16

In this section we’ll look at the

legislation behind BPR and trace how

the BPR market has developed over the

last 30 years. Towards the end of the

section we’ll also compare BPR with

some of the other IHT solutions that are

available to help advisers put BPR into a

whole-of-market context.

ORIGIN

BPR was introduced in the 1976 Finance

Act to allow the owners of small

businesses to pass on business assets

to their beneficiaries without paying

IHT. Previously the IHT liability had been

seriously impairing some businesses,

necessitating the sale of some or all of

the business and hampering growth

and productivity in this vital part of the

economy.

Over time, the scope of the relief was

widened allowing more people to

access it and achieve greater levels of

relief. Successive governments came to

understand that the relief incentivises

investment into small and medium sized

businesses. (We’ll look at the specifics

of what sorts of companies and assets

qualify in a later section of the report).

So the initial relief has transformed

from something rather narrow into a

much more generous relief. Since 1996,

investors with small, non-controlling

shareholdings in qualifying businesses

and/or partnerships can claim 100% IHT

relief. Furthermore, shares listed on the

Alternative Investment Market (AIM)

and the ICAP Securities & Derivatives

Exchange (ISDX - known as PLUS until

the exchange was bought by ICAP in

2012) also qualify.

This has been confirmed in several

iterations of the Inheritance Tax Manual,

most prominently in IHTM 18336:

“The AIM (Alternative

Investment Market) was

launched in June 1995

with the aim of attracting

a wide range of new, small

and growing companies.

This market replaced the

USM

(IHTM18339)

, which

closed at the end of 1996.

Shareholdings in AIM

companies are regarded as

‘unlisted’ for (and only for)

the purposes of business

relief

(IHTM18333)

, loss on sale

of shares

(IHTM34132)

and

instalments

(IHTM18334)

”

These developments opened the

door for stockbrokers and investment

managers with expertise in small

business investing to run discretionary

portfolios and develop products that

helped investors claim BPR and mitigate

their IHT liabilities. The requirements

were simple - pick a portfolio of safe

investments that minimised the risk

of capital loss while providing at least

inflation matching returns; and monitor

them closely to ensure that they stayed

within the legal framework of BPR

qualification. Simple, but not easy: it

requires some investment skill, which is

why it would be hard to replicate this on

a do-it-yourself basis.

GROWTH OF THE MARKET

Establishing exact figures for the size

of the market is difficult. As with all

non-mainstream, unlisted products,

up until now there has not been a

central repository of data where all of

the products, their AUM, performance

and other attributes can be analysed.

However, the National Audit Office

(NAO) does collect and publish data on

tax reliefs. Their data is for the total

amounts claimed under BPR, which

includes small businesses (i.e. it’s not

just for IHT mitigation products):

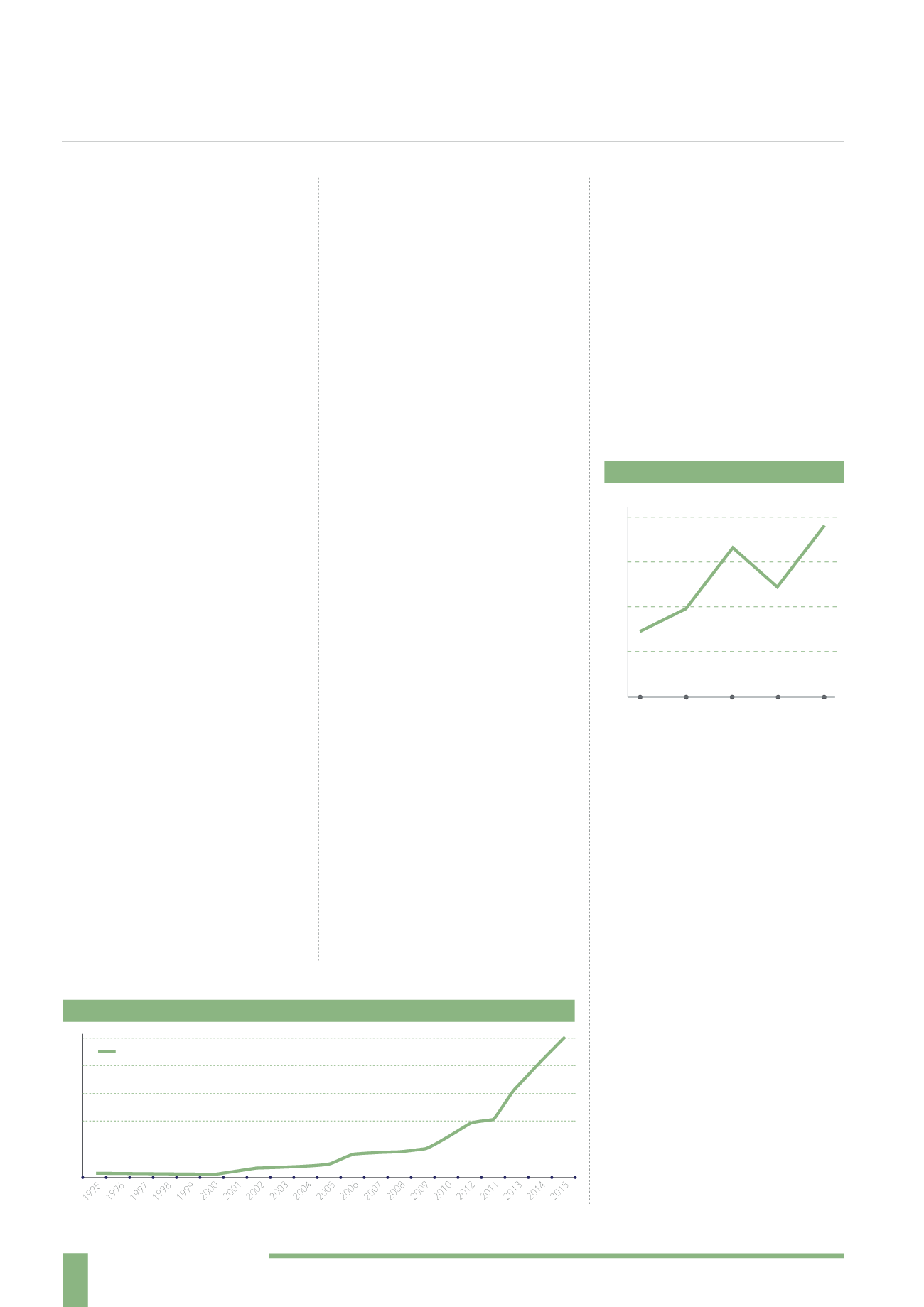

Two points are worth making here:

firstly (as the NAO note in their report)

the cost of BPR (to the exchequer) is

rising faster than the overall revenue

collected from IHT. Secondly, when the

£3.4 billion paid in IHT in 2013/14 is set

against the £385 million BPR that was

claimed in 2012/13 (the last year we

have figures for) we can see that it can be

considered to be an under-utilised relief.

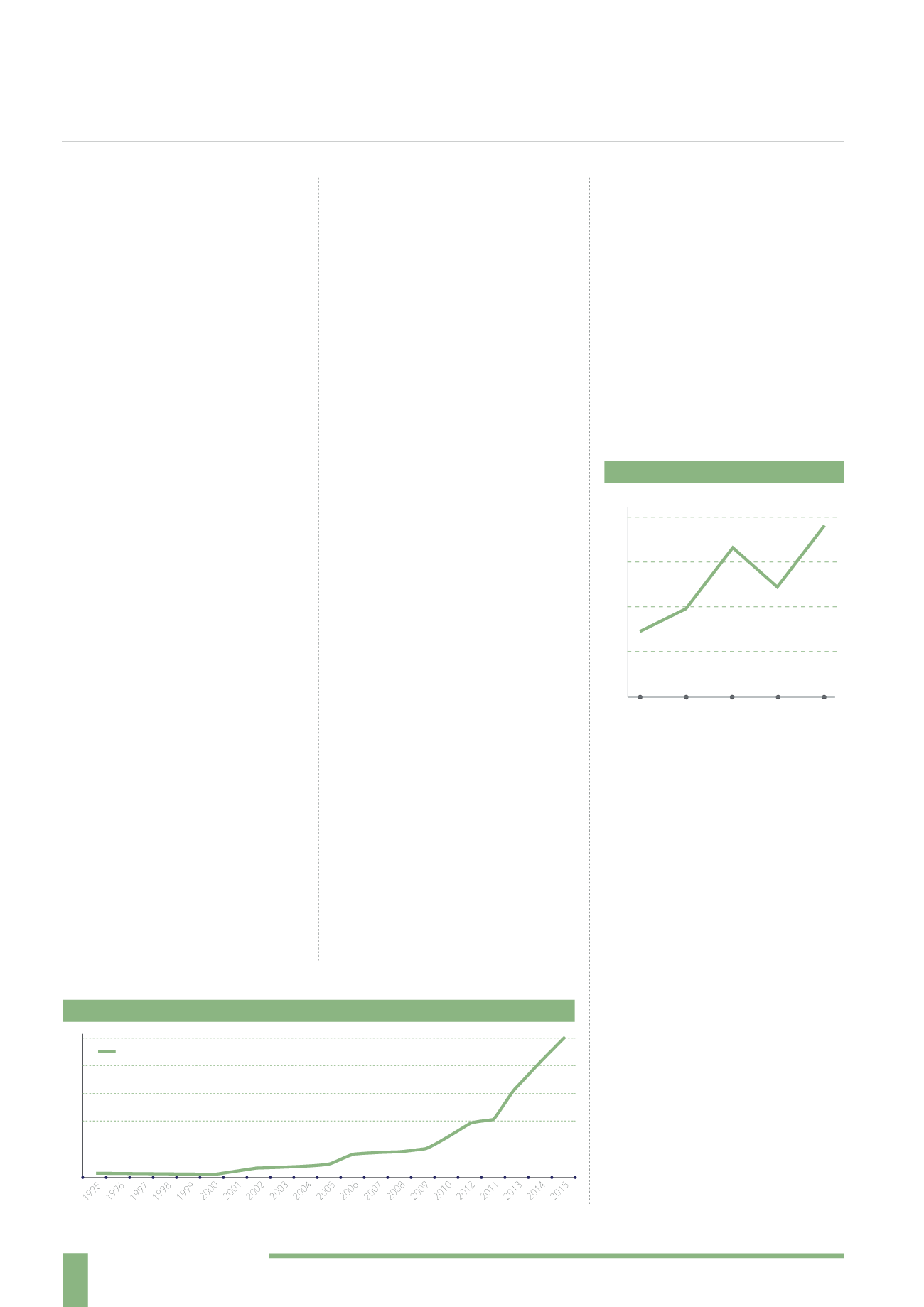

We also researched the number of

BPR products in the market and found

that there are currently slightly more

than 50 products from 38 providers.

This feels like a reasonably competitive

market for what has been a niche

service - enough competition to ensure

customers can get value for money,

but not a confusing marketplace full of

opportunistic firms trying to cash in on

the demand. As noted above, managing

these products requires experience and

the appropriate scale, so there are some

barriers to entry. We take a closer look

at this in our market analysis section.

HISTORYANDMARKETOVERVIEW

Total number of products and services

50

40

30

20

10

0

BPR MARKET GROWTH

(1995-2015)

400

300

200

100

0

2008/09 2009/10 2010/11 2011/12 2012/13

VALUE OF BPR

(2008-2013)

(£m)