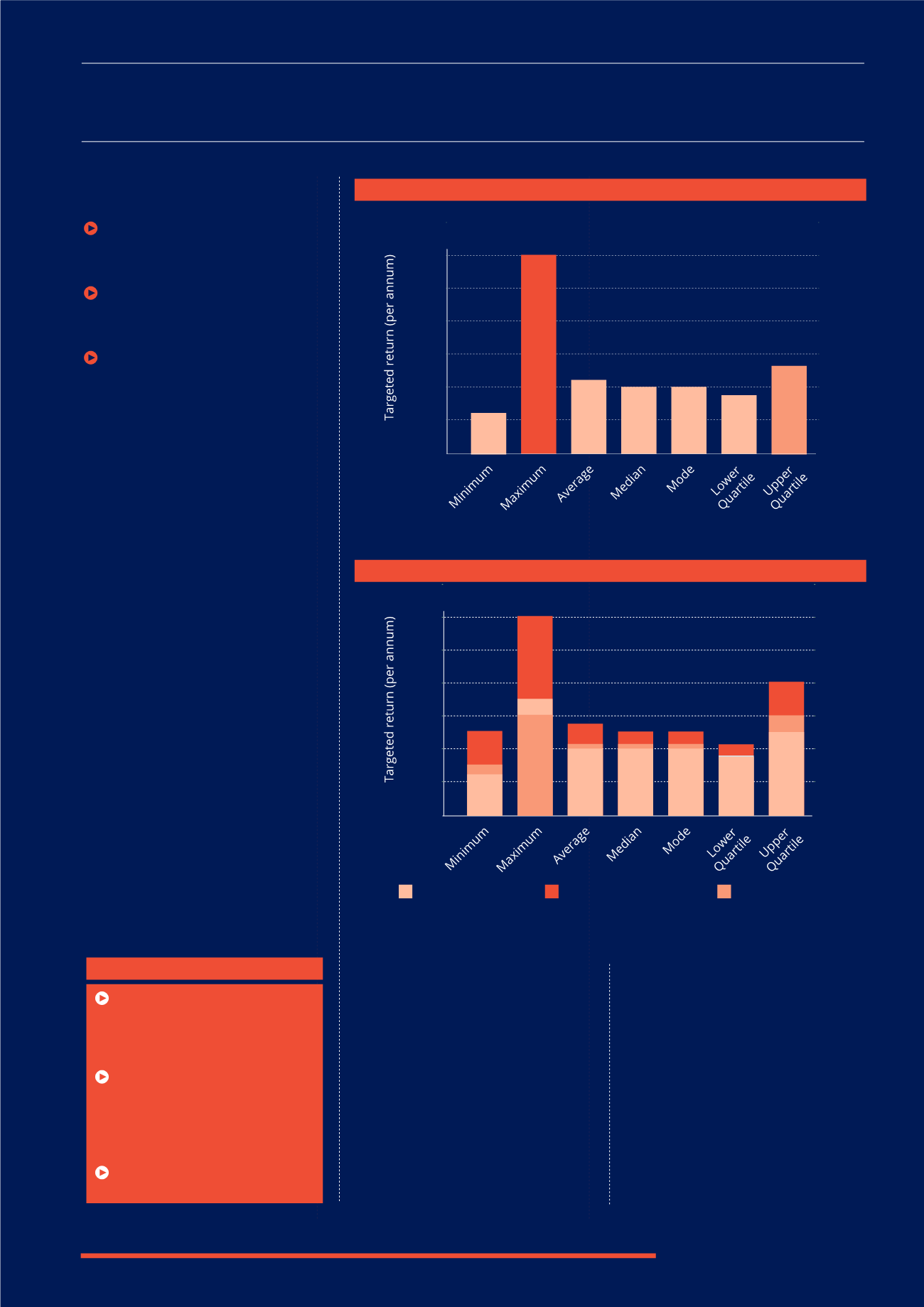

When comparing the BPR structures

side by side, the returns can also help

give us an indication of which structures

tend to have a higher level of risk.

Personal trading companies had the

highest quoted target return of 12%,

with the low end of the range still

relatively high at 5% per year.

Single company investments were the

next highest quoted returns in the

market, ranging from 3% to 6%, with the

average just over 4% per year.

Discretionary portfolios have the lowest

targeted returns, ranging from 2.5% to

7% and averaging 4% per year.

Target returns on AIM focused

investments in the market were not

quoted by the majority of providers,

perhaps a reflection of the volatility on

AIM and the lower levels of control the

managers have over the underlying

investments. Of the two that did quote

targets, one targeted 4% per year

and the other aimed to provide index

beating returns.

TARGETED RETURNS

TARGETED RETURNS BY STRUCTURE

Targeted returns range from 2.5%

to 12% per year, offering

opportunities for investors to find

market beating returns

Personal trading companies have

the highest quoted returns of 12%

per year which could signal that

these tend to take on more risk than

other structures

AIM portfolio providers generally

did not provided target return figures

RETURNS KEY POINTS

Personal Trading Company

Single Company

Discretionary Portfolio

RETURNS

12%

10%

8%

6%

4%

2%

12%

10%

8%

6%

4%

2%