Peer to Business Lending

Alternative Finance Sector Report - October 2014 13

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

EMOTIONAL BENEFITS

Emotional benefits can often be unique

to different businesses or projects.

It can often be hard to put a price on

these benefits – they could involve a

feel good factor such as helping the

local community or charities, or have an

environmental impact such as reducing

carbon emissions.

P2B lending allows investors to vet

investment opportunities and gives

them insight into the business, the

people behind it and just what they

plan to do with the money. This can

create a personal attachment to the

investment and mean that it is much

more interesting to the investor than

putting the money in mainstream

opportunities. Investors can choose to

lend to a company based on more than

just financial returns or stability. They

may want to aid the local community,

help individual companies they have a

prior connection with or fund activities

they have a personal interest in. P2B

can make lending far more exciting

and investors can see first-hand the

difference their money has made.

Another benefit here is that investors can

screen investment opportunities based

upon their personal preferences, morals

or beliefs. They may choose to lend only

to carbon neutral companies, companies

that don’t test on animals or companies

in a specific geographic location. The list

could be endless.

P2B lending is a far more diverse and

exciting investment sector than the

initial headline returns and opportunities

suggest.

RISK RATING AND RETURNS

P2B lending offers a wide range of

risks and returns for investors, which

should be clear and easy to understand.

However different platforms use

different assessment criteria when

approving loans, which can make it

hard to assess risks across a number

of platforms and investment offerings

unless the platform offers long-term data

on defaults, losses after any recoveries

and the effect of any platform fees.

Lending platforms will assess

opportunities based on a number

of different criteria and then apply a

risk rating based upon the perceived

level of risk that the borrower will

default and not pay back the loan.

Risk ratings commonly range from A+

to C-, or very low-risk to high or very

high-risk – this aims to provide some

continuity with mainstream investment

products, but the risk ratings applied

do not necessarily match-up between

platforms or indeed to the actual default

rates experienced on a platform. It

is important to note also that some

platforms price lender rates of return to

lender demand. Funding Circle does this

through a mechanism called a ‘reverse

auction’ where strong demand for a

loan drives down the return for lenders.

There is the risk with reverse auctions

that interest rates payable to lenders fall

below an appropriate level for the risk

attached to the loan. Some platforms

use fixed rate auctions which aim to

price the loan to the risk involved, so

that lenders without as much experience

of business lending can lend within the

parameters set within the P2B platform’s

credit policy. This is the mechanism used

by Assetz Capital for example. Other

platforms price returns to lenders at a

much reduced rate compared to the

borrower rate, but use some of the profit

margin to fund a provision fund that is

anticipated to cover the risk of defaults

and missed payments. These returns

could potentially be below the rate of

return appropriate for the level of risk

involved, although the provision fund

aims to provide security for this risk.

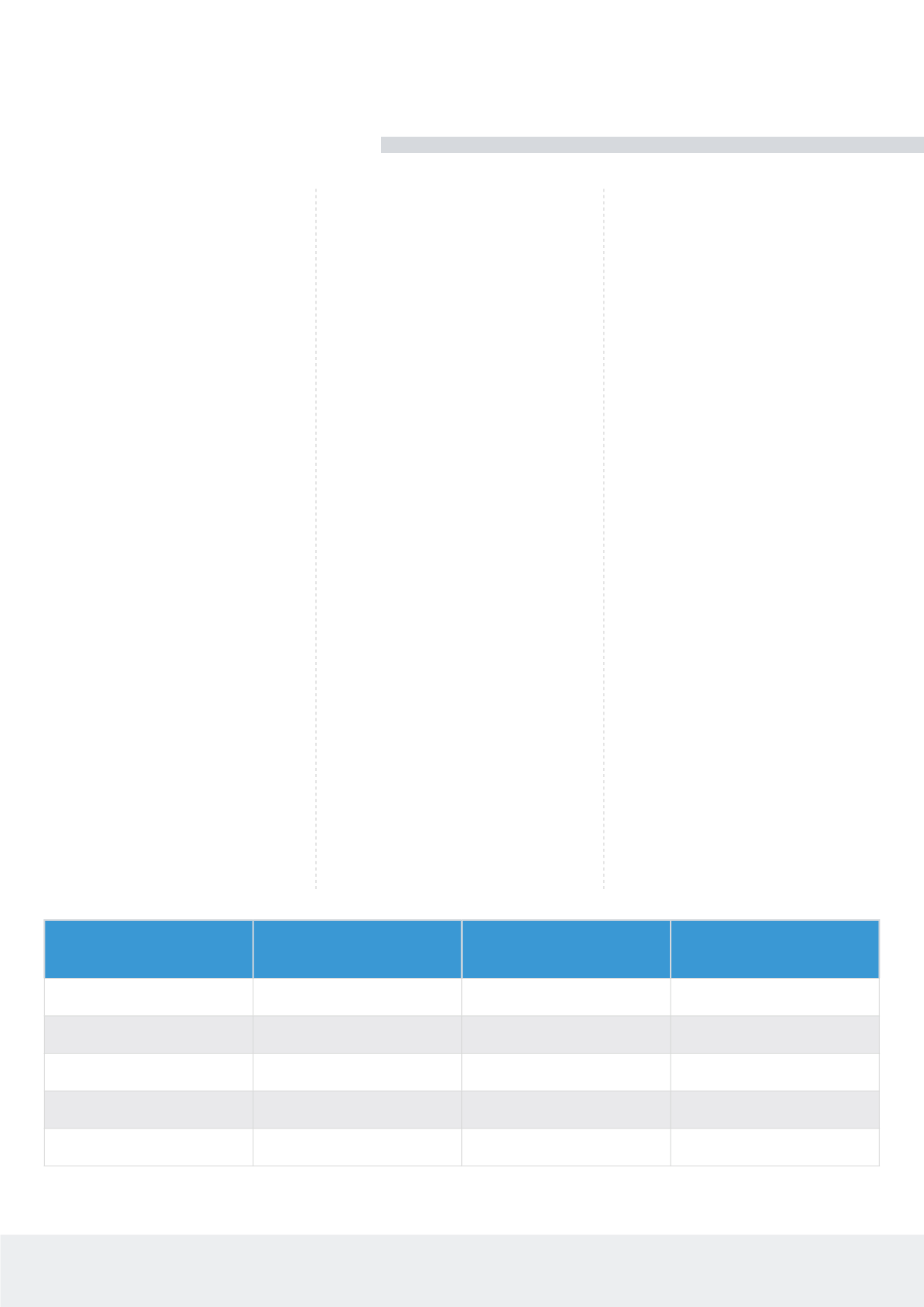

The following table is based on a cross

section of the different risk ratings and

returns available in the P2B lending

market. This includes the different risk

ratings used, risk levels available, returns

on offer and predicted bad debts.

RISK RATING

RISK LEVEL

GROSS RETURNS

(PER YEAR)

BAD DEBTS

A+

Very Low

5-7%

1.2%

A

Low

7-9%

2.5%

B

Medium

9-11%

4%

C

Medium/High

11-13%

5.5%

C-

High

13-15%

8%

SOURCE:

Assetz Capital, Funding Circle, Lend Invest, Wellesley And Co., ThinCats, Funding Empire, and Relendex