18

Gifts are relatively simple to implement,

but specialist knowledge is required

to ensure that the tax consequences

are understood; that the donor can

afford to make the gift and that the

record keeping is accurate in case of a

challenge from HMRC when the estate

is assessed. The process of making the

gift should not be expensive, although

of course the advice has to be paid for.

The biggest issue with gifts, apart from

the time it takes to achieve 100% relief,

is the loss of access and control. The

gift becomes the sole property of the

beneficiary (a gift without reservation)

as soon as the gift is made and the

donor has no legal claim on the assets

or income (or any other benefits).

This can be a concern if the donor

anticipates that they might need the

money in the future, or if they feel their

intended beneficiary isn’t capable of

managing the money responsibly.

For the avoidance of doubt, gifting one’s

principle private residence (whilst still

intending to reside there) would be a

gift WITH reservation, and so would

not qualify as a PET unless the donor

were to pay rent to the donee in which

case it is not a gift with reservation.

TRUSTS

Trusts are usually used in conjunction

with gifts - a gift can be placed in trust.

This places the assets in a legal wrapper

that is controlled by the trustees.

Trusts have all the IHT benefits of a

gift, but give the donor (settlor) more

control and mean they can potentially

retain some of the benefits.

The settlor can specify when the assets

are distributed to the beneficiary

(usually upon their death where IHT is

concerned, but this feature can also be

used to delay distribution, perhaps to

prevent youngsters spending money

unwisely for example) and how those

assets are invested prior to that. IHT

is often immediately chargeable on

transferring the assets into the trust and

there may be a 20% upfront tax charge

as well (chargeable lifetime transfer).

If the settlor wants to receive some

benefit from the assets placed in the

trust, then a discounted gift trust or

loan trust must be used. These more

complex legal structures allow the donor

to receive income from the assets, but

usually mean that something less than

100% IHT mitigation is achieved. And as

they are based around gifts, the same

timeframes apply - seven years until full

IHT relief on the portion of the gift that

is not reserved for the settlor’s benefit.

There are a wide variety of trusts and

trust law is complex, so specialist

knowledge is required here, and of

course this complexity comes at a high

price: setting up and running trusts can

be expensive and may not be worth

considering for amounts under £100,000.

As with gifts, the biggest issue with

trusts is the loss of control. Although

the settlor can exercise some control

and take some benefit from the trust,

the assets are owned and managed by

the trustees - if the settlor exercises

control then it is likely that the

arrangement will be deemed a sham

trust and the full IHT liability will apply.

Discounted gift trusts are currently

the most popular IHT mitigation

strategy, favoured by over 70% of

advisers according to FT research.

Source: OBR

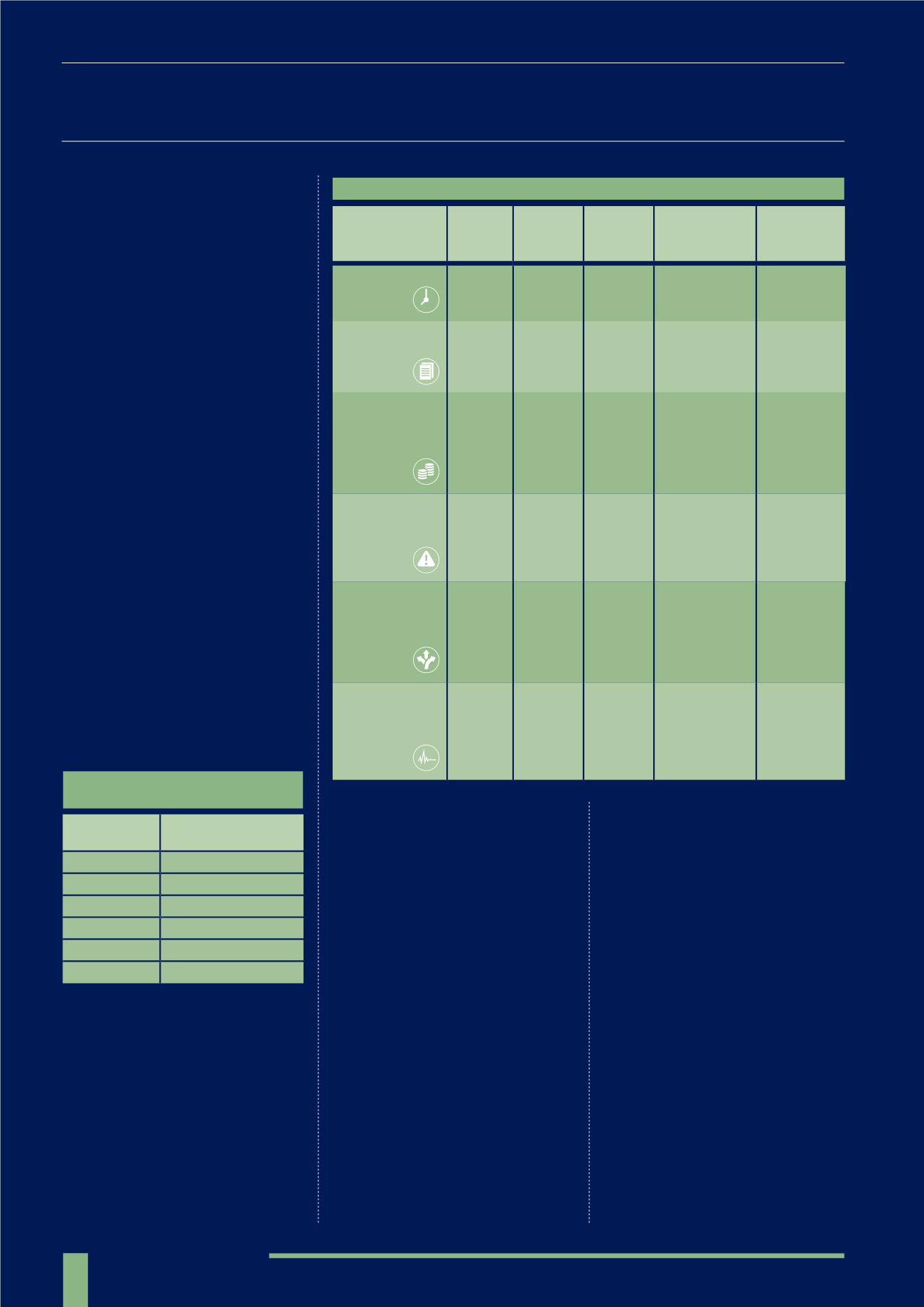

SLIDING SCALE OF TAPER

RELIEF ON PET

s

N⁰ of years

from gift

% of IHT

(reduction in tax charged)

1-3

100%

3

80%

4

60%

5

40%

6

20%

7

0%

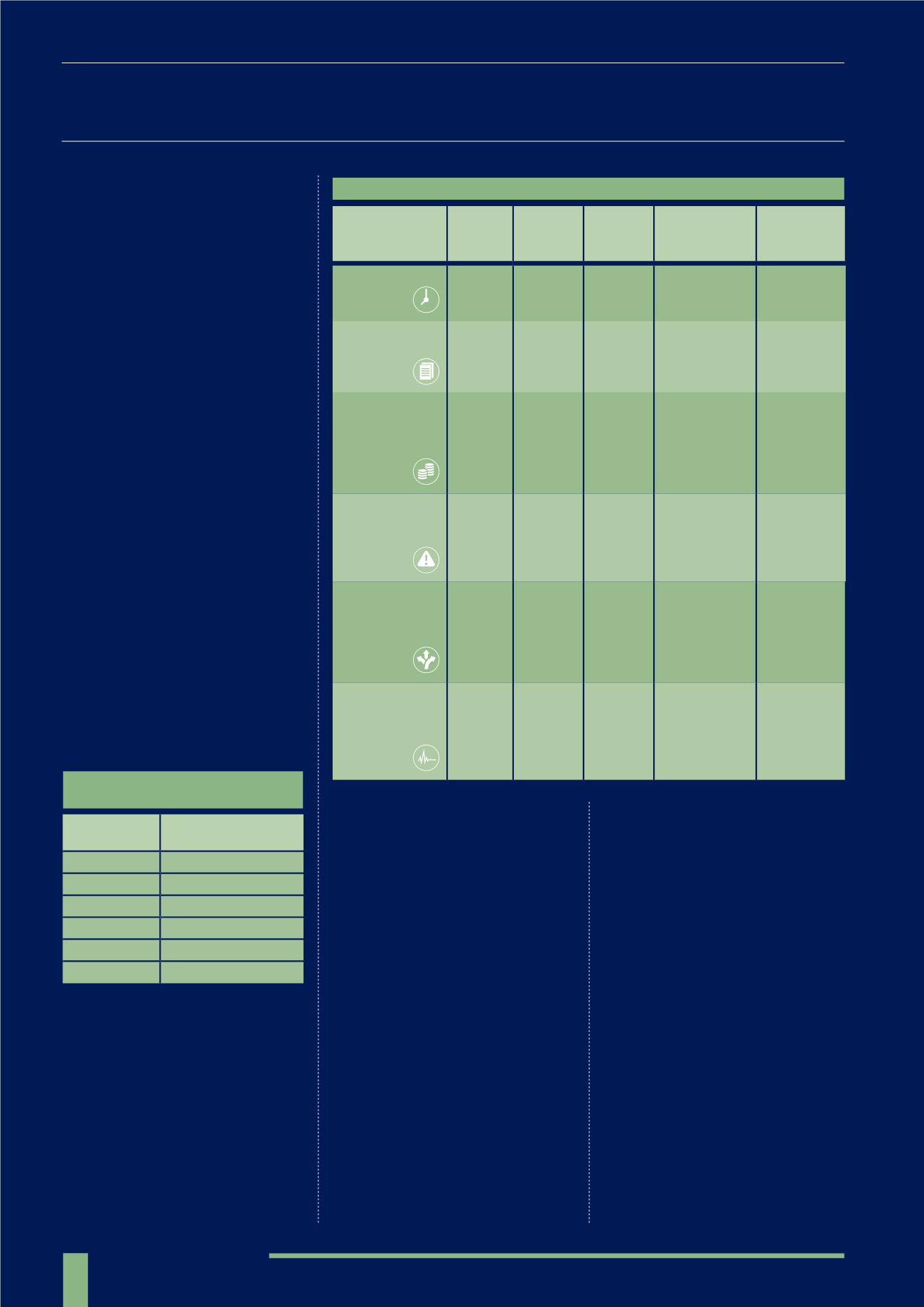

BPR

EIS

Trusts

Gifts / PETs

(

Potentially

Exempt Transfers)

Life

Assurance

Timeframe

2 years

from

share

ownership

2 years

from share

ownership

7 years

Tapers - but 7

years for full

relief

As soon as

the policy is in

place

Implementation

and ongoing

administration

Simple

Simple

Requires

relatively

complex

legal

structures

Specialist

advice is higly

recommended

Depends on

age and health

status - can be

restrictive

Costs

Varies,

around

2.5% initial

and 1-3%

p.a. after

beating a

hurdle

Varies,

around

2.5% initial

and 1.5%

ongoing

AMC

High

Low, but there

will be a charge

for the advice

Monthly

premium or

lump sum

- will vary

depending on

sum assured,

age and health

Investment

Risk

Medium

to high

Medium to

high

Depends

on how the

assets are

invested

None

None

Flexibility

Yes,

can exit at

any time

Yes,

subject to

liquidity

and

implication

to the other

reliefs

No access,

but some

control

depending

on the

legal

structure.

Lose access

and control

Can cancel the

policy, subject

to costs

Mitigation

100% 100% Can be

100%,

depending

upon the

structure

(after 7

years)

100%

(after 7 years)

No mitigation

- just pays the

bill with sum

assured

IHT SOLUTIONS COMPARISON

“Discounted gift trusts are currently the most popular IHT mitigation strategy, favoured by over

70% of advisers”