56

The data we collected on the BPR

market can be broken down in a handful

of different ways. The following sections

of this report provide an overall analysis

of the BPR market, looking at how it

has grown in recent years, the different

economic sectors where investments

can be made and the different

structures available for investors

looking to access the market.

We break the data down by:

Structure and objective

Focus

Investment objective

Forecast returns

Charges and fees

OVERALL MARKET ANALYSIS

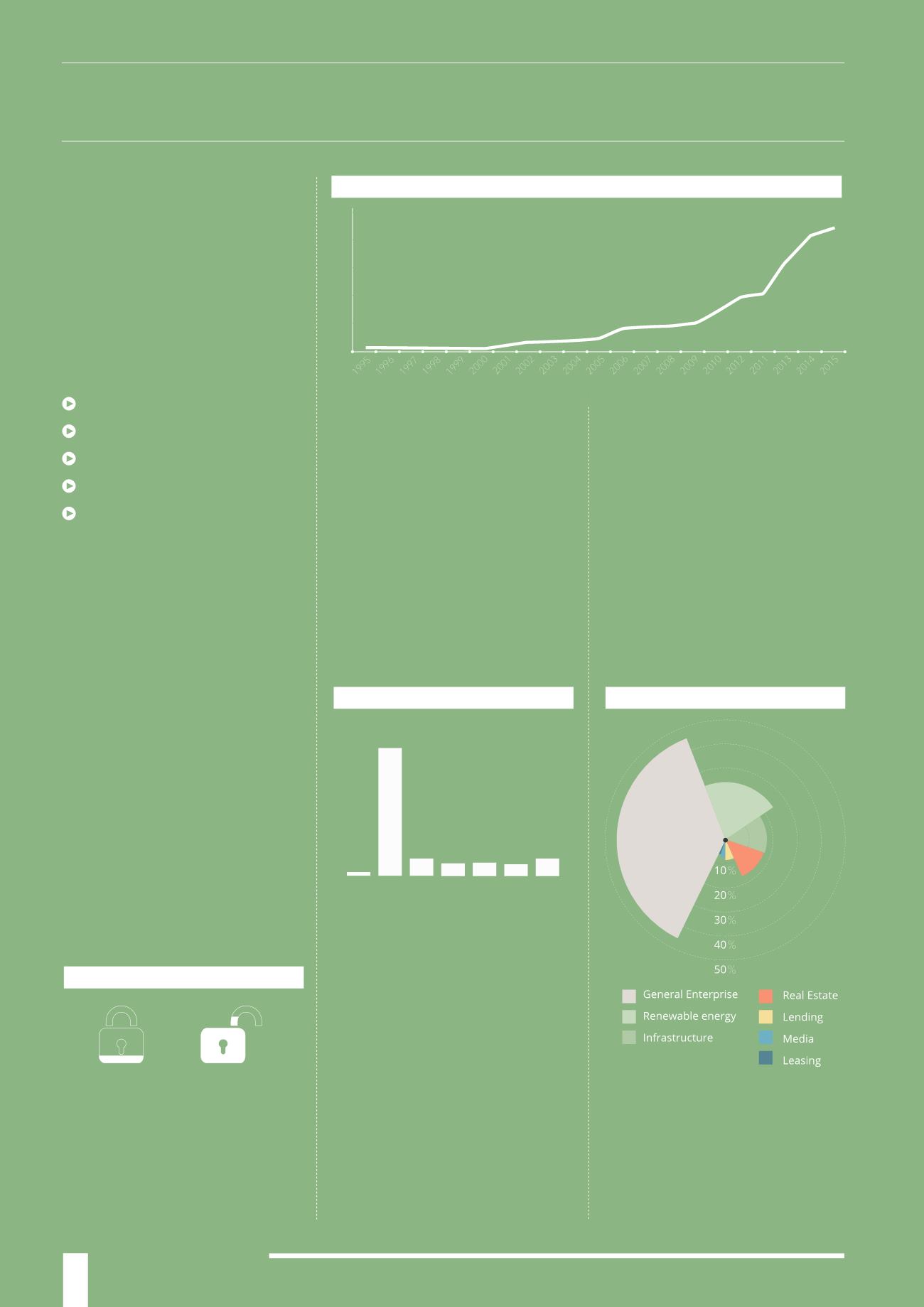

The first product identified on our

register launched in 1995 and the

market remained very small until 2006.

Since 2006, we’ve witnessed a 90%

growth in the number of products

available. We have identified 52

products in total, of which 37 are still

open for investment today.

We can speculate that the recent growth

in the number of products available may

be down to a combination of factors.

The wealthy baby-boomer generation

is beginning to age and the need for IHT

mitigation is greater; house prices have

soared and the IHT threshold is frozen

at £325,000. Or indeed it may be the fact

that these products are becoming more

popular as both investment managers

and investors are catching on to the

benefits of estate planning via BPR.

Of the products that were collected

on the register, 71% were open to

investment with the remaining 29%

closed to new investment. Many IHT

planning products are operated on a

discretionary basis, rather than through

a fund, meaning that these products are

evergreen. One reason for favouring

evergreen products is that customers

are investing for estate planning

purposes and want their funds to be

invested immediately; investors do not

want to wait for a fund to close for the

2 year qualifying period to commence.

Some specialist products that are

structured as a single company that

act much like a fund do have closing

dates, however products structured as

a personal trading company will most

likely also be evergreen.

Across the market the average minimum

required initial investment was £67,500,

with the mode (the most frequently

occurring figure) at £50,000. This graph

does not include any minimum top up

investments.

One might expect that these products

would have a high minimum investment

level, as they are aimed at wealthier

clients, but the lowest entry level was

just £5,000. This could be another

indication that BPR is becoming more

mainstream and meets the needs of an

increasing number of clients.

On the other hand there are several

offerings with high minimum investment

levels, with the highest being £500,000.

This makes it clear that the ultra-wealthy

also utilise BPR for IHT relief, and don’t

rely solely on gifts and trusts.

However, the cluster of mean, median

and mode at £50,000 - £70,000 shows

where this market is pitching itself.

Minimum additional investment or “top

up” increments varied from £5,000 -

£25,000. It is important to note that any

top up would take a further two years to

qualify for IHT relief.

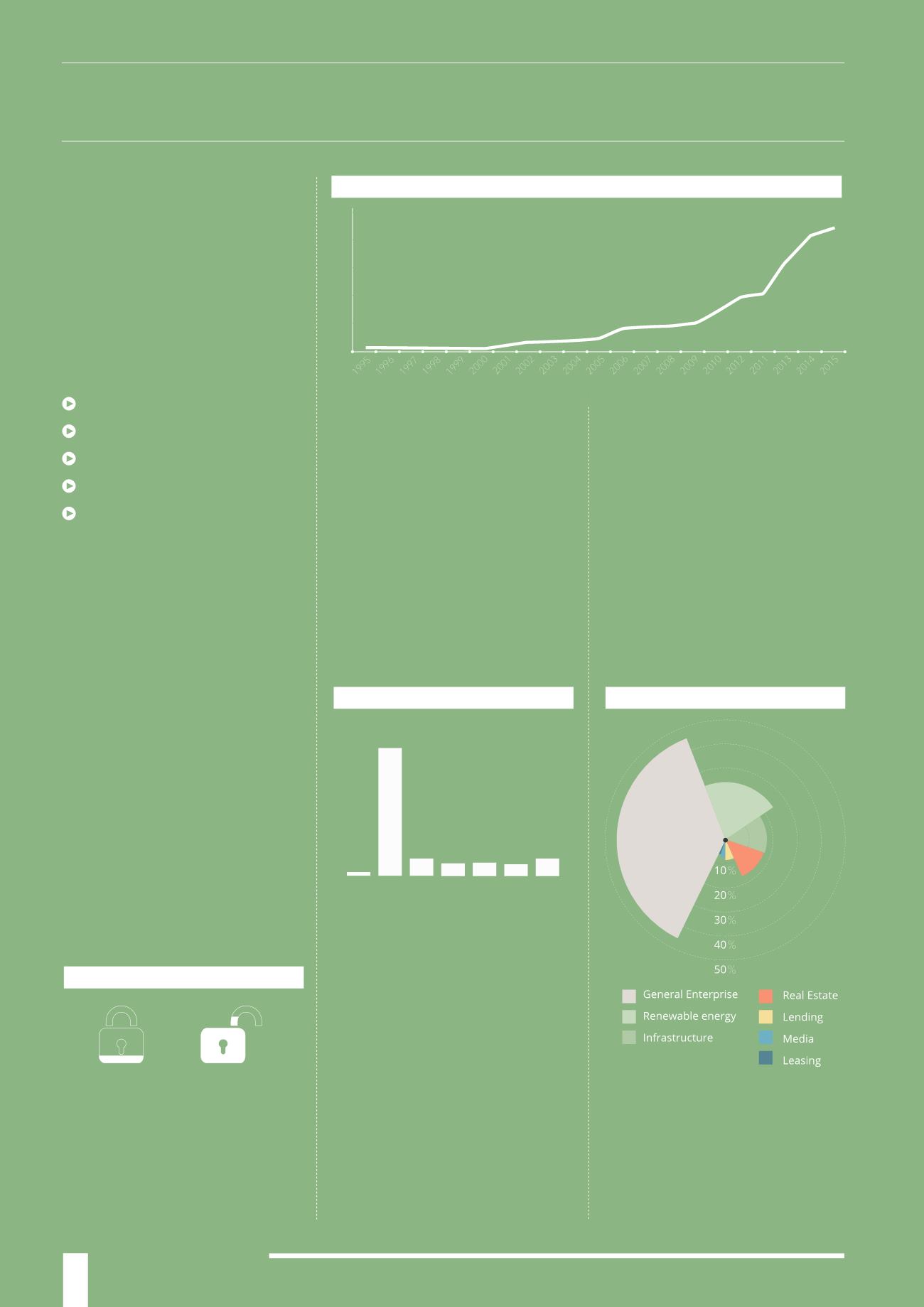

BPR qualifying assets are not difficult

to identify, and there are eligible

investments across a wide range of

business sectors. BPR products tend

to spread investment across a range of

two or three sectors, mitigating risk.

50

40

30

20

10

0

BPR MARKET GROWTH

(CUMULATIVE N⁰ OF PRODUCTS)

(1995-2015)

INVESTMENT STATUS

29

%

CLOSED

71

%

OPEN

SECTORS

“Since 2005 the product market has grown 780%, with 2013 seeing the most product launches

in one year“

MINIMUM INVESTMENTS

5,000

Min

Max

Average

Median

Mode

500,000

67,500

50,000 50,000

25,000

76.250

Lower

Quartile

Upper

Quartile