Peer to Business Lending

Alternative Finance Sector Report - October 2014 3

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

6 -

ALTERNATIVE FINANCE

MARKET

During 2013, £310m was raised through

donation-based crowdfunding, making

this the largest sector of the UK

alternative finance market (33%). £287m

was raised through peer-to-peer lending

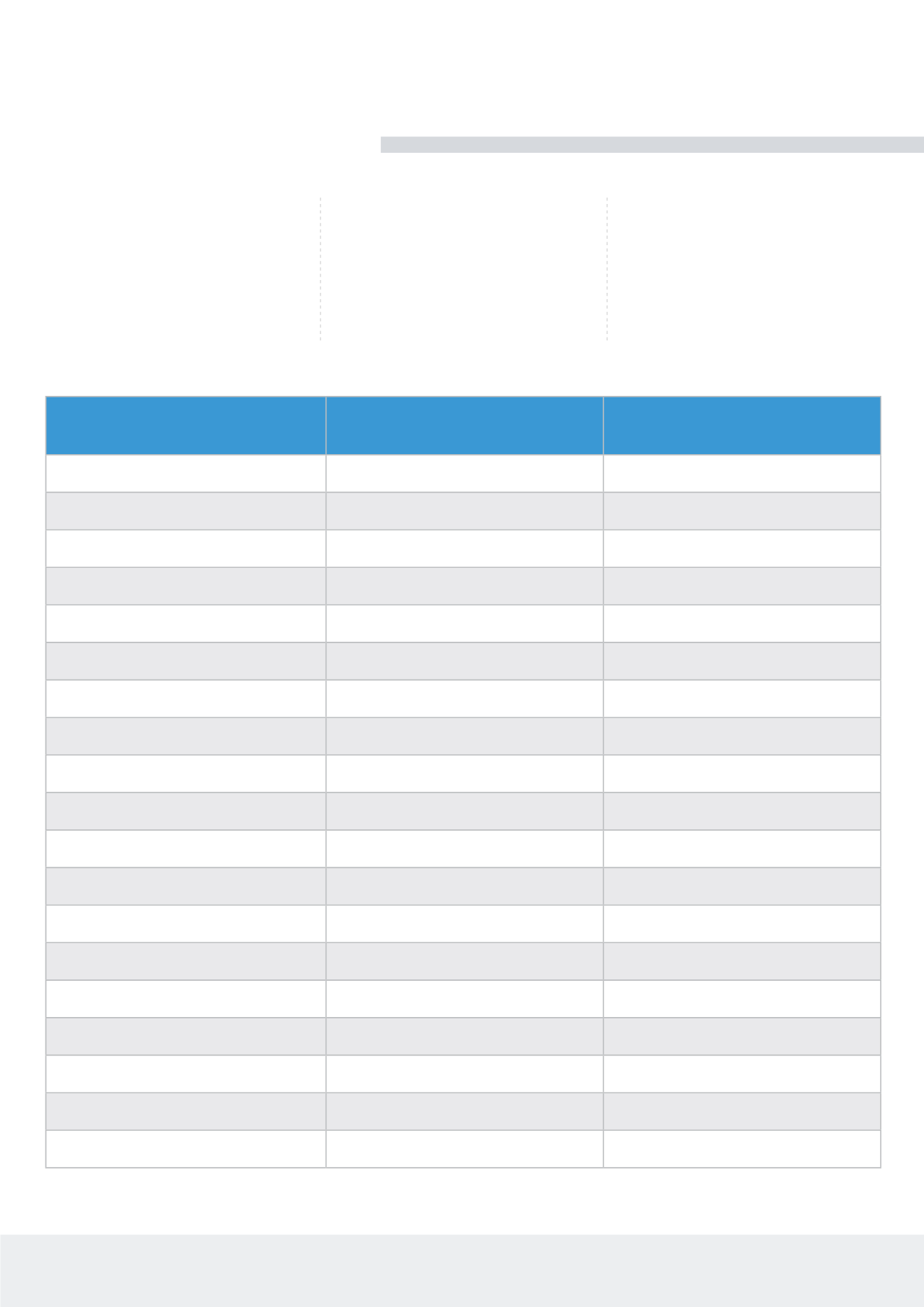

PLATFORM

SECTOR

MARKET SHARE

(PAST 3 MONTHS)

Ratesetter

P2P Consumer Lending

16.81%

LendInvest

P2P Property Lending

16.07%

Zopa

P2P Consumer Lending

14.22%

Funding Circle

P2P Business Lending

13.99%

Market Invoice

Invoice Financing

13.62%

Wellesley & Co.

P2P Property Lending

10.25%

Platform Black

Invoice Financing

2.96%

Assetz Capital

P2P Business / Property Lending

2.96%

ThinCats

P2P Business Lending

2.66%

Crowdcube

Equity Crowdfunding

2.01%

Folk 2 Folk

P2P Property Lending

1.15%

Syndicate Room

Equity Crowdfunding

0.70%

Saving Stream

P2P Property / Marine Lending

0.63%

FundingKnight

P2P Business Lending

0.49%

Money&Co

P2P Business Lending

0.48%

Crowdbank

Equity Crowdfunding

0.48%

Rebuildingsociety

P2P Business Lending

0.25%

Abundance Generation

P2P Business Lending

0.19%

UK Bond Network

P2P Business Lending

0.08%

Liberum AltFi Volume index (Includes pure P2P and partial P2P companies) (13/08/2014)

(30.5% of the market) and £193m raised

through peer-to-business lending (20.5%

of the market). Back in 2011, donation

based crowdfunding accounted for

nearly 70% of the market - it is clear

that other sectors within the alternative

finance market are growing in popularity

with investors. The charts on page 2 and

below, evidence how the market as a

whole has grown over the last three years

and how sectors such as

peer-to-business lending and invoice

trading have witnessed dramatic growth

and increased their market share.

SOURCE:

AltFi.com

6