67

CONCLUSIONS

It seems that when it comes to using

BPR products, the biggest consideration

for advisers is the individual client’s

situation - this consideration dictates if

BPR products are a suitable investment,

what suitable portfolio allocations

are and perhaps the BPR investment

strategy that is chosen.

Unsurprisingly, speed of relief and

ongoing access to funds (BPR’s

two big selling points) were cited

as common reasons for choosing

BPR as an asset class. However, the

investment philosophy and experience

of the investment team were the

biggest criteria when it came to

choosing a manager (but conventional

considerations such as costs and past

performance were not far behind).

Investment risk, liquidity risk and lack

of transparency around the underlying

investments were cited as the biggest

concerns with BPR, by both advisers who

recommend BPR and those who do not.

The qualitative comments we received

are summarised in the bullet points on

the right. Some of these might be so

obvious as to be truisms, and some are

contradictory, but then meeting the

needs of investors and advisers, and

balancing their conflicting requirements

are what the providers get paid for.

PROVIDER SURVEY

We undertook a survey of the BPR

product provider community to

establish how well they understand

advisers’ and investors’ needs, and

if there are any issues where the

perceptions or expectations of the buy

and sell side do not match.

The survey was sent to the providers

that were captured on our investment

register. We promised respondents a

hard copy of the report as an incentive

to participate in the survey and we had

16 responses.

INTENTION OF THE SURVEY

Our intention was to see how well

providers understood and met the

needs of advisers and investors;

whether they understand their

concerns; which factors they think are

most important when considering an

investment; the types of products they

structure; and the suitability of their

products.

We also used this as an opportunity

to gauge how they see the market

developing over the next five years and

what changes they think would improve

the marketplace.

SURVEY ANALYSIS

The survey included up to a maximum

of 21 questions and was ‘dynamic’ -

subsequent questions depend upon

previous answers.

Q

.

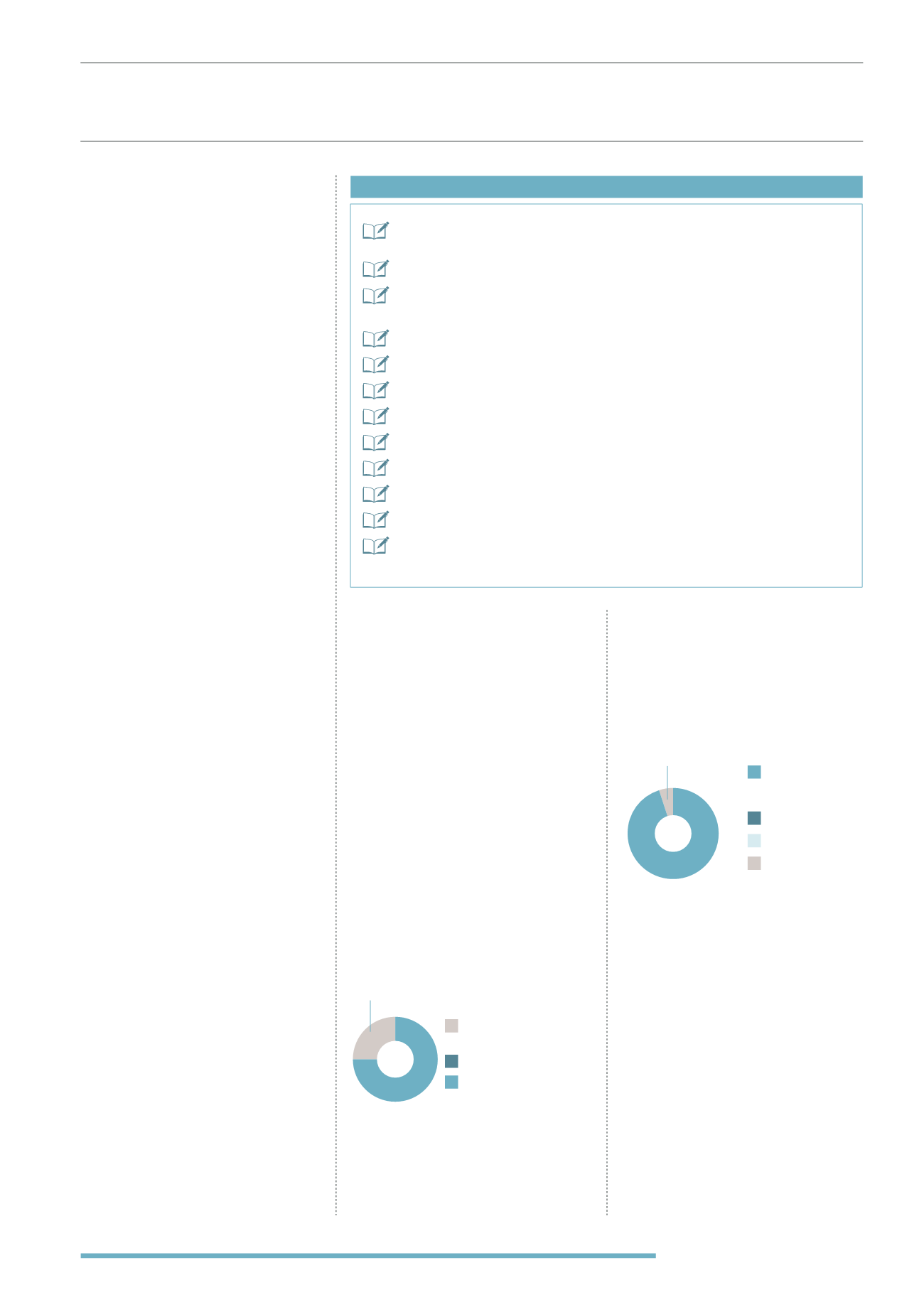

What segment of clients do you

believe BPR is suitable for?

The majority (75%) of BPR product

providers believe that BPR is a suitable

investment for both HNW/Sophisticated

investors and ordinary retail investors,

mirroring what advisers think.

Taking both these results together, it

would seem that the consensus is that

BPR meets the needs of ordinary retail

investors and not just HNW investors.

Q

.

What % of a client’s total portfolio do

you believe is suitable to be placed in a

BPR product?

93% of the product providers believe

the percentage of a client’s portfolio

that should be placed in a BPR product

depends on their specific needs. Each

responded that age, health, attitude

towards risk, the size of their estate,

and wealth should all play a role in

determining the level of investment

for BPR. Again, this mirrors the

advisers’ responses and shows that

the individual client situation is the

overriding concern and there is no need

to be dogmatic about who should be

investing in these products and in what

amounts.

HNW Investors /

Sophisticated Investors

Ordinary Retail Investors

Both

0

%

“

The biggest consideration for advisers is the individual client’s situation”

25

%

75

%

It depends upon

the client

< 5

%

5-10

%

> 10

%

0

%

7

%

0

%

93

%

LESSONS FOR PROVIDERS FROM ADVISERS

Don’t claim the products are low risk, and then put in lots of risk warnings

in your brochures!

Be more transparent about your investment activity

Engage with the regulator and HMRC, don’t leave BPR qualification or

client suitability to chance

Lower costs

Decrease risks, improve liquidity

Do a better job of telling your story as an industry

Provide independent due diligence and verification of key points

Increase investor protections

Make it easier to carry out comparisons of the market

Provide a higher income yield

Conduct a consumer marketing campaign (not just advisers)

There is a cost (to clients) of doing nothing and needlessly paying IHT –

there is a need for these products