Peer to Business Lending

Alternative Finance Sector Report - November 2014

6

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

11 -

• 12 -

The majority of growth in the UK market has been in the last few years. In May 2014 the total size of the UK P2P market topped £1.5bn,

according to the latest figures published by AltFi Data. The Liberum AltFi Volume index (which tracks the volume of loans originated

by UK P2P lenders) passed £1bn in December 2013, meaning that the industry grew by 50% in just five months. If the rate of growth

continues at the same pace, AltFi estimate that the Liberum AltFi Volume index could reach £2.75bn by the end of the year, showing

175% (year on year) growth.

11

“£1.5bn is a major milestone for the rapidly growing P2P Lending industry in the UK, but

perhaps more important is the fact that almost a third of those loans have been originated

in 2014, underlining the phenomenal growth of the industry.”

Sam Griffiths, AltFi Data

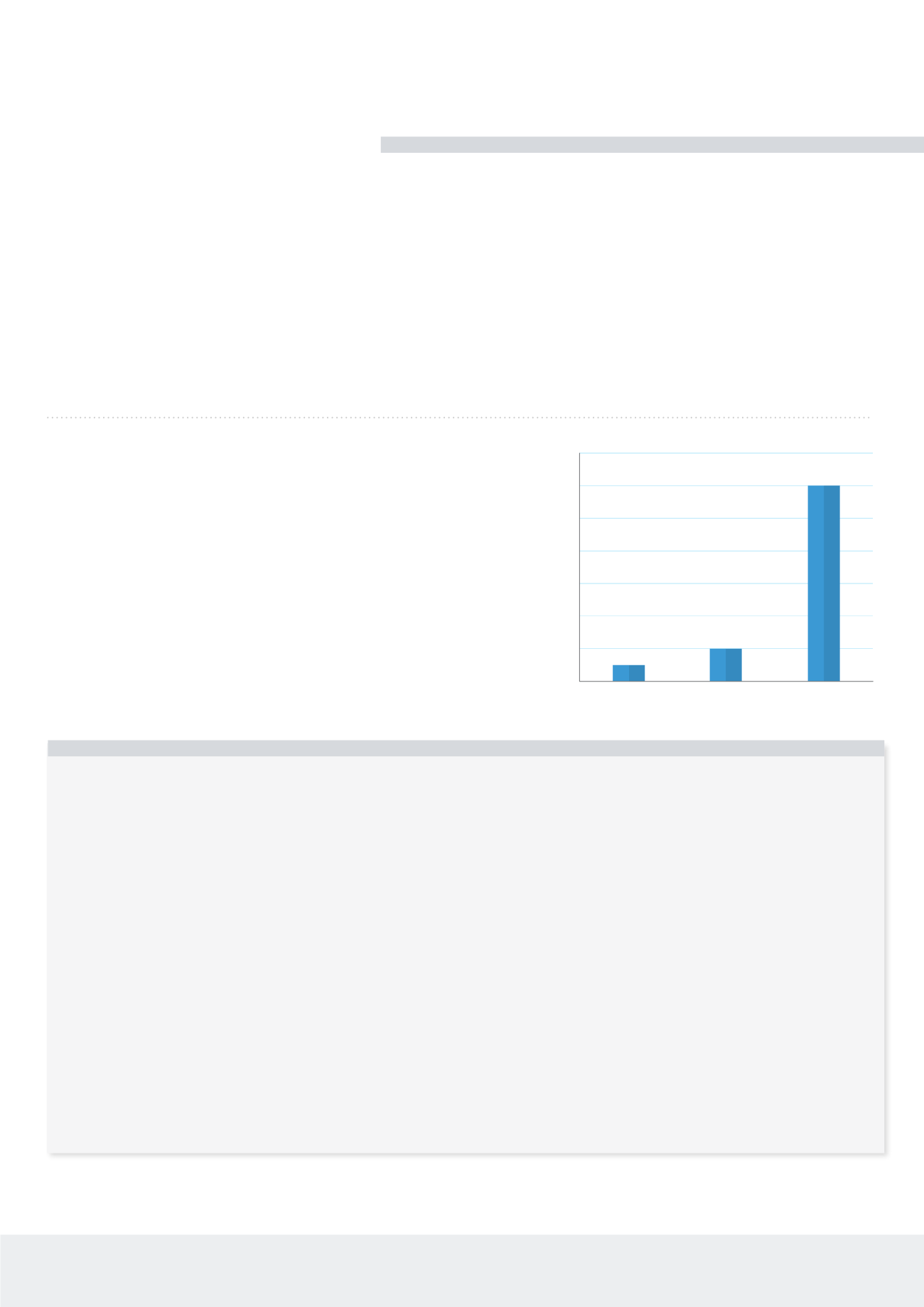

UK Government Lending via P2P (£M) (2012-2014)

The UK Government has been very supportive to P2P lending in an

initiative to boost investment into small UK companies and reduce

the reliance of large mainstream lenders.

12

Zopa received £10m of

government capital in 2012, alongside P2B lender Funding Circle which

initially received £20m. The money was to be lent through the platform

and to be matched by private lenders. Due to the success of the initial

round of lending, Funding Circle have since received more government

capital, although this only accounts for a relatively small value compared

to the level of private investment raised.

SOURCE:

Zopa, Funding Circle, Liberum

70

00

MARKET INVOICE

ZOPA

FUNDING CIRCLE

10

20

30

40

50

60

PEER-TO-BUSINESS (P2B)

P2B lending involves lending to small or medium sized enterprises (SMEs). It works in exactly the same way as P2P and is

based on the same principles, but in some cases, depending upon how the loan is structured, it can be

LESS

risky.

Loans can be asset backed (secured against property, personal guarantees from a Director or a debenture over the assets

of the business) and are generally only made to profitable companies which can evidence their operational history. The

returns on offer vary, depending on the perceived risk of the borrower. The level of risk is established using a credit model

designed individually by each platform.

By bypassing banks both lenders and borrowers can receive a better deal.

Mainstream lenders have cut back on lending to small companies, and when businesses can borrow from the bank it is

often expensive. P2B allows borrowers to secure loans that they cannot get from a bank. (This could be for many reasons:

maybe due to having a short loan requirement time frame, a poor credit rating, not having a long enough operational

history or having a complex business).

In P2B, the decision lies with the lender who is given the information that they need to make a decision – the process is

much more straightforward and quicker than the lengthy internal processes implemented by many banks.