Peer to Business Lending

Alternative Finance Sector Report - October 2014 5

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

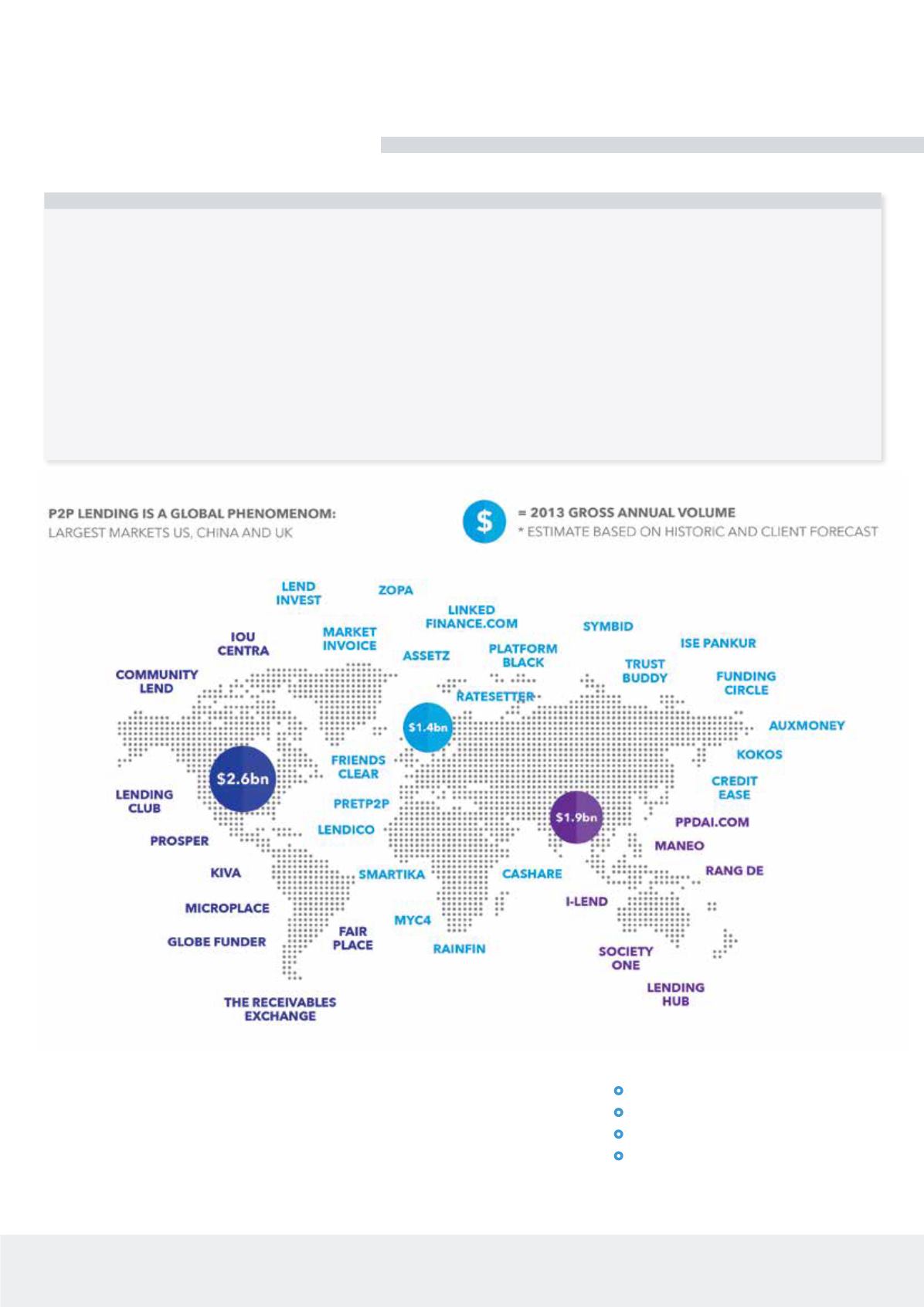

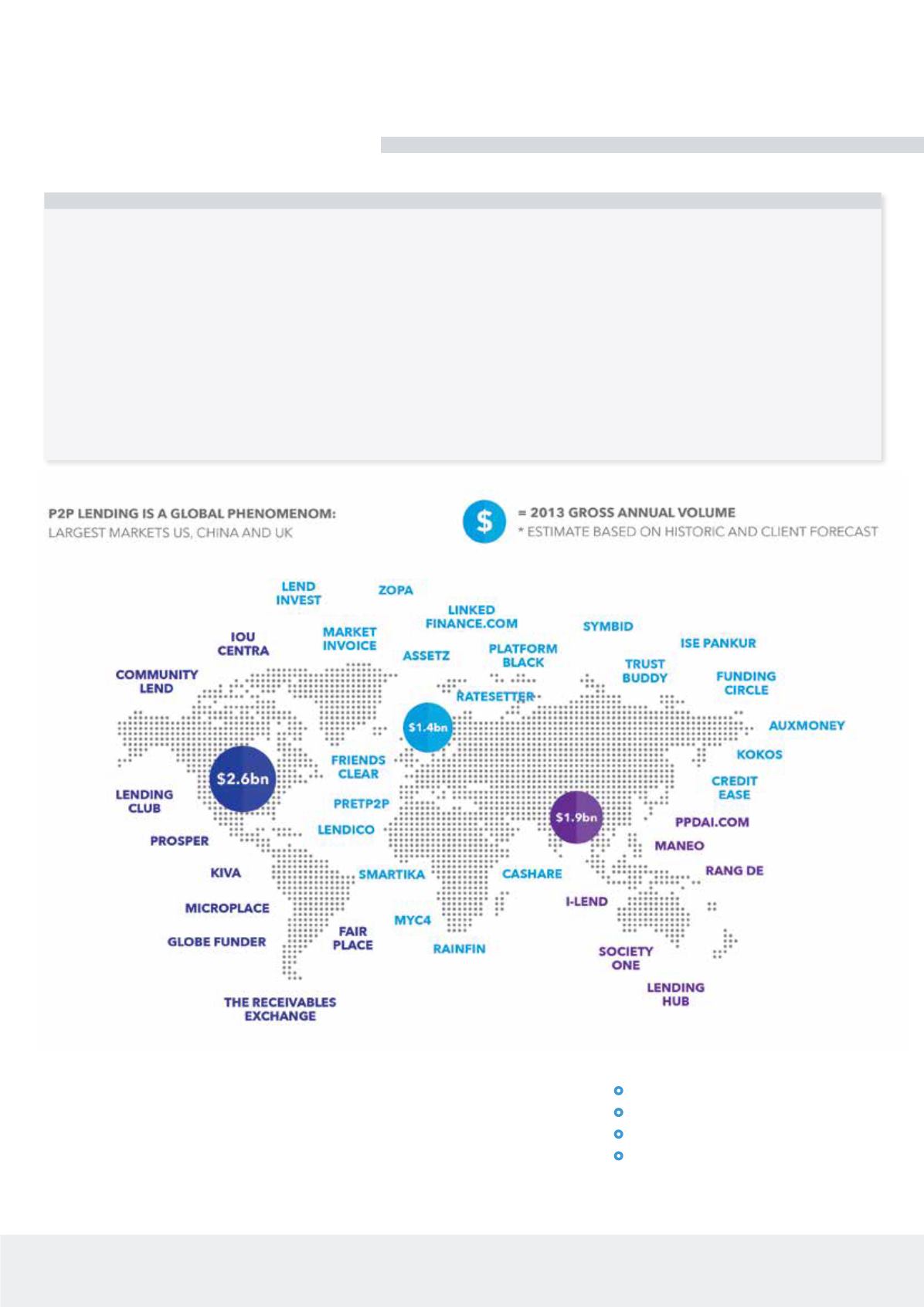

The first company in the world to

offer P2P loans was Zopa which was

founded in the UK in February 2005.

This was followed by a number of US

based platforms including Prosper and

Lending Club which launched from 2006

onwards. P2P has already become a

global market, with platforms available

on every continent.

10 - Nesta: The Rise of Future Finance

Size and Growth of the UK P2P Market

10

2011 - £68m

2012 - £127m

2013 - £287m

Average Annual Growth Rate – 107%

PEER-TO-PEER (P2P)

Peer-to-peer lending is simply the lending of money from one or many unconnected party/ies (lender) to another (borrower).

This market is now starting to become a viable alternative funding source to the traditional banking sector. It enables

monetary transactions without the use of a financial intermediary like a bank, with transactions happening through a

regulated online platform. Often this means a higher rate of return than offered by traditional savings accounts due to the

substantially lower cost base of a P2P lending platform vs. a bank.

Most P2P loans by volume in the market are unsecured personal loans (compared to secured property and business

lending). They are made to an individual rather than a company, and borrowers do not generally provide collateral as

protection to the lender against default.