Peer to Business Lending

Alternative Finance Sector Report - October 2014 15

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

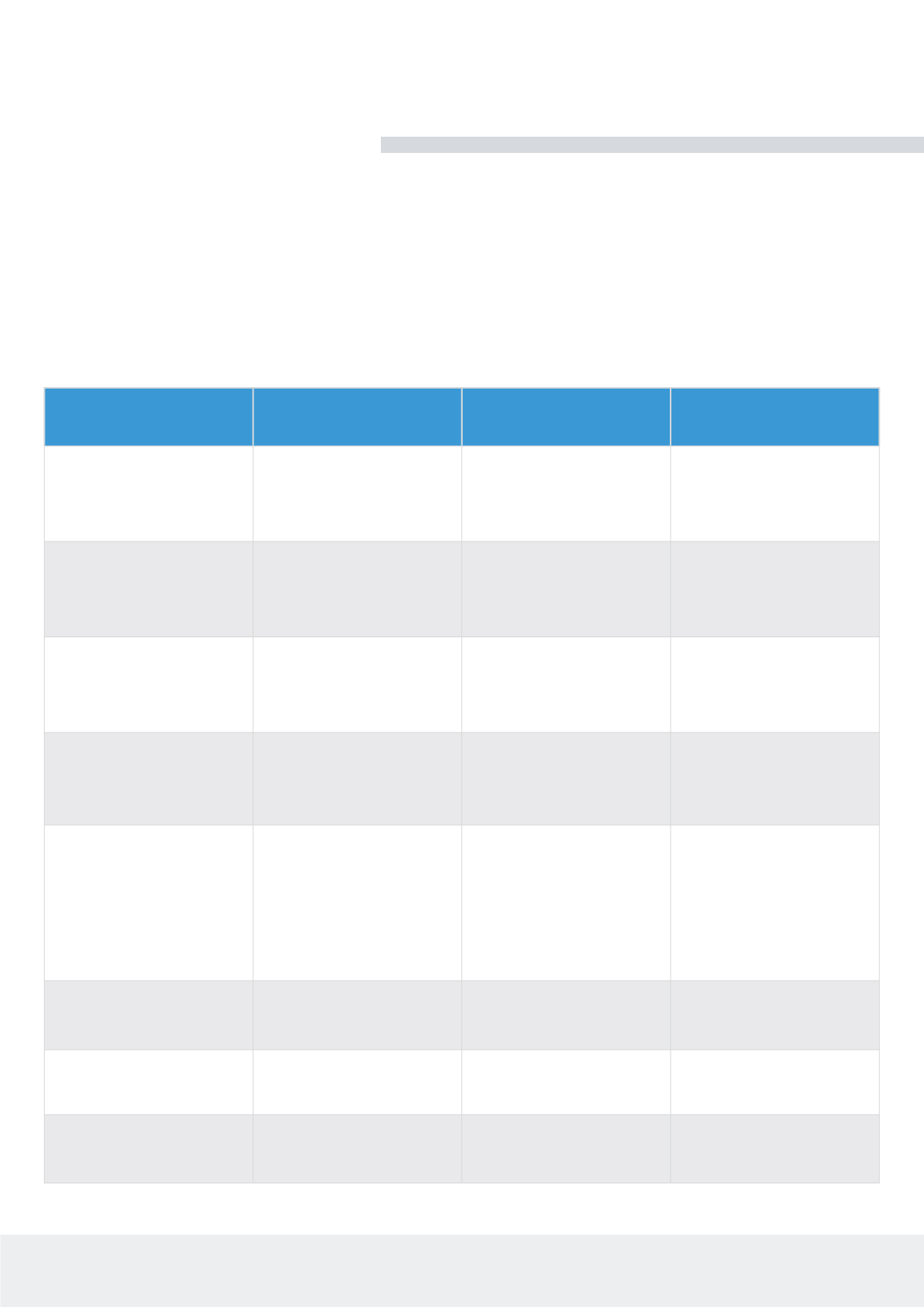

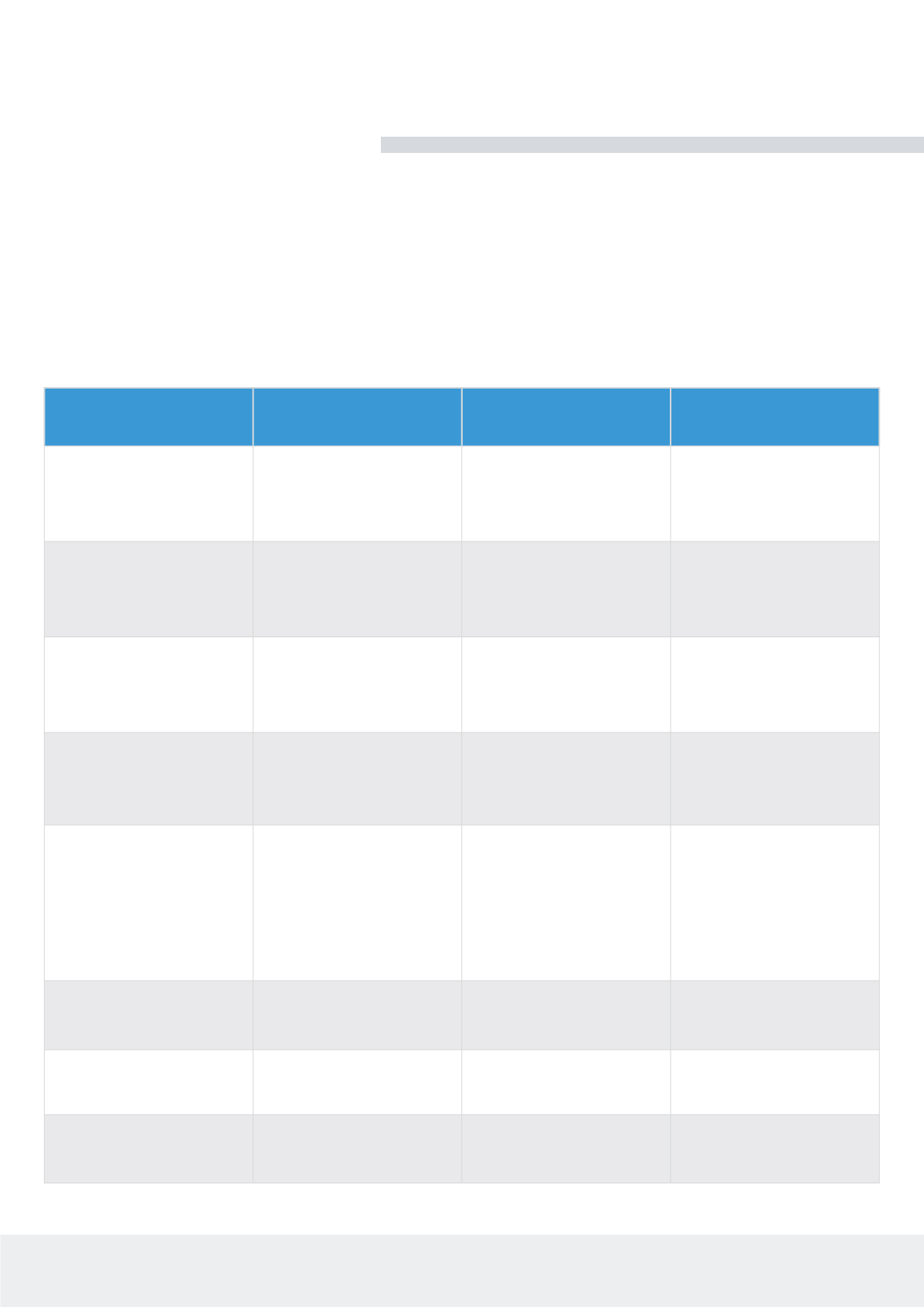

RISKS AND MITIGANTS

It is important to assess the different risks seen in the market and what processes each platform has in place to mitigate these risks to

investors. It is challenging to produce an overarching set of criteria for the whole market, but there are a number of risks that should

be universal across all platforms which can be assessed comparatively.

Viewing the risks in this manner can allow investors to screen different platforms in a completely neutral way and avoid being

influenced by headline returns, glossy marketing or the dominance of any one platform.

CRITERIA (RISKS)

LOW RISK (0-3)

MEDIUM RISK (4-6)

HIGH RISK (7-10)

Borrower Default on Loan

Full security held or

debenture over borrower

assets valued above loan

amount

Protection fund in place to

cover defaults provided the

fund does not run out of

capital.

No security held or

protection fund

Late Payment

Full security held or

debenture over borrower

assets valued above loan

amount

Protection fund and debt

recovery process in place

No security held or

protection fund. No debt

recovery process in place

Platform Failure

Loans and any loan security

held by independent trustee.

All monies held on client

account

Loans held by trustee/

company controlled by

platform provider

Trustee only appointed at

time of default

Rise in Interest Rates

Returns much higher than

available from cash deposits

or linked to base rate or Libor

Returns not high enough to

reward added risks

Very low returns being

received, similar to current

cash deposit returns

Early Exit Required

Platform has an established

secondary marketplace or

specialises in short-term

loans

Platform has recently

implemented a secondary

marketplace, or external

resale

Investors are locked-in and

cannot sell on their loan

on an aftermarket and the

marketplace is predominantly

medium-term to long-term

loans of 3 to 5 years or

greater

Credit Rating of Borrower

(Company)

AAA - A

A- - B-

CCC+ - D

Age of Borrower (Company)

5 years plus

2-5 years

New or not yet

established

Experience of Directors

Highly experienced

Relatively experienced in

chosen sector

New entrepreneur

or ideas

Example Risk Matrix