Peer to Business Lending

Alternative Finance Sector Report - November 2014

4

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

7 -

8 -

9 - Nesta: The Rise of Future Finance

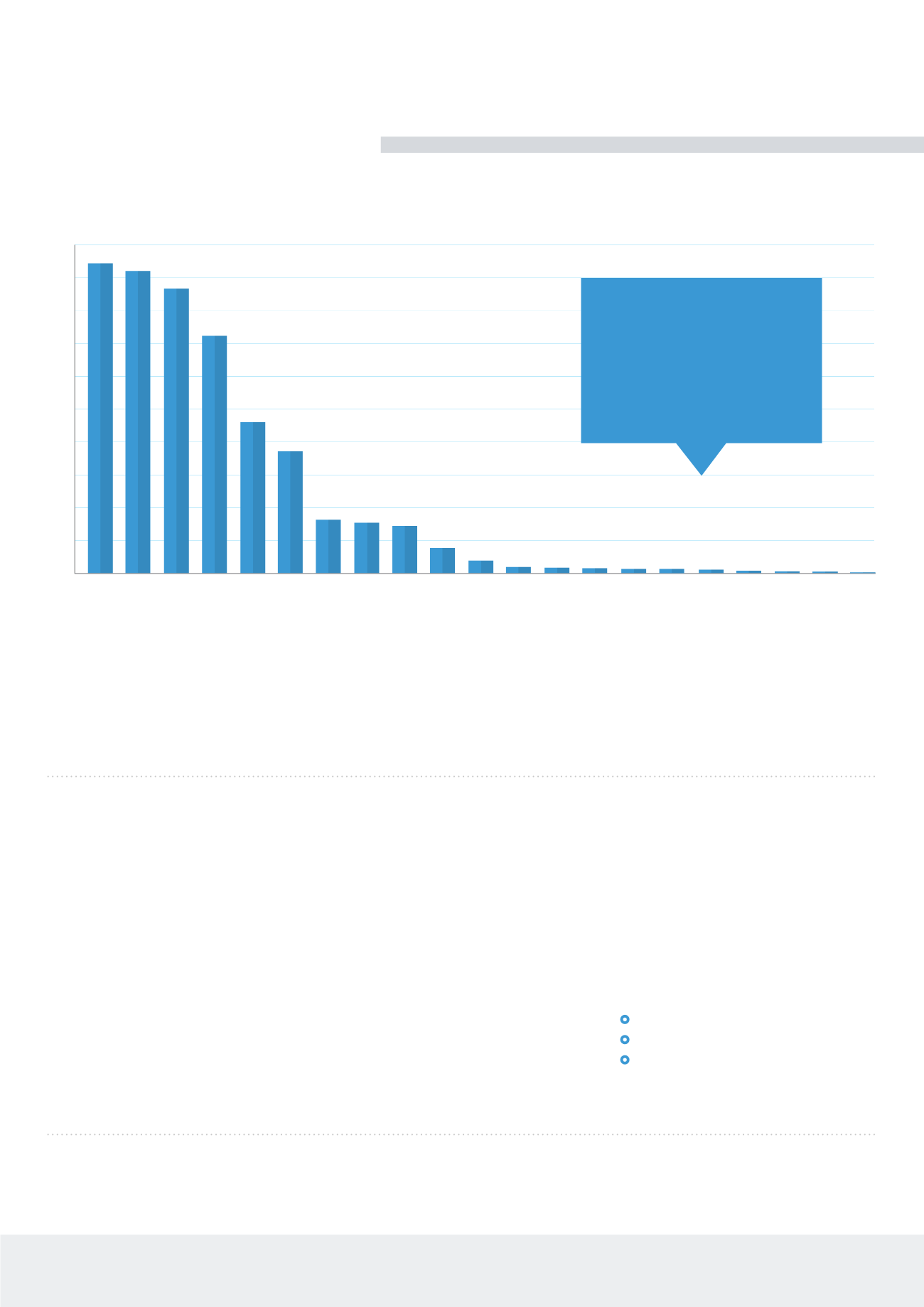

The Liberum AltFi Volume index

tracks the amount raised on a monthly

basis by P2P, P2B and invoice lending

platforms in the UK. The market is

dominated by the top four platforms

(RateSetter, LendInvest, Zopa and

Funding Circle) which account for over

60% of funds raised over the last three

months. Platforms operating the more

established P2P lending model have

historically dominated the market,

with over 40% of funds raised to date

– although over the last 3 months P2P

has accounted for only 34% and been

overtaken by P2B lending which has

accounted for nearly 50% of funds raised.

What is interesting is the rate of growth

of those lending platforms that have a

focus on property backed lending as

their growth rate has been identified

by AltFi to be much higher in the last 12

months than traditional business and

consumer platforms.

8

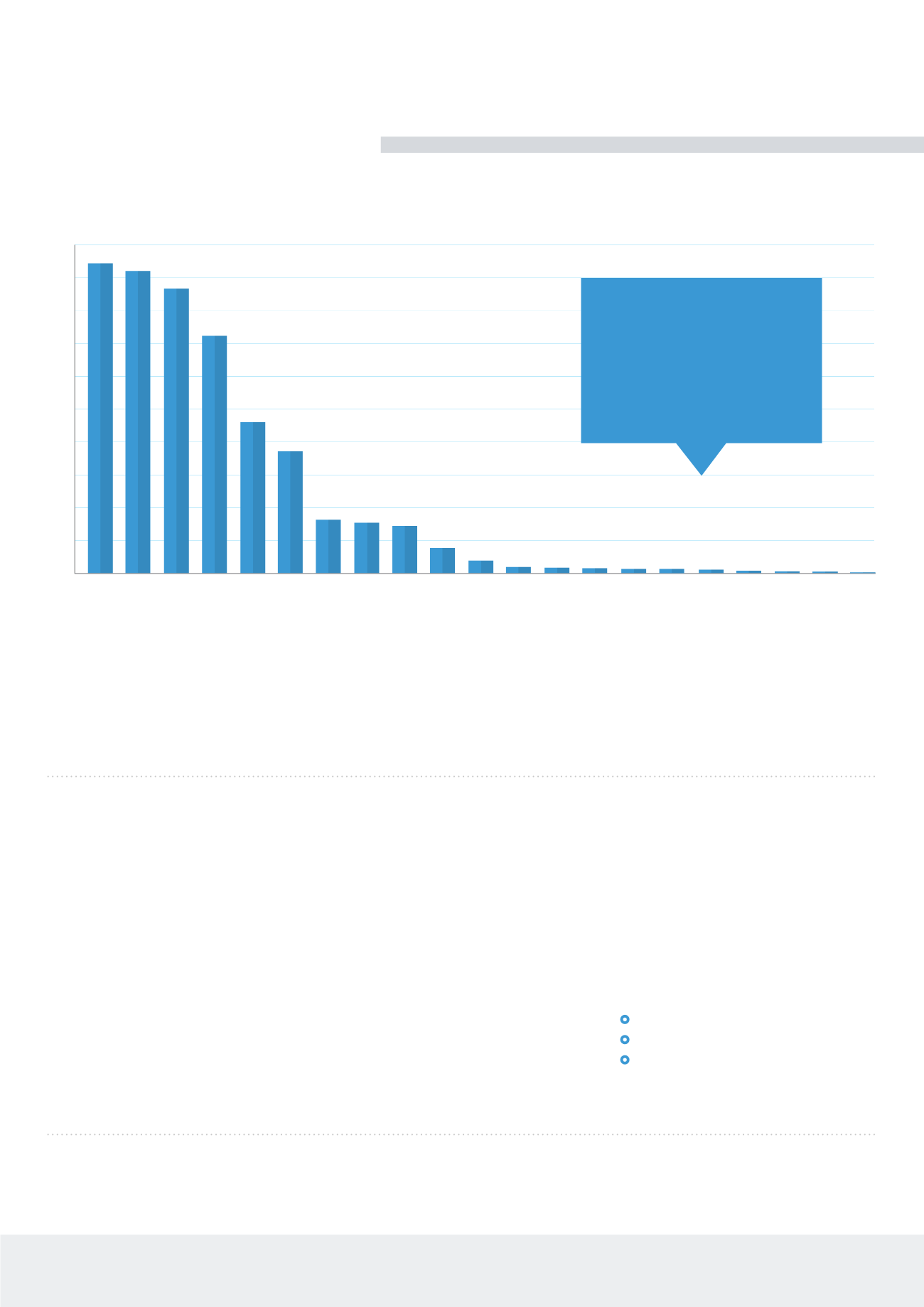

It is interesting to see the growth in the

number of consumers (lenders/investors)

participating in the UK alternative

finance market in recent years. By the

end of 2013 over 9.4m people in the

UK had participated in the market. This

represents an average annual growth

rate of 22% since 2011, which saw only

6.35m people involved in the market. If

the growth carries on at the same pace

there will be nearly 11.5m people actively

investing in the sector by the end of 2014.

Number of People Participating in UK

Alternative Finance

9

2011 – 6.35m*

2012 – 7.69m*

2013 – 9.4m*

*Number of Active Investors/Donors

Liberum AltFi Volume Index (October 2014)

SOURCE:

AltFi Data

7

20%

16%

12%

08%

04%

00%

RATESETTER

ZOPA

FUNDING CIRCLE

MARKET INVOICE

LEND INVEST

WELLESLY & CO

PLATFORM BLACK

ASSETZ CAPITAL

THIN CATS

CROWDCUBE MINIBONDS

FOLK 2 FOLK

LENDING WORKS

SAVING STREAM

FUNDINGKNIGHT

MONEY&CO

SYNDICATE ROOM

CROWD ROOM

REBUILDINGSOCIETY

CROWDCUBE

ABUNDANCE GENERATION

UK BOND NETWORK

2014

MARKET SHARE

P2P CONSUMER LENDING - 37.45%

P2P BUSINESS LENDING - 44.03%

INVOICE FINANCING - 18.16%

EQUITY CROWDFUNDING - 0.36%