66

Liquidity, investment risks, suitability

and the ultimate exit strategy are

all factors that are making advisers

hesitate before recommending BPR

products - perhaps indications of

where the industry can do more to

communicate their message and

assuage these fears.

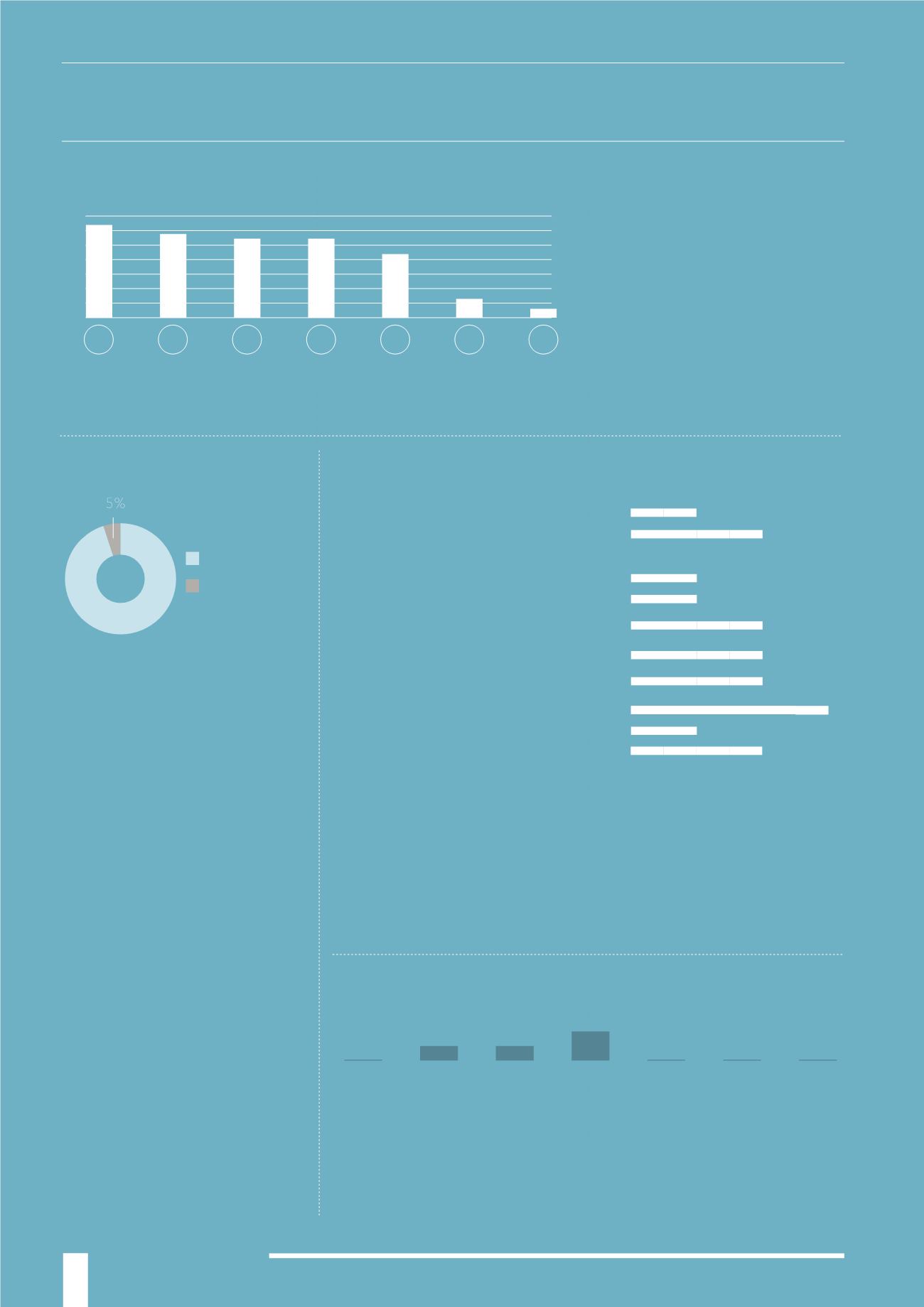

95% of advisers feel that they will

do more BPR business in the next

five years. When asked by how

much, responses ranged anywhere

from 5% to a 500% increase!

There was an acknowledgement that a

potential increase in the nil rate band

causes some uncertainty but the big

driver is simply that client banks are

ageing and their assets are growing.

Some interesting comments were

also made about the products being

accepted as more mainstream, which is

a positive sentiment for the BPR market.

Q. In your opinion, what single change

or innovation would improve the BPR

market?

When posed this question, advisers had

several different suggestions on what

could improve the BPR marketplace.

Probably the two most resounding

suggestions were lower costs, greater

transparency and awareness of the

sector. Some felt that BPR is wrongly

classified as ‘high risk’ by PI providers

and that there is not enough research

and information on the sector.

For our small sample of advisers that do not recommend BPR products at all, the

investment risk to the client is the top reason for not using BPR. Other concerns

are the expected lack of liquidity, expense and transparency - similar to the list of

concerns from advisers who do recommend BPR, but this cohort remain unconvinced.

The other notable reason was the regulatory risk to their business i.e. the risk they

may face for recommending these perceived and complex products. Again, these are

perhaps indications of areas where the industry can do more to get their message

across.

“Some advisers feel that the products are being accepted as more mainstream”

More

Less

95

%

Q

.

Do you expect to do more or less BPR

business in the next five years?

Q

.

What are your

top 5 reasons

for not recommending BPR products?

Q

.

Why do you favour trusts over BPR?

Q

.

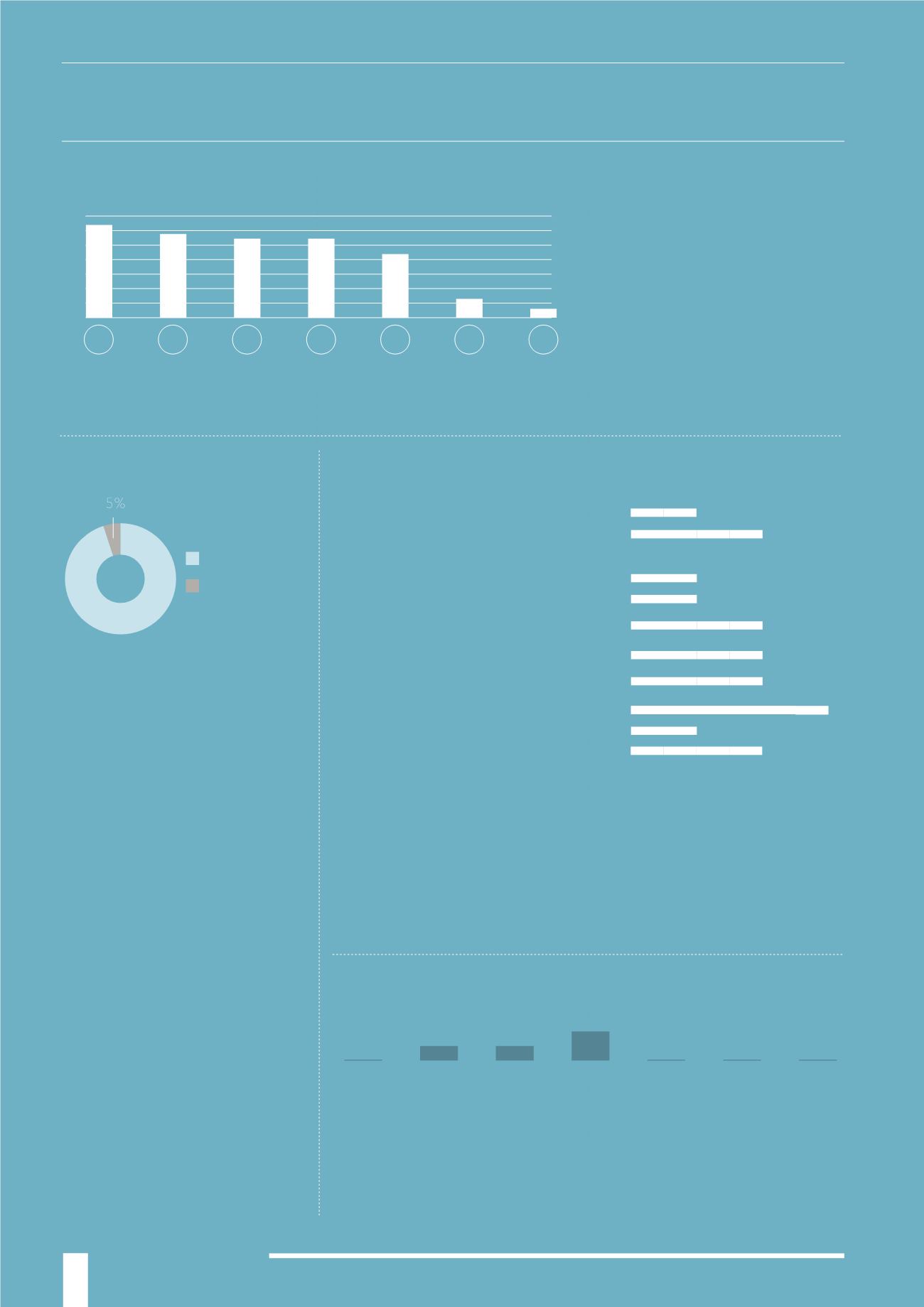

Which factor would make you hesitant about recommending BPR products?

0

0

0

0

1

1

2

Less risk

to my

business

(regulatory

risk)

Less due

diligence and

compliance

work

required

Easier to

explain to

clients

Better

established

Other

Lower risk Lower cost

Of the advisers that only use trusts for IHT mitigation, the stated reasons for using

them over BPR are a lower level of risk, less due diligence required and the ease of

explaining the product to clients.

I believe that the IHT threshold will rise

Too much due diligence and compliance work required

Too much risk to my business (regulatory risk)

Too hard to explain to clients

Fear of investing in non-mainstream asstes

Fear of investing in an esoteric tax avoidance scheme

Lack of transparency / Too hard to understand /

No past performance to assess

Too expensive

Lack of liquidity /

Concern that deal flow will dry up for the providers

Investment risk

Not suitable for my clients

Other

0

1

1

1

1

2

2

2

2

3

2

0

Unclear exit

strategy

Illiquid Too high

risk

Not suitable

for my clients

Lack of

transparency /

Not enough

supporting DD

information

Economic

sector

Other

10

0

20

30

40

50

60

70

?

?

?

?

?

?

?