19

“BPR qualifying investments provide advisers with a useful and complementary solution to

existing mainstream planning routes”

Nick Morgan, Partner, Foresight Group

ASSET REPLACEMENT

STRATEGIES

E

IS

The Enterprise Investment Scheme is

a long-standing government initiative

to encourage investment into small

and medium sized businesses. The

rules which govern whether a company

qualifies as EIS eligible are actually much

stricter than the rules for BPR, so EIS

qualification is de facto BPR qualification.

That means that after two years the

investment is fully exempt from IHT.

An investment into an EIS qualifying

company has additional tax reliefs:

investors will get up front income tax

relief, CGT relief and loss relief. However,

the stricter rules mean that EIS qualifying

companies are smaller, higher risk

companies, so these generous benefits

can only be accessed if investors are

prepared to take on more risk.

* For more information on EIS investments,

download a complimentary copy of our 2014

EIS Industry report.

EIS AND BPR

EIS and BPR are sometimes used in

combination - if clients have surplus

investable assets, an EIS investment is

used to maximise the income tax relief,

or defer tax on gains elsewhere, and the

remainder is placed into a BPR product

for the IHT mitigation.

Another possible combination is moving

a client into a BPR product after they

exit an EIS investment - retaining the

100% IHT exemption without having to

restart the two year qualifying period.

The three year BPR replacement assets

window gives ample time to implement

this solution. Limited life (“exit focused”)

EIS can be used in this scenario -

growing funds for a period of 4-5 years

at the same time as qualifying for IHT

relief, then moving them into a lower

risk BPR trade, retaining the relief.

Finally, this could be attractive for

EIS renewable energy investors.

Renewable incentives are no longer

allowable within an EIS, and there is

not a comparable asset backed, low

risk opportunity in the EIS universe.

However, the renewable incentives are

allowable when claiming BPR. The sorts

of clients who invested in renewables

via EIS, can do the same via BPR.

LIFE ASSURANCE

Life assurance falls into a slightly

different category - it doesn’t mitigate

the IHT bill at all, it simply sets aside

some money to pay for it so that

the estate can be passed on intact.

Generally the policy is written in trust

and the pay-out is made outside the

estate, so the death benefit is used to

meet the IHT liability. It can be paid

for with a single lump sum or monthly

premiums, but the cost of the policy and

access to this product will depend upon

the insurer’s assessment of age, lifestyle

and health status - in cases of poor

health it may not be available at all.

HOW DOES BPR COMPARE?

BPR is an asset replacement strategy.

The two biggest advantages BPR has

over the other solutions available are

that it doesn’t entail any loss of control

and it can be 100% effective within two

years.

Another big benefit is the simplicity

of the solution - no complex legal

structures or careful planning of the

amount and timing of gifts is required

and there is no need to grapple with

POAT (Pre-Owned Asset Tax) or GWR

(Gifts With Reservation) provisions.

However, the investment capital is still

at risk. This is a double edged sword of

course - the downside risk comes with the

potential upside of growth and income.

Investors with enough wealth and

sufficient income are likely to want to use

up their gifts-from-income allowances

first and foremost and more cautious

investors may still prefer to use trusts

to keep the assets in very low risk. But

planning for long lives is difficult and

the flexibility that BPR investments offer

cannot be ignored. At the other end

of the scale, clients who want swift IHT

mitigation should also be considering BPR.

SUMMARY

This is a statutory relief that is well

established, and over the years a set

of products has developed to help

investors utilise BPR. There are clear

advantages and disadvantages when

compared to other IHT mitigation

solutions, and whether to use BPR at

all and if so how much to allocate will

always vary depending upon the client

circumstances. In most cases, it would

seem to best to use BPR as part of an

overall estate planning strategy.

“We recommend that advisers

look for a fund manager

with deep sector expertise

and a track record of wealth

preservation, plus attractive

liquidity provisions”

Matthew Bugden, Ingenious

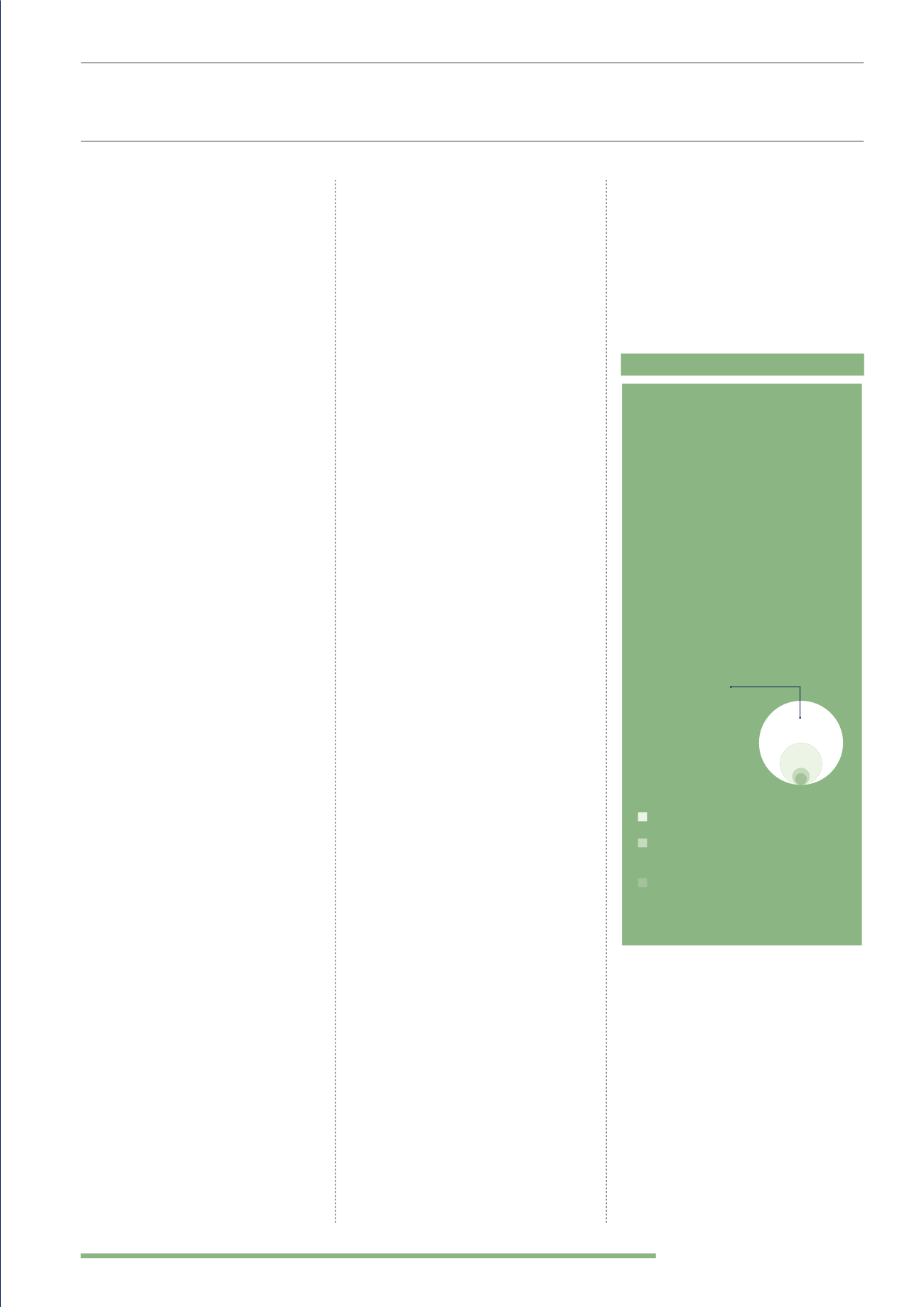

Source: National Audit Office

( 2010 - 2011 )

260,000 notified for probate

36,000 estates valued at above the

tax threshold

20,000 did not have to pay any

inheritance tax because of the value

of reliefs and exemptions they were

able to claim

560.000 deaths

Most estates were not

notified for probate

because there was a

surviving spouse or

because they were

relatively small

Inheritance tax is an example of a

tax which under HMRC’s definition,

provides progressivity in the tax

system by ensuring the burden falls

most on those who can most afford

to pay. It is unlike most other taxes in

that the amount of relief far exceeds

the amount of tax collected. Several

reliefs define the scope of the tax and

the value of these reliefs in 2012-13

was £22.4 billion, seven times the

value of tax collected. The biggest

relief is obviously the nil rate band,

which accounted for £18.4 billion of

relief in this period.

SCOPE OF IHT RELIEFS