Peer to Business Lending

Alternative Finance Sector Report - November 2014

8

Luke Jackson

Samantha Goins

PUBLISHED

October 14

AUTHOR

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

21 - uk.deposits.org • 22 -

/ • 23 -

P2B VS. BANKS AND TRADITIONAL STRATEGIES

The obvious headline difference between investing through P2B lending and bank deposits is returns. At the time of publication

(October 2014) the Bank of England base rate still sits at 0.5%, the best available rate on cash deposits is 0.75% and the best instant

access cash ISA rate is 1.5%. Compare this to the average rate of 6.1% (after fees and bad debts) from the UK’s largest P2B lender

Funding Circle and the 11.6% weighted average return from the last 12 months from Assetz Capital and it is very clear how attractive

P2B investing is.

P2B lending is debt based, paying fixed returns. The value of the investment will not fluctuate depending on the performance of

financial markets. Investors will not receive more back than the interest that has been agreed, and they should not receive any

less – unless of course the borrower defaults, then you could lose everything you have invested if the loan was unsecured. Secured

lending will see recovery rates of between 0% and 100% in cases varying from fraud through to a business loan backed by a low loan

to value property.

Investors must also take into account inflation to calculate whether they are seeing a real return on their investment. The returns on

current accounts, fixed term savings accounts and some government bonds are less than the current inflation rate (CPI) of 1.2%

21

meaning that many savers are losing purchasing power each year – the money they believe is safe sitting in a “risk free” savings

account is being eroded by inflation and losing value each year.

According to a recent AltFi article, the superior rate of return on offer from P2B lending is the key to attracting more savers to the sector.

23

P2B involves multiple investors providing a single loan to the borrower. This is similar to how banking institutions use short-term

savings from a number of customers to provide long-term business loans and mortgages. With P2B there is no banking institution

acting as the middle man, this is managed by the platform in return for a fee. The chain of intermediaries is much smaller than in

the banking sector, and platforms have much lower overheads (they don’t have branches, they don’t need as many staff, they don’t

undertake risky investment business) – platforms can solely focus on matching lenders and borrowers. The advantage is that loans are

only matched to the number of investors (lenders) available - there is no risk of being overcapitalised. This eliminates the risk of a run

on redemptions, as was seen with the run on bank deposits during the financial crisis (Northern Rock).

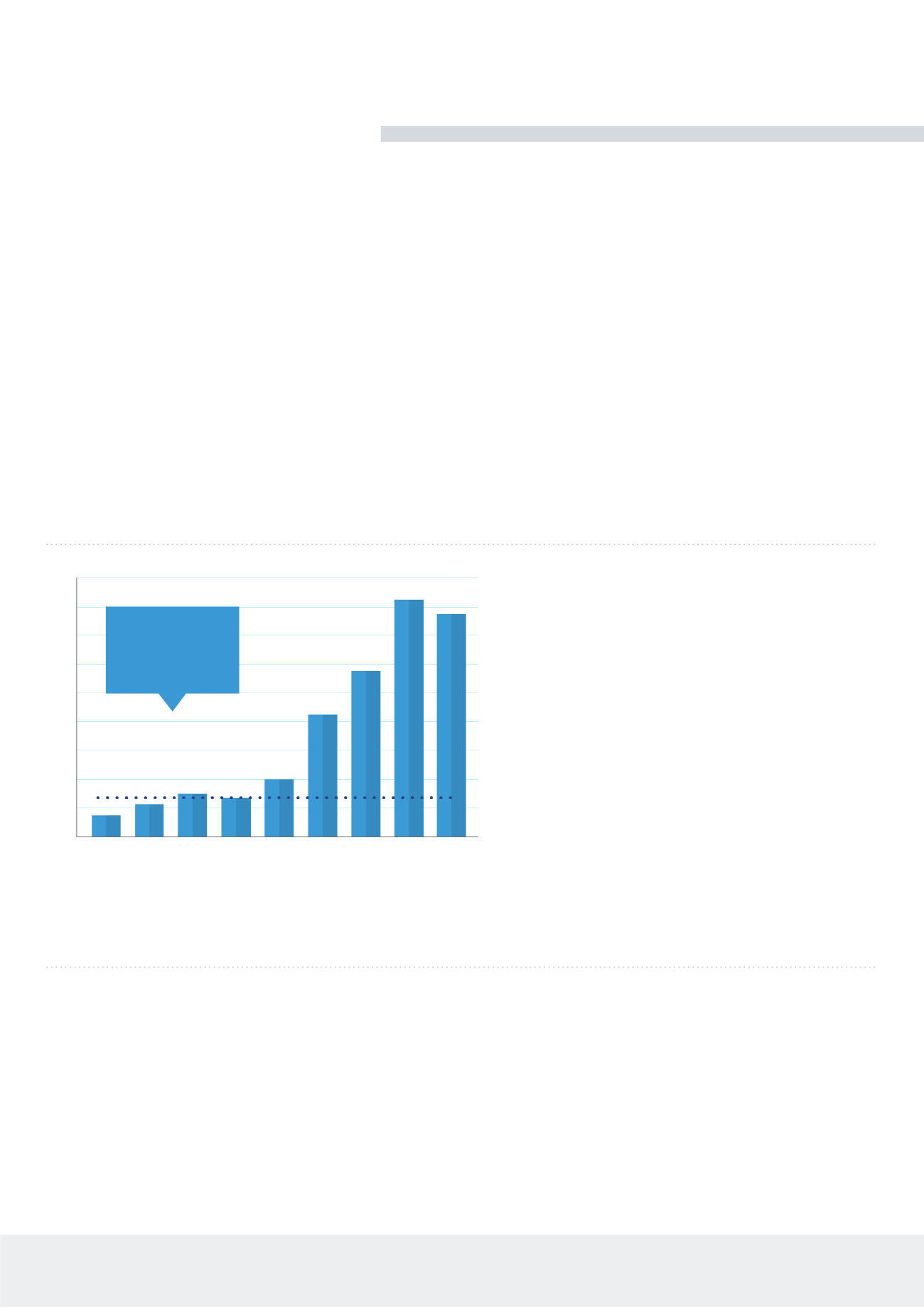

P2B Loans Vs. Banks And Other Investment

Strategies

The chart to the left compares returns from P2B and

P2P lending to a range of mainstream financial products

including equities, bonds and cash deposits. You can

clearly see where P2B fits across the scale of returns, with

typically lower average returns than equities but higher

returns than bonds or cash. Returns from P2B lending vary

depending on the risk rating of the loan, but on average

investors can expect net returns of 5-10% per year. P2B

generally competes on a risk basis with bonds and cash,

rather than equities. These investments do not fluctuate

in value (listed bonds do), but aim to protect the capital

invested and produce an income. Equities are generally

much riskier and will be far more volatile (on average) and

fluctuate in value on a daily basis – they are bought for

growth as well as income.

SOURCE:

Zopa, Funding Circle, Assetz Capital, Deposits.org

0%

INSTANT ACCESS

CASH ISA

CASH ISA 1YEAR FIXED

FIXED RATE BOND 1 YR

FIXED RATE BOND 2 YR

ZOPA - 3 YR (P2P)

UK EQUITIES

ASSETZ CAPITAL (P2B)

FUNDING CIRCLE (P2B)

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

NOTE:

Net returns based

on basic rate (20%)

taxpayers