23

BPR DISCRETIONARY

INVESTMENT MANAGEMENT

STRUCTURES

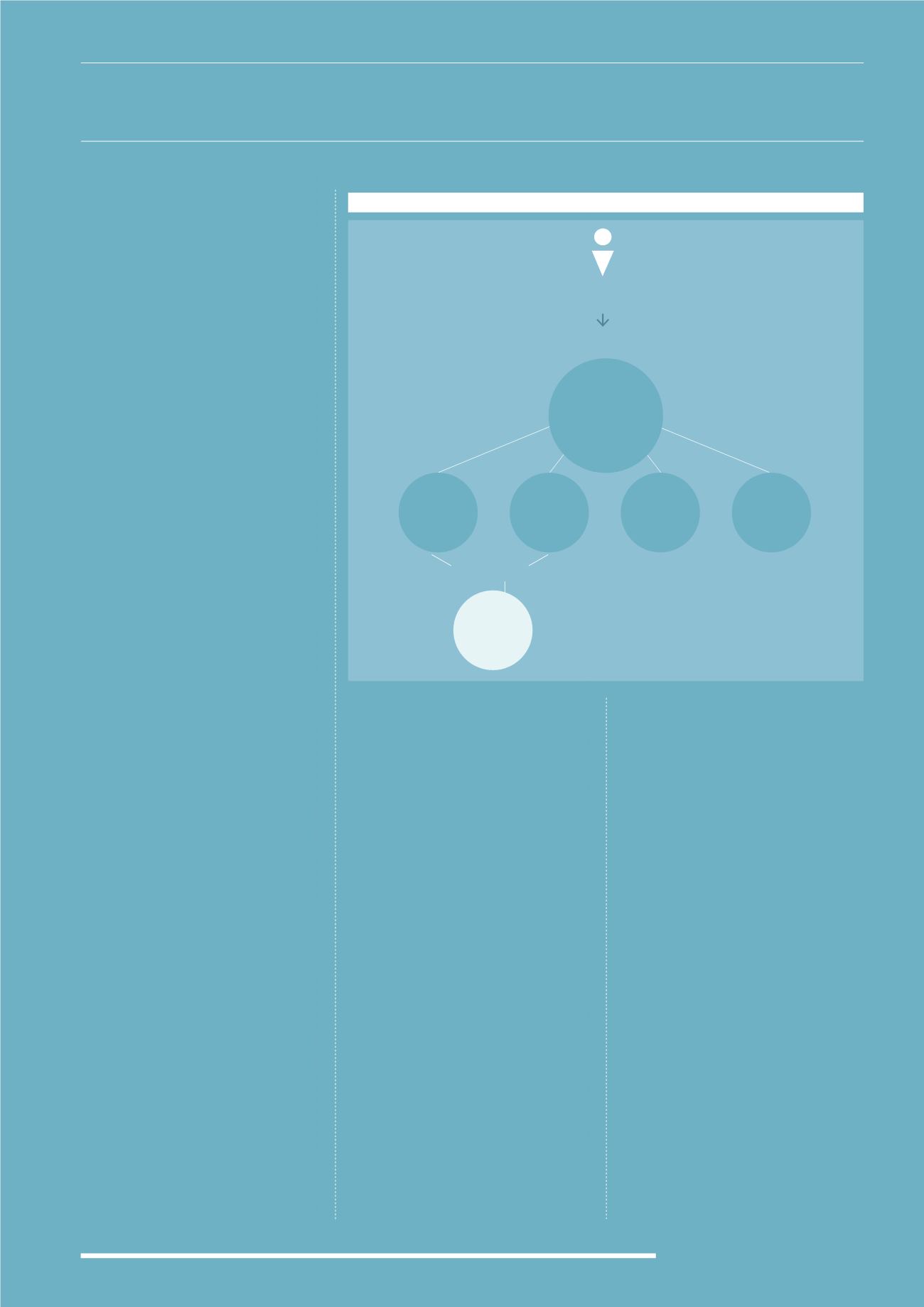

With discretionary investment

management solutions structured

like these, they are not collective

investmens (and therefore, where not

regulated, not Unregulated Collective

Investment Schemes or UCIS) as the

client retains beneficial ownership of

the underlying shares or assets on an

individual basis.

However, there are some BPR products

in the marketplace that are structured

as UCIS and therefore will have tighter

rules around their distribution - they

can only be promoted to sophisticated

and HNW investors.

Whether the structure is collective or

not, all of the investors in the product

will be invested in the same portfolio

of underlying shares or assets - this

is not to be confused with a bespoke

discretionary investment management

service, where an individual portfolio of

shares or assets is selected according to

the client’s needs and objectives. This

service is of course much more tailored,

and may come at a higher cost.

Third Parties

Investment managers will often rely

upon specialist third party services

in some key areas of their operating

model. These might include accountants

and lawyers who will ensure that

investee companies continue to comply

with BPR qualification rules; independent

custodians who look after client

monies, monitoring companies who

independently assess new investment

opportunities; and introducers who help

source new investments.

SUMMARY

There are a number of ways of

accessing BPR. People with their own

small businesses will of course qualify,

provided that the cash and assets they

have within the business comply with

the rules as mentioned in section four

(there is more on how to deal with

excess cash within a business in the

“Advisers” section).

Experienced “business angel” investors

will very likely have constructed a BPR

qualifying portfolio by virtue of the

types of companies they invest in -

whether IHT mitigation was one of their

principal objectives or not.

It is certainly possible for canny

investors or advisors who have the time

and resources to construct their own

portfolio of BPR qualifying assets. Most

likely this would be based on investing

in AIM shares, as these are easier to

identify and research. However, even

if the investor restricts his universe

solely to AIM, creating a DIY portfolio

is challenging. Firstly there is the stock

picking challenge: investors have to be

confident that their investments meet

the criteria for BPR status AND perform

at least well enough to keep up with

inflation (and hopefully do a little better

than that). Secondly, diversification: if a

portfolio strategy is being applied then

having the scale to achieve sufficient

diversification at a reasonable cost is

difficult for a private investor.

Thirdly, ongoing monitoring and

influence: investors need to be

confident that the investee companies

will continue to operate in their

interests and not take steps that would

compromise their BPR status (or indeed

dilute their holding, another risk for any

small-shareholder).

The vast majority of adviser’s clients are

not going to have their own business

and are not going to want to go down

the DIY path - so they will be looking for

investment products that can do the job

for them.

These are operated by managers with

an expertise in small company investing

where a subset of their investment

universe is BPR qualifying - so it is a

natural progression for them to develop

this useful service to meet client

demand. A minority of more expensive

services are entirely bespoke and a

minority are structured as collective

investments (UCIS), but the majority are

operated as a discretionary investment

management service.

“Risk, liquidity and diversification are key in considering the suitability of BPR”

Nick Morgan, Foresight Group

MANAGER

INVESTOR

( via custodian )

investing in:

SPV

HOLDING

CO.

UNLISTED

SHARES

AIM

SHARES

OTHER BPR

QUALIFYING

ASSETS

INVESTOR HAS

BENEFICIAL

OWNERSHIP

OF

DISCRETIONARY INVESTMENT MANAGEMENT STRUCTURE