65

Q

.

Do rumours that the IHT threshold

may rise make you hesitate to

recommend BPR products?

Inheritance tax only got one mention

in 2015 Budget, in relation to deeds

of variation. Most advisers are not

letting the possibility of a rise in the

IHT threshold hold them back from

recommending BPR products.

Perhaps either their clients are elderly

and need BPR immediately, or they are

healthy and planning ahead in which

case their estates are likely to grow and

outstrip the growth of the nil rate band.

In both cases, it means that changes

to threshold are not an important

consideration.

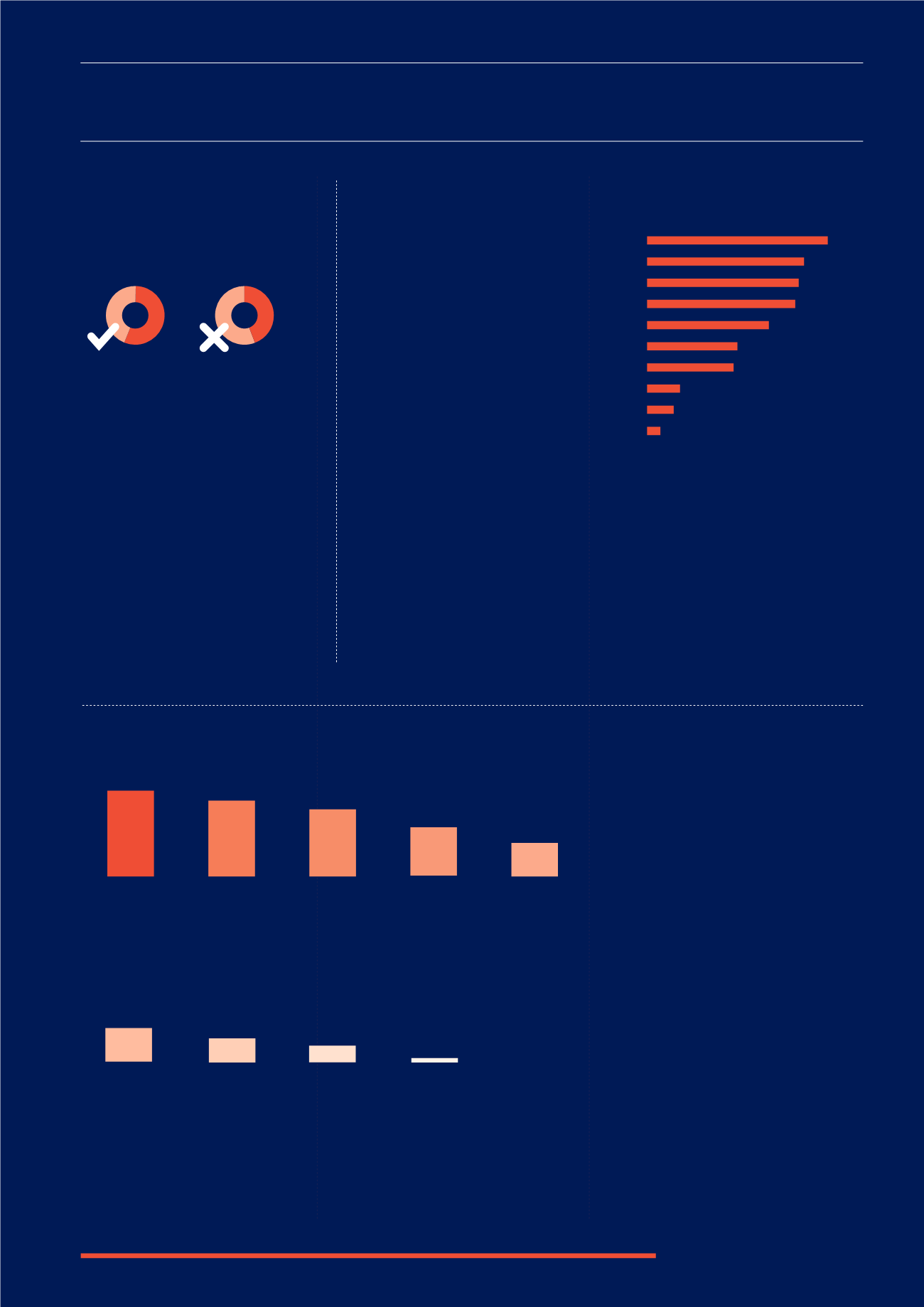

The tensions in BPR we have highlighted

throughout the report - how to balance

liquidity with risk and returns while

investing in smaller companies - are

apparent in advisers’ concerns. Liquidity

and investment risk were the two biggest

concerns. The lack of transparency and

difficulty assessing the products was

the third highest concern. All three of

these may be linked, as advisers might

be able to get comfortable with liquidity

and investment risk if they have a clear

look-through to the underlying investment

portfolio, which is not always the case

with BPR products. Finally, as always,

costs were a concern. For advisers,

when it comes to managing their clients’

investments much of what happens is out

of their control - but costs are a known

variable and so are rightly scrutinised.

It was really interesting to see both investment philosophy and the management

team score so highly as criteria for choosing a product provider. In surveys of

mainstream asset classes past performance is invariably the leading criteria. In the

BPR market investment performance can be harder to evidence, and is less important

than capital preservation. It seems that this means advisers place more weight on

the house style and personnel, and this could be backed up by the high score for

the quality of the marketing literature, where managers have the opportunity to

showcase themselves.

That’s not to say that more quantitative measures are ignored though - past

performance, costs and assets under management all scored highly.

Q

.

What are your

top 5 criteria

when choosing a BPR product provider?

“Advisers place more weight on the house style and personnel”

69

%

31

%

Q

.

What are your

top 5 concerns

when investing in a BPR product?

Lack of liquidity /

Concern that deal

flow will dry up for

the providers

92

Fear of investing in

non-mainstream

assets

36

Too much risk

to my business

(regulatory risk)

35

Lack of transparency

/ Hard to understand

/ No past performance

to assets

73

Investment

risk

87

Fear of investing

in an esoteric tax

avoidance scheme

24

Too much due

diligence and

compliance work

required

29

Too

expensive

54

Other

7

6

84

73

71

70

57

42

41

13

11

The investment philosophy

Costs

The management team

Past performance

Quality and transparency of supporting literature

Size

Having used them previously

Other

Interaction at events / seminars

As measured by AUM