Peer to Business Lending

Alternative Finance Sector Report - November 2014

12

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

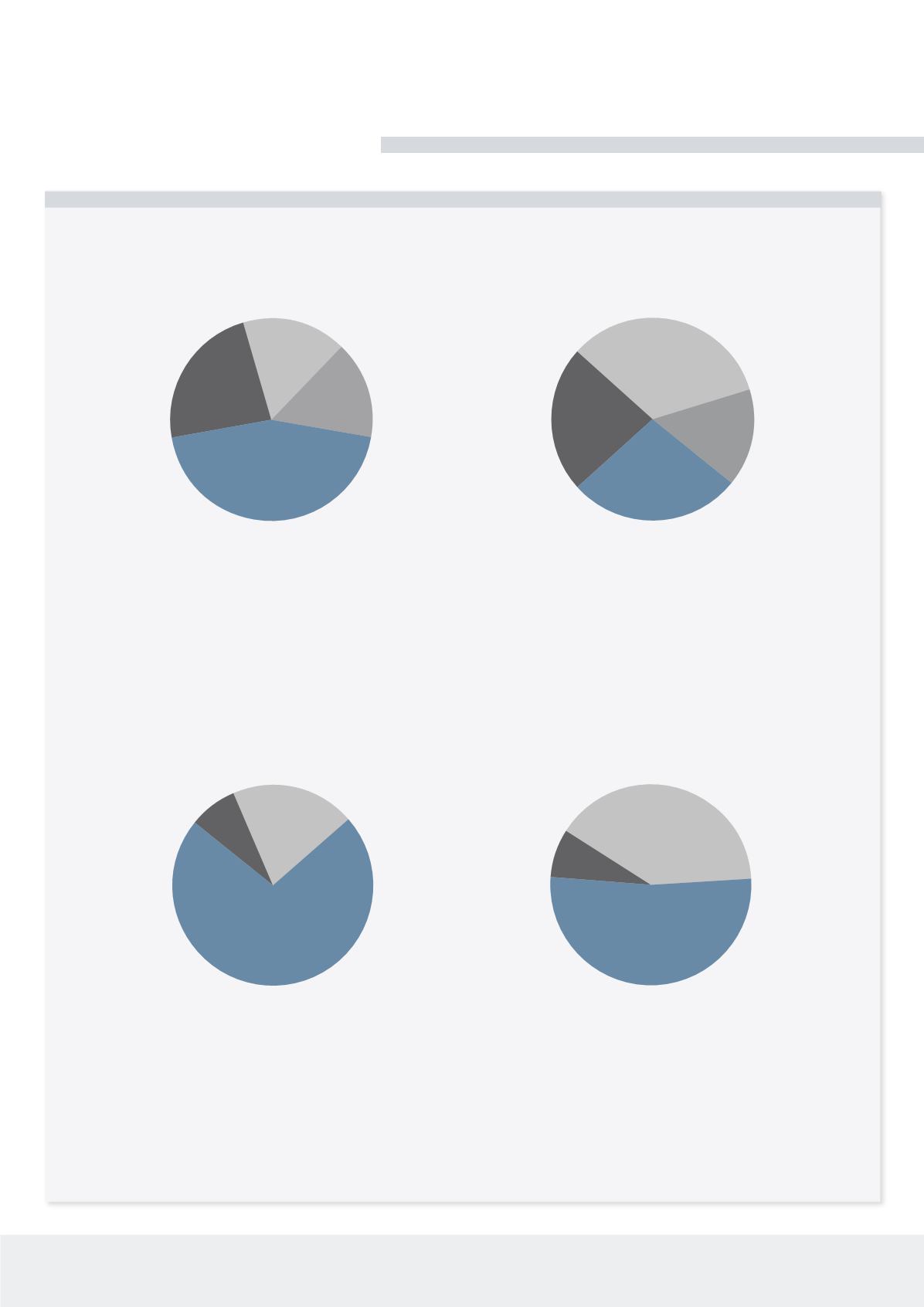

With a platform that deducts an annual fee from the gross income, typically 1%, the investor is left with 5.5% gross income. A

further minimum of 1.1% is deducted as tax (20% of 5.5%), leaving a 4.4% net annual return. As capital losses from defaulted

loans are deducted from post-tax income, with a typical bad debt rate of 1.5% across all P2P lenders, the 4.4% net return is

reduced to 2.9% - or just 1.8% net for a higher rate taxpayer.

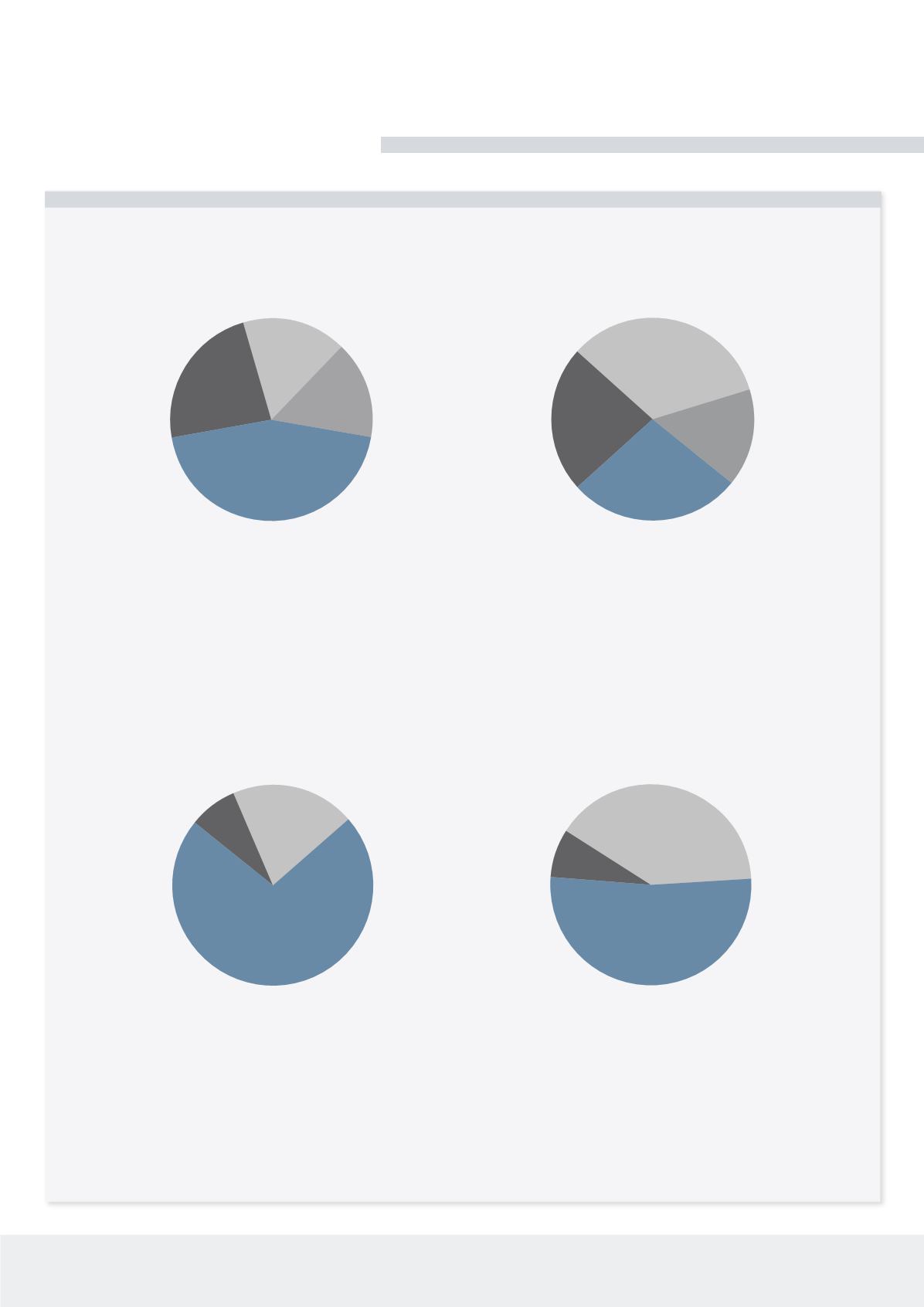

With a P2P lending platform that does not charge fees to lenders and uses tangible assets as security, then net returns may be

significantly higher. With no lenders fees only 1.3% would be deducted as tax for a 20% taxpayer, giving a net return of 5.2%

(3.9% for a 40% taxpayer). With tangible security against the loan, bad debts can be reduced to as low as 0.5% on average.

Therefore the net return for a 20% taxpayer is 4.7%, over 50% more than unsecured P2P lenders.

1.1

1

2.9

1.5

20%

TAX RATE

Tax

Tax

Fee

Fee

Net

Return

Net

Return

Bad

Debts

Bad

Debts

40%

TAX RATE

2.2

1

1.8

1.5

1.3

4.7

0.5

20%

TAX RATE

Tax

Tax

Net

Return

Net

Return

Bad

Debts

Bad

Debts

40%

TAX RATE

2.6

3.4

1.5

Returns From Asset Backed SME Lending Platform (6.5% Gross Return)

SOURCE:

Assetz Capital

Returns From Typical SME Lending Platform (6.5% Gross Return)