Peer to Business Lending

Alternative Finance Sector Report - October 2014 9

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

24 -

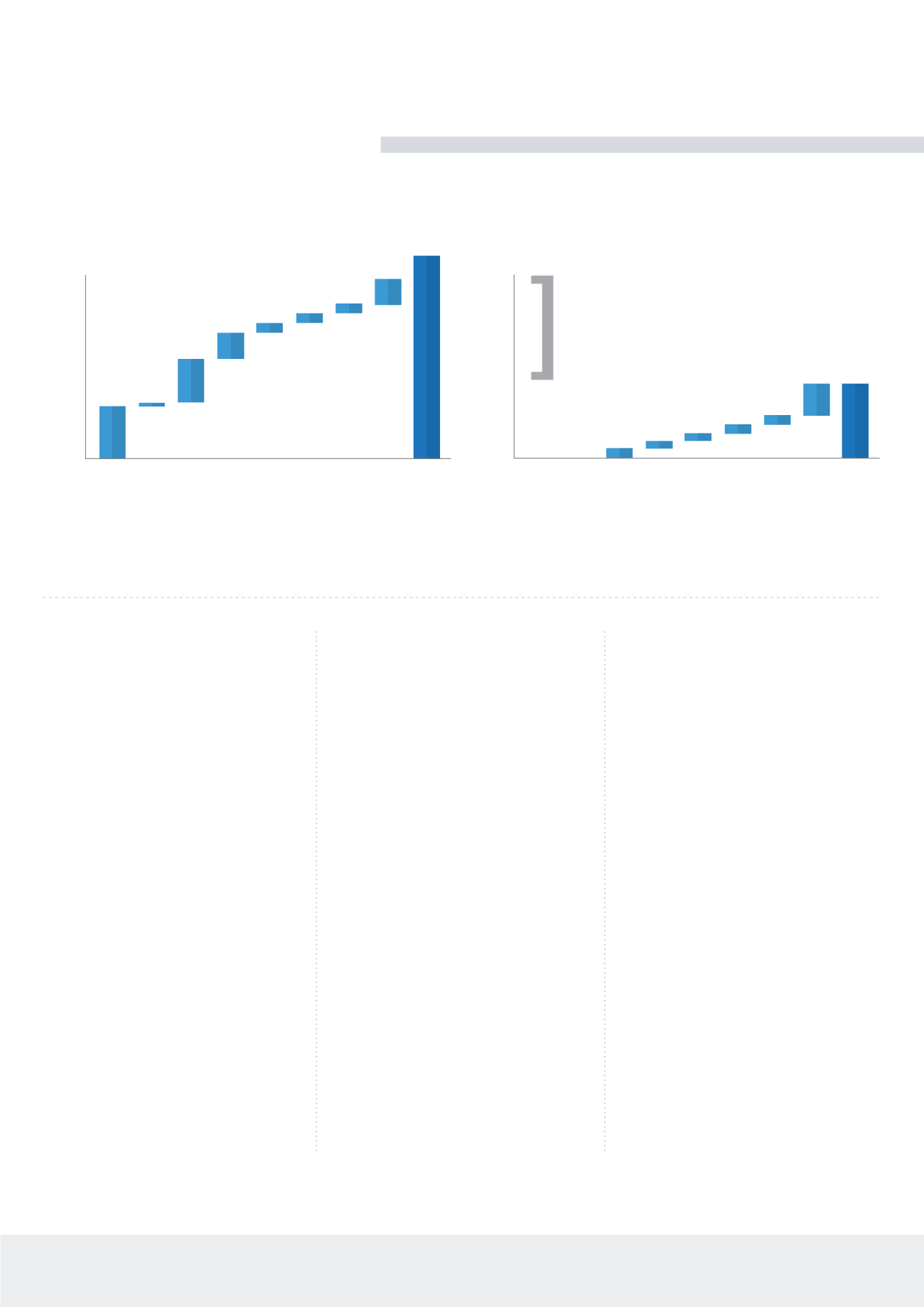

Based on a comparison between the

average US bank and US based lender

Lending Club, directly comparing

the costs of P2P loans to bank loans,

there is a huge difference in overheads

and costs. The cost per loan for the

average outstanding bank loan is 6.95%,

compared to only 2.7% for outstanding

P2P loans. P2P lending platforms do not

have expensive branches, huge numbers

of staff and expensive regulatory

conditions to service. It is this cost base

advantage that should ensure that even

when interest rates rise again, P2P and

P2B should continue to offer competitive

rates to both lenders and borrowers

versus traditional banks.

WHY YOU SHOULD READ THIS REPORT

P2B lending is a rapidly growing sector,

offering investors a wide range of

options to achieve higher returns than

are available elsewhere, without taking

on unsuitable levels of risk. The sector

is easily accessible 24hours a day, and

all it takes is a click of a button to invest.

Investors, advisers and intermediaries

operating in this market need to

understand the range of opportunities

available, the different ways to access the

sector and the risks and returns on offer.

Readers of this report will gain at least a

basic knowledge of the sector which will

help them to make educated decisions

regarding their involvement in the sector.

Despite the sector currently accounting

for less than 1% of business lending,

Nesta predicts that P2B has the potential

to supply up to £12.3bn in lending to

businesses annually.

24

This is significant

on a number of fronts. Firstly it increases

the options for borrowers and means

that they could potentially raise finance

faster and cheaper than previously.

This also challenges the dominance of

traditional lenders, the banks, which

will have to improve their services in

order to compete in this new world.

This will also vastly benefit lenders, as it

will give them the opportunity to earn

higher returns than are available through

traditional savings products. And finally,

these benefits should combine to aid the

growth of small UK based companies,

which supply vital jobs, products and

infrastructure which benefit the UK as

a whole.

For financial intermediaries and advisers

it is becoming increasingly important to

understand new areas of finance such

as this, which investors can easily access

and manage themselves. As the reach

of the sector increases, investors will

be able to access the opportunities on

offer independently - there are no real

restrictions on them. It makes sense for

advisers to understand the sector and

be aware of what their clients are doing,

so that P2B can form part of their overall

investment portfolio and strategy. If

their clients do have exposure to P2P or

P2B investments, it could add further

risk and return to their portfolio without

the adviser being aware of or fully

understanding the sector.

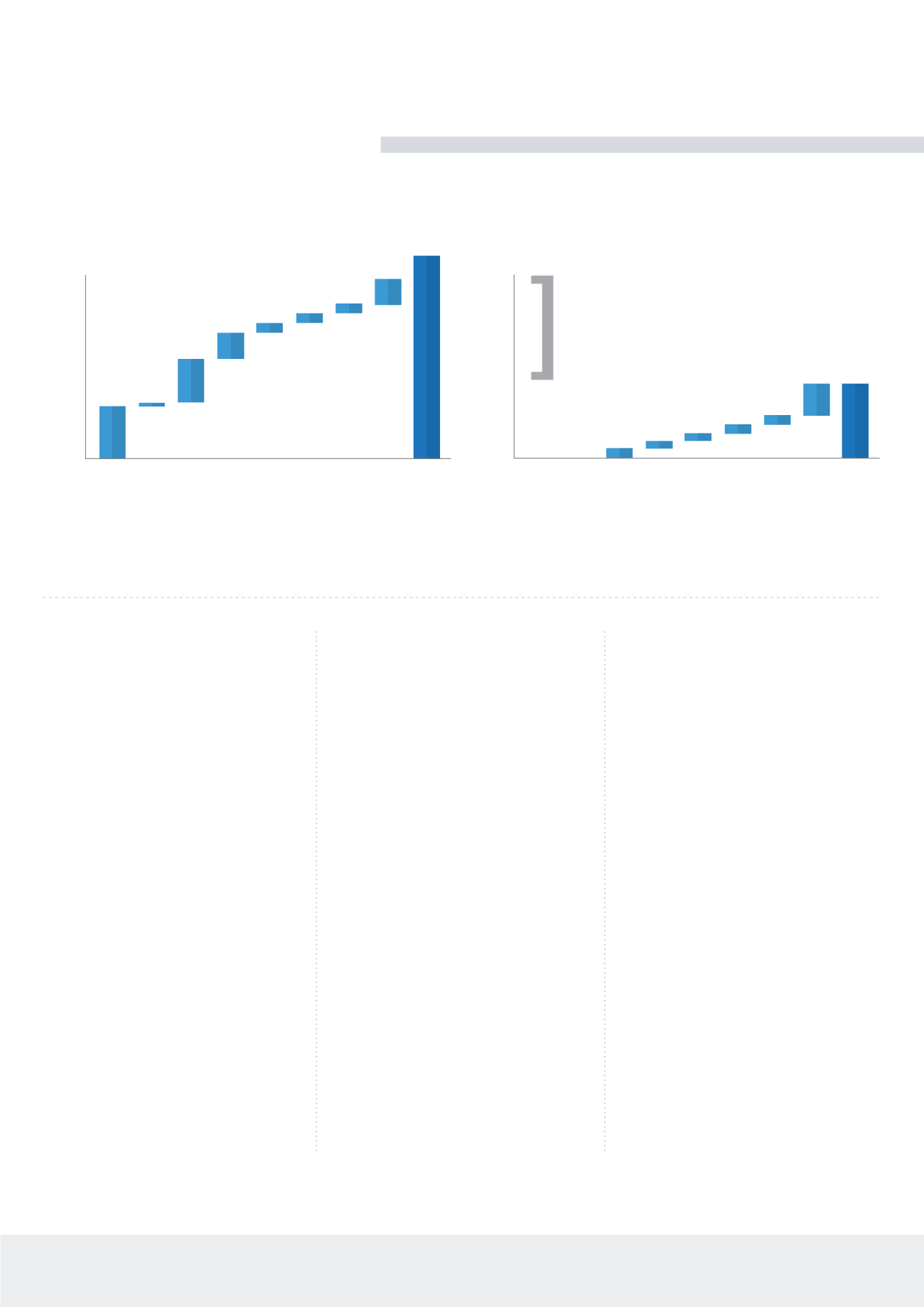

Cost base of Banks vs. Lending Club (costs as % of loans outstanding) (2015e)

SOURCE:

McKinsey, Lending Club

FDIC

BRANCH

CS/COLLECTION

OPEX TOTAL BALANCE OUTSTANDING (BPS)

BANKS

COST INEFFICIENTCIES

HIGH MARGINS

RESTRICTIVE LENDING

ORIGINATION

G&A

OTHER

MARKETING

TOTAL OPEX

IT

700

600

500

400

300

200

100

0

200

695

170

100

100

10

30

30

35

FDIC

BRANCH

CS/COLLECTION

BILLING FRAUD

PEER 2 PEER

GOVERNMENT ENDORSED

ATTRACTIVE RATES

CONVENIENT & FLEXIBLE

425bps LOWER

OPERATING EXPENSES

ORIGINATION

G&A

OTHER

MARKETING

TOTAL OPEX

IT

700

600

500

400

300

200

100

0

270

135

39

19

20

28

29

OPEX TOTAL BALANCE OUTSTANDING (BPS)