22

WAYS TO ACCESS BPR

There are a number of ways to access

BPR - we’ll take a look at each of them in

this section.

DO-IT-YOURSELF

Although the qualification rules are

simple, it’s still worth looking at some of

the potential pitfalls that would exclude

an investment from qualifying for BPR.

This report is focused on investment

products that give access to BPR,

but before we analyse the different

investment structures and

opportunities in the marketplace,

it is worth examining some of the

DIY methods of accessing BPR.

#1 OWNING YOUR OWN BUSINESS

As noted earlier, the original intention

of BPR was to protect small businesses

from IHT and ensure that they could be

handed onto the next generation intact.

Of course this is still the case today

and any clients who have their own

businesses are hopefully well advised

to ensure that they stay within the rules

for BPR qualification. We examine how

BPR products can help small business

owners and corporate clients in a

separate section.

#2 SELF-INVEST / INVESTING IN

“FRIENDS AND FAMILY”

In theory, it is possible to self-select BPR

qualifying investment opportunities.

In practice this activity would require

a lot of time and effort on the part

of the investor or adviser and some

experience of investment analysis and

portfolio construction. As with any

DIY activity, if you know what you’re

doing, you can save a large amount of

costs: and if you don’t know what you’re

doing it can turn out to be vastly more

expensive in the long run.

In a similar vein, investors might provide

equity capital to small businesses that

happen to be within their inner circle

and as a bonus these investments

turn out to qualify for BPR. This isn’t a

strategy as such, but people who have

made these sorts of investments should

check in case they are eligible for reliefs

they weren’t aware of.

For most people, the quickest, simplest

and easiest way to access BPR will be

to invest in a product that has been

specifically designed to help mitigate IHT.

EIS & SEIS

Any EIS or SEIS qualifying investment

will also qualify for BPR - the criteria

to qualify for EIS/SEIS are stricter than

BPR and EIS/SEIS could be viewed as a

subset of BPR.

Of course, EIS and SEIS bring additional

tax benefits to BPR - however they are

usually riskier investments, with lower

levels of liquidity and higher levels of

fees and charges. So it is not the case

that investors should go for the scheme

with the most generous benefits - those

benefits are only conferred when

there is additional perceived risk. If the

objective is IHT relief while retaining

access to the funds and the risk appetite

is lower, then BPR should be preferred

over EIS or SEIS.

DISCRETIONARY

INVESTMENT

MANAGEMENT

The easiest way for non-business

owners to access BPR is through an

investment product. These are typically

run by investment managers who

specialise in small companies. The

manager will take responsibility for:

Stock selection

Ensuring sufficient diversification

across the portfolio (where they use a

portfolio approach)

Ongoing monitoring to ensure that

the investments retain BPR qualifying

status

Sourcing new investments as older

ones exit

This is a discretionary investment

management service. Typically the

process is:

The client makes an investment

with a discretionary investment

manager, who has full discretion

where to invest the money.

The money is looked after by a

custodian, until it can be placed

(usually within 30 days or less).

Once it is placed, depending upon

the structure the manager uses,

the investor will have beneficial

ownership of either: an SPV, a

holding company, shares in an

unquoted company or shares on

AIM.

The structure will give the investor

exposure to BPR qualifying assets

that are involved in activities

and sectors such as: renewable

energy, energy efficiency, property

development, lending, PFI, media

and infrastructure - there is no

restriction on what can be invested

in within the qualification criteria,

but the managers are generally

looking for low risk opportunities

that meet their capital preservation

objectives.

*

depending on skill & strategy

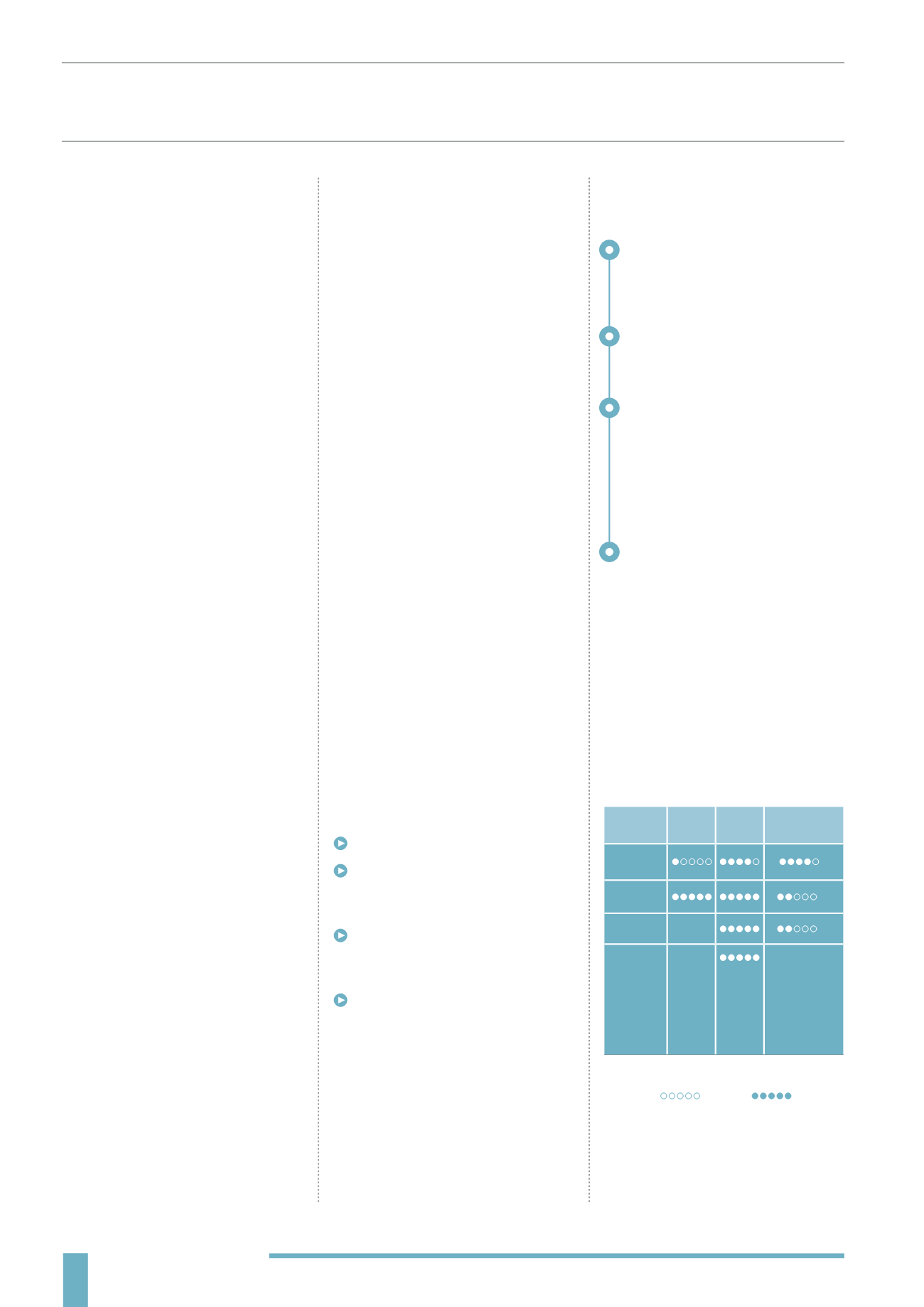

DIY

SEIS

/ EIS

Discretionary

Management

Cost

Time &

Resource

Risk

varies*

Potential

Growth

varies*

varies

(depending

on the

underlying

trades and

level of

gearing)

low

high